Desk buyback involves the treasury actively repurchasing outstanding bonds before their maturity date, providing flexibility to manage debt and potentially take advantage of favorable market conditions. Maturity redemption occurs when bonds are paid off at their scheduled end date, ensuring a predictable cash outflow and closure of the debt obligation. Choosing between desk buyback and maturity redemption depends on the company's liquidity strategy, interest rate environment, and overall financial goals.

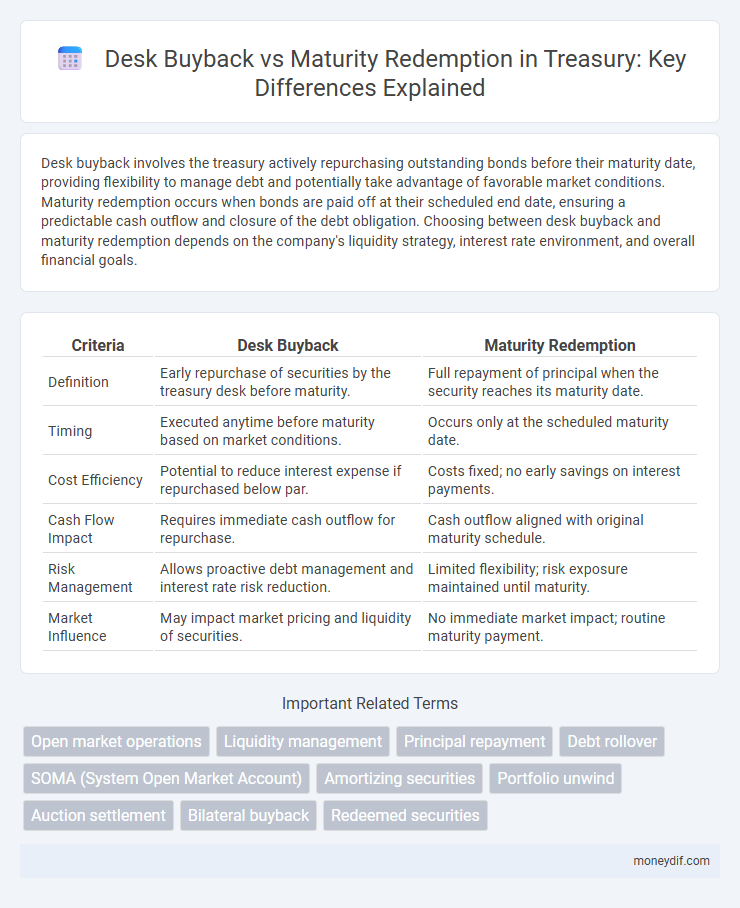

Table of Comparison

| Criteria | Desk Buyback | Maturity Redemption |

|---|---|---|

| Definition | Early repurchase of securities by the treasury desk before maturity. | Full repayment of principal when the security reaches its maturity date. |

| Timing | Executed anytime before maturity based on market conditions. | Occurs only at the scheduled maturity date. |

| Cost Efficiency | Potential to reduce interest expense if repurchased below par. | Costs fixed; no early savings on interest payments. |

| Cash Flow Impact | Requires immediate cash outflow for repurchase. | Cash outflow aligned with original maturity schedule. |

| Risk Management | Allows proactive debt management and interest rate risk reduction. | Limited flexibility; risk exposure maintained until maturity. |

| Market Influence | May impact market pricing and liquidity of securities. | No immediate market impact; routine maturity payment. |

Understanding Desk Buyback in Treasury Operations

Desk buyback in treasury operations involves repurchasing outstanding debt securities before their maturity date to manage liquidity and optimize the debt portfolio. This strategic approach allows treasuries to reduce interest expenses and adjust debt maturity profiles compared to maturity redemption, which involves repaying debt only at the contractual end date. Understanding the timing, cost implications, and market conditions is critical for effective execution of desk buybacks in treasury management.

What is Maturity Redemption?

Maturity redemption refers to the process by which a treasury security is paid off at its predetermined maturity date, returning the principal amount to the investor. Unlike desk buybacks, which involve repurchasing outstanding securities before maturity to manage debt levels or take advantage of market conditions, maturity redemption occurs as a scheduled obligation without early market intervention. This method ensures predictable cash flow management and eliminates reinvestment risk associated with premature buybacks.

Key Differences Between Desk Buyback and Maturity Redemption

Desk buyback involves the issuer repurchasing outstanding debt securities before their maturity date, providing flexibility to manage debt and interest costs effectively. Maturity redemption is the repayment of bond principal in full when the debt reaches its scheduled maturity date, ensuring the issuer meets its contractual obligation. Desk buybacks typically impact cash flow and debt metrics immediately, while maturity redemptions represent the natural conclusion of a debt instrument's lifecycle.

Objectives of Treasury Desk Buybacks

Treasury desk buybacks aim to strategically manage the debt portfolio by repurchasing outstanding bonds before maturity to reduce interest expenses and enhance liquidity. These buybacks optimize capital structure, mitigate refinancing risks, and take advantage of favorable market conditions to improve overall fiscal stability. By contrast, maturity redemptions are predetermined and lack the flexibility to capitalize on market opportunities or adjust debt profiles proactively.

Benefits of Opting for Maturity Redemption

Maturity redemption in treasury management ensures full principal repayment at the bond's scheduled maturity date, reducing reinvestment risk compared to desk buybacks. This approach provides predictable cash flow and helps maintain portfolio liquidity without market price uncertainty. Opting for maturity redemption safeguards against potential premium costs and spreads volatility inherent in early buybacks.

Impact on Financial Statements: Buyback vs. Redemption

Desk buyback reduces outstanding debt prematurely, resulting in immediate recognition of gains or losses on the income statement and a decrease in liabilities on the balance sheet, improving financial ratios like debt-to-equity. Maturity redemption involves repaying debt at its original face value, with no impact on income statement gains or losses at maturity, but a reduction in liabilities on the balance sheet. Buybacks affect cash flow through early outflows and potential changes in interest expenses, while maturity redemption influences cash flow through scheduled principal repayments without altering ongoing interest expense patterns.

Risks Involved in Desk Buybacks and Maturity Redemptions

Desk buybacks involve the risk of market price fluctuations, potentially leading to higher costs or suboptimal timing compared to maturity redemptions, which occur at the bond's fixed maturity date, ensuring predictable cash flow. Operational risks in desk buybacks include execution errors and liquidity constraints, while maturity redemptions carry minimal reinvestment risk but expose the treasury to interest rate risk when replacing the matured debt. Strategic management of these risks is crucial to optimize the treasury's debt portfolio and maintain financial stability.

Regulatory Considerations for Both Methods

Desk buybacks and maturity redemptions in Treasury management each involve distinct regulatory considerations focused on compliance with securities laws and reporting standards. Buybacks often require adherence to market manipulation regulations, prescribed tender offer rules, and transparent disclosure to avoid insider trading concerns. Maturity redemptions primarily demand strict conformity with contractual terms and timely financial reporting to regulatory bodies, ensuring accurate reflection of liability removal and avoiding liquidity misstatements.

Strategic Use Cases in Treasury Management

Desk buyback enables treasurers to strategically manage liquidity by repurchasing debt securities before maturity, optimizing cash flow and capital structure under fluctuating market conditions. Maturity redemption involves settling debt obligations at their due date, providing predictable cash outflows and supporting long-term financial planning. Integrating both methods enhances treasury operations by balancing flexibility in funding costs with disciplined maturity risk management.

Future Trends: Desk Buybacks and Maturity Redemptions

Desk buybacks offer treasuries greater flexibility by enabling issuers to repurchase outstanding debt before maturity, often taking advantage of favorable market conditions to reduce interest expenses. Maturity redemptions, while more predictable, lock issuers into fixed timelines without the opportunity for early debt management, potentially missing chances to optimize capital structure. Emerging trends indicate increased reliance on desk buybacks driven by advanced analytics and market volatility, facilitating dynamic debt portfolio management alongside traditional maturity redemptions.

Important Terms

Open market operations

Open market operations involve central banks conducting desk buybacks to inject liquidity by purchasing securities before maturity, whereas maturity redemption withdraws liquidity as securities reach their maturity and are repaid.

Liquidity management

Liquidity management involves balancing cash inflows and outflows by comparing Desk buyback strategies, which provide immediate liquidity by repurchasing securities before maturity, against Maturity redemption, where the principal is returned at the bond's scheduled maturity date, impacting cash flow timing and funding costs. Effective liquidity management requires analyzing market conditions, interest rate risk, and portfolio strategy to optimize the timing and cost-effectiveness of liquidity events.

Principal repayment

Principal repayment through desk buyback allows early recovery of loan amounts by repurchasing securities from the market, optimizing liquidity and potentially enhancing yield management. In contrast, maturity redemption involves the repayment of principal at the scheduled end date of the debt instrument, ensuring full settlement without market price exposure.

Debt rollover

Debt rollover involves replacing maturing debt by issuing new debt, with desk buyback accelerating debt reduction through repurchasing bonds before maturity, while maturity redemption entails repaying debt only at scheduled maturity dates.

SOMA (System Open Market Account)

SOMA manages Desk buybacks by repurchasing securities before maturity to stabilize market liquidity, while maturity redemptions involve the natural return of principal upon bond expiration.

Amortizing securities

Amortizing securities feature scheduled principal repayments that reduce outstanding balance over time, impacting cash flow projections for Desk buyback activities compared to Maturity redemption, where the full principal is repaid at maturity date. Desk buybacks allow for liquidity management and potential capital gains by repurchasing in secondary markets before maturity, whereas Maturity redemption ensures principal return but limits flexibility in responding to market conditions.

Portfolio unwind

Portfolio unwind strategies often involve Desk buyback and Maturity redemption as key mechanisms to reduce exposure and optimize asset allocation. Desk buyback enables active repurchasing of securities before maturity, providing liquidity management and risk control, whereas Maturity redemption involves holding assets until their natural expiration, ensuring predictable cash flow and minimizing transaction costs.

Auction settlement

Auction settlement balances Desk buyback transactions directly against Maturity redemption obligations to optimize liquidity management and reduce settlement risk.

Bilateral buyback

Bilateral buyback involves a negotiated repurchase of securities between parties, offering flexibility compared to standardized desk buybacks or automatic maturity redemptions, which follow preset terms and timelines.

Redeemed securities

Redeemed securities involve the process where Desk buyback refers to the issuer repurchasing securities before maturity, often at a predetermined price, impacting liquidity and market supply. Maturity redemption occurs when securities reach their maturity date and the principal amount is repaid to investors, concluding the investment cycle without affecting market availability.

Desk buyback vs Maturity redemption Infographic

moneydif.com

moneydif.com