The yield curve represents the relationship between interest rates and maturities for bonds currently available in the market, reflecting investor expectations and economic conditions. The forward curve, however, projects future interest rates derived from current yield curve data, used for forecasting and pricing derivatives. Understanding the differences between yield and forward curves is crucial for effective treasury management, risk assessment, and investment strategy formulation.

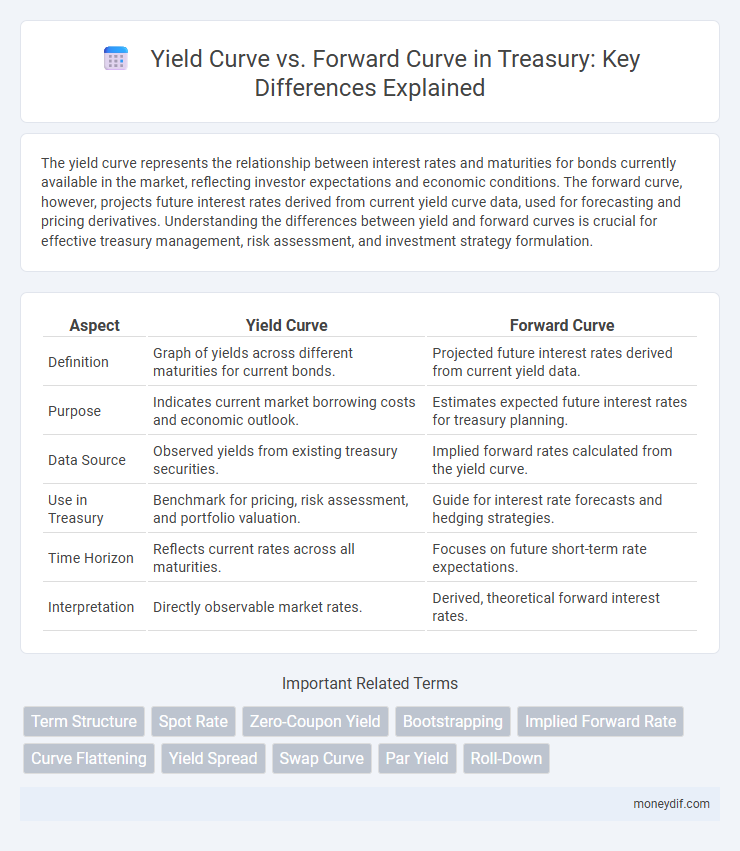

Table of Comparison

| Aspect | Yield Curve | Forward Curve |

|---|---|---|

| Definition | Graph of yields across different maturities for current bonds. | Projected future interest rates derived from current yield data. |

| Purpose | Indicates current market borrowing costs and economic outlook. | Estimates expected future interest rates for treasury planning. |

| Data Source | Observed yields from existing treasury securities. | Implied forward rates calculated from the yield curve. |

| Use in Treasury | Benchmark for pricing, risk assessment, and portfolio valuation. | Guide for interest rate forecasts and hedging strategies. |

| Time Horizon | Reflects current rates across all maturities. | Focuses on future short-term rate expectations. |

| Interpretation | Directly observable market rates. | Derived, theoretical forward interest rates. |

Understanding the Yield Curve in Treasury Markets

The yield curve represents the relationship between bond yields and their maturities, providing crucial insights into market expectations for interest rates and economic growth. In Treasury markets, the yield curve serves as a benchmark for pricing fixed-income securities and assessing risk across different time horizons. Understanding the shape and shifts of the yield curve helps investors and policymakers anticipate future inflation, monetary policy changes, and potential economic downturns.

Defining the Forward Curve: Key Concepts

The forward curve represents market expectations of future interest rates derived from current yield curve data, reflecting anticipated changes in economic conditions and monetary policy. It is constructed by calculating implied forward rates from spot rates along the yield curve, providing insights into timing and magnitude of future rate movements. Understanding the forward curve is essential for Treasury management in optimizing debt issuance strategies and hedging interest rate risk.

Yield Curve vs Forward Curve: Core Differences

The yield curve represents the relationship between interest rates and various maturities of bonds at a given point in time, reflecting current market sentiment and risk premiums. The forward curve, however, predicts future interest rates based on current expectations embedded in the yield curve, offering insights into anticipated economic conditions and monetary policy changes. Key differences include the yield curve's focus on spot rates versus the forward curve's emphasis on implied future rates, which are derived to guide investment and hedging strategies in the Treasury market.

How Yield Curves Reflect Market Sentiment

Yield curves represent current interest rates across different maturities, providing insight into market expectations for economic growth, inflation, and monetary policy. An upward-sloping yield curve typically signals investor confidence and anticipated economic expansion, while an inverted yield curve often indicates market pessimism and potential recession risk. Forward curves, derived from yield curves, incorporate expectations for future interest rates, enabling Treasury analysts to assess market sentiment over various time horizons.

Forward Curves and Future Interest Rate Expectations

Forward curves represent the market's expectations of future interest rates derived from current bond prices and yield curves, providing crucial insights for Treasury portfolio management. They enable the forecasting of interest rate movements and assist in pricing derivative instruments, risk assessment, and strategic asset allocation. Understanding forward curves enhances the ability to anticipate monetary policy shifts and economic conditions, directly impacting fixed income investments and liability management.

Practical Applications in Treasury Management

In treasury management, yield curves provide essential insights into the current interest rate environment by depicting the relationship between bond yields and maturities, enabling more accurate debt issuance and investment decisions. Forward curves, derived from yield curves, forecast future interest rates, assisting treasurers in hedging strategies and optimizing cash flow timing. Utilizing both curves supports effective risk management, capital allocation, and liquidity planning within corporate treasury operations.

Interpreting Curve Shapes: Normal, Inverted, and Flat

The yield curve plots current interest rates across different maturities, reflecting market expectations of future interest rates and economic conditions, while the forward curve projects expected future rates implied by current yield data. A normal yield curve slopes upward, indicating higher yields for longer maturities and signaling economic growth expectations, whereas an inverted curve slopes downward, often predicting a recession due to lower long-term yields relative to short-term ones. A flat curve represents uncertainty, with similar rates across maturities, suggesting a transition phase or market indecision about future interest rate movements.

Impact on Bond Pricing and Valuation

The yield curve represents the relationship between bond yields and maturities, reflecting current interest rate expectations, while the forward curve predicts future interest rates based on market expectations embedded in forward rates. Yield curves are essential for bond pricing as they offer discount rates for cash flows at different maturities, directly affecting present value calculations and bond valuation accuracy. Forward curves influence strategies like interest rate forecasting and risk management, allowing investors to price bonds more dynamically by anticipating shifts in yields and adjusting valuation models accordingly.

Treasury Strategies Using Yield and Forward Curves

Treasury strategies leveraging yield and forward curves enable investors to optimize interest rate risk and enhance portfolio returns by anticipating future rate movements. Yield curves provide current market sentiment on interest rates across maturities, while forward curves project expected future rates, guiding duration positioning and curve trades. Strategic decisions utilize discrepancies between the two curves to identify opportunities in Treasury securities, such as yield curve steepening or flattening plays and forward rate agreements.

Challenges and Limitations of Yield and Forward Curves

Yield curves often face challenges related to market liquidity and interest rate volatility that can distort the true representation of future rate expectations. Forward curves, while useful for forecasting, are limited by assumptions of no-arbitrage and market efficiency, which may not hold during periods of financial stress. Both curves can be affected by data quality issues and model risk, leading to potential mispricing in Treasury securities and hedging strategies.

Important Terms

Term Structure

The term structure of interest rates illustrates the relationship between the yield curve, representing current bond yields across maturities, and the forward curve, which forecasts future interest rates implied by current long-term yields.

Spot Rate

The spot rate represents the yield on zero-coupon bonds for specific maturities, forming the foundation of the yield curve, while the forward curve reflects the expected future spot rates derived from current spot rates through no-arbitrage conditions.

Zero-Coupon Yield

The zero-coupon yield represents the yield on a bond that pays no coupons and is essential for constructing the yield curve, which differs from the forward curve by reflecting current spot rates rather than future expected rates.

Bootstrapping

Bootstrapping is a method used to derive zero-coupon yield curves from market-observed bond prices, enabling the construction of a yield curve that reflects current interest rate expectations. Comparing the yield curve to the forward curve reveals market predictions for future interest rates, where discrepancies between the two can indicate opportunities for arbitrage or signal changing economic conditions.

Implied Forward Rate

The implied forward rate, derived from the yield curve, represents the future interest rate expected between two periods, while the forward curve directly displays these anticipated rates across different maturities.

Curve Flattening

Curve flattening occurs when the yield curve's long-term interest rates decrease relative to short-term rates, indicating reduced expectations for future economic growth or inflation. The forward curve, reflecting market expectations of future interest rates, may signal flattening if implied forward rates decline, aligning with observed yield curve compression and influencing fixed-income investment strategies.

Yield Spread

The yield spread, reflecting the difference between yields on bonds with varying maturities, is crucial for analyzing discrepancies between the yield curve and the forward curve, indicating market expectations of future interest rates and economic conditions.

Swap Curve

The swap curve represents fixed interest rates in interest rate swaps, serving as a benchmark that lies between the yield curve, which shows bond yields across maturities, and the forward curve, which projects future interest rates implied by current market prices.

Par Yield

Par yield reflects the interest rate at which a bond's price equals its face value, serving as a key reference point derived from the yield curve and influencing the shape and interpretation of the forward curve.

Roll-Down

The Roll-Down effect describes the gain or loss in bond prices as they approach maturity, influenced by the differences between the Yield Curve and the Forward Curve.

Yield Curve vs Forward Curve Infographic

moneydif.com

moneydif.com