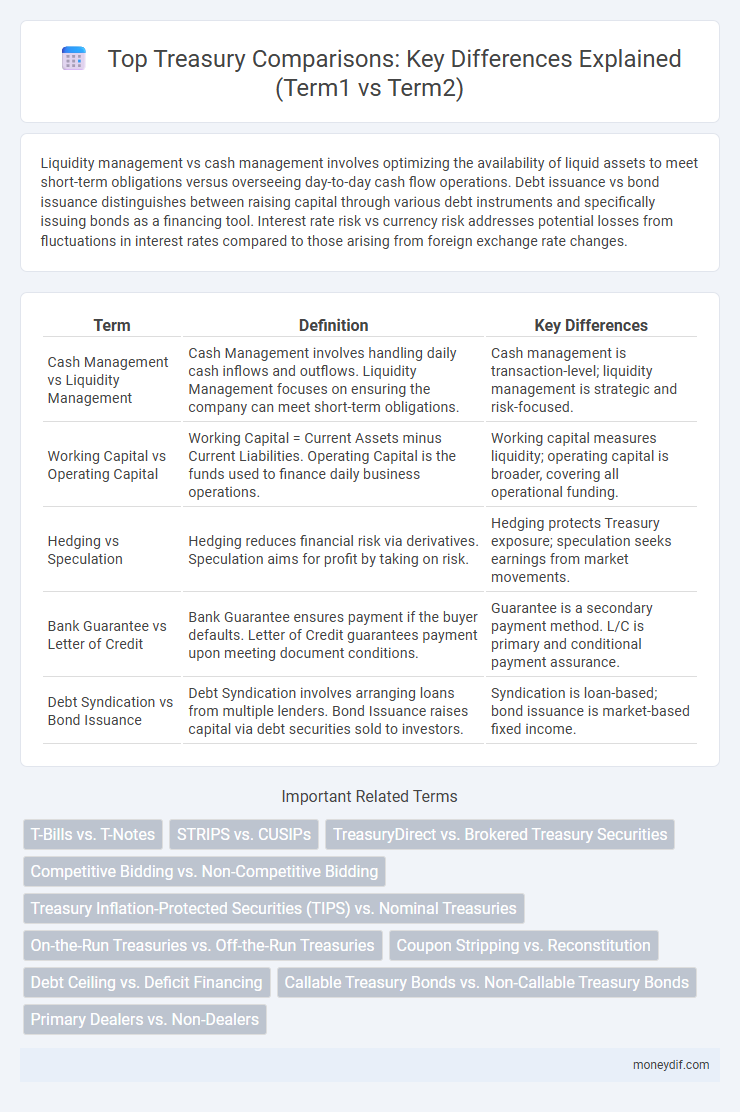

Liquidity management vs cash management involves optimizing the availability of liquid assets to meet short-term obligations versus overseeing day-to-day cash flow operations. Debt issuance vs bond issuance distinguishes between raising capital through various debt instruments and specifically issuing bonds as a financing tool. Interest rate risk vs currency risk addresses potential losses from fluctuations in interest rates compared to those arising from foreign exchange rate changes.

Table of Comparison

| Term | Definition | Key Differences |

|---|---|---|

| Cash Management vs Liquidity Management | Cash Management involves handling daily cash inflows and outflows. Liquidity Management focuses on ensuring the company can meet short-term obligations. | Cash management is transaction-level; liquidity management is strategic and risk-focused. |

| Working Capital vs Operating Capital | Working Capital = Current Assets minus Current Liabilities. Operating Capital is the funds used to finance daily business operations. | Working capital measures liquidity; operating capital is broader, covering all operational funding. |

| Hedging vs Speculation | Hedging reduces financial risk via derivatives. Speculation aims for profit by taking on risk. | Hedging protects Treasury exposure; speculation seeks earnings from market movements. |

| Bank Guarantee vs Letter of Credit | Bank Guarantee ensures payment if the buyer defaults. Letter of Credit guarantees payment upon meeting document conditions. | Guarantee is a secondary payment method. L/C is primary and conditional payment assurance. |

| Debt Syndication vs Bond Issuance | Debt Syndication involves arranging loans from multiple lenders. Bond Issuance raises capital via debt securities sold to investors. | Syndication is loan-based; bond issuance is market-based fixed income. |

Treasury Bills vs Treasury Bonds

Treasury Bills are short-term government securities with maturities of one year or less, sold at a discount and redeemed at face value, providing investors with a low-risk, liquid investment option. Treasury Bonds, in contrast, have longer maturities of 10 to 30 years, pay fixed semi-annual interest, and offer higher yields to compensate for increased interest rate risk and inflation exposure. Both instruments are backed by the U.S. government, but their differing durations and cash flow structures cater to distinct investment strategies and risk tolerances.

Cash Management vs Liquidity Management

Cash Management centers on the efficient handling of daily cash inflows and outflows to ensure operational continuity, emphasizing short-term cash availability and forecasting. Liquidity Management broadens this scope by assessing the organization's ability to meet both short-term obligations and unexpected financial demands, incorporating asset-liability strategies and access to credit facilities. Effective Treasury operations integrate both practices to optimize working capital and maintain financial stability.

Corporate Treasury vs Public Treasury

Corporate Treasury manages a company's financial resources, focusing on liquidity, risk management, and capital structure to maximize shareholder value. Public Treasury handles government funds, overseeing budget allocation, public debt issuance, and fiscal policy implementation to support national economic stability. Both entities utilize cash flow forecasting and financial reporting but differ significantly in their objectives, stakeholders, and regulatory environments.

Centralized Treasury vs Decentralized Treasury

Centralized Treasury consolidates cash management, risk assessment, and decision-making within a single corporate office, enhancing control and liquidity optimization. Decentralized Treasury distributes these functions across multiple business units or geographic locations, increasing flexibility but potentially reducing efficiency and complicating oversight. Centralized Treasury typically benefits large enterprises seeking streamlined processes, while Decentralized Treasury suits organizations requiring localized autonomy to manage currency exposure and operational risks.

Active vs Passive Treasury Investment Strategies

Active treasury investment strategies involve continuous portfolio management with frequent adjustments based on market trends, interest rate changes, and economic forecasts to maximize returns and manage risks effectively. Passive treasury investment strategies typically follow a buy-and-hold approach, mirroring benchmark indices to minimize transaction costs and maintain steady growth with reduced management complexity. Choosing between active and passive strategies depends on factors such as risk tolerance, investment horizon, and organizational objectives.

In-house Banking vs Traditional Treasury Structures

In-house banking centralizes cash management and intercompany financing within a corporate group, reducing reliance on external banks and optimizing internal liquidity flows. Traditional treasury structures depend heavily on multiple external banking relationships, often leading to higher transaction costs and fragmented cash visibility. In-house banking enhances control over funds, improves interest optimization, and streamlines risk management compared to conventional decentralized treasury models.

Treasury Risk Management vs Enterprise Risk Management

Treasury Risk Management concentrates on optimizing liquidity, managing cash flow, and mitigating financial risks such as interest rate fluctuations and foreign exchange exposure, directly impacting an organization's capital structure and funding costs. Enterprise Risk Management (ERM) encompasses a broader scope by identifying, assessing, and managing risks across all business units, including strategic, operational, financial, and compliance risks to ensure overall organizational resilience. Effective integration of Treasury Risk Management within ERM frameworks enhances decision-making by aligning financial risk controls with the company's global risk appetite and governance policies.

Treasury Workstations vs Manual Treasury Processes

Treasury Workstations streamline cash management, risk analysis, and compliance reporting through automated workflows, significantly reducing human error compared to Manual Treasury Processes. Manual methods rely heavily on spreadsheets and physical documentation, leading to slower data processing and increased operational risk. Implementing Treasury Workstations enhances real-time decision-making and improves overall treasury efficiency by integrating multiple financial instruments and systems into a single platform.

Secured vs Unsecured Treasury Funding

Secured Treasury funding involves collateralized borrowing, reducing lender risk and often resulting in lower interest rates, while unsecured Treasury funding relies solely on the borrower's creditworthiness without collateral, typically leading to higher borrowing costs. Secured funding enhances market confidence by providing lenders a claim on specific assets in case of default, whereas unsecured funding exposes lenders to greater risk but offers more flexibility in capital allocation. Treasury management strategies weigh the trade-offs between secured versus unsecured funding based on cost of capital, liquidity needs, and risk tolerance.

Short-term vs Long-term Treasury Instruments

Short-term Treasury instruments, such as Treasury bills (T-bills), mature in one year or less and offer lower yields but higher liquidity, making them ideal for immediate cash needs. Long-term Treasury instruments, including Treasury notes and bonds, have maturities ranging from 2 to 30 years, providing higher interest rates that compensate for greater interest rate risk. Investors balance portfolio duration by selecting short-term instruments for capital preservation and long-term instruments for income generation and inflation protection.

Important Terms

T-Bills vs. T-Notes

T-Bills are short-term U.S. Treasury securities maturing in one year or less with no interest payments, while T-Notes are medium-term securities maturing between 2 and 10 years that pay semiannual interest.

STRIPS vs. CUSIPs

STRIPS (Separate Trading of Registered Interest and Principal Securities) are Treasury securities that have been separated into individual interest and principal components, allowing investors to purchase zero-coupon bonds with specific maturity dates; CUSIPs (Committee on Uniform Securities Identification Procedures) are unique identification numbers assigned to all registered securities, including STRIPS, facilitating precise tracking and settlement in the U.S. financial markets. While STRIPS represent the actual securities, CUSIPs serve as essential identifiers that enable efficient trading, clearing, and record-keeping across Treasury instruments.

TreasuryDirect vs. Brokered Treasury Securities

TreasuryDirect offers a direct purchasing platform for individuals to buy and manage U.S. Treasury securities without fees, ensuring full ownership and easy access to paperless certificates, while Brokered Treasury Securities are bought through brokerage firms that may charge commissions and provide the convenience of secondary market trading and portfolio diversification. TreasuryDirect is ideal for long-term investors focused on cost efficiency and direct government transactions, whereas brokered securities appeal to those seeking market liquidity and professional portfolio management.

Competitive Bidding vs. Non-Competitive Bidding

Competitive bidding requires investors to specify the yield they are willing to accept for Treasury securities, while non-competitive bidding guarantees allotment at the auction's yield without specifying a bid.

Treasury Inflation-Protected Securities (TIPS) vs. Nominal Treasuries

Treasury Inflation-Protected Securities (TIPS) adjust their principal value based on changes in the Consumer Price Index, providing investors protection against inflation, whereas Nominal Treasuries offer fixed principal and interest payments without inflation adjustments. TIPS typically yield lower nominal interest rates but preserve purchasing power, making them attractive for inflation hedging compared to standard Nominal Treasuries which carry inflation risk.

On-the-Run Treasuries vs. Off-the-Run Treasuries

On-the-Run Treasuries are the most recently issued U.S. government bonds with higher liquidity and lower bid-ask spreads compared to Off-the-Run Treasuries, which are older issues typically offering higher yields but less trading volume.

Coupon Stripping vs. Reconstitution

Coupon stripping separates Treasury bond coupon payments into individual zero-coupon securities, while reconstitution combines these stripped coupons and principal components back into the original bond.

Debt Ceiling vs. Deficit Financing

Debt ceiling limits government borrowing capacity while deficit financing involves using debt to cover budget shortfalls within that limit.

Callable Treasury Bonds vs. Non-Callable Treasury Bonds

Callable Treasury Bonds allow issuers to redeem the bonds before maturity, offering higher yields but increased reinvestment risk compared to Non-Callable Treasury Bonds which provide fixed returns and greater investment stability.

Primary Dealers vs. Non-Dealers

Primary dealers are financial institutions authorized by the Federal Reserve to trade government securities directly and participate in Treasury auctions, ensuring liquidity and market stability. Non-dealers, on the other hand, are investors or entities that purchase Treasury securities in secondary markets without the privilege to directly engage in auctions or provide market-making functions.

Sure! Here are some niche Treasury-related "term1 vs term2" comparisons: Infographic

moneydif.com

moneydif.com