Cash Management Bills (CMBs) are short-term debt instruments issued by the government to meet temporary cash flow mismatches, typically with maturities less than 90 days. Treasury Bills (T-Bills) are also short-term government securities but are issued on a regular basis with fixed maturities of 91, 182, or 364 days to finance the government's regular borrowing needs. While both are zero-coupon securities sold at a discount, CMBs are unpredictable in timing and amount, whereas T-Bills have a scheduled issuance calendar.

Table of Comparison

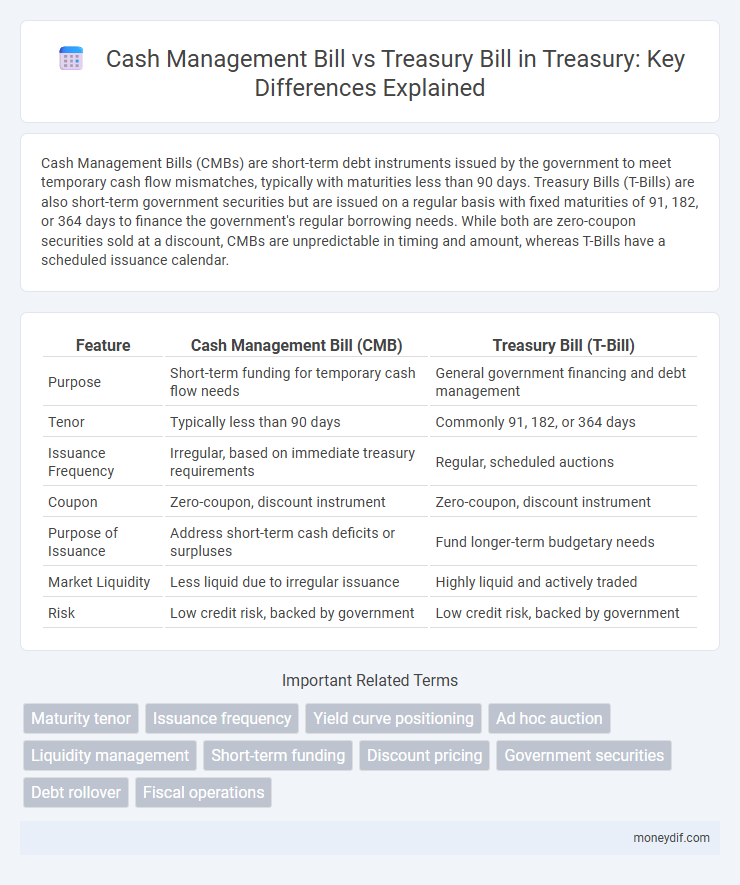

| Feature | Cash Management Bill (CMB) | Treasury Bill (T-Bill) |

|---|---|---|

| Purpose | Short-term funding for temporary cash flow needs | General government financing and debt management |

| Tenor | Typically less than 90 days | Commonly 91, 182, or 364 days |

| Issuance Frequency | Irregular, based on immediate treasury requirements | Regular, scheduled auctions |

| Coupon | Zero-coupon, discount instrument | Zero-coupon, discount instrument |

| Purpose of Issuance | Address short-term cash deficits or surpluses | Fund longer-term budgetary needs |

| Market Liquidity | Less liquid due to irregular issuance | Highly liquid and actively traded |

| Risk | Low credit risk, backed by government | Low credit risk, backed by government |

Overview of Cash Management Bills and Treasury Bills

Cash Management Bills (CMBs) are short-term government securities issued to meet urgent cash flow needs and typically have maturities ranging from a few days up to one year. Treasury Bills (T-Bills) are also short-term debt instruments issued by the government but generally have fixed maturities of 91, 182, or 364 days, used primarily for regular financing of government expenditures. Both CMBs and T-Bills are sold at a discount and do not pay periodic interest, with returns realized at maturity based on the difference between the purchase price and face value.

Key Differences Between CMBs and Treasury Bills

Cash Management Bills (CMBs) are short-term securities issued for periods typically ranging from a few days to a few months to meet urgent liquidity needs, whereas Treasury Bills (T-Bills) generally have fixed maturities of 4, 13, 26, or 52 weeks and support regular government borrowing. CMBs are issued on an ad hoc basis, without a fixed schedule, and often carry higher yields compared to T-Bills due to their shorter duration and specific funding purpose. Treasury Bills, backed by the full faith and credit of the government, offer highly liquid, risk-free investment options frequently used for routine cash flow management and monetary policy implementation.

Issuance Frequency and Purpose

Cash Management Bills (CMBs) are short-term securities issued irregularly by the Treasury to manage unexpected cash flow shortfalls, whereas Treasury Bills (T-Bills) are issued on a regular schedule to finance the government's short-term funding needs. CMBs typically have maturities ranging from a few days to six months, optimizing liquidity during unplanned fiscal demands, while T-Bills have standard maturities of 4, 8, 13, 26, and 52 weeks aimed at routine treasury financing. The issuance frequency of T-Bills provides predictable funding cycles, contrasting the ad hoc issuance of CMBs tailored to immediate treasury cash management.

Maturity Periods: CMBs vs Treasury Bills

Cash Management Bills (CMBs) have very short maturity periods, typically ranging from a few days up to 90 days, offering flexibility for temporary funding needs. Treasury Bills (T-Bills) generally have fixed maturities of 91, 182, and 364 days, providing a more standardized investment option. The shorter maturity period of CMBs makes them ideal for bridging short-term cash flow gaps, whereas T-Bills serve broader financing purposes with predefined timelines.

Interest Rates and Yield Comparisons

Cash Management Bills (CMBs) are short-term government securities issued primarily for managing temporary cash flow mismatches, often carrying slightly higher interest rates compared to Treasury Bills (T-Bills) to attract investors despite their irregular issuance. Treasury Bills, issued regularly with maturities of 91, 182, or 364 days, typically offer lower yields due to their predictable supply and strong market demand. Yield comparisons show CMBs may present marginally higher returns to compensate for their unpredictable availability, while T-Bills maintain stable, lower yields reflecting their liquidity and government backing.

Eligibility and Purchase Process

Cash Management Bills (CMBs) are short-term securities issued by the government primarily to meet temporary cash flow mismatches and are available to both institutional and retail investors, while Treasury Bills (T-Bills) are standard short-term debt instruments accessible to a wider range of investors including banks, corporations, and individuals. The purchase process for CMBs typically involves non-competitive bids in government auctions conducted by the Reserve Bank of India, similar to T-Bills, but with less frequent issuance and more flexible maturity periods. Eligibility for both includes resident Indian entities and NRIs, but CMBs are often favored for their tailored maturities and immediate liquidity needs in government finance.

Risks and Safety Considerations

Cash Management Bills (CMBs) typically carry lower interest rate risk than Treasury Bills (T-Bills) due to their shorter maturity periods, often less than 90 days, which enhances liquidity and reduces exposure to market fluctuations. Treasury Bills, while highly secure as government securities, may involve slightly higher reinvestment risk compared to CMBs because of their fixed maturities and more predictable issuance schedules. Both instruments are backed by the full faith and credit of the government, ensuring minimal credit risk, but cash management bills offer added safety in volatile interest rate environments due to their flexible, short-term nature.

Use Cases in Portfolio Management

Cash Management Bills (CMBs) offer short-term liquidity solutions, ideal for managing temporary cash flow mismatches in portfolio strategies. Treasury Bills (T-Bills) provide secure, low-risk investment options for preserving capital while earning predictable returns over slightly longer durations. Portfolio managers utilize CMBs to enhance liquidity management, whereas T-Bills are favored for stable income generation and risk mitigation.

Impact on Market Liquidity

Cash management bills (CMBs) are short-term instruments issued to meet temporary cash flow mismatches, providing immediate liquidity without altering long-term borrowing patterns, which helps stabilize market liquidity during fiscal deficits. Treasury bills (T-bills) are regular, short-term government securities aimed at financing the overall fiscal deficit, influencing market liquidity by absorbing surplus funds or injecting cash depending on issuance size and demand. The discretionary issuance of CMBs allows the government to manage intra-year liquidity fluctuations more precisely, mitigating abrupt liquidity shocks in money markets compared to the routine issuance of T-bills.

Choosing Between Cash Management Bills and Treasury Bills

Choosing between Cash Management Bills (CMBs) and Treasury Bills (T-Bills) depends on liquidity needs and fiscal timing, as CMBs offer short-term, flexible financing typically issued for a few days to a few weeks, while T-Bills provide standard maturities ranging from 4 to 52 weeks with regular auction schedules. Investors prioritize CMBs for urgent government funding requirements and short-duration investments, whereas T-Bills serve as reliable instruments for predictable cash flow and lower risk exposure. Yield differences reflect issuance purpose and market demand, making it essential to evaluate current funding objectives and market conditions when selecting between CMBs and T-Bills.

Important Terms

Maturity tenor

Maturity tenor for Cash Management Bills typically ranges from a few days to six months, whereas Treasury Bills have standardized maturities of 4, 13, 26, and 52 weeks, reflecting their distinct roles in short-term government financing and liquidity management.

Issuance frequency

Cash Management Bills (CMBs) are issued on an as-needed basis to manage short-term liquidity fluctuations, resulting in irregular issuance frequency, whereas Treasury Bills (T-Bills) have a regular issuance schedule, typically biweekly or monthly auctions. This difference impacts cash flow planning and market liquidity, with CMBs providing flexible funding solutions and T-Bills offering predictable investment opportunities.

Yield curve positioning

Yield curve positioning involves strategically allocating investments between Cash Management Bills and Treasury Bills based on their differing maturities and interest rate sensitivities to optimize liquidity and returns.

Ad hoc auction

Ad hoc auctions for cash management bills offer flexible short-term government financing compared to standard Treasury bill auctions, enabling targeted liquidity management.

Liquidity management

Liquidity management focuses on optimizing cash flow to meet short-term obligations efficiently by balancing cash reserves and investments. Cash Management Bills (CMBs) provide highly liquid, short-term funding instruments with maturities typically less than 90 days, while Treasury Bills (T-Bills) serve as longer-term government securities used to manage liquidity and finance debt over periods up to one year.

Short-term funding

Short-term funding through Cash Management Bills (CMBs) offers flexible, ad hoc liquidity solutions compared to the regularly issued, longer-maturity Treasury Bills (T-Bills) used for managing government cash flow.

Discount pricing

Discount pricing for Cash Management Bills typically involves shorter maturities and lower yields compared to Treasury Bills, reflecting their role in managing short-term liquidity needs efficiently.

Government securities

Cash Management Bills (CMBs) and Treasury Bills (T-Bills) are short-term government securities used to manage liquidity and fund government operations; CMBs are issued as ad hoc instruments to meet temporary cash shortages, typically with maturities of a few days to a few months, whereas T-Bills have fixed issuance schedules and standard maturities of 91, 182, or 364 days. Both securities are issued at a discount and redeemed at face value, serving as low-risk instruments for investors while helping the government regulate short-term cash flows and market liquidity.

Debt rollover

Debt rollover involves refinancing maturing Cash Management Bills (CMBs), short-term Treasury securities issued for cash flow management, by issuing new Treasury bills to maintain government liquidity and manage short-term funding needs efficiently.

Fiscal operations

Fiscal operations involving Cash Management Bills (CMBs) focus on short-term borrowing to address temporary mismatches in government cash flows, typically with maturities less than 91 days, while Treasury Bills (T-Bills) serve as standard instruments for managing liquidity and funding government debt with maturities ranging from 91 days to one year. CMBs are issued infrequently and mainly during cash shortfalls, whereas T-Bills represent regular, predictable borrowing and play a crucial role in monetary policy implementation.

Cash management bill vs Treasury bill Infographic

moneydif.com

moneydif.com