Cash pooling centralizes multiple accounts into a single balance, optimizing liquidity management by physically transferring funds, whereas notional pooling aggregates balances conceptually without actual fund transfers, allowing subsidiaries to benefit from combined interest calculations. Cash pooling requires legal and operational structures in place to facilitate fund movements, while notional pooling demands agreement among participating entities and is often constrained by regulatory frameworks. Choosing between cash pooling and notional pooling hinges on factors like cost efficiency, risk tolerance, regulatory compliance, and the desired level of control over cash flows.

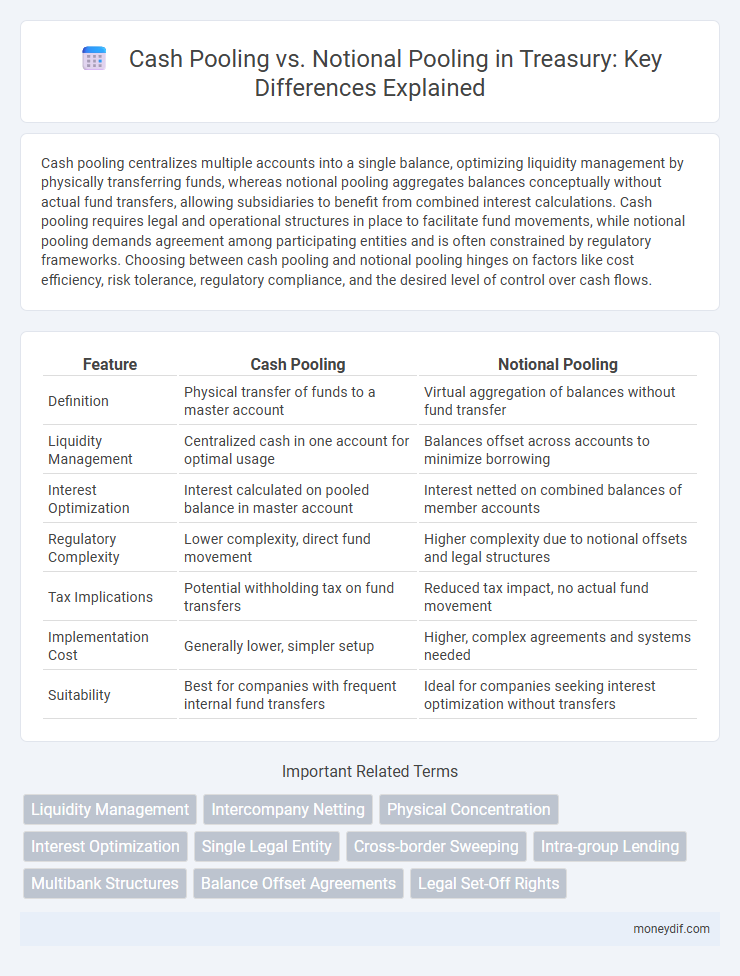

Table of Comparison

| Feature | Cash Pooling | Notional Pooling |

|---|---|---|

| Definition | Physical transfer of funds to a master account | Virtual aggregation of balances without fund transfer |

| Liquidity Management | Centralized cash in one account for optimal usage | Balances offset across accounts to minimize borrowing |

| Interest Optimization | Interest calculated on pooled balance in master account | Interest netted on combined balances of member accounts |

| Regulatory Complexity | Lower complexity, direct fund movement | Higher complexity due to notional offsets and legal structures |

| Tax Implications | Potential withholding tax on fund transfers | Reduced tax impact, no actual fund movement |

| Implementation Cost | Generally lower, simpler setup | Higher, complex agreements and systems needed |

| Suitability | Best for companies with frequent internal fund transfers | Ideal for companies seeking interest optimization without transfers |

Understanding Cash Pooling in Treasury Management

Cash pooling in treasury management centralizes the cash balances of multiple accounts into a single account to optimize liquidity and reduce borrowing costs. This technique enables real-time cash concentration, improves interest rate management, and enhances internal fund utilization without physical fund transfers. Cash pooling contrasts with notional pooling, which combines balances for interest calculation without actual movement of funds, offering flexibility in jurisdictions restricting cash transfers.

What is Notional Pooling? Key Features Explained

Notional pooling is a treasury management technique that allows multiple account balances across various currencies and entities to be consolidated virtually, enabling interest optimization without the need for physical fund transfers. Key features include the aggregation of credit and debit balances for netting interest calculation, maintenance of individual account identities, and enhanced liquidity management with reduced internal borrowing costs. This method improves cash visibility and efficiency by minimizing overdrafts and reducing external financing requirements.

Cash Pooling vs Notional Pooling: Core Differences

Cash pooling centralizes multiple accounts into one master account, enabling physical fund transfers and immediate liquidity management, while notional pooling aggregates balances virtually without actual fund movement, optimizing interest calculations across accounts. Cash pooling typically requires legal and operational integration within the same bank, whereas notional pooling allows for more flexibility across different accounts and entities but depends heavily on the bank's ability to offset credit and debit balances notionally. The core difference lies in cash pooling's physical cash concentration versus notional pooling's virtual aggregation, impacting liquidity control, interest benefits, and regulatory considerations.

Advantages of Cash Pooling for Corporates

Cash pooling offers corporates significant advantages by centralizing liquidity management, reducing external borrowing costs, and optimizing interest income through the netting of intercompany balances. This structure enhances cash visibility and control across multiple subsidiaries, enabling more efficient working capital allocation and minimizing idle cash. Corporates benefit from simplified treasury operations and improved financial flexibility without the complexity of legal or regulatory hurdles often associated with notional pooling.

Benefits and Limitations of Notional Pooling

Notional pooling offers significant benefits such as interest optimization by offsetting credit and debit balances across multiple accounts without physical fund transfers, improving liquidity management and reducing external borrowing costs. However, limitations include the complexity of regulatory compliance, especially in jurisdictions with strict banking and tax regulations, and limited availability in some countries due to legal constraints on cross-entity netting. Additionally, notional pooling requires sophisticated treasury systems and strong intercompany agreements to manage operational risks and ensure transparent allocation of interest benefits.

Regulatory Considerations for Pooling Structures

Regulatory considerations for cash pooling and notional pooling vary significantly by jurisdiction, impacting compliance, tax treatment, and legal risk. Cash pooling typically requires physical fund transfers that incur withholding tax and impose formal intercompany loan documentation requirements, while notional pooling involves virtual balances, reducing tax leakage but facing stricter regulatory scrutiny concerning interest allocation and anti-money laundering rules. Treasury teams must evaluate local banking regulations, tax authorities' stances, and cross-border restrictions to ensure pooling structures align with legal frameworks and optimize working capital management.

Tax Implications: Cash Pooling vs Notional Pooling

Cash pooling and notional pooling differ significantly in tax implications due to their structural and legal frameworks; cash pooling involves actual fund transfers between accounts, potentially triggering taxable events such as withholding taxes on intercompany loans. Notional pooling aggregates balances for interest calculation without physical movement of funds, reducing immediate tax liabilities but complicating transfer pricing compliance and interest attribution. Multinational corporations must carefully analyze local tax regulations and treaty provisions to optimize the tax efficiency of their chosen pooling method.

Selecting the Right Pooling Solution for Your Business

Choosing the right cash management strategy between cash pooling and notional pooling depends on your business's liquidity needs, legal environment, and tax implications. Cash pooling centralizes balances into a single account to optimize interest benefits but may face regulatory restrictions in some jurisdictions. Notional pooling allows individual accounts to offset balances virtually without fund transfers, offering flexibility but often requiring complex legal agreements and advanced treasury systems.

Implementation Challenges and Best Practices

Cash pooling and notional pooling present distinct implementation challenges, including regulatory compliance, intercompany agreements, and IT system integration complexities. Best practices emphasize thorough legal review, alignment with tax authorities, robust treasury management systems, and clear communication across subsidiaries to ensure transparency and control. Effective risk management frameworks and continuous monitoring are essential to optimize liquidity and minimize operational risks in both pooling structures.

Future Trends in Treasury Pooling Solutions

Future trends in treasury pooling solutions emphasize increased automation and real-time liquidity management driven by advanced fintech integrations and AI-powered analytics. Cash pooling remains favored for its straightforward cash concentration benefits, while notional pooling gains traction due to regulatory flexibility and capital efficiency in multinational corporations. Enhanced cross-border pooling capabilities and blockchain-based transparency are emerging to optimize treasury operations and reduce intercompany settlement risks.

Important Terms

Liquidity Management

Liquidity management efficiency is enhanced through cash pooling by physically concentrating funds in a single account, whereas notional pooling optimizes interest benefits by offsetting balances without actual fund transfers.

Intercompany Netting

Intercompany netting streamlines the settlement of cross-border transactions by offsetting payables and receivables between subsidiaries, reducing the number of cash movements and enhancing liquidity management. Cash pooling consolidates actual cash balances physically, whereas notional pooling offsets balances notionally without moving funds, allowing companies to optimize interest benefits while maintaining separate account structures.

Physical Concentration

Physical concentration consolidates actual cash balances into a single account, enhancing liquidity management compared to notional pooling, which aggregates balances virtually without moving funds.

Interest Optimization

Interest optimization in cash pooling maximizes liquidity benefits by consolidating actual cash balances, while notional pooling optimizes interest by offsetting credit and debit balances virtually without physical fund transfers.

Single Legal Entity

Single Legal Entity cash pooling consolidates actual cash balances for liquidity optimization within one company, whereas notional pooling aggregates virtual balances across subsidiaries without physical cash movement to reduce interest expenses.

Cross-border Sweeping

Cross-border sweeping consolidates actual cash transfers in cash pooling, enhancing liquidity management across subsidiaries, while notional pooling offsets balances virtually without physical fund movement, minimizing transaction costs and tax implications.

Intra-group Lending

Intra-group lending facilitates liquidity management by enabling cash transfers within subsidiaries, contrasting with cash pooling where physical cash balances are centralized for optimized working capital, and notional pooling which aggregates balances notionally without actual fund movements to maximize interest benefits. Cash pooling requires actual movement of funds, affecting intercompany accounts, while notional pooling maintains separate accounts, reducing transaction costs and providing interest optimization across the group.

Multibank Structures

Multibank structures in treasury management enable corporations to optimize cash flow by leveraging both cash pooling and notional pooling techniques, each offering distinct advantages in liquidity management and bank fee minimization. Cash pooling involves physical transfers of actual funds between accounts, facilitating centralized control, while notional pooling aggregates balances conceptually without fund movement, preserving individual account autonomy and reducing interest expenses based on aggregated net positions.

Balance Offset Agreements

Balance Offset Agreements optimize liquidity management by allowing cash pooling participants to offset debit and credit balances, whereas notional pooling consolidates balances notionally without physical fund transfers, enhancing interest optimization and reducing funding costs.

Legal Set-Off Rights

Legal set-off rights allow participants in cash pooling arrangements to offset mutual claims and debts, ensuring efficient liquidity management and risk mitigation. In contrast, notional pooling does not trigger legal set-off rights because it aggregates balances notionally without actual fund transfers, limiting immediate netting of exposures among accounts.

Cash Pooling vs Notional Pooling Infographic

moneydif.com

moneydif.com