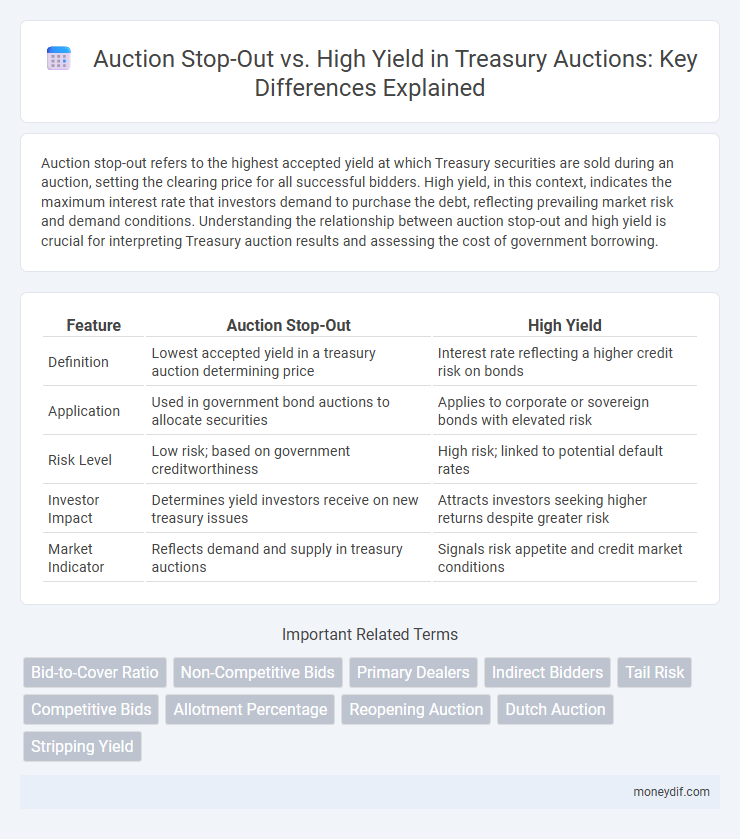

Auction stop-out refers to the highest accepted yield at which Treasury securities are sold during an auction, setting the clearing price for all successful bidders. High yield, in this context, indicates the maximum interest rate that investors demand to purchase the debt, reflecting prevailing market risk and demand conditions. Understanding the relationship between auction stop-out and high yield is crucial for interpreting Treasury auction results and assessing the cost of government borrowing.

Table of Comparison

| Feature | Auction Stop-Out | High Yield |

|---|---|---|

| Definition | Lowest accepted yield in a treasury auction determining price | Interest rate reflecting a higher credit risk on bonds |

| Application | Used in government bond auctions to allocate securities | Applies to corporate or sovereign bonds with elevated risk |

| Risk Level | Low risk; based on government creditworthiness | High risk; linked to potential default rates |

| Investor Impact | Determines yield investors receive on new treasury issues | Attracts investors seeking higher returns despite greater risk |

| Market Indicator | Reflects demand and supply in treasury auctions | Signals risk appetite and credit market conditions |

Understanding Auction Stop-Out and High Yield in Treasury Auctions

Auction stop-out in Treasury auctions refers to the highest yield accepted to sell all the offered securities, directly affecting the cost of government borrowing. High yield, or stop-out yield, determines the cutoff rate investors receive, shaping demand and price stability in the auction process. Understanding the dynamic interaction between auction stop-out and high yield is essential for analyzing Treasury auction outcomes and market interest rates.

Key Differences Between Stop-Out Yield and High Yield

Stop-out yield represents the highest accepted yield at which a treasury auction is fully subscribed, reflecting the marginal price investors are willing to accept. High yield refers to the lowest yield accepted among all successful bidders, indicating the best price achieved during the auction. The key difference lies in stop-out yield defining the cutoff point for successful bids while high yield highlights the most favorable rate attained.

How the Stop-Out Yield is Determined in Treasury Auctions

The stop-out yield in Treasury auctions is determined as the highest yield accepted among all competitive bids that fulfill the entire offering amount, effectively setting the price for all winning bidders. This yield acts as the cutoff point, ensuring the Treasury sells securities at the lowest cost to the government while meeting demand. It differs from the high yield, which is simply the maximum yield bid, since only bids at or below the stop-out yield are accepted.

Interpreting High Yield Results in Treasury Securities

Auction stop-out price in Treasury securities determines the highest yield accepted, directly impacting the final yield investors receive. Understanding high yield results requires analyzing the stop-out price relative to bid levels, reflecting market demand and investor appetite. Higher stop-out yields often indicate greater risk perceptions or liquidity needs during the auction process.

Auction Mechanics: Clearing Price vs. High Yield

Auction stop-out price represents the highest accepted yield at which Treasury securities clear during the auction, effectively determining the clearing price that all winning bidders pay. High yield is the yield of the last accepted bid, setting the maximum yield for the issue and impacting investor returns and Treasury's borrowing cost. Understanding the mechanics between stop-out and high yield is crucial for analyzing demand, price discovery, and auction efficiency in Treasury debt issuance.

Impact of Auction Stop-Out Yield on Market Participants

The auction stop-out yield directly affects market participants by setting the highest accepted yield on Treasury securities, influencing the cost of borrowing for the government and the return for investors. A higher stop-out yield signals increased risk or demand for higher compensation, impacting portfolio valuations and driving strategic asset allocations among institutional investors. Market liquidity and secondary market prices often adjust accordingly, reflecting changes in investor sentiment tied to the auction's outcome.

Stop-Out vs. High Yield: Implications for Treasury Investors

Stop-out yield represents the highest accepted bid rate in a Treasury auction, directly influencing the price investors pay for securities and indicating market demand conditions. High yield, often the stop-out yield in competitive bidding, reflects the maximum yield investors are willing to accept, impacting the cost of government borrowing and portfolio returns. Understanding the distinction between auction stop-out and high yield aids Treasury investors in assessing auction dynamics, liquidity, and potential investment risks.

Historical Trends: Treasury Auction Stop-Outs and High Yields

Historical trends in Treasury auctions reveal that stop-out yields often signal prevailing market demand and credit risk perceptions, with higher stop-out yields correlating closely to spikes in overall Treasury high yields. Analysis of past auction cycles shows that stop-out yields tend to rise during periods of fiscal uncertainty or inflationary pressure, serving as an early indicator for shifts in benchmark Treasury yields. This relationship underscores the importance of auction stop-out data in forecasting Treasury yield curves and investor risk appetite over time.

Best Practices for Analyzing Auction Yield Outcomes

Analyzing auction yield outcomes requires comparing the stop-out yield, which is the highest accepted bid in a Treasury auction, directly with prevailing high-yield benchmarks to assess market demand and pricing efficiency. Best practices emphasize examining bid-to-cover ratios and yield spreads to identify anomalies or shifts in investor appetite during issuance cycles. Accurate interpretation of stop-out yields relative to high yields supports more informed decisions on Treasury debt management and funding strategy optimization.

Frequently Asked Questions: Treasury Auction Stop-Out vs. High Yield

Treasury auction stop-out refers to the highest accepted yield at a U.S. government bond auction, serving as the cutoff rate for winning bids. High yield in this context denotes the maximum yield investors receive on the successfully allotted Treasury securities during the auction process. Understanding the stop-out yield helps investors gauge market demand and benchmark Treasury bond pricing relative to secondary market yields.

Important Terms

Bid-to-Cover Ratio

A higher bid-to-cover ratio typically indicates strong investor demand, often leading to lower auction stop-out yields, whereas a lower ratio may signal weaker demand and higher yields.

Non-Competitive Bids

Non-competitive bids guarantee acceptance at the auction stop-out yield, whereas competitive bids determine the high yield through price bidding.

Primary Dealers

Primary Dealers play a crucial role in Treasury auctions by absorbing stop-out rates, which represent the highest yield accepted and directly influence the bond's market high yield. These dealers balance demand and supply dynamics, ensuring price discovery and liquidity in government securities markets.

Indirect Bidders

Indirect bidders in auctions influence stop-out prices by driving demand, which directly affects the resulting high yield rates.

Tail Risk

Tail risk in auctions often leads to stop-out prices significantly exceeding typical trading levels, reflecting heightened default probabilities and elevated yields in high-yield bond markets.

Competitive Bids

Auction stop-out price determines the highest yield accepted in competitive bids, directly impacting bond allocation and investor returns.

Allotment Percentage

Auction stop-out rates often influence the allotment percentage by determining the cutoff yield, with higher stop-out yields typically resulting in lower allotment percentages for bidders in high-yield auctions.

Reopening Auction

Reopening auctions often influence market dynamics by adjusting the stop-out yield, which directly impacts the high yield investors receive on newly issued securities.

Dutch Auction

In a Dutch auction, the stop-out price determines the highest yield accepted for all bidders, ensuring uniform allocation at the clearing price.

Stripping Yield

Stripping yield measures the return on auction stop-out securities by isolating cash flows, enabling precise comparison against high-yield bonds' risk-adjusted performance.

Auction stop-out vs High yield Infographic

moneydif.com

moneydif.com