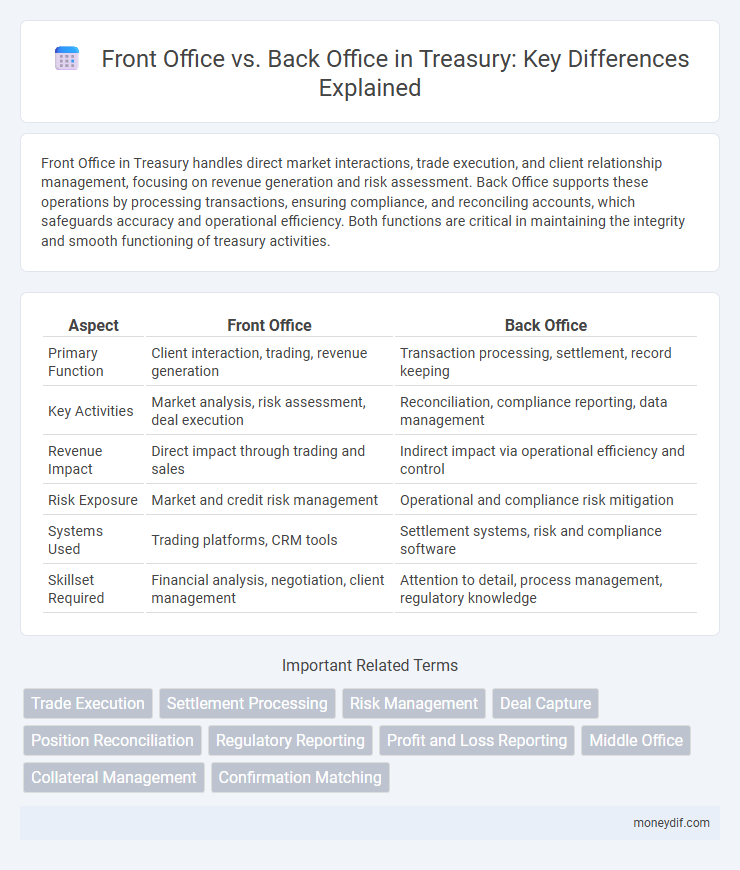

Front Office in Treasury handles direct market interactions, trade execution, and client relationship management, focusing on revenue generation and risk assessment. Back Office supports these operations by processing transactions, ensuring compliance, and reconciling accounts, which safeguards accuracy and operational efficiency. Both functions are critical in maintaining the integrity and smooth functioning of treasury activities.

Table of Comparison

| Aspect | Front Office | Back Office |

|---|---|---|

| Primary Function | Client interaction, trading, revenue generation | Transaction processing, settlement, record keeping |

| Key Activities | Market analysis, risk assessment, deal execution | Reconciliation, compliance reporting, data management |

| Revenue Impact | Direct impact through trading and sales | Indirect impact via operational efficiency and control |

| Risk Exposure | Market and credit risk management | Operational and compliance risk mitigation |

| Systems Used | Trading platforms, CRM tools | Settlement systems, risk and compliance software |

| Skillset Required | Financial analysis, negotiation, client management | Attention to detail, process management, regulatory knowledge |

Understanding Treasury Functions: Front Office vs Back Office

The Front Office in Treasury manages liquidity, risk assessment, and market operations, directly influencing cash flow and funding strategies. The Back Office supports these functions by handling settlements, reconciliation, and compliance, ensuring accuracy and regulatory adherence in financial transactions. Efficient coordination between Front and Back Office enhances treasury operations, reduces operational risk, and maintains financial stability.

Core Responsibilities: Front Office Explained

The Front Office in Treasury primarily handles liquidity management, cash flow forecasting, and risk assessment to ensure optimal financial positioning. It actively engages in market analysis, trade execution, and relationship management with banks and counterparties to support treasury operations. Core responsibilities also include strategic decision-making on funding and investment activities to maximize returns while mitigating financial risks.

Key Roles and Duties: Back Office in Treasury

The Back Office in Treasury manages critical functions such as transaction settlement, reconciliation, and compliance monitoring to ensure accuracy and regulatory adherence. It supports risk management efforts by maintaining detailed records, processing payment instructions, and handling cash management activities. This operational backbone enables the Front Office to focus on market analysis and strategic decision-making while minimizing operational risks.

Decision-Making Power: Front Office Functions

Front office functions in Treasury hold primary decision-making power over trading strategies, asset allocation, and risk management to optimize financial performance. These roles directly influence market positioning through real-time analysis and execution of transactions. Front office professionals collaborate closely with senior management to align Treasury activities with overall corporate financial goals.

Risk Management and Compliance: The Back Office Perspective

Back Office in Treasury plays a critical role in risk management and compliance by ensuring transaction accuracy, regulatory adherence, and timely reporting. This function monitors market, credit, and operational risks through robust control frameworks and compliance checks, mitigating potential financial and reputational losses. Advanced treasury management systems and regulatory technologies are leveraged to enhance real-time risk assessment and enforce strict internal controls.

Technology and Automation in Treasury Operations

Technology and automation transform treasury operations by enhancing efficiency and accuracy in both Front Office and Back Office functions. In the Front Office, real-time analytics and AI-driven forecasting streamline cash management and risk assessment, while the Back Office leverages robotic process automation (RPA) and blockchain for secure transaction processing and reconciliation. Integration of Treasury Management Systems (TMS) across these areas reduces manual errors and accelerates workflow, ensuring compliance and improved decision-making.

Front Office-Back Office Collaboration: Bridging the Gap

Front Office-Back Office collaboration in Treasury is essential for seamless cash management, risk assessment, and trade execution, ensuring accurate and compliant financial operations. Effective communication channels and integrated technology platforms enable Front Office teams to relay real-time market data and trade details to Back Office functions for prompt settlement and regulatory reporting. Strengthening this collaboration reduces operational risks, enhances liquidity forecasting accuracy, and accelerates decision-making processes critical to treasury management.

Skills and Qualifications: Treasury Front vs Back Office

Treasury front office professionals require strong analytical skills, proficiency in financial modeling, and expertise in market risk management to optimize liquidity and funding strategies. Back office roles demand meticulous attention to detail, comprehensive knowledge of compliance, settlement processes, and accounting principles to ensure accurate transaction recording and regulatory adherence. Both areas benefit from advanced certifications such as CFA for front office and CAMS or CTP for back office, emphasizing the distinct technical and operational expertise essential in treasury management.

Performance Metrics: Measuring Front and Back Office Success

Performance metrics in Treasury front office emphasize real-time deal execution speed, profitability per trade, and risk-adjusted returns, reflecting direct market engagement efficiency. Back office performance metrics prioritize accuracy in transaction processing, reconciliation timeliness, and compliance adherence, ensuring operational integrity and regulatory compliance. Balanced measurement frameworks enable Treasury departments to optimize both revenue generation and operational resilience.

Future Trends: Evolving Roles in Treasury Operations

Future trends in treasury operations emphasize the integration of advanced technologies such as artificial intelligence and blockchain to enhance real-time data analysis and security measures. Front office roles are evolving to prioritize strategic decision-making and external stakeholder engagement, while back office functions increasingly automate routine processes like reconciliation and compliance monitoring. This shift enables treasuries to achieve greater efficiency, reduce operational risks, and support agile financial management.

Important Terms

Trade Execution

Trade execution in the front office involves real-time order placement and market interaction to optimize pricing and timing, while the back office focuses on trade confirmation, clearing, and settlement to ensure accurate record-keeping and regulatory compliance. Efficient coordination between front office trading systems and back office processing platforms is crucial for minimizing operational risk and enhancing overall trade lifecycle management.

Settlement Processing

Settlement processing ensures accurate transfer of securities and funds by coordinating front office trade execution with back office confirmation and reconciliation tasks.

Risk Management

Effective risk management in financial institutions requires seamless coordination between the front office, which handles client interactions and trading activities, and the back office, responsible for transaction processing, compliance, and risk monitoring.

Deal Capture

Deal Capture is a critical process that involves recording and validating trade details in the Front Office, ensuring accurate transaction execution and pricing. The Back Office supports this by managing post-trade activities such as confirmation, settlement, and regulatory compliance to mitigate operational risk.

Position Reconciliation

Position reconciliation ensures alignment between Front Office trading records and Back Office settlement data to prevent discrepancies and operational risks.

Regulatory Reporting

Regulatory reporting in financial institutions involves meticulous data management where the Front Office captures real-time transaction and trade data, while the Back Office ensures accuracy, compliance, and reconciliation before submitting reports to regulators such as the SEC, FCA, or ESMA. Effective collaboration between these departments is essential for meeting stringent regulatory frameworks like MiFID II, Dodd-Frank, or Basel III, minimizing operational risk and avoiding heavy penalties.

Profit and Loss Reporting

Profit and loss reporting in financial institutions distinguishes the front office, responsible for generating revenue through trading and sales activities, from the back office, which handles trade settlements, risk management, and accounting to ensure accuracy and compliance. Accurate P&L reconciliation between these offices enhances transparency, supports regulatory compliance, and aids in performance evaluation by isolating trading strategies and operational costs.

Middle Office

Middle Office functions serve as a critical link between Front Office trading activities and Back Office administrative processes, focusing on risk management, trade validation, and compliance monitoring to ensure transaction accuracy and regulatory adherence. They optimize operational efficiency by reconciling trade details, managing collateral, and providing performance analytics, thereby supporting both the revenue-generating Front Office and the settlement-driven Back Office.

Collateral Management

Front Office Collateral Management focuses on real-time trade support and risk assessment, while Back Office Collateral Management ensures accurate settlement, reconciliation, and regulatory compliance.

Confirmation Matching

Confirmation matching ensures trade details such as price, quantity, and settlement dates are accurately aligned between front office trading desks and back office operations to minimize discrepancies. Efficient workflows in confirmation matching reduce settlement risk and improve overall trade processing accuracy in financial institutions.

Front Office vs Back Office Infographic

moneydif.com

moneydif.com