Eurodollars refer to U.S. dollar-denominated deposits held in banks outside the United States, primarily used in international finance and treasury operations for efficient liquidity management. Eurobonds are international bonds issued in a currency different from the country where it is issued, often utilized by corporations and governments to raise capital across borders. Treasury professionals analyze the differences in risk, yield, and regulatory environments between Eurodollars and Eurobonds to optimize funding strategies and balance sheet management.

Table of Comparison

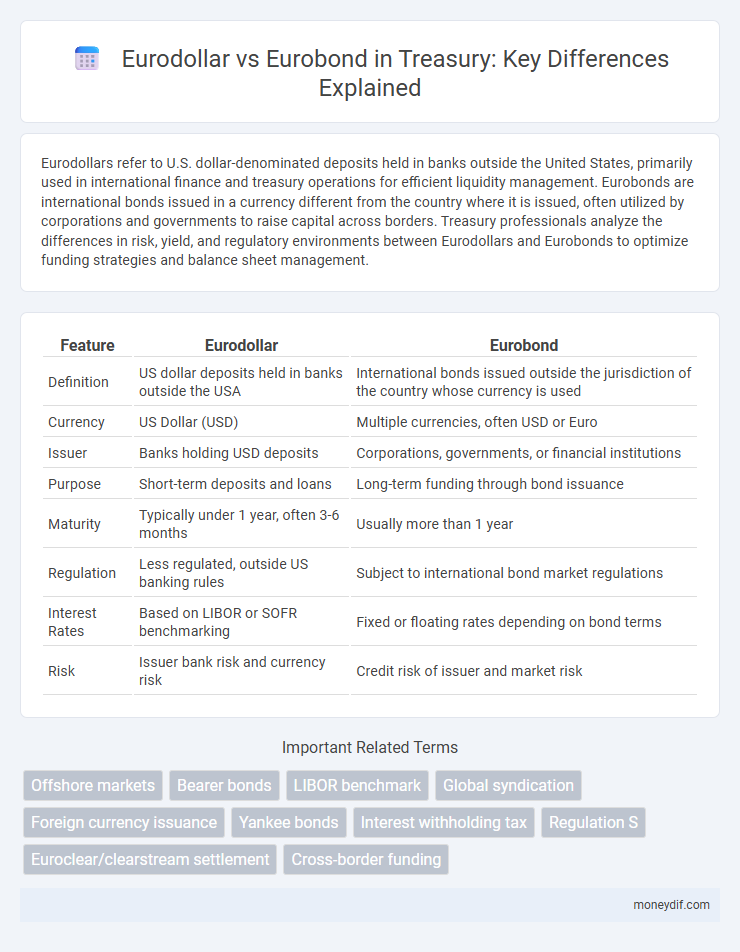

| Feature | Eurodollar | Eurobond |

|---|---|---|

| Definition | US dollar deposits held in banks outside the USA | International bonds issued outside the jurisdiction of the country whose currency is used |

| Currency | US Dollar (USD) | Multiple currencies, often USD or Euro |

| Issuer | Banks holding USD deposits | Corporations, governments, or financial institutions |

| Purpose | Short-term deposits and loans | Long-term funding through bond issuance |

| Maturity | Typically under 1 year, often 3-6 months | Usually more than 1 year |

| Regulation | Less regulated, outside US banking rules | Subject to international bond market regulations |

| Interest Rates | Based on LIBOR or SOFR benchmarking | Fixed or floating rates depending on bond terms |

| Risk | Issuer bank risk and currency risk | Credit risk of issuer and market risk |

Introduction to Eurodollar and Eurobond

Eurodollars are U.S. dollar-denominated deposits held in banks outside the United States, facilitating offshore lending and borrowing with reduced regulatory constraints. Eurobonds are international bonds issued in a currency different from the issuer's home country, providing diverse funding sources and access to global capital markets. Both Eurodollars and Eurobonds play critical roles in global treasury management by enhancing liquidity and offering flexible financing options.

Defining Eurodollar: Core Characteristics

Eurodollars are U.S. dollar-denominated deposits held in banks outside the United States, primarily in Europe, serving as a critical source of short-term funding in the international money market. These deposits offer flexibility and liquidity, often used by corporations and financial institutions to manage foreign exchange risk and capitalize on interest rate differentials. Unlike Eurobonds, which are debt securities issued in a currency not native to the issuing country, Eurodollars represent deposits rather than tradable fixed-income instruments.

Understanding Eurobonds: Key Features

Eurobonds are international bonds issued in a currency different from the issuer's home country, typically traded in the Eurobond market and known for their broad investor base and flexibility. They offer fixed or floating interest rates, have longer maturities than Eurodollars, and provide issuers with access to international capital without US regulatory constraints. The key features include bearer or registered form, exemption from withholding tax in many jurisdictions, and issuance by sovereign, corporate, or supranational entities to diversify funding sources.

Historical Evolution of Eurodollar and Eurobond Markets

The Eurodollar market emerged in the 1950s when U.S. dollars were deposited in European banks to circumvent domestic regulations, catalyzing a global offshore dollar market. The Eurobond market developed in the 1960s, primarily driven by corporations seeking to raise capital in international currencies outside the jurisdiction of the issuer's domestic laws. These markets facilitated cross-border capital flows, contributing to the globalization of finance and the development of sophisticated treasury management strategies.

Issuers and Investors: Who Uses Eurodollars vs Eurobonds?

Eurodollars are dollar-denominated deposits held in banks outside the United States, primarily used by multinational corporations, financial institutions, and sovereign governments seeking short-term liquidity and cost-effective dollar funding. Eurobonds, on the other hand, are international bonds issued in a currency different from the issuer's domestic currency, commonly utilized by corporations and sovereign entities aiming to diversify investor bases and raise long-term capital across global markets. Investors in Eurodollars typically prefer liquid, low-risk assets for short-term treasury management, while Eurobond investors seek stable income streams and currency diversification in their fixed-income portfolios.

Currency Denomination: Comparing Eurodollar and Eurobond Structures

Eurodollar deposits are U.S. dollar-denominated deposits held in banks outside the United States, enabling seamless dollar transactions in international markets without exposure to U.S. banking regulations. Eurobonds, in contrast, are debt instruments issued in a currency different from the country where they are sold, often denominated in U.S. dollars, euros, or other major currencies, facilitating diversified currency exposure for investors. The distinct currency denomination in Eurodollar and Eurobond structures influences interest rate risk, foreign exchange risk, and regulatory treatment across global treasury operations.

Regulatory Environments and Jurisdictional Differences

Eurodollars are U.S. dollar-denominated deposits held in banks outside the United States, primarily regulated by the jurisdiction where the offshore bank operates, often benefiting from less stringent U.S. banking regulations. Eurobonds, on the other hand, are international bonds issued in a currency not native to the country where they are issued, subject to the regulatory frameworks of the issuing country and key financial centers such as London or Luxembourg, with varying disclosure and tax treatment requirements. The divergent regulatory environments affect compliance costs, investor protections, and taxation, influencing corporate decisions on capital raising through Eurodollars or Eurobonds.

Risk Profile: Credit, Interest Rate, and Exchange Rate Risks

Eurodollars carry minimal exchange rate risk as they are dollar-denominated deposits held outside the United States but are exposed to interest rate risk due to fluctuations in US dollar interest rates and credit risk linked to the issuing bank's solvency. Eurobonds expose investors to credit risk from the issuer's default possibility, interest rate risk driven by global interest rate changes impacting bond prices, and exchange rate risk when denominated in currencies other than the investor's base currency. Managing these risks involves creditworthiness assessment of issuers, interest rate hedging strategies, and currency risk mitigation techniques tailored to the specific instruments.

Market Liquidity and Trading Practices

Eurodollar deposits offer high market liquidity due to their widespread use among multinational banks and availability in the offshore U.S. dollar market, making them a preferred short-term funding instrument. Eurobonds, denominated in various currencies and traded primarily over-the-counter, exhibit lower liquidity compared to Eurodollars but provide greater issuer flexibility in terms of currency and investor base. Trading practices for Eurodollars emphasize interbank transactions with standardized contract sizes, while Eurobonds involve bond dealers and involve more complex settlement processes reflecting diverse regulatory environments.

Strategic Applications in Treasury Management

Eurodollars offer treasury management teams access to U.S. dollar-denominated deposits held outside the United States, facilitating efficient short-term liquidity management and cost-effective funding in global markets. Eurobonds serve as strategic instruments for raising long-term capital in diverse currencies, enabling treasury departments to optimize debt portfolios and manage interest rate and currency risks effectively. Leveraging Eurodollars for cash management and Eurobonds for capital structure diversification enhances overall treasury strategy and financial flexibility.

Important Terms

Offshore markets

Offshore markets facilitate the trading of Eurodollars, which are U.S. dollar-denominated deposits held in banks outside the United States, and Eurobonds, which are international bonds issued in a currency different from the issuer's domestic currency. Eurodollars provide liquidity and financing for multinational corporations, while Eurobonds offer diversified investment opportunities across global capital markets.

Bearer bonds

Bearer bonds are unregistered debt securities often issued in the Eurobond market, distinguishing them from Eurodollar deposits which are U.S. dollar-denominated time deposits held in foreign banks.

LIBOR benchmark

The LIBOR benchmark, primarily based on Eurodollar deposits, serves as a key reference rate for pricing Eurobonds issued in US dollars, reflecting short-term interbank lending costs.

Global syndication

Global syndication involves the coordinated distribution of Eurodollar loans and Eurobonds across international markets, enhancing liquidity and risk-sharing among diverse investors. Eurodollar deposits represent US dollar-denominated funds held outside the United States, primarily used in syndicated lending, whereas Eurobonds are international debt instruments issued in a currency different from the issuer's domestic currency, facilitating cross-border capital raising.

Foreign currency issuance

Foreign currency issuance facilitates global capital flows by allowing entities to raise funds in currencies different from their home market, with Eurodollars representing U.S. dollars deposited in banks outside the United States, primarily used in short-term money markets. Eurobonds are long-term debt securities issued in a currency not native to the country where they are issued, enabling corporations and governments to access international investors and diversify funding sources beyond domestic capital markets.

Yankee bonds

Yankee bonds are U.S. dollar-denominated bonds issued by foreign entities in the U.S. market, differing from Eurodollar bonds which are U.S. dollar-denominated bonds issued outside the U.S., and Eurobonds which are international bonds typically denominated in a currency different from the issuing country's currency.

Interest withholding tax

Interest withholding tax on Eurobonds often varies by jurisdiction, whereas Eurodollar deposits generally face no withholding tax, making Eurodollars more tax-efficient for interest income.

Regulation S

Regulation S provides a safe harbor exemption for offers and sales of Eurodollar deposits and Eurobonds outside the United States, facilitating capital market transactions by non-U.S. investors. Eurodollar deposits represent U.S. dollar-denominated time deposits held in banks outside the United States, while Eurobonds are international bonds issued in a currency different from the issuer's domestic currency, often regulated under Regulation S to avoid U.S. securities registration.

Euroclear/clearstream settlement

Euroclear and Clearstream facilitate the efficient settlement of Eurodollar transactions, ensuring secure handling of these U.S. dollar-denominated deposits held outside the United States, while also supporting the custody and settlement of Eurobonds, which are international bonds issued in a currency not native to the issuer's country. Their integrated platforms enhance liquidity and reduce settlement risk for cross-border fixed income securities trading, particularly in multi-currency environments involving Eurodollars and Eurobonds.

Cross-border funding

Cross-border funding often involves Eurodollars, which are U.S. dollar deposits held in banks outside the United States, providing liquidity for international borrowers without direct exposure to U.S. banking regulations. Eurobonds, in contrast, are international bonds issued in a currency not native to the country where they are issued, offering issuers access to global capital markets and investors diversified exposure beyond domestic markets.

Eurodollar vs Eurobond Infographic

moneydif.com

moneydif.com