Liquidity at risk measures the potential shortfall in cash or liquid assets needed to meet short-term obligations during stressed market conditions, highlighting a firm's ability to manage immediate funding requirements. Value at risk quantifies the maximum expected loss over a specific time horizon at a given confidence level, focusing on market risk exposure from price fluctuations in the investment portfolio. Understanding the differences between liquidity at risk and value at risk is critical for treasury management to balance funding stability with market risk appetite effectively.

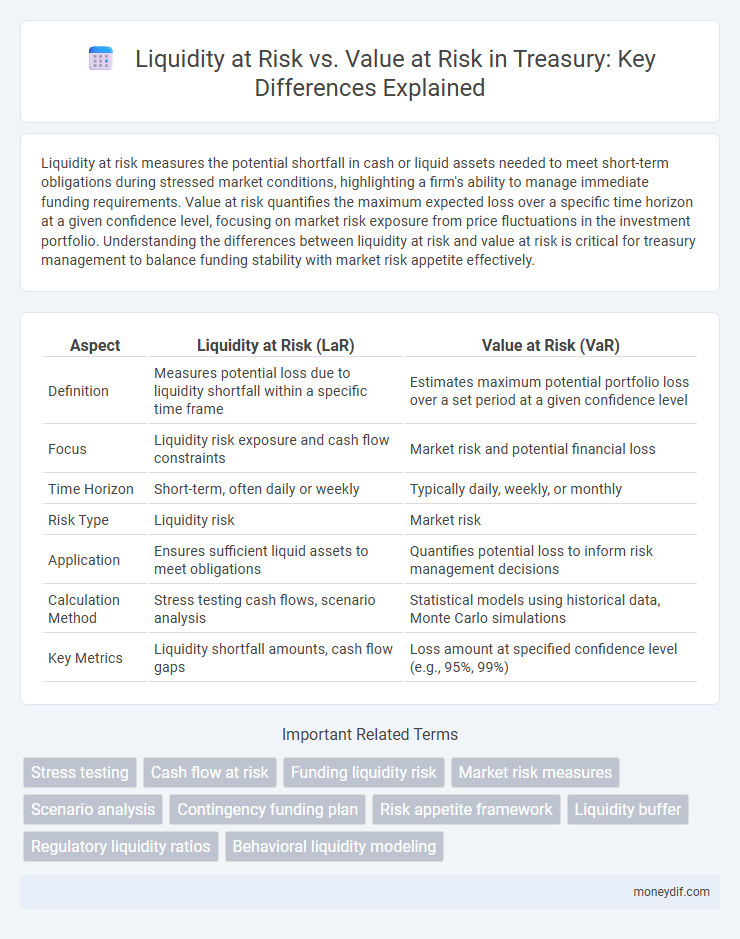

Table of Comparison

| Aspect | Liquidity at Risk (LaR) | Value at Risk (VaR) |

|---|---|---|

| Definition | Measures potential loss due to liquidity shortfall within a specific time frame | Estimates maximum potential portfolio loss over a set period at a given confidence level |

| Focus | Liquidity risk exposure and cash flow constraints | Market risk and potential financial loss |

| Time Horizon | Short-term, often daily or weekly | Typically daily, weekly, or monthly |

| Risk Type | Liquidity risk | Market risk |

| Application | Ensures sufficient liquid assets to meet obligations | Quantifies potential loss to inform risk management decisions |

| Calculation Method | Stress testing cash flows, scenario analysis | Statistical models using historical data, Monte Carlo simulations |

| Key Metrics | Liquidity shortfall amounts, cash flow gaps | Loss amount at specified confidence level (e.g., 95%, 99%) |

Understanding Liquidity at Risk (LaR) in Treasury Management

Liquidity at Risk (LaR) measures the potential cash shortfall a treasury could face during stress scenarios, emphasizing the timing and availability of liquid assets to meet obligations. Unlike Value at Risk (VaR), which quantifies potential losses in portfolio value, LaR focuses on liquidity gaps and funding risks critical for maintaining operational stability. Effective treasury management integrates LaR assessments to ensure sufficient cash flow buffers and minimize the risk of liquidity crises.

Defining Value at Risk (VaR): A Treasury Perspective

Value at Risk (VaR) in Treasury quantifies the potential maximum loss over a specified period at a given confidence level, providing a statistical measure of market risk exposure. Unlike Liquidity at Risk, which focuses on cash flow shortfalls and liquidity constraints, VaR estimates the financial impact of market movements on the asset portfolio. Treasury uses VaR metrics to guide risk management decisions, optimize capital allocation, and ensure regulatory compliance.

Key Differences Between Liquidity at Risk and Value at Risk

Liquidity at Risk (LaR) measures the potential cash shortfall a treasury might face under stressed market conditions, emphasizing the firm's ability to meet short-term obligations. Value at Risk (VaR) quantifies the potential loss in portfolio value over a specific time horizon at a given confidence level, focusing on market risk exposure. The key difference lies in LaR's focus on cash flow liquidity risk versus VaR's emphasis on market price risk.

Importance of Measuring Liquidity at Risk in Treasury Operations

Measuring Liquidity at Risk (LaR) in treasury operations is crucial for ensuring sufficient cash flow to meet short-term obligations under stress scenarios, unlike Value at Risk (VaR), which primarily measures potential financial losses. LaR provides actionable insights into potential liquidity shortfalls, enabling treasurers to maintain optimal liquidity buffers and improve funding strategies. Effective LaR assessment directly supports risk management and operational resilience by preventing liquidity crises that could threaten the firm's solvency.

Value at Risk: Applications and Limitations in Treasury

Value at Risk (VaR) is extensively used in treasury to quantify potential portfolio losses under normal market conditions, enabling risk managers to allocate capital efficiently and set risk limits. Its applications include stress testing, regulatory reporting, and strategic asset allocation, providing a statistical measure of downside risk over a specified time frame and confidence level. However, VaR's limitations lie in its inability to capture extreme market events, reliance on historical data, and assumption of normal distribution, which can lead to underestimation of tail risk and liquidity stress in volatile conditions.

Tools and Techniques for Assessing Liquidity at Risk

Liquidity at risk (LaR) is assessed using stress testing, cash flow forecasting, and scenario analysis tools to evaluate potential shortfalls under adverse market conditions. Advanced techniques like dynamic liquidity simulations and historical liquidity event modeling help quantify the firm's capacity to meet obligations during liquidity crises. Quantitative metrics such as cash burn rate, liquidity coverage ratio, and funding gap analysis enhance the precision of LaR evaluations beyond traditional Value at risk (VaR) methods.

Integrating Liquidity at Risk and Value at Risk in Risk Management Frameworks

Integrating Liquidity at Risk (LaR) and Value at Risk (VaR) within risk management frameworks enhances the ability to quantify potential losses under adverse market conditions and liquidity constraints. This combined approach enables treasury teams to manage funding shortfalls and market risk simultaneously by aligning liquidity buffers with market risk exposures. Advanced models that incorporate both LaR and VaR metrics improve stress testing and scenario analysis, supporting more robust capital allocation and contingency planning.

Regulatory Requirements: LaR vs VaR in Treasury Compliance

Liquidity at Risk (LaR) and Value at Risk (VaR) serve distinct roles in treasury regulatory compliance, with LaR focusing on potential liquidity shortfalls under stressed conditions, essential for meeting Basel III liquidity coverage ratio requirements. VaR quantifies potential losses in portfolio value over a specified horizon, aligning with market risk regulations such as those enforced by the Basel Committee on Banking Supervision. Regulators mandate rigorous reporting of both LaR and VaR metrics to ensure financial institutions maintain adequate capital buffers and liquidity reserves, safeguarding against market volatility and funding stress.

Case Studies: Treasury Strategies for Managing LaR and VaR

Case studies in treasury highlight the application of Liquidity at Risk (LaR) and Value at Risk (VaR) to optimize cash flow management and risk mitigation frameworks. Financial institutions utilize LaR to quantify potential shortfalls during liquidity crunch scenarios, while VaR models assess market risk exposure within predefined confidence intervals. Effective treasury strategies integrate both metrics, enabling proactive balance sheet adjustments and stress-testing protocols to safeguard against financial distress.

Best Practices for Optimizing Treasury Risk Measurement

Liquidity at risk (LaR) and value at risk (VaR) are critical metrics for comprehensive treasury risk management, with LaR emphasizing short-term cash flow adequacy and VaR focusing on potential portfolio losses under normal market conditions. Best practices for optimizing treasury risk measurement include integrating LaR and VaR frameworks to capture both liquidity shortages and market risks, utilizing scenario analysis to assess stress conditions, and implementing real-time monitoring systems to enhance responsiveness. Combining quantitative models with qualitative judgments ensures a balanced approach that aligns risk limits with organizational liquidity policies and strategic objectives.

Important Terms

Stress testing

Stress testing evaluates extreme scenarios impacting Liquidity at Risk (LaR), measuring potential cash shortfalls under adverse conditions, while Value at Risk (VaR) quantifies potential portfolio losses within a confidence interval. Integrating LaR with VaR provides a comprehensive risk framework addressing both liquidity constraints and market value fluctuations.

Cash flow at risk

Cash flow at risk (CFaR) quantifies the potential shortfall in cash flow within a specified confidence interval, directly impacting an organization's liquidity position and operational stability. Unlike Value at Risk (VaR), which measures the maximum expected loss in portfolio value under normal market conditions, CFaR specifically emphasizes liquidity at risk by focusing on cash flow volatility and timing mismatches.

Funding liquidity risk

Funding liquidity risk quantifies the potential shortfall in available cash or collateral to meet obligations during stress, distinct from Value at Risk which measures potential losses in asset value, while Liquidity at Risk specifically estimates cash flow shortfalls under stressed conditions integrating both market and funding liquidity dynamics.

Market risk measures

Liquidity at risk quantifies potential losses from insufficient market liquidity during stress events, whereas value at risk estimates maximum expected losses over a specified period under normal market conditions.

Scenario analysis

Scenario analysis evaluates potential financial outcomes under hypothetical conditions, highlighting liquidity at risk (LAR) by focusing on cash flow shortfalls versus value at risk (VaR), which measures potential portfolio losses within a specific confidence interval; LAR emphasizes the timing and availability of liquid assets, while VaR centers on market value fluctuations. Integrating scenario analysis with LAR helps identify periods of liquidity stress that traditional VaR models may overlook, ensuring comprehensive risk management strategies.

Contingency funding plan

A contingency funding plan addresses Liquidity at Risk by ensuring sufficient liquid assets to cover unexpected cash flow shortfalls, distinct from Value at Risk which measures potential losses in portfolio value.

Risk appetite framework

Risk appetite frameworks quantify the acceptable level of liquidity risk through Liquidity at Risk (LaR) metrics while balancing market risk exposure measured by Value at Risk (VaR) to ensure comprehensive risk management.

Liquidity buffer

Liquidity buffer directly mitigates Liquidity at Risk (LaR) by ensuring sufficient liquid assets to cover potential outflows, distinguishing it from Value at Risk (VaR), which quantifies potential losses but does not address cash flow constraints.

Regulatory liquidity ratios

Regulatory liquidity ratios measure the adequacy of liquid assets to cover short-term liabilities, ensuring financial institutions maintain sufficient cash flow under stress scenarios. Liquidity at Risk (LaR) quantifies potential liquidity shortfalls under adverse conditions, while Value at Risk (VaR) assesses maximum expected losses in portfolio value, both essential for comprehensive risk management frameworks.

Behavioral liquidity modeling

Behavioral liquidity modeling quantifies potential cash outflows driven by client behavior under stress scenarios, enhancing Liquidity at Risk (LaR) assessments by incorporating dynamic withdrawal patterns beyond static Value at Risk (VaR) measures. Combining LaR with VaR provides a comprehensive risk framework that evaluates both market risk exposure and liquidity shortfalls caused by unexpected funding demands.

Liquidity at risk vs Value at risk Infographic

moneydif.com

moneydif.com