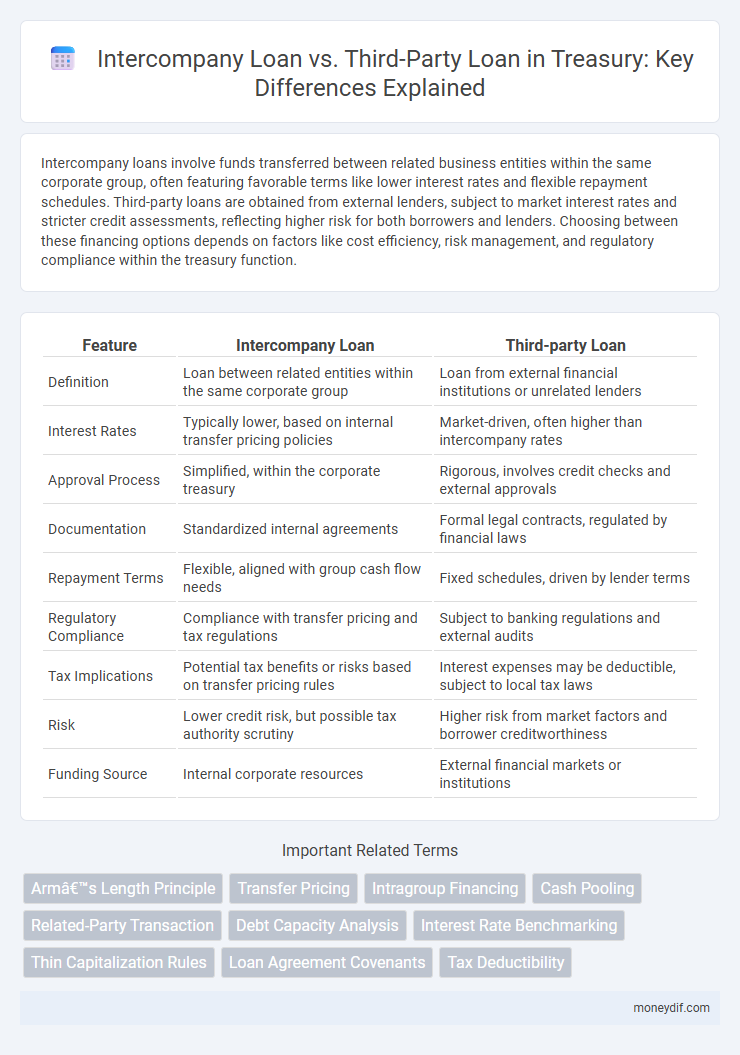

Intercompany loans involve funds transferred between related business entities within the same corporate group, often featuring favorable terms like lower interest rates and flexible repayment schedules. Third-party loans are obtained from external lenders, subject to market interest rates and stricter credit assessments, reflecting higher risk for both borrowers and lenders. Choosing between these financing options depends on factors like cost efficiency, risk management, and regulatory compliance within the treasury function.

Table of Comparison

| Feature | Intercompany Loan | Third-party Loan |

|---|---|---|

| Definition | Loan between related entities within the same corporate group | Loan from external financial institutions or unrelated lenders |

| Interest Rates | Typically lower, based on internal transfer pricing policies | Market-driven, often higher than intercompany rates |

| Approval Process | Simplified, within the corporate treasury | Rigorous, involves credit checks and external approvals |

| Documentation | Standardized internal agreements | Formal legal contracts, regulated by financial laws |

| Repayment Terms | Flexible, aligned with group cash flow needs | Fixed schedules, driven by lender terms |

| Regulatory Compliance | Compliance with transfer pricing and tax regulations | Subject to banking regulations and external audits |

| Tax Implications | Potential tax benefits or risks based on transfer pricing rules | Interest expenses may be deductible, subject to local tax laws |

| Risk | Lower credit risk, but possible tax authority scrutiny | Higher risk from market factors and borrower creditworthiness |

| Funding Source | Internal corporate resources | External financial markets or institutions |

Introduction to Intercompany and Third-party Loans

Intercompany loans are financial arrangements between subsidiaries or divisions within the same corporate group, facilitating liquidity management and capital allocation without involving external parties. Third-party loans, conversely, involve borrowing from external financial institutions or investors, typically requiring formal credit assessments and regulatory compliance. Choosing between intercompany and third-party loans depends on factors such as interest rates, repayment terms, risk exposure, and corporate governance policies.

Key Differences Between Intercompany and Third-party Loans

Intercompany loans are financial arrangements between subsidiaries or affiliated companies within the same corporate group, often featuring flexible terms and lower interest rates, designed to optimize internal cash flow and capital allocation. Third-party loans involve borrowing from external lenders, typically with stricter credit assessments, defined repayment schedules, and market-determined interest rates, aimed at securing external funding for business operations or investments. Key differences include the relationship between borrower and lender, cost of capital, regulatory compliance, and risk management strategies affecting treasury decisions.

Regulatory and Compliance Considerations

Intercompany loans involve transactions between related entities within the same corporate group, requiring strict adherence to transfer pricing regulations and arm's length principles to avoid tax penalties. Third-party loans demand compliance with external lending laws, anti-money laundering (AML) measures, and financial reporting standards imposed by regulatory authorities. Monitoring regulatory risks, ensuring proper documentation, and conducting fair market valuation are essential to maintain compliance and mitigate legal exposure in both loan types.

Tax Implications and Transfer Pricing Issues

Intercompany loans often trigger complex transfer pricing regulations as tax authorities scrutinize interest rates to ensure they align with the arm's length principle, preventing profit shifting across jurisdictions. Third-party loans typically face fewer transfer pricing challenges but may involve different withholding tax obligations depending on the lender's location. Mispricing interest rates in intercompany loans can lead to double taxation, adjustments, and penalties, making documentation and compliance critical for multinationals.

Risk Management in Intercompany vs Third-party Lending

Intercompany loans typically carry lower credit risk due to existing corporate relationships and integrated financial controls, facilitating easier monitoring and enforcement compared to third-party loans. However, intercompany lending poses operational risks such as transfer pricing scrutiny and regulatory compliance challenges that require robust governance frameworks. Third-party loans involve greater credit risk and higher due diligence costs but benefit from standardized contract terms and external risk mitigation tools like collateral and covenants.

Documentation and Legal Requirements

Intercompany loans typically require less formal documentation compared to third-party loans, often involving internal agreements that specify terms such as interest rates, repayment schedules, and covenants tailored to corporate group policies. Third-party loans necessitate comprehensive legal documentation, including detailed loan agreements, collateral provisions, and regulatory compliance to satisfy external lender and jurisdictional requirements. Legal scrutiny is higher in third-party loans due to external risk assessment, whereas intercompany loans focus on arm's length principles to ensure tax and transfer pricing compliance.

Interest Rate Determination and Benchmarking

Intercompany loans often feature interest rates determined by internal treasury policies, taking into account transfer pricing regulations and the credit profile of the borrowing affiliate, ensuring compliance with tax authorities. Third-party loans rely on external market benchmarks such as LIBOR, SOFR, or government bond yields, reflecting prevailing market risk and liquidity conditions. Benchmarking intercompany loan rates against third-party loan rates is essential for validating arm's length pricing and minimizing tax audit risks.

Reporting and Disclosure Requirements

Intercompany loans require detailed disclosure of related-party transactions in financial reports, ensuring transparency about terms, interest rates, and outstanding balances between affiliated entities. Third-party loans mandate comprehensive reporting of contractual terms, interest rates, maturities, and any contingent liabilities to comply with external regulatory standards. Both loan types must adhere to specific accounting frameworks, such as IFRS or GAAP, which dictate recognition, measurement, and disclosure requirements in financial statements.

Impact on Cash Flow and Liquidity Management

Intercompany loans typically enhance cash flow flexibility within a corporate group by allowing funds to be transferred internally without incurring external borrowing costs or credit checks, thus improving liquidity management. In contrast, third-party loans often involve interest payments and rigid repayment schedules, which can strain cash flow and reduce liquidity reserves. Effective treasury management balances these loan types to optimize cash availability and minimize financing costs across the organization.

Best Practices for Managing Intercompany and Third-party Loans

Effective management of intercompany loans requires clear documentation with defined interest rates, payment terms, and regulatory compliance to avoid tax risks and ensure transparency in consolidated financial reporting. Third-party loans demand rigorous credit risk assessment, market-based interest rates, and ongoing cash flow monitoring to safeguard liquidity and meet repayment obligations. Implementing robust tracking systems, timely reconciliations, and aligning loan agreements with corporate treasury policies optimize overall debt management and minimize financial risks.

Important Terms

Arm’s Length Principle

The Arm's Length Principle requires intercompany loans to have interest rates, terms, and conditions comparable to those of third-party loans to ensure fair transfer pricing compliance.

Transfer Pricing

Intercompany loans often feature more flexible terms and lower interest rates compared to third-party loans, reflecting internal corporate financial strategies while complying with transfer pricing regulations to avoid tax base erosion. Tax authorities closely scrutinize intercompany loan terms to ensure they align with the arm's length principle, requiring documentation that justifies interest rates and repayment conditions comparable to independent third-party financing.

Intragroup Financing

Intragroup financing involves allocating funds between affiliated companies, where intercompany loans offer flexible terms, potentially lower interest rates, and streamlined approval processes compared to third-party loans, which usually involve higher costs and stricter credit evaluations. Tax implications and regulatory compliance differ significantly between intercompany loans and third-party loans, impacting transfer pricing and consolidated financial reporting within multinational corporations.

Cash Pooling

Cash pooling optimizes liquidity by consolidating intercompany balances, reducing reliance on external funding through third-party loans that often involve higher interest rates and stricter credit terms. Intercompany loans within a cash pool benefit from flexible repayment options and lower costs compared to third-party loans, which typically require formal agreements and regulatory compliance.

Related-Party Transaction

Related-party transactions involving intercompany loans often feature favorable terms such as lower interest rates and flexible repayment schedules due to existing corporate relationships, whereas third-party loans typically involve market-driven interest rates and stricter compliance requirements to ensure arm's length standards. Regulatory bodies closely monitor intercompany loans to prevent profit shifting and tax avoidance, contrasting with third-party loans which are usually subject to standard financial scrutiny and lending criteria.

Debt Capacity Analysis

Debt capacity analysis evaluates a company's ability to incur and service additional debt based on financial metrics like EBITDA, cash flow, and leverage ratios, which differ significantly between intercompany loans and third-party loans due to varying interest rates, repayment terms, and legal constraints. Intercompany loans often provide more flexible terms and may not impact external credit ratings as heavily as third-party loans, which are subject to stricter covenants and market-driven interest rates affecting the overall debt capacity assessment.

Interest Rate Benchmarking

Interest rate benchmarking for intercompany loans often relies on internal transfer pricing policies aligned with arm's length principles, ensuring rates reflect comparable third-party loan market conditions. Third-party loan rates serve as a critical reference point, influencing the setting of intercompany loan interest to maintain compliance with tax regulations and avoid profit shifting.

Thin Capitalization Rules

Thin capitalization rules limit the amount of debt a company can use to finance its operations through intercompany loans, preventing excessive interest deductions and base erosion. These rules often impose stricter debt-to-equity ratios for intercompany loans compared to third-party loans, which are generally subject to more market-based terms and interest rates.

Loan Agreement Covenants

Loan agreement covenants in intercompany loans often include stricter financial reporting and related-party transaction disclosures compared to third-party loans, which emphasize creditworthiness and market-risk compliance. Intercompany loan covenants prioritize internal control and transfer pricing adherence, while third-party loans focus on interest coverage ratios and collateral requirements.

Tax Deductibility

Tax deductibility of interest expenses on intercompany loans often depends on transfer pricing regulations and local tax laws, which may limit deductions to arm's length interest rates to prevent profit shifting; third-party loans typically offer clearer deductibility under commercial terms, subject to standard tax code provisions. Companies must carefully document intercompany loan terms to ensure compliance and maximize deductible interest, while third-party loans provide straightforward tax treatment but may involve higher interest costs.

Intercompany Loan vs Third-party Loan Infographic

moneydif.com

moneydif.com