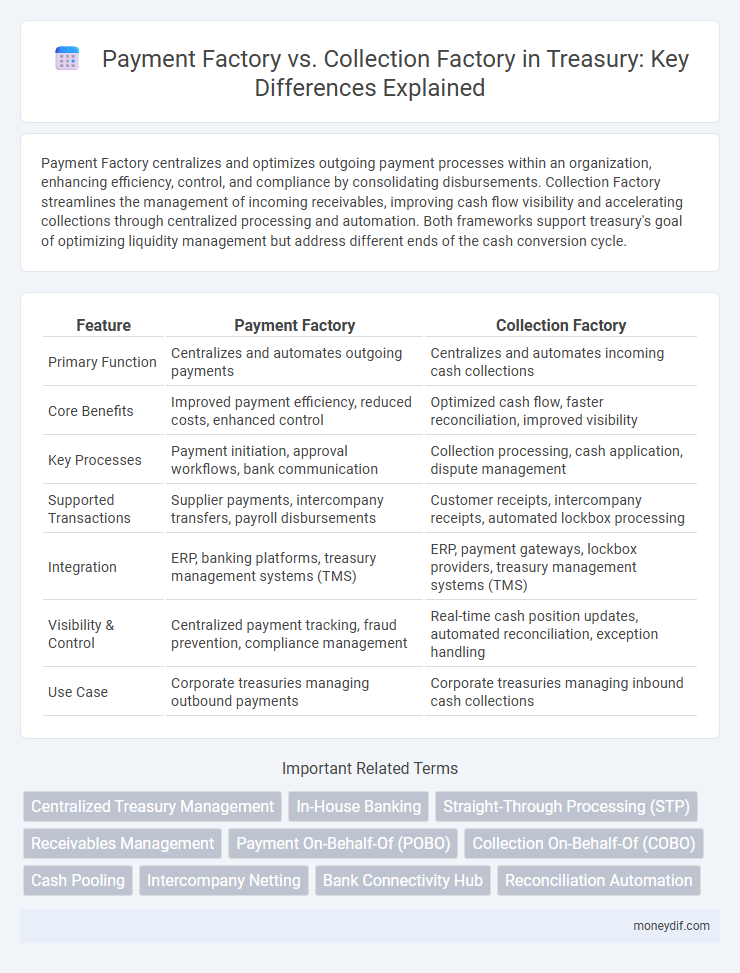

Payment Factory centralizes and optimizes outgoing payment processes within an organization, enhancing efficiency, control, and compliance by consolidating disbursements. Collection Factory streamlines the management of incoming receivables, improving cash flow visibility and accelerating collections through centralized processing and automation. Both frameworks support treasury's goal of optimizing liquidity management but address different ends of the cash conversion cycle.

Table of Comparison

| Feature | Payment Factory | Collection Factory |

|---|---|---|

| Primary Function | Centralizes and automates outgoing payments | Centralizes and automates incoming cash collections |

| Core Benefits | Improved payment efficiency, reduced costs, enhanced control | Optimized cash flow, faster reconciliation, improved visibility |

| Key Processes | Payment initiation, approval workflows, bank communication | Collection processing, cash application, dispute management |

| Supported Transactions | Supplier payments, intercompany transfers, payroll disbursements | Customer receipts, intercompany receipts, automated lockbox processing |

| Integration | ERP, banking platforms, treasury management systems (TMS) | ERP, payment gateways, lockbox providers, treasury management systems (TMS) |

| Visibility & Control | Centralized payment tracking, fraud prevention, compliance management | Real-time cash position updates, automated reconciliation, exception handling |

| Use Case | Corporate treasuries managing outbound payments | Corporate treasuries managing inbound cash collections |

Understanding Payment Factory in Treasury

A Payment Factory in Treasury centralizes and streamlines the processing of outgoing payments, improving cash flow visibility and control across an organization. It consolidates multiple payment instructions from various business units into a single platform, leveraging automation to reduce errors and enhance compliance with regulatory standards. By optimizing liquidity management and standardizing payment processes, a Payment Factory supports efficient treasury operations and minimizes transaction costs.

What is a Collection Factory?

A Collection Factory centralizes the processing and management of incoming payments, streamlining cash inflows from multiple business units into a single operational hub. It enhances liquidity visibility and accelerates cash application by standardizing collection methods and consolidating receivables. This centralized approach reduces bank fees, minimizes errors, and improves working capital management within corporate treasury operations.

Key Differences Between Payment and Collection Factories

Payment factories centralize and automate outbound cash disbursements, enhancing control over global payments, reducing fraud risk, and optimizing liquidity management. Collection factories streamline inbound cash flows by consolidating receivables, accelerating cash application, and improving working capital efficiency. Key differences lie in their core function--payment factories manage outgoing transactions, while collection factories focus on incoming receipts--and their impact on cash flow visibility and treasury operations.

Benefits of Implementing a Payment Factory

Implementing a Payment Factory streamlines outbound payment processing by centralizing transaction management, resulting in increased efficiency and reduced operational risks. It enhances cash flow visibility, enabling Treasury teams to optimize liquidity and make informed financial decisions. Standardizing payment workflows within a Payment Factory also drives cost savings and strengthens compliance across multinational operations.

Advantages of Collection Factories for Cash Management

Collection factories centralize receivables processing, enhancing cash visibility and accelerating cash flow by consolidating incoming payments across multiple channels. They reduce bank fees and administrative overhead through streamlined reconciliation and standardized procedures. This centralized approach enables more accurate forecasting and improved liquidity management, crucial for effective treasury operations.

Operational Workflows: Payment vs Collection Factories

Payment factories centralize outgoing payment processing, enabling streamlined authorization, currency management, and risk mitigation across multiple subsidiaries. Collection factories optimize receivables handling by consolidating incoming payments, accelerating cash application and improving working capital visibility. Both operational workflows enhance treasury efficiency but target opposite ends of the cash flow cycle: disbursements for payment factories and receivables for collection factories.

Technology and Automation in Treasury Factories

Payment Factories leverage centralized technology platforms to automate and standardize outbound payment processes, enhancing control and reducing operational risks across multiple entities. Collection Factories utilize integrated automation tools to streamline inbound cash flow management, improving cash visibility and accelerating reconciliation in complex multinational environments. Both factories rely heavily on advanced Treasury Management Systems (TMS) and APIs to enable real-time data exchange, optimize liquidity management, and ensure seamless intercompany transactions.

Risk Management in Payment and Collection Factories

Payment Factories centralize outbound payment processes, enhancing risk management by standardizing controls and reducing operational errors and fraud exposure. Collection Factories optimize receivables handling by consolidating incoming payments, improving cash flow visibility and mitigating credit risk through centralized monitoring. Both architectures strengthen treasury oversight by enforcing compliance and streamlining audit trails, ultimately minimizing financial and operational risks across the payment and collection lifecycle.

Choosing Between Payment Factory and Collection Factory

Choosing between a Payment Factory and a Collection Factory hinges on a company's cash flow priorities and operational focus. A Payment Factory centralizes and standardizes outgoing payments to optimize liquidity management and reduce transaction costs, while a Collection Factory streamlines incoming receivables, improving cash inflows and enhancing working capital efficiency. Evaluating transactional volume, currency complexity, and integration with Treasury Management Systems (TMS) can guide the decision to align with strategic financial goals.

Future Trends in Treasury Factory Solutions

Payment Factory solutions are evolving with advanced automation and AI integration to enhance transaction processing speed, accuracy, and fraud detection. Collection Factory platforms are adopting real-time data analytics and machine learning algorithms to optimize receivables management and improve cash flow forecasting. Future trends indicate a convergence of Payment and Collection Factory functionalities into unified Treasury Factory ecosystems, driving centralized control and seamless end-to-end liquidity management.

Important Terms

Centralized Treasury Management

Centralized Treasury Management enhances liquidity control by integrating Payment Factory for streamlined disbursements and Collection Factory for efficient receivables consolidation.

In-House Banking

In-house banking centralizes corporate cash management by integrating Payment Factory functions to streamline outbound payments and Collection Factory processes to optimize receivables, enhancing liquidity and reducing transaction costs.

Straight-Through Processing (STP)

Straight-Through Processing (STP) streamlines transaction workflows in Payment Factory setups by automating payment approvals, validations, and processing, reducing manual interventions and errors. In contrast, Collection Factory implementations focus STP on automating receivables handling, integrating cash application and reconciliation processes to accelerate cash flow and improve working capital efficiency.

Receivables Management

Receivables management optimizes cash flow by integrating Payment Factory for centralized outbound payments and Collection Factory for streamlined inbound receivables processing.

Payment On-Behalf-Of (POBO)

Payment On-Behalf-Of (POBO) centralizes outgoing payments through a Payment Factory, streamlining cash management and improving control over disbursements by consolidating multiple entity payments into a single process. Collection Factory, in contrast, focuses on centralizing receivables to accelerate cash inflows and optimize working capital across multiple subsidiaries or business units.

Collection On-Behalf-Of (COBO)

Collection On-Behalf-Of (COBO) enables centralized receivables management by allowing a Payment Factory to process collections in a streamlined manner, contrasting with a Collection Factory which focuses solely on aggregating incoming payments without direct payment processing capabilities.

Cash Pooling

Cash pooling centralizes corporate liquidity management by integrating payment factories to streamline outgoing payments and collection factories to optimize incoming cash flows for improved cash visibility and reduced banking costs.

Intercompany Netting

Intercompany netting streamlines cross-entity payments within multinational corporations, consolidating obligations to reduce transaction volumes and currency conversion costs. Payment factories centralize outgoing payments for optimized liquidity management, while collection factories focus on aggregating receivables, jointly enhancing cash flow efficiency and financial reporting accuracy.

Bank Connectivity Hub

Bank Connectivity Hub centralizes and streamlines financial transactions by integrating Payment Factory's outbound payment processing with Collection Factory's inbound cash management for optimized cash flow and enhanced operational efficiency.

Reconciliation Automation

Reconciliation automation streamlines financial processes by integrating payment factory systems that centralize outgoing payments with collection factory platforms managing inbound cash flows, enhancing accuracy and efficiency. This synergy reduces manual intervention, speeds up transaction matching, and improves cash visibility within corporate treasury operations.

Payment Factory vs Collection Factory Infographic

moneydif.com

moneydif.com