Commercial Paper and Treasury Bills are both short-term debt instruments used for financing, but they differ significantly in issuer and risk profile. Commercial Paper is unsecured, issued by corporations to meet short-term liabilities, and typically offers higher yields due to increased credit risk. Treasury Bills, backed by the government, provide a virtually risk-free investment with lower returns, making them a safer choice for conservative investors.

Table of Comparison

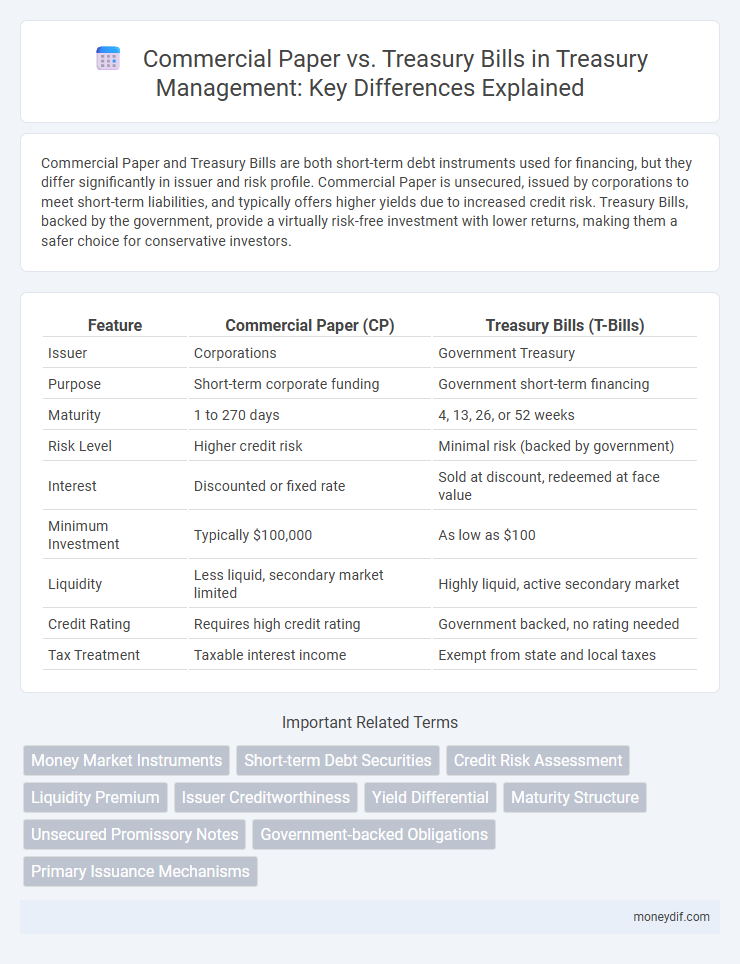

| Feature | Commercial Paper (CP) | Treasury Bills (T-Bills) |

|---|---|---|

| Issuer | Corporations | Government Treasury |

| Purpose | Short-term corporate funding | Government short-term financing |

| Maturity | 1 to 270 days | 4, 13, 26, or 52 weeks |

| Risk Level | Higher credit risk | Minimal risk (backed by government) |

| Interest | Discounted or fixed rate | Sold at discount, redeemed at face value |

| Minimum Investment | Typically $100,000 | As low as $100 |

| Liquidity | Less liquid, secondary market limited | Highly liquid, active secondary market |

| Credit Rating | Requires high credit rating | Government backed, no rating needed |

| Tax Treatment | Taxable interest income | Exempt from state and local taxes |

Overview of Commercial Paper and Treasury Bills

Commercial Paper is a short-term, unsecured promissory note issued by corporations to finance short-term liabilities, typically maturing within 270 days. Treasury Bills, or T-Bills, are short-term government securities issued by the U.S. Treasury with maturities ranging from a few days to 52 weeks, sold at a discount and redeemed at face value. Both instruments serve as important tools for managing liquidity and short-term funding needs in financial markets.

Key Differences Between Commercial Paper and Treasury Bills

Commercial Paper is an unsecured, short-term debt instrument issued primarily by corporations to finance working capital, typically with maturities up to 270 days, whereas Treasury Bills are government-backed securities issued by the U.S. Department of the Treasury with maturities ranging from a few days to one year. Commercial Paper offers higher yields due to its higher risk compared to the virtually risk-free Treasury Bills, which are backed by the full faith and credit of the U.S. government. Liquidity and credit risk differentiate the two, with Treasury Bills considered safer and more liquid, making them preferred by risk-averse investors.

Issuers: Corporates vs. Government

Commercial Paper is issued primarily by large corporations to raise short-term funds for working capital needs, typically offering higher yields due to slightly elevated credit risk. Treasury Bills are issued exclusively by the government as a low-risk debt instrument to finance national debt and manage liquidity with maturities ranging from a few days to one year. The creditworthiness of Treasury Bills is considered virtually risk-free, while Commercial Paper depends on the issuing corporation's financial health and credit rating.

Credit Risk and Default Considerations

Commercial paper carries higher credit risk compared to Treasury bills due to its issuance by corporations rather than the government, resulting in a greater likelihood of default. Treasury bills are backed by the full faith and credit of the U.S. government, making them virtually risk-free and ensuring timely repayment. Investors seeking low default risk typically prefer Treasury bills, while commercial paper may offer higher yields to compensate for increased credit risk.

Maturity Periods and Liquidity

Commercial Paper typically has a maturity period ranging from 1 to 270 days, offering flexible short-term financing for corporations, while Treasury Bills have fixed maturities of 4, 8, 13, 26, or 52 weeks, providing government-backed liquidity instruments. Treasury Bills are highly liquid due to active secondary markets and strong government credit, making them a preferred choice for risk-averse investors seeking quick access to cash. Commercial Paper offers attractive yields but carries higher credit risk and lower liquidity compared to Treasury Bills, impacting investors' portfolio strategies based on maturity preferences and risk tolerance.

Interest Rates and Yield Comparisons

Commercial paper typically offers higher interest rates than Treasury bills due to its unsecured nature and increased credit risk from corporations. Treasury bills, backed by the U.S. government, provide lower yields but greater safety and liquidity. Investors seeking higher returns often prefer commercial paper, while risk-averse investors prioritize the stable, lower-yield Treasury bills.

Regulatory Framework and Oversight

Commercial Paper is primarily governed by the Securities Act of 1933 and subject to SEC registration unless it qualifies for an exemption, while Treasury Bills are issued and regulated directly by the U.S. Department of the Treasury under statutory authority. The regulatory oversight of Commercial Paper involves the Securities and Exchange Commission to ensure transparency and compliance with investor protection laws. In contrast, Treasury Bills benefit from a streamlined issuance process and oversight by the Treasury, with less regulatory burden due to their government-backed status.

Role in Corporate and Government Financing

Commercial Paper serves as a short-term debt instrument issued by corporations to meet urgent working capital needs, offering quick liquidity at lower interest rates than bank loans. Treasury Bills are short-term government securities used to finance national debt and manage monetary policy, providing a secure investment with minimal risk. Both instruments play crucial roles in their respective sectors by facilitating efficient capital flow and liquidity management.

Investor Profiles and Suitability

Commercial Paper appeals to institutional investors and corporations seeking short-term, unsecured debt instruments with higher yields and moderate risk tolerance. Treasury Bills attract conservative investors, including risk-averse individuals and central banks, looking for government-backed, highly liquid securities with minimal credit risk. Suitability depends on the investor's risk appetite, investment horizon, and need for liquidity, with Commercial Paper fitting those prioritizing yield and Treasury Bills preferred for safety and guaranteed returns.

Risks and Benefits of Each Instrument

Commercial Paper offers higher yields compared to Treasury Bills but carries increased credit risk since it is unsecured and issued by corporations rather than the government. Treasury Bills provide lower returns but are considered virtually risk-free due to backing by the U.S. government, making them ideal for conservative investors seeking liquidity and capital preservation. The choice between these instruments hinges on risk tolerance, investment horizon, and the investor's need for return versus security.

Important Terms

Money Market Instruments

Commercial paper offers short-term, unsecured promissory notes issued by corporations for immediate funding, typically maturing within 270 days, while Treasury bills are government-backed securities with maturities ranging from a few days to one year, providing low-risk investment options backed by the U.S. Treasury. Both instruments are key money market tools, with commercial paper generally yielding higher returns due to credit risk, whereas Treasury bills prioritize security and liquidity.

Short-term Debt Securities

Commercial paper offers higher yields but higher risk compared to Treasury bills, which are backed by the U.S. government and provide lower risk short-term debt securities.

Credit Risk Assessment

Credit risk assessment for commercial paper is critical due to issuer credit variability, whereas treasury bills carry minimal credit risk as they are backed by the government.

Liquidity Premium

Liquidity premium reflects the additional yield investors demand for holding Commercial Paper over Treasury Bills due to lower market liquidity and higher credit risk. Treasury Bills typically offer lower yields as they are highly liquid and backed by the government, while Commercial Paper's yields incorporate a liquidity premium compensating for their shorter-term corporate credit exposure.

Issuer Creditworthiness

Issuer creditworthiness significantly impacts the risk profiles of Commercial Paper and Treasury Bills, with Commercial Paper typically reflecting higher credit risk due to reliance on the issuing corporation's short-term financial health, whereas Treasury Bills benefit from the U.S. government's strong credit rating and backing. Investors often demand higher yields on Commercial Paper to compensate for potential default risk, contrasting with the near-risk-free status and lower yields of Treasury Bills issued by the federal government.

Yield Differential

Yield differential between Commercial Paper and Treasury Bills reflects credit risk and liquidity differences, with Commercial Paper typically offering higher yields due to issuer credit risk compared to the virtually risk-free Treasury Bills. This spread fluctuates based on market conditions, economic outlook, and investor demand for short-term unsecured corporate debt versus government-backed securities.

Maturity Structure

Maturity structure distinguishes commercial paper, typically issued with short-term maturities ranging from 1 to 270 days, from Treasury bills, which commonly have fixed maturities of 4, 13, 26, or 52 weeks. This difference in maturity lengths reflects the varying liquidity needs and credit risk profiles of issuers in the money market.

Unsecured Promissory Notes

Unsecured promissory notes are short-term debt instruments issued without collateral, commonly used by corporations to raise working capital, contrasting with commercial paper which is also unsecured but typically issued at a discount and traded in secondary markets; Treasury bills, however, are government-backed, highly liquid, and considered the safest short-term investment. The key difference lies in credit risk and issuer type, with unsecured promissory notes and commercial paper bearing higher default risk than Treasury bills, which are backed by the full faith and credit of the government.

Government-backed Obligations

Government-backed obligations such as Treasury Bills (T-Bills) offer the highest safety due to full government guarantee, contrasting with Commercial Paper which is unsecured and typically issued by corporations with varying credit risk. Treasury Bills have shorter maturities ranging from a few days to one year with highly liquid secondary markets, while Commercial Paper often matures within 270 days and is used mainly for short-term corporate financing.

Primary Issuance Mechanisms

Primary issuance mechanisms for Commercial Paper involve private placements directly between issuers and institutional investors, facilitating quick and flexible short-term funding, while Treasury Bills are issued through competitive auctions conducted by government agencies to ensure transparent pricing and broad market participation. The commercial paper market relies heavily on credit ratings and investor relationships, whereas Treasury Bills benefit from sovereign backing and highly liquid secondary markets.

Commercial Paper vs Treasury Bills Infographic

moneydif.com

moneydif.com