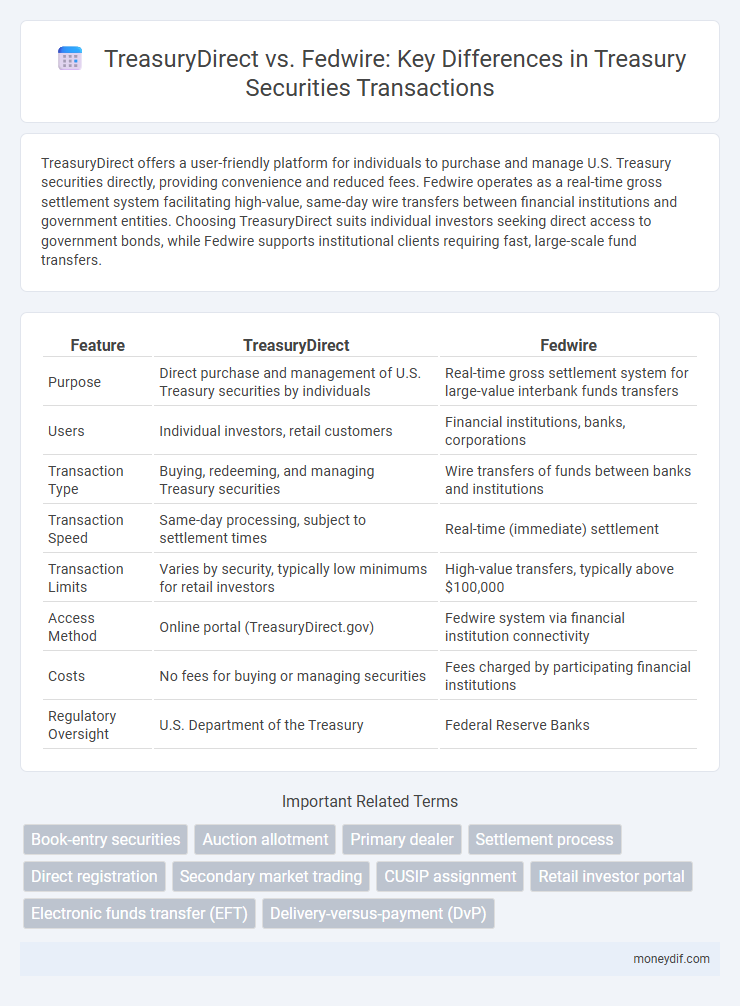

TreasuryDirect offers a user-friendly platform for individuals to purchase and manage U.S. Treasury securities directly, providing convenience and reduced fees. Fedwire operates as a real-time gross settlement system facilitating high-value, same-day wire transfers between financial institutions and government entities. Choosing TreasuryDirect suits individual investors seeking direct access to government bonds, while Fedwire supports institutional clients requiring fast, large-scale fund transfers.

Table of Comparison

| Feature | TreasuryDirect | Fedwire |

|---|---|---|

| Purpose | Direct purchase and management of U.S. Treasury securities by individuals | Real-time gross settlement system for large-value interbank funds transfers |

| Users | Individual investors, retail customers | Financial institutions, banks, corporations |

| Transaction Type | Buying, redeeming, and managing Treasury securities | Wire transfers of funds between banks and institutions |

| Transaction Speed | Same-day processing, subject to settlement times | Real-time (immediate) settlement |

| Transaction Limits | Varies by security, typically low minimums for retail investors | High-value transfers, typically above $100,000 |

| Access Method | Online portal (TreasuryDirect.gov) | Fedwire system via financial institution connectivity |

| Costs | No fees for buying or managing securities | Fees charged by participating financial institutions |

| Regulatory Oversight | U.S. Department of the Treasury | Federal Reserve Banks |

Overview of TreasuryDirect and Fedwire

TreasuryDirect is an online platform managed by the U.S. Department of the Treasury that allows individual investors to purchase and hold Treasury securities directly without intermediaries. Fedwire Funds Service, operated by the Federal Reserve Banks, facilitates real-time gross settlement of large-value interbank payments, including Treasury securities transactions. TreasuryDirect focuses on direct retail investment in government debt, while Fedwire supports high-value institutional payments and settlements in the financial system.

Key Differences Between TreasuryDirect and Fedwire

TreasuryDirect is a web-based platform designed for individuals to buy, hold, and manage U.S. Treasury securities directly from the government, offering features like electronic issuance of savings bonds and marketable securities. Fedwire, operated by the Federal Reserve Banks, is a real-time gross settlement system facilitating large-value, time-critical payments and securities transfers primarily used by financial institutions. Key differences include TreasuryDirect's focus on retail investors and direct Treasury security ownership, whereas Fedwire caters to institutional participants requiring high-speed, high-value transaction processing.

How TreasuryDirect Works

TreasuryDirect functions as a secure online platform allowing individuals to buy, hold, and manage U.S. Treasury securities directly from the U.S. Department of the Treasury, eliminating the need for intermediaries. Users create accounts to purchase Treasury bills, notes, bonds, and savings bonds, with transactions settling electronically and holdings recorded in book-entry form. This system streamlines access to government securities, contrasting with Fedwire, which facilitates large-value interbank funds transfers through a real-time gross settlement network.

How Fedwire Operates

Fedwire operates as a real-time gross settlement system managed by the Federal Reserve, facilitating instantaneous transfer of funds between participating financial institutions. It supports large-value payments, including government securities transfers, by settling transactions individually and irrevocably throughout the business day. This high-speed, secure platform contrasts with TreasuryDirect, which primarily serves individual investors for purchasing and managing Treasury securities electronically.

Eligibility and Access Requirements

TreasuryDirect offers individual investors direct access to U.S. Treasury securities with eligibility limited to U.S. citizens, residents, and entities possessing a valid Social Security Number or Tax Identification Number. In contrast, Fedwire primarily serves financial institutions, requiring participants to be eligible depository institutions or entities with Fedwire access privileges granted through Federal Reserve Banks. TreasuryDirect's online platform simplifies retail investor participation, whereas Fedwire operates as a large-value funds transfer system with strict institutional access criteria.

Transaction Speed and Settlement Times

TreasuryDirect transactions typically settle on the same day but may take up to two to three business days for certain securities, reflecting standard processing times within government systems. Fedwire offers real-time gross settlement (RTGS), enabling immediate transaction completion and settlement, which enhances liquidity and reduces settlement risk. The superior speed of Fedwire is critical for high-value, time-sensitive transfers, whereas TreasuryDirect suits longer-term investment transactions due to its batch processing and settlement schedules.

Security Features and Protections

TreasuryDirect offers robust security features including multi-factor authentication, encrypted transactions, and secure government-hosted platforms to protect investor data and funds. Fedwire provides real-time gross settlement with Federal Reserve oversight, implementing end-to-end encryption and strict access controls to ensure transaction integrity and fraud prevention. Both systems prioritize secure financial operations but differ in user access models and regulatory frameworks tailored to individual investors versus financial institutions.

Costs and Fees Comparison

TreasuryDirect offers low-cost access to U.S. government securities with no maintenance or transaction fees, making it highly economical for individual investors. Fedwire, primarily used for large wholesale payments, involves higher fees that vary by transaction amount and banking institution, reflecting its real-time gross settlement system's operational costs. Comparing TreasuryDirect's fee-free environment to Fedwire's fee structure highlights significant cost savings for retail customers managing government securities directly.

Use Cases: Retail vs. Institutional Investors

TreasuryDirect serves retail investors by offering direct access to U.S. Treasury securities for small-scale purchases, ideal for individuals seeking to invest in savings bonds and Treasury bills without intermediaries. Fedwire caters to institutional investors by enabling high-value, real-time electronic funds transfers and securities transactions, supporting critical liquidity management and settlement needs for banks and large financial entities. The distinct use cases highlight TreasuryDirect's retail focus on accessibility and cost-efficiency, while Fedwire emphasizes speed, reliability, and large-scale transaction capability for institutional operations.

Choosing the Right Platform for Treasury Securities

TreasuryDirect offers retail investors direct access to purchase and manage U.S. Treasury securities with low fees and convenience, ideal for individual investors seeking simplicity and cost efficiency. Fedwire, operated by the Federal Reserve, facilitates large-value, real-time transfers of funds and securities between financial institutions, catering to institutional investors requiring high-speed settlement and liquidity management. Selecting the right platform depends on the investor's profile, transaction size, and need for immediacy versus cost savings.

Important Terms

Book-entry securities

Book-entry securities issued by the U.S. Treasury are held electronically through TreasuryDirect, which provides direct access for individual investors, while Fedwire Securities Service primarily facilitates the electronic transfer and settlement of Treasury securities among financial institutions. TreasuryDirect offers a user-friendly platform with no transaction fees for buying and redeeming securities, whereas Fedwire enables large-scale, real-time wholesale transfers and safekeeping through a centralized depository system.

Auction allotment

Auction allotment in TreasuryDirect systems ensures direct issuance of U.S. Treasury securities to investors without intermediaries, while Fedwire facilitates the electronic transfer of these securities between financial institutions post-allotment. TreasuryDirect provides a streamlined, non-transferable platform for individual investors, whereas Fedwire supports large-volume, real-time settlement in the secondary market.

Primary dealer

Primary dealers play a crucial role in the U.S. Treasury market by purchasing government securities directly from the Treasury through TreasuryDirect and facilitating their transfer via Fedwire, the Federal Reserve's real-time gross settlement system. TreasuryDirect enables primary dealers to buy new issues in auctions, while Fedwire ensures secure and instantaneous settlement of these securities transactions between financial institutions.

Settlement process

The settlement process in TreasuryDirect involves electronic book-entry transactions directly managed by the U.S. Department of the Treasury, ensuring instant updates to investors' accounts without the need for physical certificates. In contrast, Fedwire operates as a real-time gross settlement system used by banks and financial institutions for large-value transfers, facilitating immediate finality of payments across the Federal Reserve's network.

Direct registration

Direct registration enables investors to hold securities electronically in their name on the issuer's books, often facilitated through TreasuryDirect for U.S. Treasury securities, providing a government-backed platform with no physical certificate handling. Fedwire, managed by the Federal Reserve, is primarily a real-time gross settlement system for large-value funds transfers and securities transactions between financial institutions, not designed for individual investor direct registration.

Secondary market trading

Secondary market trading of U.S. Treasury securities involves transactions between investors after initial issuance, with TreasuryDirect facilitating direct ownership of securities without physical certificates, while Fedwire serves as a real-time gross settlement system used by banks and dealers to electronically transfer large-value securities payments securely and efficiently. TreasuryDirect is ideal for individual investors holding savings bonds and Treasury bills, whereas Fedwire supports institutional participants conducting high-volume secondary market trades with instant settlement finality.

CUSIP assignment

CUSIP assignments for TreasuryDirect securities differ from Fedwire-eligible securities due to distinct issuance and transfer protocols governed by the U.S. Department of the Treasury and the Federal Reserve, respectively.

Retail investor portal

Retail investor portals provide seamless access to TreasuryDirect, enabling individual investors to buy and manage U.S. Treasury securities directly without intermediaries, while Fedwire serves primarily as a real-time gross settlement system used by financial institutions for large-value electronic funds transfers. TreasuryDirect emphasizes user-friendly interfaces for personal investment in government bonds, whereas Fedwire focuses on high-value transactional efficiency for institutional participants.

Electronic funds transfer (EFT)

Electronic funds transfer (EFT) systems like TreasuryDirect facilitate direct government securities transactions for individual investors, while Fedwire provides a real-time gross settlement service enabling large-value transfers among financial institutions and the U.S. Treasury.

Delivery-versus-payment (DvP)

Delivery-versus-payment (DvP) in TreasuryDirect typically involves electronic securities transfers settled simultaneously with payment through Fedwire, ensuring the secure and efficient exchange of government securities and funds.

TreasuryDirect vs Fedwire Infographic

moneydif.com

moneydif.com