Collateralized transactions involve providing assets as security to reduce credit risk, enhancing trust between parties and potentially lowering borrowing costs. Uncollateralized transactions lack asset backing, increasing exposure to counterparty default risk and often leading to higher interest rates to compensate for this risk. Treasury departments carefully assess the trade-offs between collateralized and uncollateralized instruments to optimize liquidity management and risk mitigation.

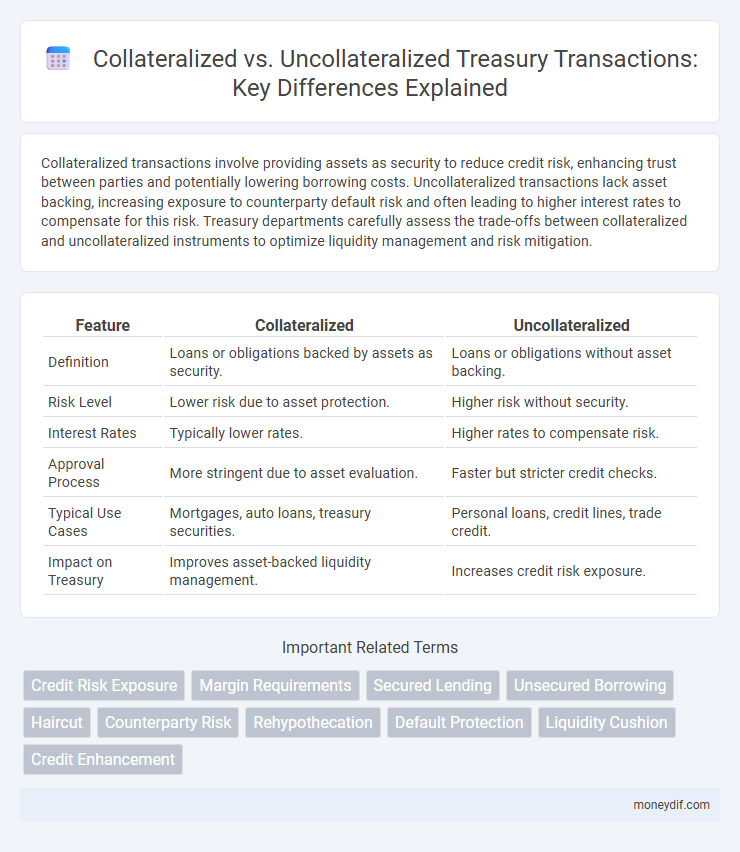

Table of Comparison

| Feature | Collateralized | Uncollateralized |

|---|---|---|

| Definition | Loans or obligations backed by assets as security. | Loans or obligations without asset backing. |

| Risk Level | Lower risk due to asset protection. | Higher risk without security. |

| Interest Rates | Typically lower rates. | Higher rates to compensate risk. |

| Approval Process | More stringent due to asset evaluation. | Faster but stricter credit checks. |

| Typical Use Cases | Mortgages, auto loans, treasury securities. | Personal loans, credit lines, trade credit. |

| Impact on Treasury | Improves asset-backed liquidity management. | Increases credit risk exposure. |

Understanding Collateralized and Uncollateralized Transactions

Collateralized transactions involve the use of specific assets as security to mitigate credit risk in treasury operations, ensuring repayment under adverse market conditions. Uncollateralized transactions rely solely on the creditworthiness of the counterparty without pledged assets, exposing the treasury to higher risk of default. Effective risk management requires evaluating the collateral value, liquidity, and counterparty credit ratings to optimize treasury funding strategies.

Key Differences Between Collateralized and Uncollateralized Instruments

Collateralized instruments in treasury management involve securing loans or obligations with specific assets, significantly reducing credit risk and often resulting in lower interest rates. Uncollateralized instruments lack asset backing, relying solely on the borrower's creditworthiness, which typically leads to higher interest rates due to increased risk exposure. The key differences hinge on risk mitigation, cost of borrowing, and the influence on credit assessment processes.

Risk Management in Collateralized vs Uncollateralized Structures

Collateralized structures mitigate counterparty credit risk by securing transactions with assets, reducing potential losses in default scenarios. Uncollateralized structures expose counterparties to higher credit risk, relying on creditworthiness assessments and contractual agreements without asset backing. Effective risk management in collateralized setups includes monitoring collateral value and margin calls, while uncollateralized frameworks require stringent credit limits and continuous credit exposure evaluation.

Impact on Liquidity: Collateralized vs Uncollateralized Approaches

Collateralized transactions enhance liquidity by providing secured assets that reduce counterparty risk, enabling easier access to funding and lower borrowing costs. Uncollateralized approaches, while offering greater flexibility, often lead to higher risk premiums and restricted liquidity due to the lack of asset backing. Treasury management prioritizes collateral to ensure stable liquidity levels and optimize capital efficiency in volatile markets.

Credit Risk Exposure in Treasury Operations

Collateralized transactions in treasury operations significantly reduce credit risk exposure by requiring assets as security, which can be liquidated if the counterparty defaults, thereby enhancing risk mitigation. Uncollateralized transactions expose treasuries to higher credit risk as there is no asset-backed guarantee, relying solely on the counterparty's creditworthiness and increasing potential losses in the event of default. Effective credit risk management in treasury involves assessing counterparty credit profiles and implementing collateral agreements to limit exposure and safeguard liquidity.

Regulatory Requirements for Collateralized and Uncollateralized Dealings

Regulatory requirements for collateralized dealings mandate stringent margin calls, daily valuation, and segregation of posted assets to mitigate counterparty risk under frameworks like Basel III and EMIR. Uncollateralized transactions, typically limited by higher capital charges and enhanced credit risk assessments, face tighter limits and more rigorous documentation due to increased potential for credit exposure. Regulatory bodies enforce these distinctions to ensure financial stability and reduce systemic risk within treasury operations.

Cost Implications in Treasury: Collateralized vs Uncollateralized

Collateralized transactions in treasury management require the pledging of assets, typically resulting in lower borrowing costs due to reduced credit risk and enhanced lender protection. Uncollateralized transactions lack asset backing, leading to higher interest rates to compensate for increased default risk, which directly impacts the cost of funds. Treasury teams must weigh the liquidity trade-offs and cost differentials when choosing between collateralized and uncollateralized funding sources.

Examples of Collateralized and Uncollateralized Products

Collateralized treasury products include repurchase agreements (repos), asset-backed securities (ABS), and secured loans, where specific assets serve as collateral to reduce credit risk. Uncollateralized treasury products involve instruments like unsecured commercial paper, unsecured lines of credit, and unsecured bank loans, which rely on the issuer's creditworthiness without backing from specific assets. Understanding the risk profiles and security features of these products is essential for optimizing treasury management and mitigating financial exposure.

Market Practices and Trends in Collateralized vs Uncollateralized Trading

Market practices in Treasury trading show a strong preference for collateralized transactions due to reduced credit risk and improved liquidity management. Collateralized trading dominates in interest rate swaps and repos, driven by regulatory requirements like EMIR and Dodd-Frank that increase transparency and risk mitigation. Uncollateralized trades persist mainly in interbank lending and FX swaps, favored for flexibility and speed despite higher counterparty risk and limited market transparency.

Best Practices for Managing Collateral and Unsecured Treasury Transactions

Effective management of collateralized treasury transactions involves rigorous monitoring of asset valuations and timely margin calls to mitigate counterparty risk, ensuring liquidity and regulatory compliance. For uncollateralized transactions, best practices emphasize robust credit risk assessment, setting exposure limits, and continuous counterparty creditworthiness evaluations to prevent potential losses. Implementing advanced treasury management systems enables real-time risk analytics and enhances decision-making for both secured and unsecured exposures.

Important Terms

Credit Risk Exposure

Credit risk exposure significantly decreases when loans or derivatives are collateralized, as the collateral provides a security buffer that mitigates potential losses in case of default. Uncollateralized exposures inherently carry higher credit risk because they rely solely on the borrower's creditworthiness without any tangible assets to offset potential default losses.

Margin Requirements

Margin requirements for collateralized transactions are typically lower due to reduced credit risk compared to higher margin requirements mandated for uncollateralized trades to mitigate potential default exposure.

Secured Lending

Secured lending involves loans backed by collateral assets, reducing lender risk and often resulting in lower interest rates, while uncollateralized lending relies solely on borrower creditworthiness, typically carrying higher interest rates and stricter approval criteria. Collateral types can include real estate, vehicles, or inventory, providing tangible security for lenders in contrast to unsecured loans such as credit cards or personal loans.

Unsecured Borrowing

Unsecured borrowing involves loans or credit extended without requiring collateral, relying solely on the borrower's creditworthiness and financial history. Unlike collateralized borrowing, which secures the loan with assets to reduce lender risk, unsecured borrowing typically carries higher interest rates due to increased default risk and limited recovery options for lenders.

Haircut

Haircut in finance refers to the percentage reduction applied to the market value of collateral in collateralized transactions to protect lenders against potential decreases in asset value. In collateralized loans, haircuts mitigate credit risk by adjusting collateral valuation, whereas uncollateralized loans do not involve haircuts since there is no collateral backing the transaction.

Counterparty Risk

Counterparty risk in collateralized transactions is significantly mitigated through the use of posted collateral, which acts as a financial buffer against potential default, whereas uncollateralized exposures pose higher risk due to the absence of such protective assets. The presence or absence of collateral directly influences credit risk management strategies and regulatory capital requirements in derivatives and lending markets.

Rehypothecation

Rehypothecation enables secured lenders to reuse collateral in collateralized transactions, increasing liquidity, whereas uncollateralized transactions lack pledged assets, elevating counterparty risk.

Default Protection

Default protection is more robust in collateralized agreements due to secured assets reducing creditor risk compared to unsecured exposure in uncollateralized contracts.

Liquidity Cushion

Liquidity cushion refers to the reserve of liquid assets held to meet short-term obligations without relying on asset sales or external funding. In collateralized transactions, liquidity cushions are typically smaller due to secured assets providing confidence to lenders, whereas uncollateralized deals require larger cushions to mitigate higher credit risk and potential liquidity shortfalls.

Credit Enhancement

Credit enhancement improves the creditworthiness of collateralized and uncollateralized financial instruments by reducing risk through collateral support or third-party guarantees.

Collateralized vs Uncollateralized Infographic

moneydif.com

moneydif.com