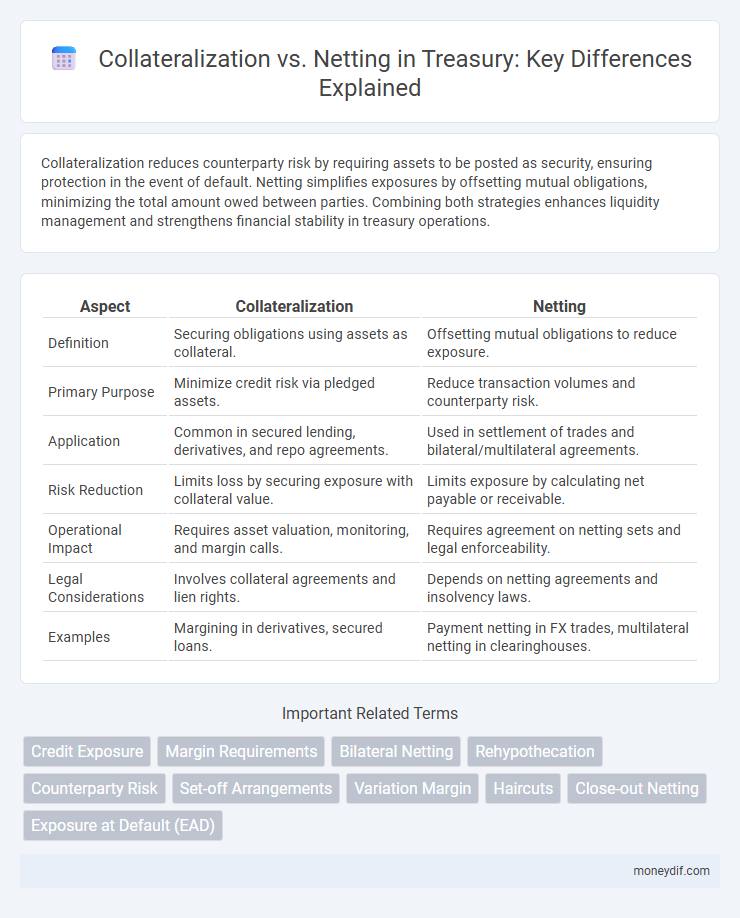

Collateralization reduces counterparty risk by requiring assets to be posted as security, ensuring protection in the event of default. Netting simplifies exposures by offsetting mutual obligations, minimizing the total amount owed between parties. Combining both strategies enhances liquidity management and strengthens financial stability in treasury operations.

Table of Comparison

| Aspect | Collateralization | Netting |

|---|---|---|

| Definition | Securing obligations using assets as collateral. | Offsetting mutual obligations to reduce exposure. |

| Primary Purpose | Minimize credit risk via pledged assets. | Reduce transaction volumes and counterparty risk. |

| Application | Common in secured lending, derivatives, and repo agreements. | Used in settlement of trades and bilateral/multilateral agreements. |

| Risk Reduction | Limits loss by securing exposure with collateral value. | Limits exposure by calculating net payable or receivable. |

| Operational Impact | Requires asset valuation, monitoring, and margin calls. | Requires agreement on netting sets and legal enforceability. |

| Legal Considerations | Involves collateral agreements and lien rights. | Depends on netting agreements and insolvency laws. |

| Examples | Margining in derivatives, secured loans. | Payment netting in FX trades, multilateral netting in clearinghouses. |

Introduction to Collateralization and Netting in Treasury

Collateralization in treasury involves securing obligations with assets to reduce credit risk and enhance counterparty confidence, often using securities or cash as collateral. Netting consolidates multiple obligations into a single net payment or receipt, minimizing settlement risk and capital requirements in treasury operations. Both practices are essential for optimizing liquidity management and mitigating counterparty exposure in financial transactions.

Key Differences Between Collateralization and Netting

Collateralization involves pledging assets to secure a financial obligation, reducing credit risk by providing a tangible guarantee, whereas netting consolidates multiple obligations into a single payment to simplify settlement and minimize exposure. Collateralization requires ongoing valuation and management of pledged assets, while netting depends on contractual agreements to offset mutual debts, streamlining cash flow and reducing liquidity demands. The key difference lies in collateralization's focus on asset-backed security versus netting's emphasis on mutual offset of bilateral or multilateral exposures.

How Collateralization Works in Treasury Operations

Collateralization in treasury operations involves pledging assets such as securities or cash to secure obligations, reducing counterparty risk and enhancing creditworthiness. By holding collateral, treasuries ensure payment or performance of financial contracts, particularly in derivatives and lending transactions. This process improves liquidity management and mitigates exposure by providing a safety net against default while maintaining regulatory compliance.

The Mechanisms of Netting: Types and Applications

Netting in treasury management involves aggregating multiple payment obligations into a single net payment to reduce credit exposure and operational risk. Key types include bilateral netting, which consolidates transactions between two parties, and multilateral netting, which involves multiple parties to streamline settlement processes. Applications of netting mechanisms enhance liquidity management, optimize capital usage, and improve counterparty risk mitigation in financial institutions.

Risk Mitigation: Collateralization vs Netting

Collateralization reduces counterparty credit risk by requiring the posting of assets to secure exposures, ensuring immediate access to collateral in default scenarios. Netting minimizes overall exposure by offsetting reciprocal obligations, decreasing the aggregate credit risk and capital requirements. Both mechanisms enhance risk mitigation but serve distinct purposes: collateralization provides tangible security, whereas netting optimizes exposure management.

Regulatory Impacts on Collateralization and Netting

Regulatory frameworks such as Basel III and EMIR impose stringent collateralization requirements to mitigate counterparty credit risk, increasing the demand for high-quality liquid assets as collateral. Netting agreements, recognized under the ISDA Master Agreement and local insolvency laws, enhance risk reduction by allowing offsetting of exposures, thereby lowering capital requirements. Regulatory emphasis on both collateralization and netting strengthens financial stability by reducing systemic risk in derivative markets.

Treasury Efficiency: Comparing Collateral and Netting Strategies

Collateralization enhances Treasury efficiency by reducing counterparty credit risk through pledged assets, improving liquidity management and regulatory compliance. Netting strategies streamline settlement processes by offsetting mutual obligations, minimizing gross exposure and operational costs. Combining collateralization with netting optimizes capital allocation, reduces funding requirements, and strengthens risk mitigation frameworks within corporate Treasury operations.

Cost Implications for Collateralization and Netting

Collateralization incurs direct costs linked to funding collateral, including margin calls and liquidity management, which can strain treasury resources and impact capital allocation efficiency. Netting reduces the overall exposure by consolidating multiple obligations, leading to lower collateral requirements and decreased operational expenses. These cost implications influence treasury strategies by balancing liquidity needs against risk reduction and regulatory capital demands.

Best Practices for Implementing Collateralization and Netting

Effective implementation of collateralization and netting in treasury management requires establishing clear legal documentation such as Credit Support Annexes (CSAs) and Master Netting Agreements (MNAs) to mitigate counterparty risk. Regularly updating collateral thresholds and conducting mark-to-market valuations ensure accurate margin calls and reduce exposure. Employing automated systems for real-time monitoring and reconciliation enhances operational efficiency and compliance with regulatory standards like Basel III.

Future Trends in Treasury Collateralization and Netting

Future trends in treasury collateralization emphasize the integration of advanced technology such as blockchain and AI to enhance transparency and efficiency in collateral management. Netting processes are evolving with real-time data analytics and automation, reducing counterparty risk and optimizing liquidity usage across complex portfolios. Regulatory developments are increasingly driving standardized frameworks to support seamless collateralization and netting in global treasury operations.

Important Terms

Credit Exposure

Credit exposure represents the potential loss a party faces if a counterparty defaults, and its reduction is crucial in risk management. Collateralization mitigates credit exposure by securing transactions with assets, while netting reduces the aggregate exposure by offsetting mutual obligations, both enhancing financial stability.

Margin Requirements

Margin requirements ensure sufficient collateralization by mandating parties to hold adequate assets as security, reducing credit risk in financial transactions. Netting aggregates multiple obligations into a single net payment, effectively lowering the total collateral needed and optimizing margin requirements in derivatives trading.

Bilateral Netting

Bilateral netting reduces counterparty credit exposure by offsetting mutual obligations, enhancing collateral efficiency and minimizing margin requirements in derivative transactions. Compared to collateralization alone, netting consolidates exposures, allowing parties to hold less collateral while maintaining effective risk management and liquidity optimization.

Rehypothecation

Rehypothecation enables lenders to reuse pledged collateral, impacting risk management by influencing collateralization efficiency and netting arrangements in derivative transactions.

Counterparty Risk

Collateralization reduces counterparty risk by securing exposures with assets, while netting minimizes total exposure by offsetting mutual obligations between parties.

Set-off Arrangements

Set-off arrangements enable parties to offset mutual obligations, reducing credit exposure by consolidating debts, while collateralization involves securing obligations with assets to mitigate default risk. Netting techniques streamline multiple financial transactions into a single payment obligation, enhancing efficiency and minimizing counterparty risk in conjunction with collateral frameworks.

Variation Margin

Variation Margin represents daily collateral exchanged to cover mark-to-market losses in derivatives trading, ensuring counterparty credit risk mitigation through timely adjustments. While collateralization involves posting assets to secure obligations, netting aggregates multiple positions to reduce overall exposure, with variation margin playing a critical role in both processes by reflecting real-time market fluctuations.

Haircuts

Haircuts in financial collateral refer to the percentage reduction applied to the market value of an asset to account for risk before it is accepted as collateral, ensuring adequate protection against price volatility. Compared to netting, which consolidates multiple obligations to reduce exposure, haircuts specifically adjust asset values to mitigate credit risk in collateralized transactions.

Close-out Netting

Close-out netting consolidates multiple financial obligations into a single net payable or receivable amount upon default, significantly reducing counterparty credit risk. When combined with collateralization, it enhances credit risk mitigation by allowing the posted collateral to cover the net exposure rather than gross exposures, improving capital efficiency and lowering potential losses in derivatives and securities financing transactions.

Exposure at Default (EAD)

Exposure at Default (EAD) quantifies the potential loss a lender faces when a borrower defaults, factoring in collateralization which reduces EAD by offsetting credit exposure through pledged assets. Netting agreements further lower EAD by consolidating multiple obligations into a single net exposure, minimizing credit risk and capital requirements under regulatory frameworks like Basel III.

Collateralization vs Netting Infographic

moneydif.com

moneydif.com