Treasury Single Account (TSA) centralizes government funds into a single account to enhance cash management and reduce borrowing costs by improving visibility and control over public resources. In contrast, Multiple Account Structure involves maintaining separate accounts for different government agencies or functions, which can lead to inefficiencies, fragmented cash management, and higher operational costs. Implementing TSA promotes fiscal discipline and transparency, whereas multiple accounts may complicate reconciliation and delay fund utilization.

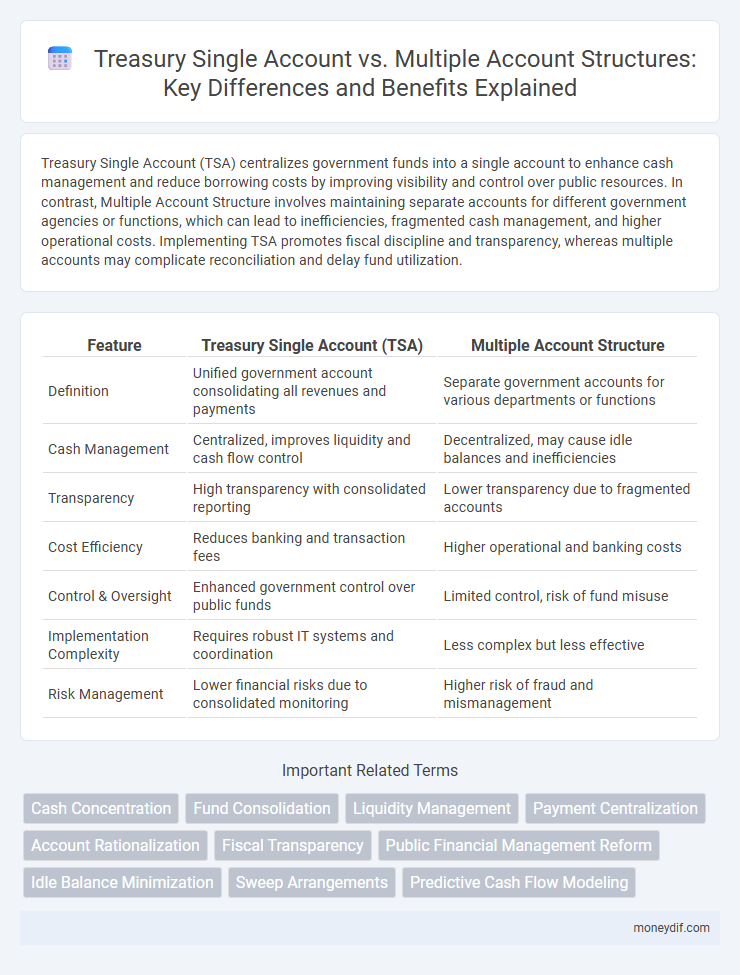

Table of Comparison

| Feature | Treasury Single Account (TSA) | Multiple Account Structure |

|---|---|---|

| Definition | Unified government account consolidating all revenues and payments | Separate government accounts for various departments or functions |

| Cash Management | Centralized, improves liquidity and cash flow control | Decentralized, may cause idle balances and inefficiencies |

| Transparency | High transparency with consolidated reporting | Lower transparency due to fragmented accounts |

| Cost Efficiency | Reduces banking and transaction fees | Higher operational and banking costs |

| Control & Oversight | Enhanced government control over public funds | Limited control, risk of fund misuse |

| Implementation Complexity | Requires robust IT systems and coordination | Less complex but less effective |

| Risk Management | Lower financial risks due to consolidated monitoring | Higher risk of fraud and mismanagement |

Overview of Treasury Single Account (TSA)

The Treasury Single Account (TSA) is a unified structure of government bank accounts consolidating all government revenues and payments into a single account to enhance cash management and reduce borrowing costs. It enables real-time monitoring of government funds, minimizes idle balances, and fosters transparency and accountability in public financial management. Implemented widely by countries to streamline public sector cash flows, the TSA contrasts with the Multiple Account Structure, where government agencies maintain separate bank accounts, often leading to inefficiencies and fragmented cash management.

Understanding Multiple Account Structures

Multiple Account Structures in treasury management involve maintaining separate accounts for different government agencies or departments, enhancing financial autonomy and accountability. This approach facilitates targeted cash management, allowing distinct revenue and expenditure tracking across units, which can improve budget control and operational efficiency. However, it may increase administrative complexity and limit the flexibility of cash mobilization compared to a Treasury Single Account (TSA) system.

Key Differences: TSA vs Multiple Accounts

A Treasury Single Account (TSA) consolidates all government revenues and receipts into a single account to enhance cash management and reduce borrowing costs, whereas Multiple Account Structures maintain separate accounts for various government entities, leading to fragmented cash balances. TSA improves fiscal discipline by providing a consolidated view of public funds, enabling efficient resource allocation and reducing idle balances across ministries. Multiple Account Structures often result in higher operational costs and complexity due to duplicated account management and limited cash visibility.

Advantages of Implementing a TSA

Implementing a Treasury Single Account (TSA) consolidates government cash resources, enhancing cash management efficiency and reducing borrowing costs by providing a unified view of cash balances. TSA minimizes idle balances in multiple accounts, ensuring optimal utilization of funds and improving fiscal discipline through centralized control and real-time monitoring of public finances. The structure reduces the risk of fraud and misappropriation by limiting fragmented accounts, facilitating transparency and accountability in government financial operations.

Drawbacks of Multiple Account Structures

Multiple Account Structures often lead to fragmented cash management, reducing transparency and increasing the risk of idle balances across numerous accounts. This complexity complicates liquidity forecasting and impairs efficient government-wide resource allocation. Furthermore, increased administrative costs and potential for reconciliation errors undermine overall fiscal discipline in public financial management.

Impact on Cash Management Efficiency

The Treasury Single Account (TSA) consolidates government funds into a unified account, enhancing cash visibility and reducing idle balances, which significantly improves cash management efficiency. In contrast, a Multiple Account Structure fragments funds across various accounts, complicating liquidity monitoring and increasing transaction costs due to dispersed balances. Implementing TSA streamlines cash flow control, optimizes government borrowing, and minimizes overdraft risks, leading to more effective public financial management.

Risk and Control Considerations

The Treasury Single Account (TSA) centralizes government funds, reducing risks of fund fragmentation and improving control through real-time cash visibility and enhanced reconciliation processes. In contrast, Multiple Account Structures increase operational risks by complicating cash management, elevating the potential for idle balances and fraud due to limited oversight. Effective risk mitigation in treasury management favors TSA implementation, ensuring tighter control over public resources and streamlined fiscal discipline.

Government Revenue Transparency

The Treasury Single Account (TSA) consolidates all government revenues into one centralized account, enhancing transparency by providing real-time visibility and reducing the risk of revenue leakage. In contrast, the Multiple Account Structure fragments government funds across various accounts, complicating reconciliations and increasing opportunities for mismanagement. Adopting TSA improves fiscal discipline and supports accurate financial reporting, essential for transparent public revenue management.

Steps for Transitioning to a TSA

Transitioning to a Treasury Single Account (TSA) involves comprehensive steps including conducting a detailed financial audit to identify all existing government accounts, followed by establishing a centralized banking relationship with a designated commercial bank. Key actions also include developing and implementing an integrated cash management system to consolidate all receipts and payments into the TSA, alongside training staff on new procedures and regulatory compliance. Continuous monitoring and phased migration ensure minimal disruption while achieving enhanced liquidity management and fiscal transparency compared to the multiple account structure.

Global Best Practices in Treasury Account Management

Global best practices in Treasury Account Management emphasize the implementation of a Treasury Single Account (TSA) to enhance cash consolidation, reduce idle balances, and improve government liquidity management. TSA facilitates real-time cash visibility and centralized control, minimizing borrowing costs and enhancing fiscal discipline compared to Multiple Account Structures that often lead to fragmented cash pools and operational inefficiencies. International financial institutions recommend TSA adoption to ensure transparency, optimize resource allocation, and streamline public financial management across government entities.

Important Terms

Cash Concentration

Cash concentration optimizes liquidity management by aggregating funds into a Treasury Single Account, whereas a Multiple Account Structure allows decentralized control but may increase idle balances and transaction costs.

Fund Consolidation

Fund consolidation enhances cash management efficiency by integrating multiple government or corporate accounts into a Treasury Single Account (TSA), reducing idle balances and improving liquidity tracking. In contrast, a Multiple Account Structure (MAS) often complicates fund visibility and increases reconciliation efforts, resulting in suboptimal resource allocation and higher transaction costs.

Liquidity Management

Liquidity management is enhanced through Treasury Single Account (TSA) by consolidating government or corporate funds into a unified structure, enabling efficient cash flow monitoring and minimizing idle balances. In contrast, Multiple Account Structures may lead to fragmented cash resources, increasing complexities in fund allocation, reconciliation, and forecasting accuracy.

Payment Centralization

Payment centralization enhances cash management efficiency by consolidating funds into a Treasury Single Account, contrasting with the fragmentation and increased reconciliation complexity of a Multiple Account Structure.

Account Rationalization

Account Rationalization streamlines government or corporate cash management by consolidating multiple accounts into a Treasury Single Account (TSA), reducing idle balances and enhancing fiscal transparency. Compared to a Multiple Account Structure, TSA centralizes fund control, improves liquidity management, and minimizes borrowing requirements through unified cash balances.

Fiscal Transparency

Fiscal transparency improves significantly under a Treasury Single Account (TSA) system by consolidating government revenues and expenditures into a unified platform, enhancing real-time tracking and accountability. In contrast, a Multiple Account Structure often leads to fragmented cash management, complicating fiscal monitoring and increasing risks of misappropriation or inefficiency.

Public Financial Management Reform

Implementing a Treasury Single Account (TSA) enhances public financial management by consolidating government revenues and payments, reducing fiscal risks and improving cash management compared to the inefficiencies of a Multiple Account Structure.

Idle Balance Minimization

Idle balance minimization enhances government cash management by consolidating funds within a Treasury Single Account (TSA), reducing fragmented liquidity across multiple bank accounts and maximizing the use of public resources. In contrast, a Multiple Account Structure (MAS) often leads to idle balances in separate accounts, increasing borrowing costs and lowering operational efficiency.

Sweep Arrangements

Sweep arrangements efficiently consolidate funds by automatically transferring surplus balances from multiple sub-accounts into a single Treasury Single Account (TSA), optimizing liquidity management and minimizing idle cash. This contrasts with a multiple account structure where funds remain segregated, often resulting in irregular cash flow and reduced interest earnings.

Predictive Cash Flow Modeling

Predictive cash flow modeling enhances financial accuracy by integrating Treasury Single Account structures, which consolidate funds for optimized liquidity management, compared to the fragmented visibility inherent in Multiple Account Structures.

Treasury Single Account vs Multiple Account Structure Infographic

moneydif.com

moneydif.com