MT940 and BAI2 are electronic formats used in bank statement reporting for treasury management, with MT940 being an international SWIFT standard widely adopted for detailed transaction reporting. MT940 offers extensive data fields and structured transaction information, facilitating comprehensive cash management and reconciliation processes. BAI2, primarily used in North America, features a simpler format with less granularity but remains effective for routine cash position tracking and account analysis.

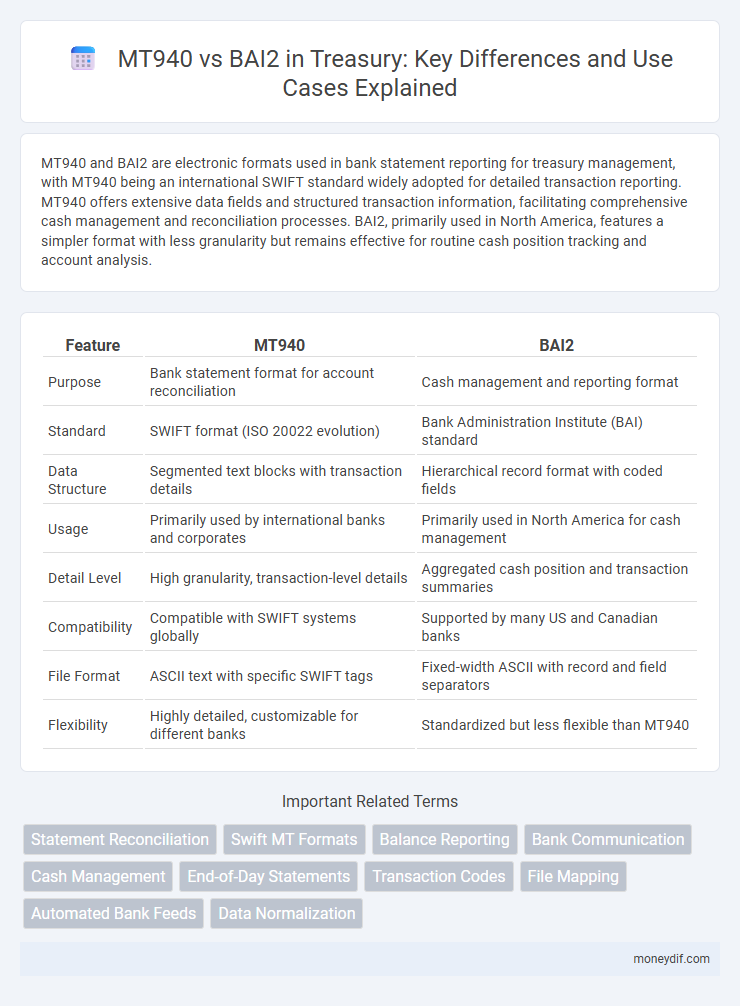

Table of Comparison

| Feature | MT940 | BAI2 |

|---|---|---|

| Purpose | Bank statement format for account reconciliation | Cash management and reporting format |

| Standard | SWIFT format (ISO 20022 evolution) | Bank Administration Institute (BAI) standard |

| Data Structure | Segmented text blocks with transaction details | Hierarchical record format with coded fields |

| Usage | Primarily used by international banks and corporates | Primarily used in North America for cash management |

| Detail Level | High granularity, transaction-level details | Aggregated cash position and transaction summaries |

| Compatibility | Compatible with SWIFT systems globally | Supported by many US and Canadian banks |

| File Format | ASCII text with specific SWIFT tags | Fixed-width ASCII with record and field separators |

| Flexibility | Highly detailed, customizable for different banks | Standardized but less flexible than MT940 |

Introduction to Treasury Reporting Standards

MT940 and BAI2 are prominent Treasury reporting standards used for electronic bank statement communication. MT940, developed by SWIFT, offers detailed transaction-level data with a structured format ideal for international banking and reconciliation processes. BAI2, created by the Bank Administration Institute, provides summarized account transaction information widely adopted in North America for cash management and liquidity monitoring.

Overview of MT940 Format

MT940 is a standardized SWIFT format used by banks worldwide to deliver detailed end-of-day account statements directly to corporate treasury systems, enabling enhanced cash management and reconciliation processes. It structures transaction data into blocks containing transaction details, balances, and reference information, facilitating automated processing and improved liquidity visibility. Compared to BAI2, MT940 offers a globally recognized, ISO-compliant format with extensive transaction detail and standardized tags that enhance data consistency across international banking institutions.

Overview of BAI2 Format

BAI2 is a standardized electronic format used for cash management and bank statement reporting, widely adopted by financial institutions to facilitate automated processing of account transactions. It provides detailed, structured data on deposits, withdrawals, and balances in a hierarchical format, enhancing reconciliation and liquidity management accuracy. Unlike MT940, which is SWIFT-based and primarily used in international banking, BAI2 is commonly employed in the U.S. market for domestic treasury operations and cash flow analysis.

Key Differences between MT940 and BAI2

MT940 is an international SWIFT format used for detailed end-of-day bank statements, providing standardized data fields for easier reconciliation and financial analysis, while BAI2 is a US-centric format favored for its compact structure and batch-processing capabilities tailored to corporate cash management. MT940 supports rich transaction-level detail and global interoperability, making it suitable for multinational corporations, whereas BAI2's format emphasizes summary balances and cash position reporting optimized for domestic banking environments. Differences also include MT940's standardized SWIFT network usage contrasted with BAI2's flexibility allowing custom bank-specific layouts and data types.

MT940 Structure and Key Features

MT940 is an international SWIFT standard format for electronic bank statements, characterized by its structured, detailed transaction records using specific tags for account information, balance details, and individual entries. The format provides high granularity with fields such as :20: (transaction reference number), :25: (account identification), :61: (statement line), and :86: (information to account owner), enabling precise reconciliation and cash management processes. Its widespread adoption supports multi-currency reporting and automated integration into treasury management systems, enhancing real-time cash visibility compared to the older BAI2 format.

BAI2 Structure and Key Features

BAI2 is a standardized format used primarily for cash management and bank reporting, characterized by its hierarchical structure consisting of File, Group, and Record levels that organize detailed transaction data efficiently. Key features include clear segregation of account information, balance summaries, and a wide range of transaction codes enabling comprehensive cash position analysis. Its flexibility and widespread adoption across banks make BAI2 a preferred choice for automated bank reconciliation and treasury cash flow management.

Use Cases: MT940 vs BAI2 in Treasury

MT940 and BAI2 are widely used bank statement formats in treasury management, with MT940 preferred for detailed transaction-level reporting and reconciliation in corporate cash management. BAI2 is commonly utilized for high-volume cash position reporting and interbank communication due to its structured format and industry-standard ANSI specifications. Treasury teams select MT940 for granular cash flow analysis, whereas BAI2 serves better in large-scale liquidity monitoring and automated account balance processing.

Integration and Compatibility Considerations

MT940 offers enhanced integration capabilities with modern ERP and treasury management systems due to its standardized SWIFT format, enabling automated reconciliation and real-time transaction tracking. BAI2 remains widely compatible with various legacy banking and financial platforms, ensuring broad institutional support but often requires additional middleware for seamless integration. Treasury teams must evaluate their existing system architecture and partner bank capabilities to choose between MT940's structured data advantage and BAI2's established interoperability.

Benefits and Challenges of MT940 and BAI2

MT940 offers detailed, standardized electronic bank statement reporting that enhances reconciliation accuracy and supports cash flow forecasting, but its complexity requires sophisticated parsing systems. BAI2 delivers a flexible format widely used in North America, enabling efficient transaction reporting and integration with treasury management systems, though inconsistent implementations can cause data interpretation challenges. Both formats improve financial transparency, yet choosing between them depends on organizational needs for compatibility, data granularity, and processing resources.

Choosing the Right Format for Treasury Operations

MT940 offers detailed, structured bank statement data with standardized formats ideal for automated reconciliation and reporting in treasury operations. BAI2 provides broader transaction reporting with flexibility for various financial institutions but may require additional parsing and customization. Selecting the right format depends on the treasury system's compatibility, reporting needs, and the level of transaction detail required for efficient cash management and audit trails.

Important Terms

Statement Reconciliation

Statement reconciliation between MT940 and BAI2 formats involves matching transaction details to ensure accuracy and completeness in financial reporting. MT940, widely used in SWIFT banking, provides detailed end-of-day bank statements with structured fields, whereas BAI2, commonly employed in the United States, offers batch-oriented cash management data, requiring specialized parsing to align transactions for effective reconciliation.

Swift MT Formats

Swift MT940 is a standardized SWIFT message format used for detailed end-of-day bank account statements, while BAI2 is a proprietary format mainly used in the United States for cash management reporting and offers broader transaction coding flexibility.

Balance Reporting

Balance reporting in MT940 format provides detailed daily account statement information with precise transaction-level data, enabling accurate reconciliation and liquidity management for corporate clients. In contrast, BAI2 format offers summarized balance and transaction information with flexible customization options, commonly used for cash management and bank-to-corporate communication across various financial institutions.

Bank Communication

MT940 is a standardized SWIFT message format widely used for electronic bank statement reporting, enabling seamless reconciliation and audit processes; BAI2, primarily utilized in the United States, offers detailed cash management reporting with a proprietary structure that supports complex transaction categorization but lacks global standardization. Financial institutions prefer MT940 for its international acceptance and machine-readable XML compatibility, while BAI2 remains favored for domestic treasury management due to its granular data specificity.

Cash Management

MT940 is a standardized SWIFT format widely used for detailed electronic bank statements in international cash management, whereas BAI2 is a North American banking format primarily utilized for domestic cash reporting and reconciliation processes.

End-of-Day Statements

MT940 format provides end-of-day bank statement details with standardized SWIFT messaging, whereas BAI2 offers a flexible, US-centric bank data format for comprehensive transaction reporting.

Transaction Codes

MT940 and BAI2 are both standardized bank statement formats used for electronic transaction reporting; MT940 is an SWIFT message format widely adopted by banks worldwide, offering detailed transaction codes for precise financial reconciliation. BAI2, developed by the Bank Administration Institute, emphasizes batch transaction processing with specific code sets tailored to North American corporate banking needs, facilitating efficient cash application and automated account reconciliation.

File Mapping

File mapping for MT940 and BAI2 involves converting transaction data formats to ensure compatibility with financial systems, optimizing reconciliation processes. MT940, an SWIFT standard, provides detailed, structured bank statements, while BAI2, a standardized format used primarily in the United States, emphasizes cash management reporting and batch transaction summaries.

Automated Bank Feeds

Automated Bank Feeds streamline reconciliation by importing transaction data directly from bank statements in standardized formats like MT940 and BAI2, each offering distinct advantages: MT940 provides detailed, structured SWIFT messaging widely used in Europe, while BAI2 is a flexible format commonly preferred in North American banking for detailed cash management reporting. Choosing between MT940 and BAI2 depends on regional banking standards and the level of transaction detail required for optimized financial data integration and automation.

Data Normalization

Data normalization in financial messaging enhances consistency and accuracy by transforming diverse formats like MT940 and BAI2 into standardized structures. While MT940 offers detailed transaction-level statements, BAI2 provides concise batch reports, making normalization essential for unified reconciliation and reporting across banking systems.

MT940 vs BAI2 Infographic

moneydif.com

moneydif.com