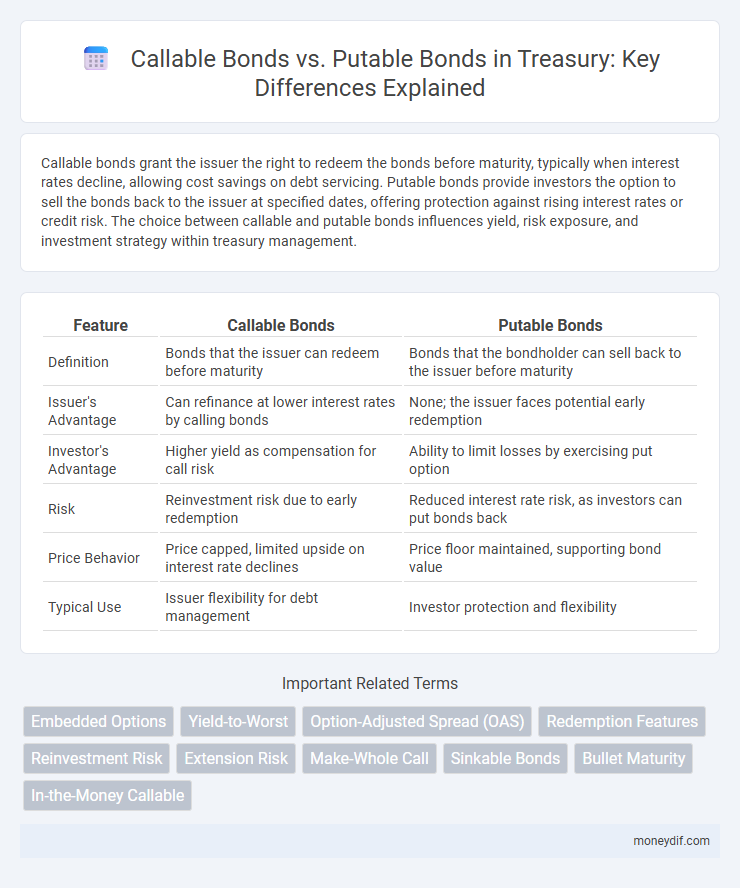

Callable bonds grant the issuer the right to redeem the bonds before maturity, typically when interest rates decline, allowing cost savings on debt servicing. Putable bonds provide investors the option to sell the bonds back to the issuer at specified dates, offering protection against rising interest rates or credit risk. The choice between callable and putable bonds influences yield, risk exposure, and investment strategy within treasury management.

Table of Comparison

| Feature | Callable Bonds | Putable Bonds |

|---|---|---|

| Definition | Bonds that the issuer can redeem before maturity | Bonds that the bondholder can sell back to the issuer before maturity |

| Issuer's Advantage | Can refinance at lower interest rates by calling bonds | None; the issuer faces potential early redemption |

| Investor's Advantage | Higher yield as compensation for call risk | Ability to limit losses by exercising put option |

| Risk | Reinvestment risk due to early redemption | Reduced interest rate risk, as investors can put bonds back |

| Price Behavior | Price capped, limited upside on interest rate declines | Price floor maintained, supporting bond value |

| Typical Use | Issuer flexibility for debt management | Investor protection and flexibility |

Introduction to Callable and Putable Bonds

Callable bonds grant issuers the right to redeem the bond before maturity, allowing them to manage interest rate risk and refinancing costs. Putable bonds provide investors the option to sell the bond back to the issuer at predetermined prices, protecting against rising interest rates and credit risk. Both bond types offer flexibility, but cater to different risk management strategies within Treasury portfolios.

Key Features of Callable Bonds

Callable bonds give the issuer the right to redeem the bond before its maturity date, typically at a predetermined call price, which allows refinancing at lower interest rates when market conditions improve. These bonds usually offer higher yields compared to non-callable bonds to compensate investors for the call risk. Investors face reinvestment risk since the bond may be called away during periods of declining interest rates, limiting potential price appreciation.

Main Characteristics of Putable Bonds

Putable bonds grant investors the right to sell the bond back to the issuer at a predetermined price before maturity, providing downside protection during interest rate increases. These bonds typically exhibit lower yields compared to non-putable bonds due to the embedded put option's value. Their main characteristics include enhanced liquidity, reduced interest rate risk, and appeal to risk-averse investors seeking flexible exit strategies.

Advantages of Callable Bonds for Issuers

Callable bonds provide issuers with the strategic advantage of refinancing debt at lower interest rates when market conditions improve, reducing overall borrowing costs. These bonds enhance financial flexibility by allowing issuers to manage liabilities and capital structure more actively. The ability to redeem bonds before maturity helps issuers mitigate interest rate risk and optimize debt management.

Benefits of Putable Bonds for Investors

Putable bonds provide investors with the advantage of flexibility by allowing them to sell the bond back to the issuer before maturity at a predetermined price, reducing interest rate risk. This feature protects investors during periods of rising interest rates, as they can exit the bond and reinvest at higher yields. The put option enhances the bond's marketability, offering a safeguard against adverse market movements and preserving capital value.

Interest Rate Impact on Callable vs Putable Bonds

Callable bonds expose issuers to higher interest rate risk because rising rates may lead to bondholders losing the call option value, resulting in reinvestment at lower yields. Putable bonds provide investors with protection against falling interest rates by allowing bondholders to sell the bond back to the issuer, minimizing price decline impact. Interest rate fluctuations directly affect the valuation and exercise strategy of these embedded options, influencing bond prices and yield spreads in Treasury markets.

Yield Differences Between Callable and Putable Bonds

Callable bonds generally offer higher yields compared to putable bonds due to the issuer's right to redeem the bond before maturity, which increases reinvestment risk for investors. Putable bonds tend to have lower yields because they provide bondholders the option to sell the bond back to the issuer at predetermined prices, reducing interest rate risk. The yield spread between callable and putable bonds reflects the compensation investors demand for bearing the call risk versus the benefit of having a put option.

Credit Risk Considerations

Callable bonds carry higher credit risk because issuers often redeem them when interest rates decline, potentially limiting investors' returns during favorable market conditions. Putable bonds offer investors protection by allowing early redemption, thereby reducing exposure to credit risk and interest rate fluctuations. Evaluating credit risk in callable versus putable bonds involves assessing issuer creditworthiness, call or put provisions, and prevailing market interest rates.

Pricing and Valuation of Callable and Putable Treasury Bonds

Pricing and valuation of callable Treasury bonds incorporate the issuer's right to redeem the bond before maturity, which typically results in higher yields to compensate investors for the reinvestment risk and limits price appreciation during interest rate declines. Putable Treasury bonds offer investors the option to sell the bond back to the issuer, reducing interest rate risk and often valued with a premium reflected in lower yields compared to comparable non-putable bonds. Valuation models for these bonds integrate option pricing techniques, such as the Black-Scholes or binomial model, to accurately assess embedded call or put options' impact on bond price sensitivity to interest rate movements.

Strategic Portfolio Use: Callable vs Putable Bonds

Callable bonds offer issuers the strategic advantage of retiring debt early during declining interest rates, allowing portfolio managers to reinvest at lower yields and manage interest rate risk effectively. Putable bonds enhance investor control by granting the option to sell the bond back to the issuer before maturity, providing downside protection in rising rate environments and improving liquidity management. Balancing callable and putable bonds within a treasury portfolio supports optimized cash flow timing, risk mitigation, and yield enhancement based on prevailing market conditions.

Important Terms

Embedded Options

Embedded options in callable bonds allow issuers to redeem the bond before maturity, typically at a premium, providing flexibility to refinance when interest rates decline; conversely, putable bonds grant holders the right to sell the bond back to the issuer at a predetermined price, offering protection against rising interest rates. The valuation of these embedded options significantly impacts bond pricing and yield, with callable bonds generally exhibiting higher yields due to issuer advantage and putable bonds showing lower yields reflecting investor protection.

Yield-to-Worst

Yield-to-Worst measures the lowest potential yield on callable bonds versus the highest potential yield on putable bonds, reflecting the risk of early redemption or forced sale.

Option-Adjusted Spread (OAS)

Option-Adjusted Spread (OAS) measures the yield spread of callable bonds by adjusting for the embedded call option, reflecting the additional risk and potential loss to investors if the issuer redeems early. In contrast, OAS on putable bonds accounts for the embedded put option that provides investors with downside protection, often resulting in a narrower spread compared to non-option bonds, as the put option reduces the bond's interest rate risk and credit risk.

Redemption Features

Redemption features in callable bonds grant issuers the right to redeem the bond before maturity, often at a premium, allowing refinancing in declining interest rate environments and increasing reinvestment risk for investors. Putable bonds provide holders the option to sell the bond back to the issuer at predetermined times or prices, offering downside protection by enabling early redemption when interest rates rise or credit quality declines.

Reinvestment Risk

Reinvestment risk is higher in callable bonds because issuers tend to redeem bonds when interest rates decline, forcing investors to reinvest at lower yields; putable bonds reduce reinvestment risk by giving investors the option to sell the bond back to the issuer at predetermined prices, allowing reinvestment at better rates when interest rates rise. The presence of call options increases uncertainty about cash flows, while put options provide investors with more control over reinvestment timing and rate risk.

Extension Risk

Extension risk is higher in callable bonds because the issuer can delay repayment by calling the bond when interest rates decline, leading to longer holding periods and reduced reinvestment opportunities for investors. Putable bonds reduce extension risk by allowing investors to sell the bond back to the issuer before maturity, limiting the time exposure and potential loss from rising interest rates.

Make-Whole Call

Make-whole calls on callable bonds require issuers to pay bondholders a premium based on the present value of remaining coupon payments, whereas putable bonds grant investors the right to sell the bond back to the issuer at a predetermined price before maturity.

Sinkable Bonds

Sinkable bonds require the issuer to regularly retire portions of the bond issue before maturity, reducing credit risk compared to callable bonds, which allow issuers to redeem bonds early at their discretion, potentially disadvantaging investors. Putable bonds give investors the option to sell the bond back to the issuer at specified times, enhancing investor protection against rising interest rates, contrasting with the issuer-controlled advantages of callable and sinkable bonds.

Bullet Maturity

Bullet maturity in callable bonds limits issuer call options by fixing the principal repayment date, whereas in putable bonds, it establishes the final date for investor redemption rights.

In-the-Money Callable

In-the-money callable bonds allow issuers to redeem the bond before maturity when the market interest rate drops below the coupon rate, enabling cost savings by refinancing at lower rates; in contrast, putable bonds give investors the right to sell the bond back to the issuer before maturity when interest rates rise, reducing downside risk. The intrinsic value of an in-the-money call option on a callable bond is the difference between the bond's price and its call price, whereas putable bonds' value increases with rising interest rates due to the put option's protective feature.

Callable Bonds vs Putable Bonds Infographic

moneydif.com

moneydif.com