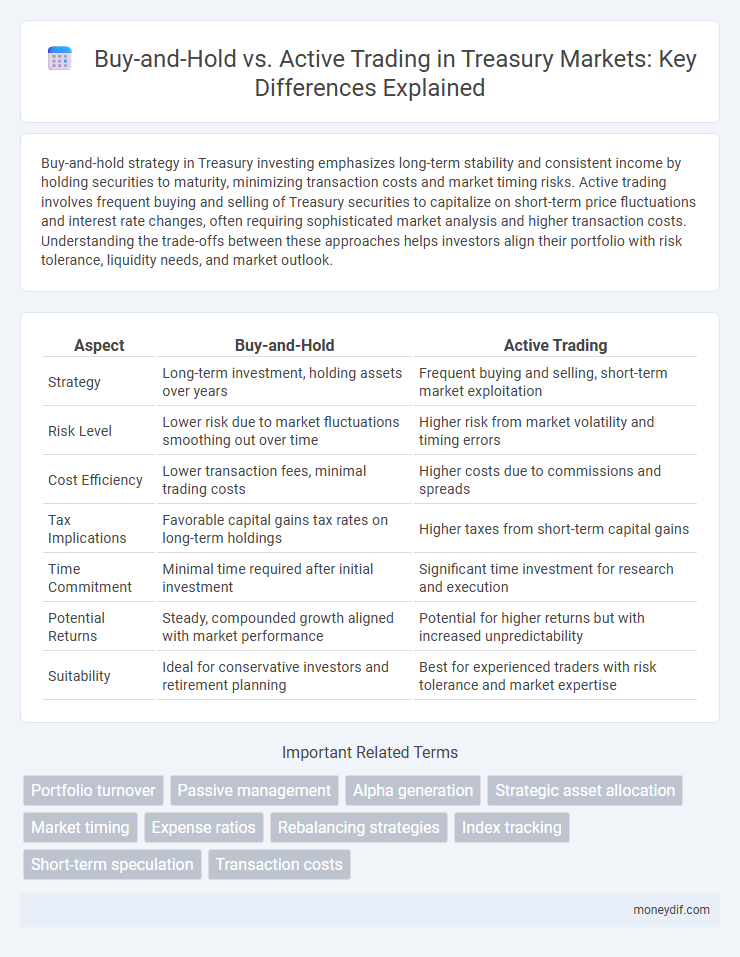

Buy-and-hold strategy in Treasury investing emphasizes long-term stability and consistent income by holding securities to maturity, minimizing transaction costs and market timing risks. Active trading involves frequent buying and selling of Treasury securities to capitalize on short-term price fluctuations and interest rate changes, often requiring sophisticated market analysis and higher transaction costs. Understanding the trade-offs between these approaches helps investors align their portfolio with risk tolerance, liquidity needs, and market outlook.

Table of Comparison

| Aspect | Buy-and-Hold | Active Trading |

|---|---|---|

| Strategy | Long-term investment, holding assets over years | Frequent buying and selling, short-term market exploitation |

| Risk Level | Lower risk due to market fluctuations smoothing out over time | Higher risk from market volatility and timing errors |

| Cost Efficiency | Lower transaction fees, minimal trading costs | Higher costs due to commissions and spreads |

| Tax Implications | Favorable capital gains tax rates on long-term holdings | Higher taxes from short-term capital gains |

| Time Commitment | Minimal time required after initial investment | Significant time investment for research and execution |

| Potential Returns | Steady, compounded growth aligned with market performance | Potential for higher returns but with increased unpredictability |

| Suitability | Ideal for conservative investors and retirement planning | Best for experienced traders with risk tolerance and market expertise |

Introduction to Buy-and-Hold and Active Trading in Treasury

Buy-and-hold in Treasury involves purchasing securities and holding them until maturity, minimizing transaction costs and interest rate risk through a long-term strategy. Active trading in Treasury requires frequent buying and selling to capitalize on short-term price fluctuations and interest rate movements, demanding continuous market analysis and timing. Both approaches aim to optimize portfolio returns but differ significantly in risk exposure, liquidity management, and operational complexity.

Core Principles of Treasury Buy-and-Hold Strategies

Treasury buy-and-hold strategies emphasize maintaining government securities until maturity to minimize market risk and secure predictable cash flows. This approach leverages the core principle of capital preservation through steady interest income, avoiding the volatility associated with active trading. Risk management focuses on duration matching and liquidity planning to ensure alignment with the investor's liability structure and cash needs.

Key Tactics in Active Treasury Trading

Active treasury trading relies on key tactics such as duration management, yield curve positioning, and tactical allocation shifts to optimize returns and manage interest rate risk. Traders employ strategies like roll-down yields exploitation, relative value trades between maturities, and dynamic hedging to capitalize on market volatility and changing economic conditions. Monitoring macroeconomic indicators and leveraging real-time data analytics drive informed decision-making in active treasury portfolio adjustments.

Comparing Long-term Stability vs. Short-term Gains

Buy-and-hold strategies in Treasury investments emphasize long-term stability by minimizing transaction costs and capitalizing on consistent interest income, reducing exposure to market volatility. Active trading seeks short-term gains through frequent buying and selling, aiming to capitalize on interest rate fluctuations and market inefficiencies but incurs higher risks and transaction fees. Treasury portfolio managers must weigh the trade-off between the predictable income of buy-and-hold and the potential for increased returns through active trading approaches.

Risk Management: Passive vs. Active Treasury Approaches

Buy-and-hold strategies in Treasury management minimize transaction frequency, reducing market timing risks and offering stability through steady interest income. Active trading allows quicker responses to interest rate fluctuations and liquidity needs but increases exposure to market volatility and operational risks. Effective risk management balances these approaches to optimize portfolio performance while controlling exposure to interest rate and credit risks.

Impact of Market Conditions on Treasury Investment Strategies

Market conditions profoundly influence Treasury investment strategies, with buy-and-hold investors benefiting from stable or declining interest rates through predictable income and capital preservation. Active trading strategies become advantageous in volatile or rising rate environments, allowing investors to capitalize on price fluctuations and adjust duration exposure to optimize returns. Understanding yield curve shifts and economic indicators is critical for selecting the appropriate approach to maximize Treasury portfolio performance.

Cost Considerations: Hold vs. Trade in the Treasury Market

Buy-and-hold strategies in the Treasury market minimize transaction costs, such as bid-ask spreads and brokerage fees, by reducing trade frequency and capitalizing on interest income over time. Active trading incurs higher costs due to frequent buying and selling, including bid-ask spreads, market impact, and potential tax liabilities on short-term gains. Cost efficiency in a buy-and-hold approach can enhance total returns, especially in stable interest rate environments where price volatility is limited.

Performance Metrics for Buy-and-Hold vs. Active Trading

Buy-and-hold strategies typically show higher long-term returns by minimizing transaction costs and capitalizing on compound growth, whereas active trading aims to outperform the market through frequent trades but often incurs higher fees and tax implications. Performance metrics such as Sharpe ratio, alpha, and beta highlight that buy-and-hold portfolios generally exhibit lower volatility and more consistent risk-adjusted returns compared to active trading strategies. Empirical data from treasury asset management reveals that buy-and-hold approaches outperform active trading in terms of cost efficiency and realized gains over extended periods.

Suitability for Different Investor Profiles

Buy-and-hold strategies suit risk-averse investors seeking long-term wealth accumulation through predictable, compound growth. Active trading appeals to experienced investors comfortable with market volatility and seeking short-term gains by capitalizing on price fluctuations. Understanding individual risk tolerance, investment horizon, and financial goals is critical for selecting the appropriate approach in treasury management.

Conclusion: Choosing the Right Treasury Investment Strategy

Selecting the right Treasury investment strategy depends on individual risk tolerance, market knowledge, and financial goals. Buy-and-hold offers stability and predictable returns through long-term holding of government securities, minimizing transaction costs and market timing risks. Active trading requires continuous market analysis and swift decision-making to capitalize on interest rate fluctuations but involves higher risk and operational complexity.

Important Terms

Portfolio turnover

Portfolio turnover measures the frequency of asset trades, where buy-and-hold strategies exhibit low turnover and active trading results in high turnover, impacting transaction costs and tax liabilities.

Passive management

Passive management relies on buy-and-hold strategies to minimize transaction costs and tax implications, contrasting with active trading's frequent buy-sell actions aimed at outperforming the market.

Alpha generation

Alpha generation measures the excess return of an investment strategy compared to a benchmark, highlighting the potential outperformance achievable through active trading. Buy-and-hold strategies often aim for market returns with reduced transaction costs, while active trading seeks to create alpha by exploiting market inefficiencies and timing opportunities.

Strategic asset allocation

Strategic asset allocation involves setting a fixed investment mix based on long-term financial goals and risk tolerance, aligning closely with the buy-and-hold approach that emphasizes minimizing trading frequency to reduce costs and capitalize on market growth. In contrast, active trading seeks to outperform benchmarks through frequent portfolio adjustments, but often incurs higher transaction costs and increased market timing risks compared to the discipline of strategic asset allocation.

Market timing

Market timing involves attempting to predict future market movements to buy low and sell high, contrasting sharply with the buy-and-hold strategy that focuses on long-term investment regardless of short-term volatility. Studies show that active trading often underperforms buy-and-hold due to transaction costs, tax implications, and the difficulty of accurately timing market reversals.

Expense ratios

Expense ratios for buy-and-hold investors typically remain low due to minimal trading, whereas active trading strategies incur higher expense ratios from frequent transactions and management fees.

Rebalancing strategies

Rebalancing strategies optimize portfolio risk and return by systematically adjusting asset allocations, contrasting with buy-and-hold's passive stance and active trading's frequent market timing efforts.

Index tracking

Index tracking involves replicating a specific market index's performance by holding the same securities in the same proportions, aligning closely with a buy-and-hold strategy that focuses on long-term growth and minimal trading activity. Active trading, in contrast, aims to outperform the market through frequent buying and selling based on market trends, but typically incurs higher costs and increased risk compared to the cost efficiency and lower volatility of index tracking.

Short-term speculation

Short-term speculation involves frequently buying and selling securities to capitalize on market fluctuations, contrasting with the buy-and-hold strategy that focuses on long-term investment growth through sustained ownership. Active trading requires constant market analysis and timing, potentially yielding quicker profits but higher transaction costs and risks compared to the passive, lower-risk buy-and-hold approach.

Transaction costs

Transaction costs in buy-and-hold strategies are typically lower due to fewer trades, minimizing brokerage fees and bid-ask spreads, while active trading incurs higher costs through frequent transactions, including commissions, taxes, and potential slippage. These elevated expenses can significantly erode returns in active trading, emphasizing the importance of cost analysis when choosing between long-term holding and short-term market timing.

Buy-and-hold vs Active trading Infographic

moneydif.com

moneydif.com