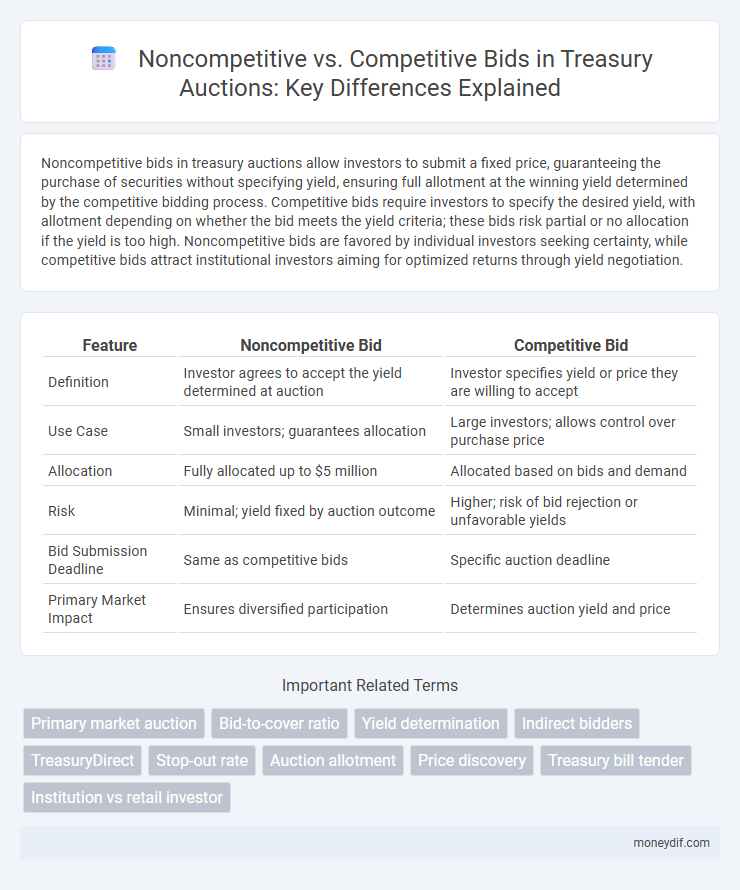

Noncompetitive bids in treasury auctions allow investors to submit a fixed price, guaranteeing the purchase of securities without specifying yield, ensuring full allotment at the winning yield determined by the competitive bidding process. Competitive bids require investors to specify the desired yield, with allotment depending on whether the bid meets the yield criteria; these bids risk partial or no allocation if the yield is too high. Noncompetitive bids are favored by individual investors seeking certainty, while competitive bids attract institutional investors aiming for optimized returns through yield negotiation.

Table of Comparison

| Feature | Noncompetitive Bid | Competitive Bid |

|---|---|---|

| Definition | Investor agrees to accept the yield determined at auction | Investor specifies yield or price they are willing to accept |

| Use Case | Small investors; guarantees allocation | Large investors; allows control over purchase price |

| Allocation | Fully allocated up to $5 million | Allocated based on bids and demand |

| Risk | Minimal; yield fixed by auction outcome | Higher; risk of bid rejection or unfavorable yields |

| Bid Submission Deadline | Same as competitive bids | Specific auction deadline |

| Primary Market Impact | Ensures diversified participation | Determines auction yield and price |

Understanding Treasury Auctions: An Overview

Treasury auctions offer two bidding methods: noncompetitive bids guarantee the purchase of the desired amount of securities at the winning yield without specifying a price, ensuring investors receive the full allocation. Competitive bids allow investors to specify the yield or discount rate they are willing to accept, with successful bids awarded based on the lowest yields submitted. Understanding these methods is essential for investors seeking to participate in U.S. Treasury securities auctions and manage their investment strategies effectively.

What is a Noncompetitive Bid?

A noncompetitive bid in Treasury auctions allows investors to purchase securities without specifying a yield, ensuring they receive the full amount of the security at the winning yield determined by the competitive bids. This bidding method guarantees allocation up to $5 million for Treasury bills, notes, and bonds, making it ideal for individual investors or entities seeking simplicity and certainty. Noncompetitive bids streamline the bidding process by removing the need to analyze market yield fluctuations, providing a straightforward way to invest in U.S. government debt.

What is a Competitive Bid?

A competitive bid in Treasury auctions is a submission by investors specifying the exact yield they are willing to accept on securities, such as Treasury bills or bonds. These bids are ranked from the lowest yield to the highest until the entire offering amount is allocated, ensuring that only the most favorable rates secure the securities. Unlike noncompetitive bids, competitive bidders risk receiving partial or no allocation if their specified yield is too high compared to other bids.

Key Differences Between Noncompetitive and Competitive Bids

Noncompetitive bids guarantee the purchase of Treasury securities at the yield determined by competitive bidding without specifying a bid price, ensuring allocation but foregoing price control. Competitive bids specify the desired yield or discount rate, subjecting the bidder to potential non-allocation if the bid is too high relative to market demand. Key differences revolve around pricing certainty, allocation risk, and bidder risk tolerance, with noncompetitive bids favoring certainty and competitive bids targeting potentially lower yields.

Advantages of Noncompetitive Bidding in Treasury Auctions

Noncompetitive bidding in Treasury auctions guarantees investors a fixed allocation of securities at the yield determined by the competitive bids, eliminating the risk of bid rejection and simplifying the purchasing process. This method offers accessibility to individual investors and small entities who might lack the expertise or resources to analyze market conditions for competitive bidding. Noncompetitive bids promote market stability by ensuring a baseline level of participation and demand for Treasury securities.

Advantages of Competitive Bidding in Treasury Auctions

Competitive bidding in Treasury auctions fosters price discovery by allowing market-driven yield determination, ensuring fair and transparent allocation of securities. It enhances liquidity by attracting a diverse pool of bidders, which contributes to efficient market functioning and robust demand for Treasury issues. This process also mitigates the risk of underpricing, maximizing government revenue by closely reflecting prevailing market conditions.

Eligibility Requirements for Each Bidding Method

Noncompetitive bids allow individual investors to purchase Treasury securities without specifying a yield, with eligibility restricted to individuals and certain institutions placing bids up to $5 million. Competitive bids require bidders, typically large financial institutions or primary dealers, to specify the yield or discount rate they are willing to accept, and only winning bids at or below the highest accepted yield are awarded. Eligibility for competitive bidding is limited to entities capable of submitting high-volume bids and meeting strict financial and regulatory standards set by the Treasury.

Risks and Limitations: Noncompetitive vs Competitive Bids

Noncompetitive bids in Treasury auctions guarantee allocation but carry the risk of receiving higher prices due to limited price discovery, potentially leading to less favorable yields for investors. Competitive bids allow investors to specify the price or yield, increasing the risk of no allocation if bids are too aggressive, thus exposing them to market volatility. The primary limitation of noncompetitive bids is the lack of price control, while competitive bids face allocation uncertainty amid fluctuating demand and interest rate changes.

How to Participate in Treasury Auctions

To participate in Treasury auctions, investors submit either noncompetitive or competitive bids. Noncompetitive bids guarantee the purchase of securities at the yield determined by the auction without specifying a yield, making it accessible for individual investors seeking simplicity and certainty. Competitive bids require specifying the desired yield, with the risk of partial or no allocation if the bid is too high, typically favored by institutional investors aiming for yield control.

Choosing the Right Bidding Strategy for Investors

Noncompetitive bids ensure investors receive the full amount of Treasury securities requested at the yield determined by competitive bidding, making it ideal for those prioritizing guaranteed allocation with minimal market timing risk. Competitive bids allow investors to specify the yield they are willing to accept, potentially securing securities at lower rates but with the risk of partial or no allocation if the bid is too high. Investors must evaluate their risk tolerance and market outlook to choose between the assured allocation of noncompetitive bids and potentially favorable pricing from competitive bids.

Important Terms

Primary market auction

Primary market auctions for Treasury securities feature noncompetitive bids, allowing investors to submit a quantity without specifying yield, ensuring full allotment at the resulting auction price. Competitive bids, meanwhile, specify desired yields and quantities, with allocation determined by ranking bids from lowest to highest yield until the offering amount is exhausted.

Bid-to-cover ratio

The bid-to-cover ratio measures demand in Treasury auctions by comparing total bids received to securities offered, with competitive bids specifying yield limits while noncompetitive bids accept the average auction price. A higher bid-to-cover ratio indicates strong investor interest and liquidity, often driven by a large volume of noncompetitive bids from smaller investors seeking guaranteed allocation.

Yield determination

Yield determination in noncompetitive bids guarantees investors receive the average yield of accepted competitive bids, ensuring certainty of allocation but at a fixed yield, while competitive bids allow bidders to specify yields, resulting in allocation based on bid price and demand, often leading to variable yields. The noncompetitive process benefits small investors with fixed yields, whereas competitive bidding influences overall yield through market-driven price discovery.

Indirect bidders

Indirect bidders typically participate through competitive bids, placing price and quantity proposals in auctions to secure securities, while noncompetitive bids allow investors--often indirect bidders--to request a fixed quantity of securities at the yield determined by the competitive bidding process, ensuring full allocation but without price negotiation. This distinction highlights that indirect bidders use noncompetitive bids to avoid price risk and competitive bids when aiming for potentially better yields through price competition.

TreasuryDirect

TreasuryDirect offers investors the option to submit noncompetitive bids, guaranteeing the purchase of desired Treasury securities at the auction's final yield without specifying bid price or yield, while competitive bids require specifying a yield and carry the risk of not winning the bid if the submitted yield is too high. Noncompetitive bids are limited to $10 million per auction and prioritize simplicity and certainty, whereas competitive bids allow institutional investors to tailor their purchase price for potentially better returns but with greater risk.

Stop-out rate

Stop-out rates tend to be higher in noncompetitive bids compared to competitive bids due to guaranteed acceptance regardless of price submission.

Auction allotment

Auction allotment prioritizes competitive bids by allocation based on bid price, while noncompetitive bids guarantee allotment at the average winning price without price submission.

Price discovery

Price discovery in auctions sharply differs between noncompetitive bids, where buyers accept market prices without influencing them, and competitive bids, which actively reveal true market value through bidding competition.

Treasury bill tender

Noncompetitive bids in Treasury bill tenders guarantee investors allocation at the yield determined by competitive bidding, while competitive bids specify the yield desired but risk partial or no allocation.

Institution vs retail investor

Institutional investors often prefer competitive bids in Treasury auctions to secure specific yield targets, leveraging their ability to analyze market trends and bid strategically. Retail investors typically utilize noncompetitive bids, ensuring allocation at the average auction price without the need for complex bidding strategies, which simplifies their participation in the primary market.

Noncompetitive bid vs Competitive bid Infographic

moneydif.com

moneydif.com