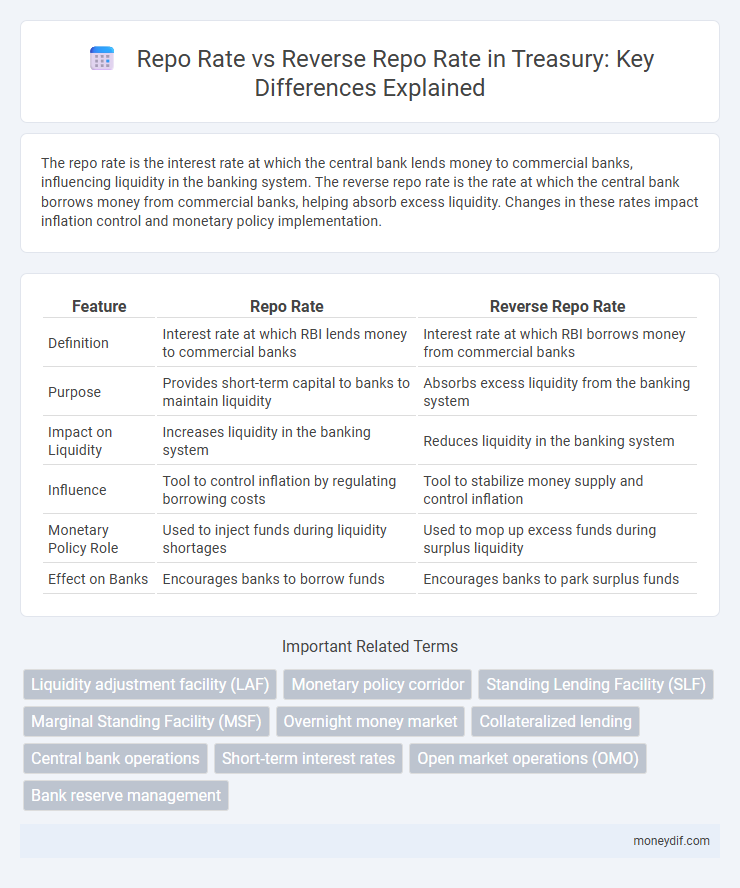

The repo rate is the interest rate at which the central bank lends money to commercial banks, influencing liquidity in the banking system. The reverse repo rate is the rate at which the central bank borrows money from commercial banks, helping absorb excess liquidity. Changes in these rates impact inflation control and monetary policy implementation.

Table of Comparison

| Feature | Repo Rate | Reverse Repo Rate |

|---|---|---|

| Definition | Interest rate at which RBI lends money to commercial banks | Interest rate at which RBI borrows money from commercial banks |

| Purpose | Provides short-term capital to banks to maintain liquidity | Absorbs excess liquidity from the banking system |

| Impact on Liquidity | Increases liquidity in the banking system | Reduces liquidity in the banking system |

| Influence | Tool to control inflation by regulating borrowing costs | Tool to stabilize money supply and control inflation |

| Monetary Policy Role | Used to inject funds during liquidity shortages | Used to mop up excess funds during surplus liquidity |

| Effect on Banks | Encourages banks to borrow funds | Encourages banks to park surplus funds |

Understanding Repo Rate and Reverse Repo Rate

The repo rate is the interest rate at which the central bank lends funds to commercial banks for short-term liquidity needs, influencing money supply and inflation control. The reverse repo rate is the rate at which the central bank borrows money from commercial banks, helping absorb excess liquidity from the banking system. Understanding these rates is crucial for managing monetary policy, stabilizing the economy, and guiding lending and borrowing behaviors within the financial system.

Key Differences between Repo Rate and Reverse Repo Rate

Repo rate is the interest rate at which the central bank lends money to commercial banks to meet short-term liquidity needs, influencing money supply and inflation control. Reverse repo rate is the rate at which the central bank borrows money from commercial banks, helping absorb excess liquidity and maintain financial stability. Key differences include their directional flow of funds with repo rate injecting liquidity into the banking system, while reverse repo rate withdraws liquidity, and their distinct roles in monetary policy transmission.

Role of Repo Rate in Monetary Policy

The repo rate, set by central banks, serves as a crucial instrument in monetary policy to control liquidity and inflation by influencing short-term interest rates and borrowing costs for commercial banks. Adjustments to the repo rate directly impact credit availability, consumer spending, and overall economic growth, making it a primary tool for stabilizing the economy. In contrast, the reverse repo rate helps absorb excess liquidity from the banking system, but the repo rate's role in signaling monetary tightening or easing remains central to policy decisions.

Function of Reverse Repo Rate in Liquidity Management

The reverse repo rate is a critical tool used by the central bank to absorb excess liquidity from the banking system, helping maintain monetary stability. By offering banks an interest rate on funds parked with the central bank, it incentivizes them to deposit surplus cash, thus controlling inflationary pressures. This function fine-tunes liquidity levels, ensuring balanced money supply and supporting effective treasury management.

Impact on Commercial Banks: Repo vs Reverse Repo Rate

The repo rate influences commercial banks by determining the cost at which they can borrow money from the central bank, directly affecting their lending rates and liquidity management. The reverse repo rate impacts commercial banks by providing an opportunity to park surplus funds with the central bank, earning interest and thereby influencing the banks' short-term investment decisions and liquidity surplus management. Differential adjustments between the repo and reverse repo rates serve as key monetary tools to regulate banking sector liquidity, credit availability, and overall economic stability.

Repo and Reverse Repo Rate Trends in Recent Years

Repo and reverse repo rates have shown distinct trends in recent years, reflecting central banks' monetary policy adjustments to stabilize liquidity and control inflation. Repo rates increased during periods of tightening monetary policy to curb inflation, while reverse repo rates often rose simultaneously to encourage banks to park excess funds with the central bank. These fluctuations highlight the dynamic interplay between liquidity management and interest rate targets in response to evolving economic conditions.

How Repo Rates Influence Inflation and Growth

Repo rates directly impact liquidity by determining the cost at which banks borrow from the central bank, influencing credit availability in the economy. Lower repo rates reduce borrowing costs, encouraging businesses and consumers to spend and invest, which can stimulate economic growth but also risk higher inflation. Higher repo rates increase borrowing costs, tempering demand and curbing inflationary pressures while potentially slowing economic expansion.

Reverse Repo Rate and Its Effect on Market Liquidity

Reverse repo rate represents the rate at which the central bank absorbs liquidity from the banking system by selling government securities with an agreement to repurchase them later. A higher reverse repo rate incentivizes banks to park excess funds with the central bank, reducing market liquidity and controlling inflationary pressures. This tool helps stabilize short-term interest rates and ensures money supply aligns with the economy's demand.

Repo vs Reverse Repo Rate: Implications for Treasury Operations

Repo rate represents the interest at which the central bank lends to commercial banks, impacting liquidity management and short-term borrowing costs in treasury operations. Reverse repo rate is the interest paid by the central bank on excess reserves parked by commercial banks, influencing treasury cash flow and surplus fund allocation. Understanding the differential between repo and reverse repo rates is critical for optimizing treasury strategies, ensuring effective liquidity management, and minimizing funding costs.

Central Bank Strategies: Balancing Repo and Reverse Repo Rates

Central banks strategically adjust repo and reverse repo rates to control liquidity and stabilize the economy. By increasing the repo rate, they make borrowing costlier, curbing inflation, while raising the reverse repo rate encourages banks to deposit more funds, absorbing excess liquidity. This balance between repo and reverse repo rates ensures effective monetary policy implementation and financial market stability.

Important Terms

Liquidity adjustment facility (LAF)

Liquidity Adjustment Facility (LAF) manages short-term liquidity by allowing banks to borrow funds at the repo rate while depositing excess funds at the lower reverse repo rate.

Monetary policy corridor

The monetary policy corridor is the interest rate band defined by the repo rate as the upper limit and the reverse repo rate as the lower limit, guiding short-term liquidity and borrowing costs in the economy.

Standing Lending Facility (SLF)

Standing Lending Facility (SLF) provides overnight liquidity to banks at an interest rate typically aligned with or slightly above the repo rate, while the reverse repo rate is the rate at which banks park excess funds with the central bank under the reverse repo mechanism.

Marginal Standing Facility (MSF)

Marginal Standing Facility (MSF) allows banks to borrow overnight funds from the Reserve Bank of India at a rate typically 25 basis points above the repo rate, serving as a lender of last resort when banks exhaust their repo limits. The repo rate is the rate at which the RBI lends to banks, while the reverse repo rate is the rate at which it borrows money from banks, influencing liquidity and monetary policy operations.

Overnight money market

The overnight money market is influenced by the repo rate, which determines the cost of borrowing funds, and the reverse repo rate, which affects the returns on lending funds to the central bank, thereby guiding short-term liquidity and interest rate trends.

Collateralized lending

Collateralized lending involves borrowing funds against assets where the repo rate determines the cost for banks to borrow from the central bank, while the reverse repo rate influences the interest earned on excess reserves parked with the central bank.

Central bank operations

Central bank operations involve managing liquidity through the repo rate, the interest rate at which banks borrow funds from the central bank, and the reverse repo rate, which is the rate the central bank pays to banks for lending excess reserves. Adjusting these rates influences short-term interest rates, controls inflation, and stabilizes the currency by regulating money supply in the economy.

Short-term interest rates

Short-term interest rates are heavily influenced by the repo rate, which is the rate at which central banks lend money to commercial banks, injecting liquidity into the economy, while the reverse repo rate is the rate at which central banks borrow money from commercial banks, absorbing excess liquidity. The gap between the repo rate and reverse repo rate helps regulate monetary policy, control inflation, and stabilize short-term market interest rates.

Open market operations (OMO)

Open market operations (OMO) influence liquidity by adjusting the repo rate, which is the rate at which banks borrow from the central bank, and the reverse repo rate, the rate at which banks park excess funds with the central bank. Changes in the repo rate typically stimulate or restrain borrowing, while adjustments in the reverse repo rate manage surplus liquidity and control inflationary pressures within the economy.

Bank reserve management

Bank reserve management strategically balances liquidity by leveraging the repo rate to borrow funds against securities for short-term cash needs, while utilizing the reverse repo rate to invest excess reserves securely with the central bank, optimizing interest income and maintaining regulatory compliance. Efficient handling of these rates directly influences a bank's ability to manage reserve requirements, control money supply, and stabilize financial operations within monetary policy frameworks.

Repo rate vs Reverse repo rate Infographic

moneydif.com

moneydif.com