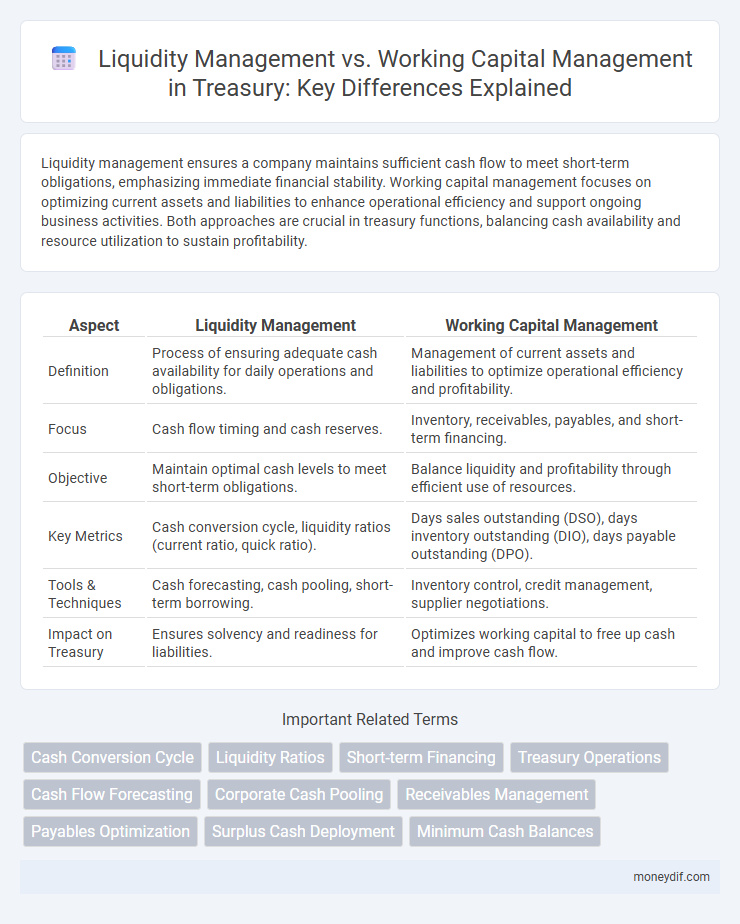

Liquidity management ensures a company maintains sufficient cash flow to meet short-term obligations, emphasizing immediate financial stability. Working capital management focuses on optimizing current assets and liabilities to enhance operational efficiency and support ongoing business activities. Both approaches are crucial in treasury functions, balancing cash availability and resource utilization to sustain profitability.

Table of Comparison

| Aspect | Liquidity Management | Working Capital Management |

|---|---|---|

| Definition | Process of ensuring adequate cash availability for daily operations and obligations. | Management of current assets and liabilities to optimize operational efficiency and profitability. |

| Focus | Cash flow timing and cash reserves. | Inventory, receivables, payables, and short-term financing. |

| Objective | Maintain optimal cash levels to meet short-term obligations. | Balance liquidity and profitability through efficient use of resources. |

| Key Metrics | Cash conversion cycle, liquidity ratios (current ratio, quick ratio). | Days sales outstanding (DSO), days inventory outstanding (DIO), days payable outstanding (DPO). |

| Tools & Techniques | Cash forecasting, cash pooling, short-term borrowing. | Inventory control, credit management, supplier negotiations. |

| Impact on Treasury | Ensures solvency and readiness for liabilities. | Optimizes working capital to free up cash and improve cash flow. |

Understanding Liquidity Management in Treasury

Liquidity management in treasury focuses on ensuring that an organization maintains sufficient cash and liquid assets to meet its short-term obligations without compromising operational efficiency. It involves real-time monitoring of cash flows, optimizing cash reserves, and managing short-term investments to maximize liquidity while minimizing the cost of funds. Effective liquidity management safeguards against insolvency risks and supports strategic financial stability within the corporate treasury function.

Defining Working Capital Management

Working Capital Management involves managing a company's short-term assets and liabilities to ensure operational efficiency and maintain sufficient liquidity for daily operations. It focuses on optimizing inventory levels, accounts receivable, and accounts payable to improve cash flow and profitability. Effective working capital management reduces the risk of financial distress and supports sustainable business growth.

Key Objectives: Liquidity vs Working Capital

Liquidity management focuses on ensuring a company has sufficient cash flow to meet short-term obligations and maintain operational stability, emphasizing real-time cash availability and risk mitigation. Working capital management aims to optimize the balance between current assets and current liabilities, enhancing operational efficiency and supporting ongoing business activities through effective inventory, receivables, and payables management. Both strategies are critical for financial health, with liquidity management prioritizing solvency and working capital management emphasizing profitability and asset utilization.

Core Components of Liquidity Management

Core components of liquidity management include cash flow forecasting, maintaining adequate cash reserves, and optimizing short-term investments to ensure the organization meets its immediate financial obligations. Effective liquidity management prioritizes real-time monitoring of cash inflows and outflows, short-term borrowing capabilities, and contingency planning for unexpected liquidity needs. These elements distinguish liquidity management from working capital management, which primarily focuses on optimizing current assets and liabilities such as inventory, accounts receivable, and accounts payable.

Essential Elements of Working Capital Management

Working Capital Management revolves around optimizing current assets and liabilities to ensure operational efficiency and solvency, with essential elements including inventory management, accounts receivable, and accounts payable. Maintaining an optimal balance between cash flow, receivables, and payables reduces the risk of liquidity shortages and supports smooth business operations. Effective working capital management directly impacts a company's profitability and short-term financial health by minimizing costs and maximizing resource utilization.

Tools and Techniques for Managing Liquidity

Liquidity management employs cash flow forecasting, bank overdraft facilities, and short-term investments to ensure immediate cash availability, while working capital management focuses on optimizing current assets and liabilities like inventory turnover and accounts receivable collection. Cash concentration systems and zero-balance accounts are crucial tools in liquidity management, enabling efficient centralization of cash and minimizing idle balances. Techniques such as cash pooling, demand forecasting, and electronic payment systems enhance liquidity control by accelerating cash inflows and managing outflows effectively.

Strategies for Optimizing Working Capital

Effective strategies for optimizing working capital in treasury involve closely managing receivables, payables, and inventory to enhance cash flow and operational efficiency. Implementing real-time cash forecasting and dynamic discounting can improve liquidity while reducing financing costs. Leveraging automated treasury management systems ensures accurate tracking and timely decision-making, aligning working capital optimization with overall corporate financial goals.

Impact on Treasury Performance and Risk

Liquidity management ensures optimal cash flow to meet short-term obligations, directly enhancing Treasury's capability to maintain solvency and reduce liquidity risk. Working capital management focuses on efficiently balancing current assets and liabilities to optimize operational efficiency, which indirectly supports Treasury performance by stabilizing cash conversion cycles. Effective integration of both strategies minimizes financial risk, improves cash availability, and strengthens overall Treasury risk management frameworks.

Liquidity Management vs Working Capital: Key Differences

Liquidity management focuses on ensuring a company has sufficient cash flow to meet short-term obligations, prioritizing immediate financial stability. Working capital management involves optimizing current assets and liabilities to enhance operational efficiency and support ongoing business activities. The key difference lies in liquidity management targeting cash availability for solvency, while working capital management aims to balance resources for sustained operational performance.

Best Practices in Treasury for Balancing Liquidity and Working Capital

Effective liquidity management in treasury ensures sufficient cash flow to meet short-term obligations while avoiding excess idle funds, optimizing cash conversion cycles enhances working capital efficiency by reducing days sales outstanding and inventory turnover times. Implementing real-time cash forecasting and automated payment systems supports accurate liquidity planning, enabling treasurers to balance liquidity reserves with operational funding needs. Best practices emphasize integrated treasury technology platforms that align liquidity management with working capital strategies for improved financial agility and minimized borrowing costs.

Important Terms

Cash Conversion Cycle

The Cash Conversion Cycle measures how efficiently a company manages its liquidity by optimizing working capital components such as inventory, receivables, and payables.

Liquidity Ratios

Liquidity ratios measure a company's ability to meet short-term obligations by analyzing liquid assets, which is essential for effective liquidity management and optimizing working capital management strategies.

Short-term Financing

Short-term financing plays a crucial role in liquidity management by ensuring sufficient cash flow to meet immediate obligations, whereas working capital management focuses on optimizing current assets and liabilities to maintain operational efficiency. Effective short-term financing strategies directly impact liquidity ratios, such as the current ratio and quick ratio, while working capital management influences inventory turnover and accounts receivable cycles.

Treasury Operations

Treasury operations focus on optimizing liquidity management to ensure sufficient cash flow for daily obligations, while working capital management targets the efficient use of short-term assets and liabilities to support operational efficiency. Effective coordination between these functions enhances cash conversion cycles, minimizes financing costs, and maximizes asset utilization for overall financial stability.

Cash Flow Forecasting

Cash flow forecasting enables precise liquidity management by predicting available cash to meet short-term obligations, ensuring sufficient liquidity for operational stability. In contrast, working capital management focuses on optimizing current assets and liabilities to enhance operational efficiency and maintain a balance between profitability and liquidity.

Corporate Cash Pooling

Corporate cash pooling optimizes liquidity management by consolidating cash balances for efficient cash flow control while supporting working capital management through improved fund allocation and reduced borrowing costs.

Receivables Management

Effective receivables management improves liquidity by accelerating cash inflows, which directly optimizes working capital management and enhances overall financial stability.

Payables Optimization

Payables Optimization enhances liquidity management by strategically timing supplier payments to improve cash flow and reduce reliance on external financing. It directly impacts working capital management by efficiently balancing accounts payable with receivables and inventory to maximize operational liquidity and financial flexibility.

Surplus Cash Deployment

Surplus cash deployment optimizes liquidity management by ensuring excess funds are efficiently allocated for short-term obligations while balancing working capital management to maintain operational efficiency and financial stability.

Minimum Cash Balances

Minimum cash balances ensure sufficient liquidity to meet short-term obligations without hampering operational efficiency, balancing cash reserves against working capital components like inventory and receivables. Effective liquidity management focuses on maintaining these minimum balances to prevent insolvency, while working capital management optimizes cash flow to enhance overall business profitability.

Liquidity Management vs Working Capital Management Infographic

moneydif.com

moneydif.com