Debt covenants are specific conditions set by lenders to protect their interests, often restricting a borrower's actions related to debt issuance, repayment, and financial ratios tied to the loan agreement. Financial covenants encompass a broader range of performance metrics, including liquidity ratios, profitability, and net worth requirements, designed to ensure the overall financial health and stability of the borrower. Understanding the distinction between debt covenants and financial covenants is crucial for effective treasury management and maintaining compliance with loan terms.

Table of Comparison

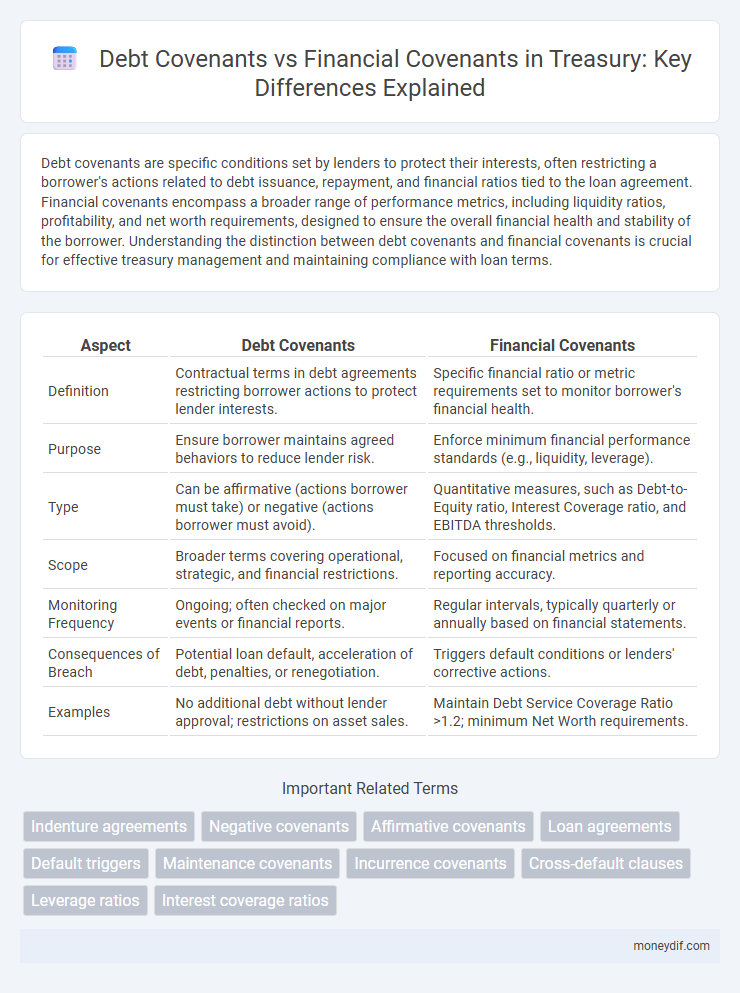

| Aspect | Debt Covenants | Financial Covenants |

|---|---|---|

| Definition | Contractual terms in debt agreements restricting borrower actions to protect lender interests. | Specific financial ratio or metric requirements set to monitor borrower's financial health. |

| Purpose | Ensure borrower maintains agreed behaviors to reduce lender risk. | Enforce minimum financial performance standards (e.g., liquidity, leverage). |

| Type | Can be affirmative (actions borrower must take) or negative (actions borrower must avoid). | Quantitative measures, such as Debt-to-Equity ratio, Interest Coverage ratio, and EBITDA thresholds. |

| Scope | Broader terms covering operational, strategic, and financial restrictions. | Focused on financial metrics and reporting accuracy. |

| Monitoring Frequency | Ongoing; often checked on major events or financial reports. | Regular intervals, typically quarterly or annually based on financial statements. |

| Consequences of Breach | Potential loan default, acceleration of debt, penalties, or renegotiation. | Triggers default conditions or lenders' corrective actions. |

| Examples | No additional debt without lender approval; restrictions on asset sales. | Maintain Debt Service Coverage Ratio >1.2; minimum Net Worth requirements. |

Introduction to Debt Covenants and Financial Covenants

Debt covenants are contractual clauses in loan agreements that restrict borrower actions to protect lender interests, often focusing on maintaining specific financial metrics or operational limits. Financial covenants specifically refer to quantitative measures like debt-to-equity ratios, interest coverage ratios, or minimum net worth requirements that a borrower must maintain throughout the loan term. Understanding the distinction and interplay between debt covenants and financial covenants is crucial for effective treasury risk management and compliance monitoring.

Defining Debt Covenants in Treasury Management

Debt covenants in treasury management are legally binding terms set by lenders to restrict or mandate specific actions by the borrower, ensuring repayment ability. They focus primarily on financial metrics such as leverage ratios, interest coverage, and liquidity levels to mitigate credit risk. Unlike broader financial covenants, debt covenants specifically aim to protect creditor interests and maintain the financial health required under loan agreements.

Understanding Financial Covenants: Key Concepts

Financial covenants are specific clauses in debt agreements that set measurable financial targets a borrower must maintain, such as leverage ratios, interest coverage, and liquidity levels to ensure creditworthiness. They differ from debt covenants that broadly govern borrower behavior and restrictions, focusing instead on quantitative financial performance and risk indicators. Understanding these key concepts helps treasurers monitor compliance, manage risk effectively, and maintain lender confidence throughout the loan tenure.

Types of Debt Covenants: Affirmative vs. Negative

Debt covenants in treasury management are crucial contractual clauses that regulate borrowers' actions to protect lenders' interests. Affirmative covenants require the borrower to maintain specific financial ratios or operational standards, such as timely financial reporting or maintaining insurance coverage. Negative covenants restrict the borrower from certain activities like incurring additional debt or selling key assets, ensuring that financial risk remains controlled.

Common Financial Covenants in Financing Agreements

Common financial covenants in financing agreements typically include debt-to-equity ratios, interest coverage ratios, and minimum net worth requirements, designed to ensure the borrower's ongoing financial stability and ability to meet obligations. Debt covenants specifically restrict actions related to borrowing, such as limits on additional debt or lien encumbrances, while broader financial covenants monitor overall financial health and performance metrics. These covenants enable lenders to mitigate risk by closely tracking key financial indicators throughout the loan term.

Comparative Analysis: Debt Covenants vs. Financial Covenants

Debt covenants are contractual clauses in loan agreements that restrict specific borrower actions to protect lender interests, while financial covenants focus exclusively on maintaining certain financial ratios or thresholds such as debt-to-equity or interest coverage ratios. Debt covenants often include operational restrictions like limits on asset sales or dividend payments, providing broader control, whereas financial covenants emphasize quantitative financial metrics to monitor the borrower's fiscal health. Understanding the distinction and interplay between these covenants is crucial for effective risk management and ensuring compliance with debt agreements in corporate treasury operations.

The Role of Covenants in Credit Risk Assessment

Debt covenants specifically restrict borrower behaviors related to debt obligations, such as limitations on additional borrowing or asset sales, directly influencing lender risk exposure. Financial covenants impose quantitative financial metrics, including minimum interest coverage ratios or leverage ratios, serving as early warning indicators of potential credit deterioration. Both covenant types play a critical role in credit risk assessment by enforcing discipline and providing monitoring mechanisms that protect lenders from default and loss.

Monitoring and Compliance of Debt and Financial Covenants

Debt covenants primarily restrict a borrower's actions to ensure timely debt repayment, requiring continuous monitoring of key financial ratios such as debt-to-equity and interest coverage ratios to maintain compliance. Financial covenants, broader in scope, encompass a variety of performance metrics including liquidity, profitability, and leverage, necessitating regular financial reporting and analysis to detect covenant breaches early. Effective compliance requires treasury teams to implement automated tracking systems and maintain proactive communication with lenders to address potential violations before they impact loan terms.

Consequences of Covenant Breaches

Debt covenant breaches often trigger immediate lender remedies such as acceleration of debt repayment, increased interest rates, or enforced collateral liquidation, posing significant liquidity risks. Financial covenant violations, which involve failing to meet specified financial ratios like debt-to-equity or interest coverage, may result in renegotiation of terms, penalty fees, or restrictions on further borrowing. Timely monitoring and proactive management of both debt and financial covenants are crucial to avoid costly defaults and maintain healthy lender relationships.

Best Practices for Negotiating Covenants in Treasury Operations

Debt covenants primarily restrict specific financial actions to protect lenders, while financial covenants focus on maintaining key financial ratios and operational metrics essential for company stability. Best practices for negotiating covenants in treasury operations include clearly defining flexible thresholds, ensuring alignment with strategic cash flow forecasts, and incorporating periodic review clauses to adapt to changing market conditions. Effective communication between treasury teams and lenders enhances mutual understanding and facilitates covenant terms that support sustainable financial health.

Important Terms

Indenture agreements

Indenture agreements typically distinguish debt covenants as specific obligations ensuring timely debt repayment, while financial covenants focus on maintaining prescribed financial ratios to safeguard lender interests.

Negative covenants

Negative covenants restrict specific actions by borrowers, such as incurring additional debt or selling key assets, to protect lenders' interests within debt covenants. Financial covenants, a subset of debt covenants, impose quantitative financial metrics like maintaining a minimum interest coverage ratio or maximum leverage ratio to ensure ongoing fiscal health and reduce credit risk.

Affirmative covenants

Affirmative covenants are specific obligations that a borrower agrees to maintain during the term of a loan, ensuring operational and financial stability, and they are a key subset of debt covenants focused on compliance actions. Financial covenants, as part of debt covenants, specifically require the borrower to meet predefined financial metrics like debt-to-equity ratios or minimum interest coverage, ensuring ongoing financial health and reducing lender risk.

Loan agreements

Loan agreements often include debt covenants, which restrict borrower activities to ensure timely debt repayment, and financial covenants, which impose specific financial ratios like debt-to-equity or interest coverage to monitor the borrower's fiscal health. Debt covenants primarily focus on behavioral limitations such as prohibiting additional borrowing, while financial covenants require maintaining certain financial thresholds throughout the loan term.

Default triggers

Default triggers in debt covenants often include missed interest payments, breach of loan-to-value ratios, or failure to maintain minimum net worth, whereas financial covenants specifically focus on maintaining key financial metrics like debt-to-equity ratio, interest coverage ratio, and cash flow thresholds. Violating either type of covenant can lead to immediate loan acceleration, increased interest rates, or enforcement actions by lenders.

Maintenance covenants

Maintenance covenants are a subset of financial covenants that require borrowers to maintain specific financial ratios, such as minimum interest coverage or maximum leverage ratios, throughout the loan term to ensure ongoing creditworthiness. Unlike incurrence covenants that restrict actions only when certain events occur, maintenance covenants provide continuous monitoring of financial health under debt covenants, safeguarding lenders against borrowers' deteriorating financial conditions.

Incurrence covenants

Incurrence covenants restrict additional debt or financial obligations based on specific financial ratios or conditions, distinguishing them from general financial covenants that monitor ongoing financial health and performance metrics.

Cross-default clauses

Cross-default clauses trigger a default if a borrower defaults on any other debt, acting as a critical mechanism within debt covenants to protect lenders. Unlike financial covenants, which set performance benchmarks such as debt-to-equity ratios or interest coverage, cross-default clauses specifically link defaults across multiple loan agreements.

Leverage ratios

Leverage ratios, such as debt-to-equity and debt-to-EBITDA, play a critical role in debt covenants by setting limits on a borrower's indebtedness to protect lenders' interests. Financial covenants encompass a broader range of performance measures, including leverage ratios, profitability, and liquidity metrics, ensuring overall financial health and compliance with loan agreements.

Interest coverage ratios

Interest coverage ratios are critical metrics in debt covenants, ensuring borrowers maintain sufficient earnings to cover interest expenses, thus limiting default risk. Financial covenants may use interest coverage ratios as benchmarks to trigger restrictions or penalties, safeguarding lenders' financial interests through consistent cash flow monitoring.

Debt covenants vs Financial covenants Infographic

moneydif.com

moneydif.com