The bid-to-cover ratio measures demand intensity in Treasury auctions by comparing total bids received to the amount offered, indicating market appetite for government securities. Indirect bidder participation, often representing foreign central banks and institutional investors, influences this ratio by providing stable, large-scale demand that supports auction success. High indirect bidder engagement typically correlates with stronger bid-to-cover ratios, reflecting confidence in the Treasury market and global economic stability.

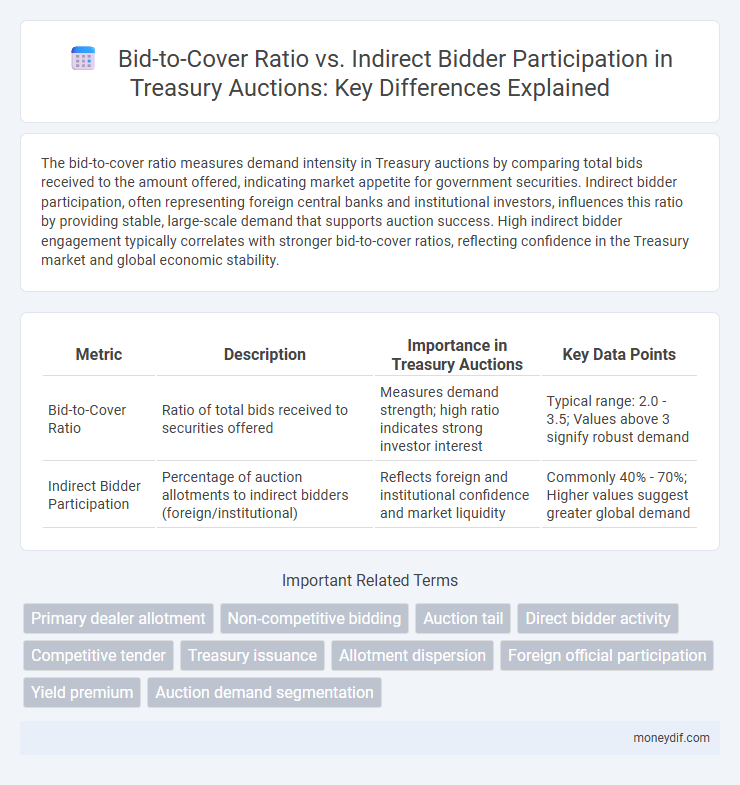

Table of Comparison

| Metric | Description | Importance in Treasury Auctions | Key Data Points |

|---|---|---|---|

| Bid-to-Cover Ratio | Ratio of total bids received to securities offered | Measures demand strength; high ratio indicates strong investor interest | Typical range: 2.0 - 3.5; Values above 3 signify robust demand |

| Indirect Bidder Participation | Percentage of auction allotments to indirect bidders (foreign/institutional) | Reflects foreign and institutional confidence and market liquidity | Commonly 40% - 70%; Higher values suggest greater global demand |

Understanding the Bid-to-Cover Ratio in Treasury Auctions

The bid-to-cover ratio is a key indicator of demand in Treasury auctions, measuring the total bids submitted relative to the amount of securities offered. Indirect bidder participation, often comprising foreign central banks and large institutional investors, significantly influences this ratio by injecting substantial demand. A high bid-to-cover ratio combined with strong indirect bidding signals robust market confidence and appetite for U.S. government debt.

Defining Indirect Bidder Participation

Indirect bidder participation in Treasury auctions refers to demand from investors who purchase securities through intermediaries rather than directly bidding themselves, often including foreign central banks and institutional investors. The bid-to-cover ratio measures total bids received relative to the amount offered, reflecting overall demand and auction competitiveness. High indirect bidder participation often correlates with elevated bid-to-cover ratios, signaling strong investor confidence in U.S. Treasury securities.

Bid-to-Cover Ratio: Indicator of Auction Demand

The Bid-to-Cover Ratio serves as a key indicator of auction demand, reflecting the total bids received relative to the amount of securities offered by the Treasury. A higher ratio signifies strong investor interest, often driven by robust indirect bidder participation such as central banks and foreign investors. Monitoring this ratio alongside indirect bidder participation helps gauge market confidence and potential price stability in Treasury auctions.

Role of Indirect Bidders in Treasury Markets

Indirect bidders play a crucial role in Treasury markets by enhancing liquidity and stabilizing bid-to-cover ratios during auctions. Their participation often reflects demand from foreign central banks, mutual funds, and asset managers, contributing to price discovery and efficient allocation of government debt. A higher bid-to-cover ratio driven by strong indirect bidder activity signals robust market confidence and broader investor interest in Treasury securities.

Factors Influencing Bid-to-Cover Ratio

The bid-to-cover ratio in Treasury auctions is significantly influenced by indirect bidder participation, which includes foreign central banks and other institutional investors acting through primary dealers. Higher indirect bidder demand often reflects increased market confidence and global demand for safe-haven assets, thereby elevating the bid-to-cover ratio. Variations in macroeconomic indicators, geopolitical stability, and interest rate expectations further impact both indirect bidding behavior and the overall bid-to-cover ratio.

Trends in Indirect Bidder Participation Rates

Trends in indirect bidder participation show a consistent increase, correlating with higher bid-to-cover ratios in Treasury auctions, indicating stronger demand from foreign central banks and international investors. Elevated bid-to-cover ratios typically reflect heightened market confidence and liquidity, as indirect bidders play a crucial role in absorbing large issuances. Monitoring these metrics provides insights into global appetite for U.S. debt, influencing Treasury issuance strategies and debt management policies.

Impact of Bid-to-Cover Ratio on Treasury Yields

The bid-to-cover ratio serves as a critical indicator of demand in Treasury auctions, directly influencing Treasury yields by signaling investor appetite for government securities. Higher bid-to-cover ratios typically indicate stronger demand, which can lead to lower yields as the Treasury can borrow more cheaply due to increased competition among bidders. Indirect bidder participation, especially from foreign central banks, amplifies this effect by contributing to elevated demand, thereby further suppressing Treasury yields and stabilizing government borrowing costs.

Comparing Direct vs. Indirect Bidders in Auctions

The bid-to-cover ratio serves as a crucial metric to evaluate market demand in Treasury auctions, reflecting the ratio of total bids received to the amount offered. Indirect bidder participation, typically comprising foreign central banks and institutional investors, often exhibits higher bid-to-cover ratios compared to direct bidders like primary dealers, indicating stronger appetite and confidence from international investors. Comparing direct versus indirect bidders highlights indirect bidders' influence in stabilizing auction results and driving competitive pricing, essential for efficient Treasury debt management.

Interpreting the Relationship: Bid-to-Cover vs Indirect Participation

The bid-to-cover ratio, a key indicator of demand in Treasury auctions, often correlates with indirect bidder participation, which includes foreign central banks and international investors. Higher indirect participation generally signals strong global confidence, leading to elevated bid-to-cover ratios that reflect robust auction demand. Analyzing this relationship provides insights into international market sentiment and potential shifts in Treasury yield dynamics.

What Bid-to-Cover Ratios and Indirect Bidders Reveal About Market Sentiment

High bid-to-cover ratios in Treasury auctions indicate strong demand and robust investor confidence, reflecting positive market sentiment. Indirect bidders, often representing foreign central banks and global institutions, provide insights into international appetite for U.S. debt, with their participation levels signaling confidence or caution about economic stability. Analyzing the interplay between bid-to-cover ratios and indirect bidder participation offers a nuanced understanding of both domestic and global investor perceptions in Treasury markets.

Important Terms

Primary dealer allotment

Higher bid-to-cover ratios in primary dealer allotments often correspond with increased indirect bidder participation, indicating stronger market confidence and demand.

Non-competitive bidding

Non-competitive bidding typically lowers the bid-to-cover ratio as indirect bidder participation increases, reflecting reduced price competition in auctions.

Auction tail

Auction tail length tends to decrease when the bid-to-cover ratio is high and indirect bidder participation increases, indicating stronger demand and market confidence.

Direct bidder activity

Direct bidder activity typically increases as the bid-to-cover ratio rises, while indirect bidder participation often inversely correlates, reflecting differing risk appetites and strategic behaviors in auction markets.

Competitive tender

A higher bid-to-cover ratio in competitive tenders often correlates with increased indirect bidder participation, reflecting broader market interest and improved pricing efficiency.

Treasury issuance

Higher bid-to-cover ratios often correlate with increased indirect bidder participation in Treasury issuance, reflecting strong foreign central bank and international investor demand. Indirect bidders typically stabilize auctions by absorbing large volumes of securities, enhancing market liquidity and price discovery.

Allotment dispersion

Higher bid-to-cover ratios correlate with increased indirect bidder participation, indicating greater allotment dispersion in competitive bidding environments.

Foreign official participation

Higher foreign official participation often correlates with a lower bid-to-cover ratio and reduced indirect bidder participation in government bond auctions.

Yield premium

Higher bid-to-cover ratios correlate strongly with increased indirect bidder participation, reflecting a lower yield premium demanded by investors.

Auction demand segmentation

Auction demand segmentation reveals that higher bid-to-cover ratios correlate with increased indirect bidder participation, indicating stronger competitive interest from non-primary bidders.

Bid-to-cover ratio vs Indirect bidder participation Infographic

moneydif.com

moneydif.com