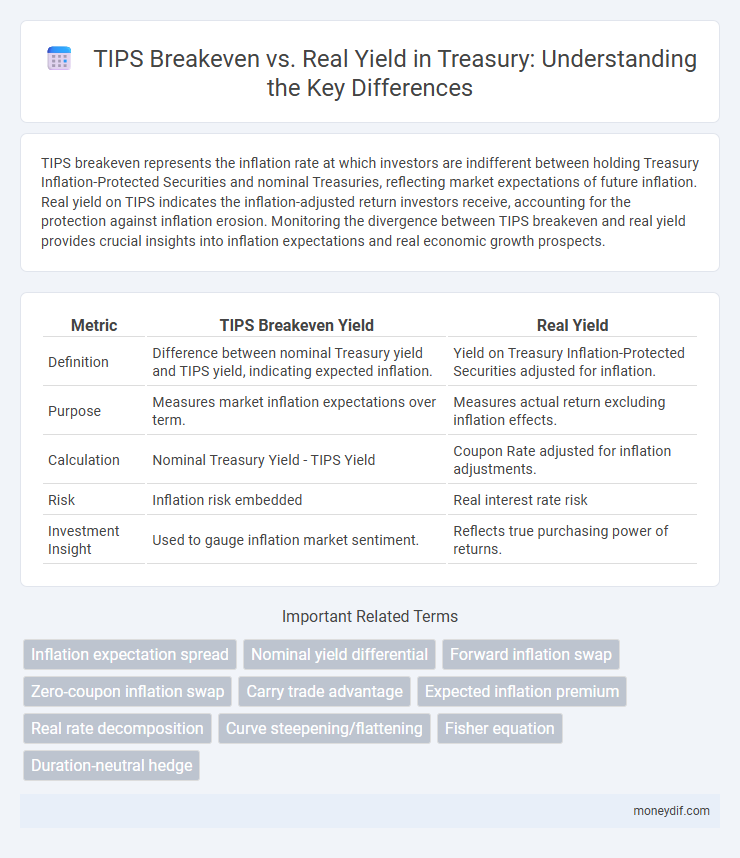

TIPS breakeven represents the inflation rate at which investors are indifferent between holding Treasury Inflation-Protected Securities and nominal Treasuries, reflecting market expectations of future inflation. Real yield on TIPS indicates the inflation-adjusted return investors receive, accounting for the protection against inflation erosion. Monitoring the divergence between TIPS breakeven and real yield provides crucial insights into inflation expectations and real economic growth prospects.

Table of Comparison

| Metric | TIPS Breakeven Yield | Real Yield |

|---|---|---|

| Definition | Difference between nominal Treasury yield and TIPS yield, indicating expected inflation. | Yield on Treasury Inflation-Protected Securities adjusted for inflation. |

| Purpose | Measures market inflation expectations over term. | Measures actual return excluding inflation effects. |

| Calculation | Nominal Treasury Yield - TIPS Yield | Coupon Rate adjusted for inflation adjustments. |

| Risk | Inflation risk embedded | Real interest rate risk |

| Investment Insight | Used to gauge inflation market sentiment. | Reflects true purchasing power of returns. |

Understanding TIPS Breakeven: Definition and Calculation

TIPS breakeven represents the inflation rate at which the return on Treasury Inflation-Protected Securities (TIPS) equals that of nominal Treasury bonds, calculated by subtracting the real yield of TIPS from the nominal yield of comparable-maturity Treasuries. This breakeven inflation rate provides critical insight into market expectations for future inflation and helps investors gauge the inflation risk premium embedded in nominal Treasury yields. Understanding the calculation of TIPS breakeven is essential for interpreting inflation forecasts and making informed investment decisions in inflation-protected securities.

Real Yield Explained: What Investors Need to Know

Real yield on Treasury Inflation-Protected Securities (TIPS) reflects the inflation-adjusted return investors receive, excluding the inflation component, providing crucial insight into the true earning potential compared to nominal yields. The breakeven inflation rate, derived from the difference between TIPS yields and nominal Treasury yields, indicates market inflation expectations and guides investment decisions on inflation risk. Understanding real yield dynamics helps investors assess purchasing power preservation and optimize portfolios amid fluctuating inflation forecasts.

TIPS Breakeven Rate vs. Real Yield: Key Differences

TIPS breakeven rate reflects the market's inflation expectations by comparing nominal Treasury yields with TIPS yields, indicating anticipated inflation over the bond's term. Real yield on TIPS represents the inflation-adjusted return, revealing the true purchasing power investors gain after accounting for inflation. Understanding the divergence between TIPS breakeven rates and real yields is crucial for assessing inflation risk and making informed investment decisions in Treasury securities.

How TIPS Breakeven Predicts Future Inflation

TIPS breakeven inflation rate represents the difference between nominal Treasury yields and TIPS real yields, serving as a market-based predictor of expected inflation over the maturity period. When breakeven rates rise, it signals increasing inflation expectations among investors, influencing monetary policy decisions and Treasury issuance strategies. Monitoring the breakeven spread aids in assessing inflation trends and guiding fixed-income investment allocations within the Treasury market.

Real Yield: Implications for Investment Returns

Real yields on Treasury Inflation-Protected Securities (TIPS) reflect the true inflation-adjusted return investors can expect, serving as a critical measure of purchasing power preservation. Unlike breakeven inflation rates, which estimate market inflation expectations, real yields provide a more direct indicator of actual investment returns after accounting for inflation. Strong positive real yields signal robust returns in real terms, enhancing portfolio resilience against inflationary pressures in fixed-income allocations.

Interpreting Market Sentiment Through Breakeven Rates

TIPS breakeven inflation rates reflect the market's expectations of future inflation by calculating the difference between nominal Treasury yields and real yields on Treasury Inflation-Protected Securities (TIPS). A rising breakeven rate signals that investors anticipate higher inflation, influencing Treasury demand and overall market sentiment. Monitoring breakeven rates alongside real yields provides critical insight into inflation expectations, risk appetite, and monetary policy outlook.

TIPS Breakeven and Real Yield in Economic Cycles

TIPS breakeven inflation represents market expectations for future inflation and often rises during economic expansions as demand pressures increase. Real yield on TIPS reflects the inflation-adjusted return investors require, typically rising during tightening cycles when monetary policy aims to control inflation. Analyzing the divergence between TIPS breakeven inflation and real yields provides critical insights into investor sentiment and inflation expectations across different phases of economic cycles.

Investment Strategies Using TIPS Breakeven and Real Yield

TIPS breakeven inflation rates provide a market-based measure of expected inflation, guiding investors in adjusting portfolio allocations to hedge against inflation risks. Real yields on TIPS reflect the inflation-adjusted return on investment, influencing decisions on the timing and duration of bond holdings to maximize real income. Combining TIPS breakeven and real yield analysis enables strategic asset allocation by balancing inflation protection with yield optimization in Treasury portfolios.

Risks and Limitations of TIPS Breakeven Analysis

TIPS breakeven inflation rates represent the market's inflation expectations derived from the difference between nominal Treasury yields and TIPS real yields. Risks include liquidity disparities between TIPS and nominal Treasuries, which can distort breakeven calculations, and the influence of inflation risk premiums embedded in nominal yields. Limitations involve the assumption that TIPS accurately reflect real yields without distortion and the potential for supply-demand imbalances affecting pricing, leading to misleading inflation expectations.

Historical Trends: TIPS Breakeven vs. Real Yield

Historical trends show that TIPS breakeven inflation rates fluctuate closely with real Treasury yields, reflecting market expectations for future inflation. During periods of economic uncertainty, breakeven rates tend to widen as investors seek inflation protection, while real yields often decline due to safe-haven demand. Over the long term, the inverse relationship between TIPS real yields and breakeven inflation rates provides insight into shifting inflationary expectations and monetary policy impacts.

Important Terms

Inflation expectation spread

The inflation expectation spread, measured by the difference between TIPS breakeven inflation rates and real yields, reflects market consensus on future inflation relative to real returns. A widening spread indicates rising anticipated inflation or declining real yields, impacting investment strategies and monetary policy assessments.

Nominal yield differential

Nominal yield differential, calculated as the gap between nominal Treasury yields and TIPS breakeven inflation rates, directly reflects real yield changes by isolating inflation expectations from real interest rate movements.

Forward inflation swap

Forward inflation swaps provide market-implied future inflation expectations derived from the spread between TIPS breakeven inflation rates and real yields, reflecting investor inflation risk premiums and real interest rate projections.

Zero-coupon inflation swap

Zero-coupon inflation swaps provide a pure inflation exposure priced between TIPS breakeven inflation rates and real yields, reflecting market expectations of future inflation.

Carry trade advantage

Carry trade profits increase when TIPS breakeven inflation rates exceed real yields, indicating higher expected inflation and favorable real return differentials.

Expected inflation premium

Expected inflation premium is calculated as the difference between TIPS breakeven inflation rates and real yields, reflecting investors' inflation expectations embedded in Treasury Inflation-Protected Securities.

Real rate decomposition

Real rate decomposition separates the TIPS breakeven inflation rate into real yield and expected inflation components, highlighting inflation expectations' impact on Treasury Inflation-Protected Securities valuation.

Curve steepening/flattening

Curve steepening occurs when the spread between TIPS breakeven inflation rates and real yields widens, indicating rising inflation expectations relative to real returns. Conversely, curve flattening reflects a narrowing breakeven spread as real yields and inflation expectations converge, signaling market adjustments in inflation risk premium or monetary policy outlook.

Fisher equation

The Fisher equation defines the relationship between nominal interest rates, real interest rates, and expected inflation, expressed as nominal rate real rate + expected inflation. In the context of TIPS breakeven inflation, the difference between nominal Treasury yields and TIPS yields represents the market's inflation expectation, with the real yield on TIPS reflecting the inflation-adjusted return investors demand.

Duration-neutral hedge

A duration-neutral hedge involving TIPS balances exposure by offsetting changes in real yields with adjustments in breakeven inflation rates, minimizing interest rate risk without directional bet on inflation. This strategy leverages the interplay between real yields and TIPS breakeven inflation to stabilize portfolio sensitivity across varying economic conditions.

TIPS breakeven vs Real yield Infographic

moneydif.com

moneydif.com