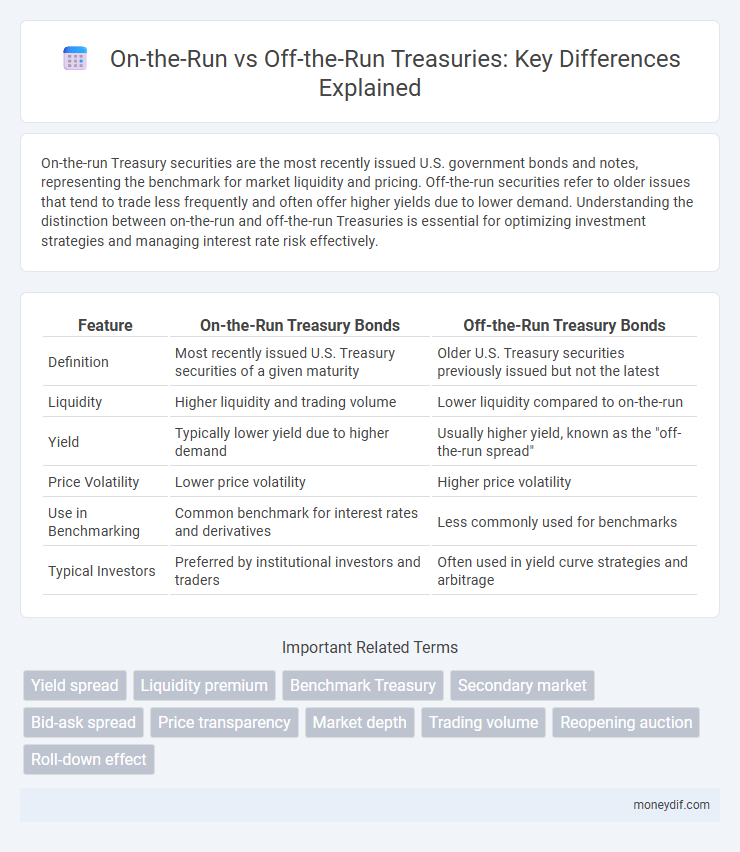

On-the-run Treasury securities are the most recently issued U.S. government bonds and notes, representing the benchmark for market liquidity and pricing. Off-the-run securities refer to older issues that tend to trade less frequently and often offer higher yields due to lower demand. Understanding the distinction between on-the-run and off-the-run Treasuries is essential for optimizing investment strategies and managing interest rate risk effectively.

Table of Comparison

| Feature | On-the-Run Treasury Bonds | Off-the-Run Treasury Bonds |

|---|---|---|

| Definition | Most recently issued U.S. Treasury securities of a given maturity | Older U.S. Treasury securities previously issued but not the latest |

| Liquidity | Higher liquidity and trading volume | Lower liquidity compared to on-the-run |

| Yield | Typically lower yield due to higher demand | Usually higher yield, known as the "off-the-run spread" |

| Price Volatility | Lower price volatility | Higher price volatility |

| Use in Benchmarking | Common benchmark for interest rates and derivatives | Less commonly used for benchmarks |

| Typical Investors | Preferred by institutional investors and traders | Often used in yield curve strategies and arbitrage |

Understanding On-the-Run and Off-the-Run Treasuries

On-the-run Treasuries represent the most recently issued U.S. government bonds of a particular maturity, offering the highest liquidity and serving as benchmark securities for pricing. In contrast, Off-the-run Treasuries are older issues that, while less liquid, often trade at a discount due to lower demand and serve as important instruments for yield curve analysis. Understanding the distinction between On-the-run and Off-the-run Treasuries is crucial for investors and analysts assessing market liquidity, price benchmarks, and yield spreads in fixed income markets.

Key Differences: On-the-Run vs Off-the-Run Securities

On-the-run Treasury securities are the most recently issued U.S. government bonds or notes and typically exhibit higher liquidity and tighter bid-ask spreads compared to off-the-run securities, which are older issues. Off-the-run Treasuries often trade at a discount, offering slightly higher yields due to lower demand and reduced market activity. The liquidity premium associated with on-the-run securities significantly impacts pricing, making them preferred for benchmark rates and primary market transactions.

Liquidity Comparison in Treasury Markets

On-the-run Treasury securities, being the most recently issued benchmarks, exhibit significantly higher liquidity compared to off-the-run issues due to greater bid-ask tightness and larger trading volumes. Off-the-run Treasuries, issued in prior auctions, typically experience lower market depth and wider spreads, making them less attractive for quick execution. This liquidity differential directly impacts pricing efficiency and the ease of portfolio rebalancing within Treasury markets.

Yield Disparities: What Drives the Spread?

On-the-run Treasury securities consistently offer lower yields compared to off-the-run bonds due to their superior liquidity and frequent trading activity, which investors value. Yield spreads between on-the-run and off-the-run issues are influenced by market demand, supply of benchmark securities, and perceived risk premiums associated with older, less traded bonds. The presence of a liquidity premium and varying investor preferences for immediacy in settlement contribute significantly to the differential pricing across these Treasury issues.

Pricing Dynamics of On-the-Run and Off-the-Run Bonds

On-the-run Treasury bonds are the most recently issued securities and typically trade at a premium due to their higher liquidity and benchmark status, resulting in tighter bid-ask spreads. Off-the-run bonds, which are older issues, often trade at a discount reflecting lower demand and reduced market activity, causing wider spreads and less price transparency. The pricing dynamics between these two categories highlight the liquidity premium embedded in on-the-run bonds, influencing yield curves and affecting relative valuations in fixed income markets.

Trading Strategies Using On-the-Run and Off-the-Run Treasuries

Trading strategies leveraging on-the-run Treasuries capitalize on their high liquidity and tighter bid-ask spreads, making them ideal for quick execution and price discovery in the fixed income market. Off-the-run Treasuries, while less liquid and exhibiting wider spreads, present opportunities for yield enhancement through relative value arbitrage and curve positioning due to their pricing discounts. Combining on-the-run and off-the-run Treasury securities allows traders to exploit temporary mispricings and hedge interest rate risk effectively across different maturities.

Role in Treasury Auctions and Market Benchmarks

On-the-run Treasury securities serve as primary benchmarks in Treasury auctions due to their recent issuance and higher liquidity, attracting significant investor demand and facilitating price discovery. Off-the-run Treasuries, though older and less liquid, provide essential depth to the yield curve and offer alternative investment options in the secondary market. The distinction between on-the-run and off-the-run securities influences auction dynamics, trading strategies, and the accuracy of market benchmarks used for pricing and risk assessment.

Impact on Portfolio Management and Valuation

On-the-run Treasury securities, being the most recently issued and actively traded, typically exhibit tighter bid-ask spreads and higher liquidity, which enhances accurate portfolio valuation and efficient trade execution. Off-the-run issues, though less liquid and often priced at a discount to on-the-run counterparts, provide valuable diversification and potential yield pickup, affecting portfolio risk-return profiles. Portfolio managers must balance the liquidity benefits of on-the-run securities with the valuation advantages and yield opportunities presented by off-the-run instruments to optimize overall portfolio performance.

Risks and Considerations for Investors

On-the-run Treasury securities, being the most recently issued, generally offer higher liquidity and tighter bid-ask spreads compared to off-the-run issues, reducing transaction costs for investors. However, off-the-run Treasuries may present greater price volatility and wider spreads due to lower demand and trading frequency, increasing market risk. Investors must weigh liquidity premiums against potential yield differences while considering their portfolio's risk tolerance and investment horizon.

Recent Trends in On-the-Run and Off-the-Run Spreads

Recent trends in Treasury markets show widening spreads between On-the-run and Off-the-run securities, reflecting increased demand for liquidity and benchmark status in On-the-run bonds. On-the-run Treasuries typically trade at higher prices and lower yields due to greater liquidity, while Off-the-run issues offer higher yields but face reduced market interest. This divergence impacts portfolio strategies, emphasizing the trade-off between liquidity premiums and yield enhancements.

Important Terms

Yield spread

Yield spread between on-the-run and off-the-run Treasury securities reflects liquidity premiums and market demand differences, with on-the-run bonds typically offering lower yields due to higher liquidity and recent issuance.

Liquidity premium

On-the-run Treasury securities typically have a lower liquidity premium compared to off-the-run securities due to higher demand and easier marketability.

Benchmark Treasury

Benchmark Treasury securities are classified into on-the-run issues, which are the most recently issued and highly liquid, and off-the-run issues, which are older maturities offering lower liquidity and often used to gauge yield curve dynamics.

Secondary market

On-the-run Treasury securities, being the most recently issued and actively traded, typically exhibit higher liquidity and lower yields compared to off-the-run securities in the secondary market.

Bid-ask spread

On-the-run Treasury securities typically exhibit narrower bid-ask spreads compared to off-the-run issues due to higher liquidity and active trading.

Price transparency

Price transparency in bond markets significantly differs between on-the-run securities, which exhibit higher liquidity and clearer pricing, and off-the-run securities, where lower liquidity leads to less transparent and more variable pricing.

Market depth

On-the-run securities exhibit greater market depth with higher liquidity and tighter bid-ask spreads compared to off-the-run securities, which are less frequently traded and display lower market depth.

Trading volume

On-the-run Treasury securities consistently exhibit higher trading volume compared to off-the-run issues due to their greater liquidity and benchmark status.

Reopening auction

Reopening auctions increase liquidity by issuing additional bonds of On-the-run securities, enhancing price transparency compared to Off-the-run issues.

Roll-down effect

The roll-down effect captures the price change dynamics between on-the-run and off-the-run Treasury securities, where on-the-run bonds typically trade at a premium due to higher liquidity and demand. As these on-the-run bonds age and become off-the-run, their yields generally rise and prices decline, creating predictable roll-down returns exploited by fixed income investors.

On-the-run vs Off-the-run Infographic

moneydif.com

moneydif.com