SWIFT MT messages are traditional financial communication formats used for high-speed, standardized transactions across banks, relying on a fixed field structure that ensures compatibility with legacy systems. SWIFT MX messages, based on the ISO 20022 standard, offer enhanced flexibility through XML formatting, enabling richer data content and improved interoperability for complex payment instructions. Financial institutions are increasingly adopting SWIFT MX to leverage detailed transaction data and support evolving regulatory requirements while maintaining global communication efficiency.

Table of Comparison

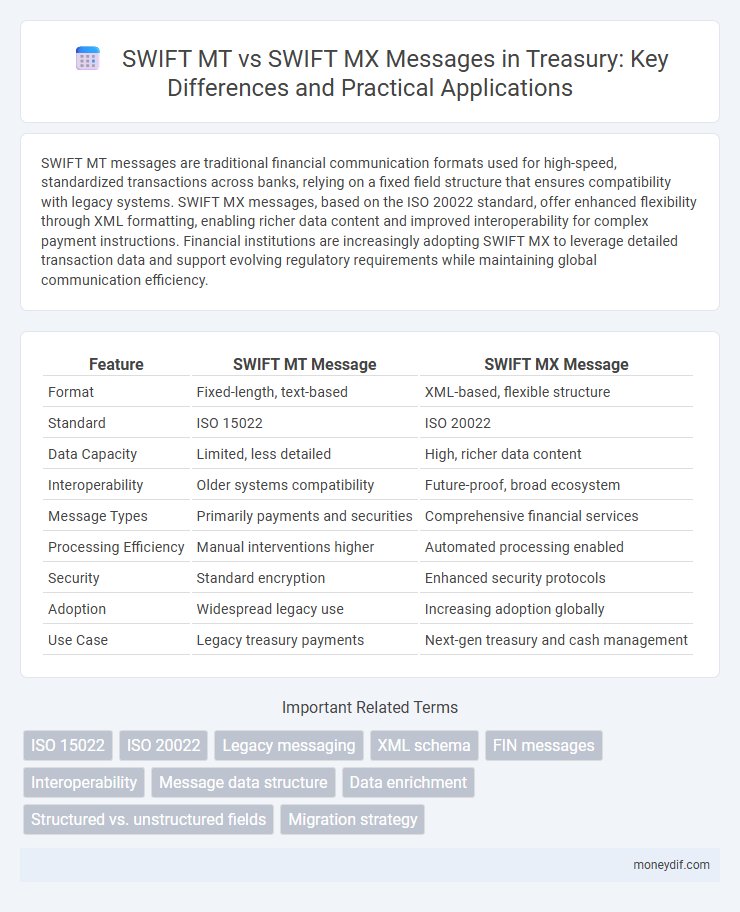

| Feature | SWIFT MT Message | SWIFT MX Message |

|---|---|---|

| Format | Fixed-length, text-based | XML-based, flexible structure |

| Standard | ISO 15022 | ISO 20022 |

| Data Capacity | Limited, less detailed | High, richer data content |

| Interoperability | Older systems compatibility | Future-proof, broad ecosystem |

| Message Types | Primarily payments and securities | Comprehensive financial services |

| Processing Efficiency | Manual interventions higher | Automated processing enabled |

| Security | Standard encryption | Enhanced security protocols |

| Adoption | Widespread legacy use | Increasing adoption globally |

| Use Case | Legacy treasury payments | Next-gen treasury and cash management |

Introduction to SWIFT Messaging in Treasury

SWIFT MT messages, based on the legacy FIN format, remain widely used for treasury operations due to their standardized, fixed-format structure facilitating efficient payment instructions and confirmations. In contrast, SWIFT MX messages employ XML syntax, offering enhanced flexibility, richer data content, and improved interoperability aligned with the ISO 20022 standard. Treasury systems increasingly adopt SWIFT MX to streamline cross-border transactions, improve data quality, and support regulatory reporting requirements.

What is a SWIFT MT Message?

A SWIFT MT message is a standardized financial communication format used primarily for payment instructions, confirmations, and securities transactions within the global banking network. It employs a fixed-format structure with specific message types, such as MT103 for customer payments, ensuring efficient, secure, and reliable transfer of financial information between banks. The MT message format is widely adopted in treasury operations for its simplicity and compatibility with legacy systems in cross-border payment processing.

What is a SWIFT MX Message?

A SWIFT MX message is an ISO 20022-compliant financial message format used within the SWIFT network to facilitate standardized and structured communication for payments, securities, trade, and treasury transactions. It supports richer and more detailed data compared to the older SWIFT MT messages, enabling enhanced interoperability and regulatory reporting. SWIFT MX messages utilize XML syntax, allowing for improved automation, validation, and integration across global financial institutions.

Key Structural Differences: MT vs MX

SWIFT MT messages use a fixed format with predefined fields structured in blocks, designed for traditional financial communications such as payments and securities transactions. In contrast, SWIFT MX messages employ XML-based standards, allowing greater flexibility, extensibility, and richer data elements to support complex and evolving treasury operations. The key structural difference lies in MT's rigid block format versus MX's hierarchical, machine-readable XML schema, which enhances interoperability and automation in treasury processes.

Data Formats: FIN (MT) vs XML (MX)

SWIFT MT messages utilize the FIN format, a structured, fixed-length text format designed for rapid processing and compatibility with legacy financial systems. In contrast, SWIFT MX messages are based on the XML format, providing enhanced flexibility, richer data content, and improved validation capabilities through standardized schemas. The transition from FIN to XML supports the evolving needs of treasury operations by enabling easier integration with modern systems and compliance with ISO 20022 standards.

Advantages of MX over MT in Treasury Operations

SWIFT MX messages provide enhanced data structure and increased flexibility compared to traditional MT messages, allowing for richer and more precise transaction details in Treasury operations. The XML-based format of MX supports greater automation and straight-through processing, reducing manual intervention and errors. Enhanced compliance capabilities and improved interoperability with regulatory standards also make MX messages more efficient for global Treasury management.

Migration Challenges: Transitioning from MT to MX

Transitioning from SWIFT MT to MX messages poses significant migration challenges, including the need for extensive system upgrades to accommodate the XML-based MX format's complex structure. Treasury departments must address interoperability issues between legacy MT infrastructure and the new MX messaging standards, ensuring seamless transaction processing without data loss or delays. Comprehensive staff training and robust testing protocols are essential to mitigate risks associated with the migration and maintain compliance with evolving regulatory requirements.

Regulatory Implications for Treasury Professionals

SWIFT MT messages, based on the traditional FIN format, are deeply integrated into current treasury operations but face increasing regulatory scrutiny due to limited data granularity. SWIFT MX messages utilize the ISO 20022 standard, offering enhanced data transparency and compliance with evolving global regulations such as the European Central Bank's settlement finality directive. Treasury professionals must prioritize transitioning to SWIFT MX to ensure adherence to stricter Anti-Money Laundering (AML) and Know Your Customer (KYC) regulatory requirements while optimizing regulatory reporting efficiency.

Impact on Treasury Automation and Straight-Through Processing

SWIFT MT messages, based on a structured but older format, often require manual intervention for exceptions, slowing Treasury automation and reducing Straight-Through Processing (STP) rates. SWIFT MX messages utilize ISO 20022 standards, enabling richer data and enhanced machine readability, which significantly improves workflow automation and STP efficiency in Treasury operations. The adoption of MX messages facilitates real-time processing, reduces errors, and streamlines reconciliation processes across global treasury systems.

Future Outlook: The Evolution of SWIFT Messages in Treasury

SWIFT MX messages represent the future of treasury communications by offering enhanced data granularity and support for ISO 20022 standards, enabling more efficient and transparent transaction processing. The evolution from legacy MT messages to MX formats facilitates greater automation and improved interoperability across global financial institutions. As adoption of MX messages accelerates, treasury operations will benefit from richer data analytics and streamlined regulatory compliance.

Important Terms

ISO 15022

ISO 15022 defines the syntax and data fields for SWIFT MT messages, enabling standardized financial communication across institutions. SWIFT MX messages are based on the ISO 20022 standard, offering enhanced data structure and richer XML formats that improve interoperability and automation beyond the capabilities of ISO 15022-based MT messages.

ISO 20022

ISO 20022 is a global standard for financial messaging that enhances data richness and interoperability, contrasting with the traditional SWIFT MT messages which are legacy, less structured formats primarily used for payment instructions. SWIFT MX messages, based on ISO 20022, provide greater semantic clarity, improved data validation, and support for end-to-end transaction tracking, facilitating smoother integration across diverse financial systems.

Legacy messaging

Legacy messaging primarily involves SWIFT MT messages, which are based on a fixed-format structure, whereas SWIFT MX messages utilize the XML-based ISO 20022 standard for enhanced data richness and interoperability.

XML schema

XML schema for SWIFT MX messages defines the structure, elements, and data types based on ISO 20022 standards, enabling advanced data validation and interoperability across financial systems. In contrast, SWIFT MT messages rely on fixed-format message types without an XML schema, limiting flexibility and increasing dependency on manual parsing and error handling.

FIN messages

SWIFT MT messages are traditional, fixed-format financial messages extensively used for cross-border payment instructions, while SWIFT MX messages adopt an XML-based structure offering enhanced flexibility and richer data content for improved interoperability in financial communications. The transition to SWIFT MX supports regulatory compliance and real-time processing, positioning it as the modern standard in global financial messaging frameworks.

Interoperability

SWIFT MT messages, based on the traditional FIN format, offer widespread legacy interoperability for global financial institutions, while SWIFT MX messages use the ISO 20022 XML standard to enable enhanced data richness and future-proof cross-platform integration. Migrating from MT to MX improves interoperability by standardizing data elements, facilitating automation, and supporting complex transaction workflows across diverse financial systems.

Message data structure

SWIFT MT messages utilize a traditional block-based format optimized for financial institutions' legacy systems, structuring data in fixed fields for specific transaction types. In contrast, SWIFT MX messages employ XML-based schemas that support richer, more flexible, and extensible data elements aligned with ISO 20022 standards for improved interoperability and automated processing.

Data enrichment

Data enrichment in SWIFT MT messages focuses on enhancing traditional FIN format content with supplementary business data for improved transaction context, while SWIFT MX messages, based on ISO 20022 XML standards, inherently support richer data elements and structured information, facilitating more comprehensive and granular financial data enrichment. This enables greater interoperability, automated processing, and compliance efficiency in cross-border payments and financial communication.

Structured vs. unstructured fields

SWIFT MT messages use structured fields with predefined formats facilitating fast, standardized financial communications, whereas SWIFT MX messages utilize unstructured fields based on XML, allowing more flexibility and richer data representation for improved interoperability. The transition from MT to MX enhances data validation, processing automation, and supports compliance with evolving regulatory standards through detailed, machine-readable content.

Migration strategy

A comprehensive migration strategy prioritizes transitioning from SWIFT MT to more versatile and ISO 20022-compliant SWIFT MX messages to enhance interoperability and data richness.

SWIFT MT message vs SWIFT MX message Infographic

moneydif.com

moneydif.com