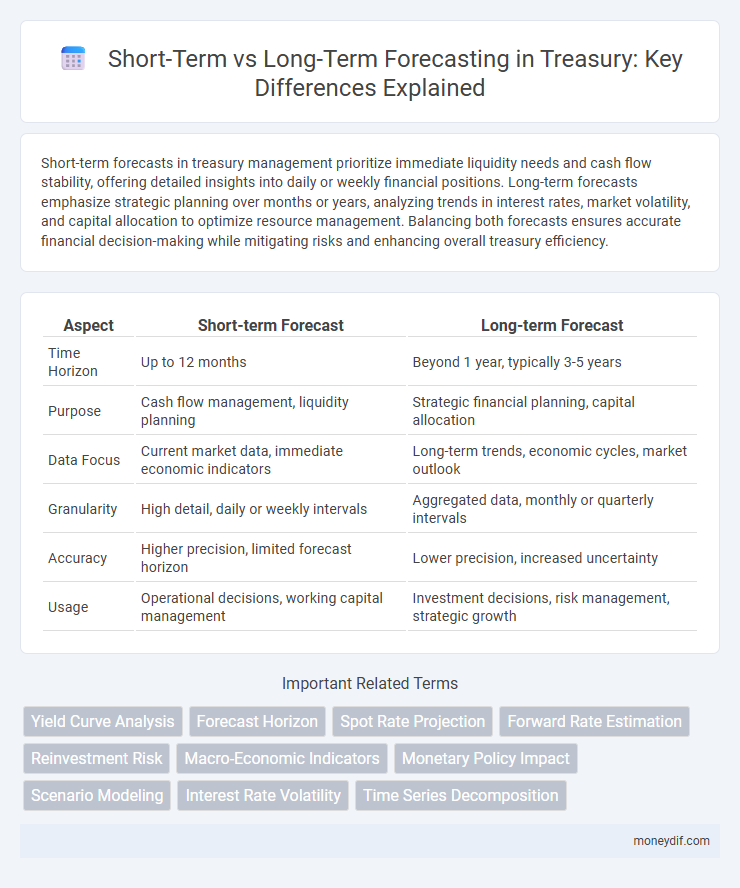

Short-term forecasts in treasury management prioritize immediate liquidity needs and cash flow stability, offering detailed insights into daily or weekly financial positions. Long-term forecasts emphasize strategic planning over months or years, analyzing trends in interest rates, market volatility, and capital allocation to optimize resource management. Balancing both forecasts ensures accurate financial decision-making while mitigating risks and enhancing overall treasury efficiency.

Table of Comparison

| Aspect | Short-term Forecast | Long-term Forecast |

|---|---|---|

| Time Horizon | Up to 12 months | Beyond 1 year, typically 3-5 years |

| Purpose | Cash flow management, liquidity planning | Strategic financial planning, capital allocation |

| Data Focus | Current market data, immediate economic indicators | Long-term trends, economic cycles, market outlook |

| Granularity | High detail, daily or weekly intervals | Aggregated data, monthly or quarterly intervals |

| Accuracy | Higher precision, limited forecast horizon | Lower precision, increased uncertainty |

| Usage | Operational decisions, working capital management | Investment decisions, risk management, strategic growth |

Introduction to Treasury Forecasting

Treasury forecasting involves predicting cash flow and liquidity needs with distinct approaches for short-term and long-term horizons. Short-term forecasts typically cover daily to monthly periods, emphasizing cash management and working capital optimization. Long-term forecasts extend over quarters or years, supporting strategic planning and capital allocation decisions.

Defining Short-term and Long-term Forecasts

Short-term forecasts in treasury typically cover periods ranging from one week to one year, concentrating on immediate cash flow projections and liquidity management. Long-term forecasts extend beyond one year, often spanning three to five years, and focus on strategic planning, debt management, and capital investments. Accurately defining these forecasting horizons ensures effective allocation of resources and risk mitigation in treasury operations.

Objectives of Short-term Treasury Forecasts

Short-term treasury forecasts primarily aim to manage liquidity by predicting cash inflows and outflows within a 30 to 90-day period, ensuring the company can meet its immediate financial obligations. These forecasts help optimize working capital, minimize borrowing costs, and avoid unnecessary interest expenses by providing accurate visibility into daily and weekly cash positions. Effective short-term forecasting supports tactical decision-making in cash management, including timing for short-term investments and debt repayments.

Objectives of Long-term Treasury Forecasts

Long-term treasury forecasts aim to provide strategic insights on cash flow trends and liquidity positions over extended periods, typically beyond one year. These forecasts support capital planning, debt management, and investment decisions by projecting future funding needs and potential risks. Accurate long-term forecasting enhances an organization's ability to optimize resource allocation and ensure financial stability.

Key Differences: Short-term vs Long-term Forecasting

Short-term forecasting in treasury focuses on cash flow projections and liquidity management typically within days to months, enabling agile responses to immediate financial needs. Long-term forecasting extends over years, emphasizing capital planning, debt management, and strategic investment decisions to ensure sustained financial stability and growth. The key differences lie in the time horizon, data granularity, and the emphasis on operational versus strategic financial objectives.

Data Sources and Inputs for Treasury Forecasts

Treasury forecasts rely heavily on diverse data sources to ensure accuracy and relevance, with short-term forecasts primarily utilizing real-time cash flow data, accounts receivable and payable, and liquidity positions. Long-term forecasts incorporate macroeconomic indicators, historical financial trends, market conditions, and strategic business plans to anticipate future cash needs and investment opportunities. Integrating internal ERP systems, bank statements, and external market intelligence platforms enhances the precision of both short-term and long-term treasury forecasting.

Techniques and Tools for Accurate Forecasting

Short-term forecasting in treasury relies heavily on cash flow analysis, rolling forecasts, and real-time data integration using tools such as ERP systems and cash management software to ensure liquidity and operational efficiency. Long-term forecasting incorporates economic indicators, scenario analysis, and financial modeling techniques like discounted cash flow (DCF) and Monte Carlo simulations to predict future financial positions and guide strategic investment decisions. Advanced analytics platforms and AI-driven forecasting software enhance accuracy by processing large datasets and identifying trends that traditional methods may overlook.

Impact on Liquidity and Cash Management

Short-term forecasts provide immediate visibility into liquidity needs, enabling precise cash flow management and timely funding decisions to avoid shortfalls. Long-term forecasts offer strategic insights, assisting in capital allocation and investment planning to optimize cash reserves over extended periods. Balancing both forecasts ensures optimal liquidity management, reducing risks of cash deficits and enhancing overall financial stability.

Challenges in Short-term and Long-term Forecasting

Short-term forecasting in treasury faces challenges such as market volatility, rapidly changing interest rates, and unexpected liquidity demands that can disrupt cash flow predictions. Long-term forecasting struggles with uncertainties stemming from economic cycles, regulatory changes, and geopolitical risks, making it difficult to accurately project capital needs and investment returns. Both timeframes require sophisticated modeling and continuous data updates to mitigate risks and improve forecast reliability.

Best Practices for Optimizing Treasury Forecasts

Accurate treasury forecasting relies on integrating short-term forecasts, which focus on daily cash flows and liquidity management, with long-term forecasts that address strategic financial planning and capital allocation. Best practices for optimizing treasury forecasts involve leveraging real-time data analytics, incorporating scenario analysis for risk assessment, and regularly updating assumptions to reflect market volatility and business changes. Utilizing advanced forecasting software and fostering collaboration between treasury, finance, and operations teams enhances forecast precision and supports effective decision-making.

Important Terms

Yield Curve Analysis

Yield Curve Analysis distinguishes short-term forecasts, reflecting immediate economic conditions and monetary policies, from long-term forecasts that anticipate sustained economic growth and inflation trends.

Forecast Horizon

Forecast horizon defines the time span for predictions, with short-term forecasts typically covering hours to months for immediate decision-making, while long-term forecasts extend from years to decades, supporting strategic planning and policy development.

Spot Rate Projection

Spot rate projection combines short-term forecasts, which capture immediate market fluctuations, with long-term forecasts that account for macroeconomic trends to improve currency value predictions.

Forward Rate Estimation

Forward rate estimation involves predicting future interest rates derived from current yield curves, essential for both short-term and long-term forecasting in financial markets. Short-term forecasts rely heavily on recent market data and liquidity conditions, while long-term forecasts incorporate macroeconomic trends, inflation expectations, and risk premia to estimate sustainable forward rates.

Reinvestment Risk

Reinvestment risk arises when cash flows from short-term investments are reinvested at lower rates, impacting projected returns compared to long-term forecasts that assume stable or rising interest rates. Accurate short-term forecasts help mitigate reinvestment risk by adjusting strategies for fluctuating yields, whereas long-term forecasts may underestimate this risk by presuming consistent rate environments.

Macro-Economic Indicators

Macro-economic indicators such as GDP growth rate, inflation rate, and unemployment rate provide critical data for short-term forecasts by capturing immediate economic fluctuations and trends. Long-term forecasts rely on these indicators combined with structural factors like demographic changes and technological advancements to project sustained economic performance over extended periods.

Monetary Policy Impact

Monetary policy impacts short-term forecasts by influencing immediate economic variables like interest rates and inflation expectations, while its effects on long-term forecasts shape economic growth and stability through investment and productivity changes.

Scenario Modeling

Scenario modeling enhances decision-making by contrasting short-term forecasts focused on immediate trends with long-term forecasts that incorporate broader economic uncertainties and strategic outcomes.

Interest Rate Volatility

Interest rate volatility typically causes more pronounced fluctuations in short-term forecasts due to immediate market reactions to economic data and central bank policies, whereas long-term forecasts incorporate broader trends and structural factors, resulting in comparatively smoother projections. Understanding the divergence between short-term interest rate fluctuations and long-term rate expectations is crucial for effective risk management and investment strategy planning.

Time Series Decomposition

Time series decomposition separates data into trend, seasonal, and residual components, enhancing the accuracy of short-term forecasts by capturing immediate patterns and seasonal effects. Long-term forecasts rely more heavily on the trend component, as seasonal and irregular variations become less predictable over extended periods.

Short-term Forecast vs Long-term Forecast Infographic

moneydif.com

moneydif.com