STRIPS are Treasury securities separated into individual interest and principal components, allowing investors to purchase zero-coupon bonds that mature at face value without periodic interest payments. TIPS are Treasury Inflation-Protected Securities designed to protect investors from inflation by adjusting the principal based on changes in the Consumer Price Index, with interest paid semiannually on the adjusted principal. While STRIPS provide a fixed return at maturity, TIPS offer inflation-adjusted returns, making them suitable for different investment strategies focused on interest income versus inflation protection.

Table of Comparison

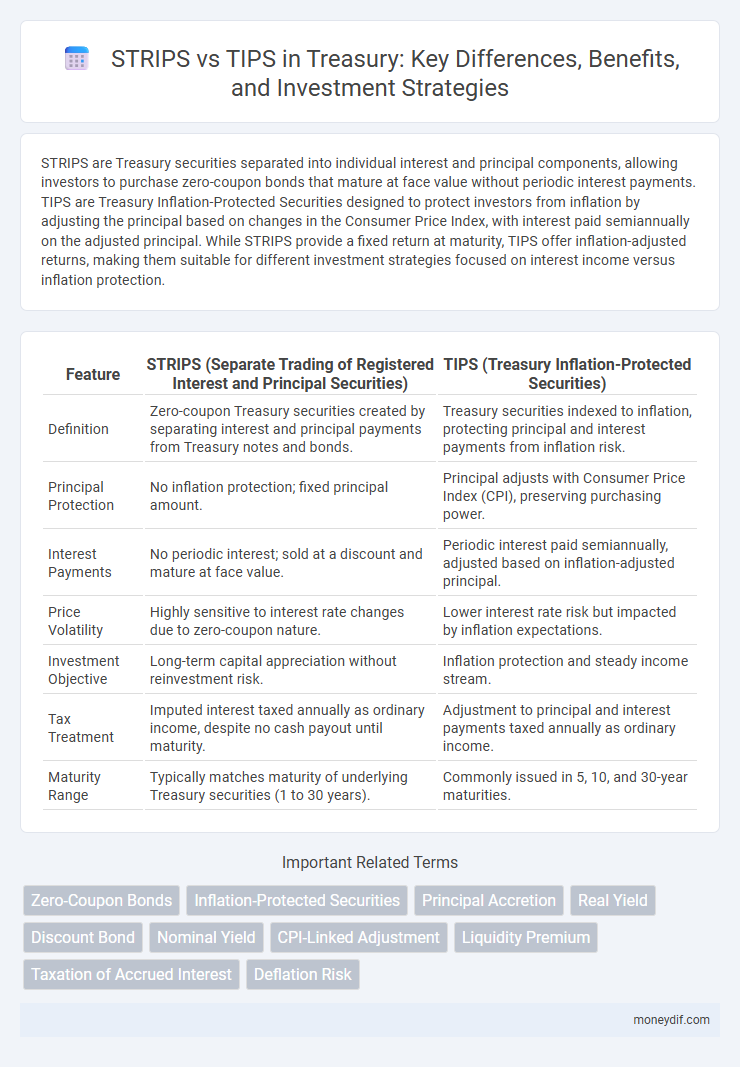

| Feature | STRIPS (Separate Trading of Registered Interest and Principal Securities) | TIPS (Treasury Inflation-Protected Securities) |

|---|---|---|

| Definition | Zero-coupon Treasury securities created by separating interest and principal payments from Treasury notes and bonds. | Treasury securities indexed to inflation, protecting principal and interest payments from inflation risk. |

| Principal Protection | No inflation protection; fixed principal amount. | Principal adjusts with Consumer Price Index (CPI), preserving purchasing power. |

| Interest Payments | No periodic interest; sold at a discount and mature at face value. | Periodic interest paid semiannually, adjusted based on inflation-adjusted principal. |

| Price Volatility | Highly sensitive to interest rate changes due to zero-coupon nature. | Lower interest rate risk but impacted by inflation expectations. |

| Investment Objective | Long-term capital appreciation without reinvestment risk. | Inflation protection and steady income stream. |

| Tax Treatment | Imputed interest taxed annually as ordinary income, despite no cash payout until maturity. | Adjustment to principal and interest payments taxed annually as ordinary income. |

| Maturity Range | Typically matches maturity of underlying Treasury securities (1 to 30 years). | Commonly issued in 5, 10, and 30-year maturities. |

Introduction to Treasury Securities

Treasury STRIPS (Separate Trading of Registered Interest and Principal of Securities) are zero-coupon securities that allow investors to hold and trade the individual interest and principal components of eligible Treasury notes and bonds separately. Treasury Inflation-Protected Securities (TIPS) provide principal protection against inflation by adjusting the principal value based on changes in the Consumer Price Index, ensuring that interest payments and principal value rise with inflation. Both STRIPS and TIPS serve different investor needs within Treasury securities, with STRIPS focused on fixed income through discounted bonds and TIPS offering inflation hedging.

What are STRIPS?

STRIPS (Separate Trading of Registered Interest and Principal Securities) are Treasury securities that have been separated into individual interest and principal components, allowing investors to purchase either the interest payments or the principal repayment independently. These zero-coupon bonds are sold at a discount and mature at face value, providing a fixed return without periodic interest payments. STRIPS are often used for precise cash flow matching and long-term investment planning due to their predictable maturity values.

What are TIPS?

TIPS, or Treasury Inflation-Protected Securities, are government bonds specifically designed to protect investors from inflation by adjusting the principal value based on changes in the Consumer Price Index (CPI). Unlike STRIPS, which are zero-coupon securities created by separating the principal and interest payments of Treasury bonds, TIPS provide investors with a fixed interest rate applied to an inflation-adjusted principal. This structure helps maintain the purchasing power of the investment by increasing the principal during inflationary periods and decreasing it during deflation.

Key Differences Between STRIPS and TIPS

STRIPS (Separate Trading of Registered Interest and Principal Securities) are zero-coupon Treasury securities issued by separating the interest and principal components of Treasury bonds into individual securities, while TIPS (Treasury Inflation-Protected Securities) are Treasury bonds designed to protect investors from inflation by adjusting the principal based on changes in the Consumer Price Index (CPI). STRIPS provide pure discount instruments with no periodic interest payments, offering returns solely from the difference between purchase price and maturity value, whereas TIPS provide semi-annual interest payments that vary with inflation-adjusted principal, preserving purchasing power. The primary distinction lies in STRIPS focusing on time value and discounting of fixed cash flows, while TIPS focus on inflation protection with principal adjustments and real yield preservation.

Inflation Protection: STRIPS vs TIPS

TIPS (Treasury Inflation-Protected Securities) provide direct inflation protection by adjusting principal based on the Consumer Price Index, ensuring the bond's value keeps pace with inflation. STRIPS (Separate Trading of Registered Interest and Principal Securities) are zero-coupon bonds stripped from Treasury notes or bonds and do not offer built-in inflation protection since their value remains fixed until maturity. Investors seeking inflation hedging typically prefer TIPS for maintaining purchasing power against rising prices, whereas STRIPS are chosen for fixed, predictable returns without inflation adjustment.

Investment Strategies for STRIPS and TIPS

STRIPS offer investors a zero-coupon bond strategy, allowing for precise cash flow timing and predictable returns by separating principal and interest payments into individual securities. TIPS provide an inflation-protected investment approach, adjusting principal with changes in the Consumer Price Index to preserve purchasing power and deliver real yield over inflation. Combining STRIPS for long-term fixed payouts with TIPS for inflation hedging can optimize portfolio diversification and risk management in Treasury investments.

Tax Considerations for STRIPS and TIPS

STRIPS (Separate Trading of Registered Interest and Principal Securities) are subject to federal income tax annually on the imputed interest, despite no actual cash payments until maturity, creating phantom income for investors. TIPS (Treasury Inflation-Protected Securities) adjust their principal value with inflation, and taxable interest is reported annually based on the inflation-adjusted principal, resulting in tax liability even if interest is not received. Understanding these tax implications is crucial for investors to manage cash flow and tax planning effectively with Treasury securities.

Risk Profiles: STRIPS Compared to TIPS

STRIPS (Separate Trading of Registered Interest and Principal of Securities) carry higher interest rate risk because they are pure zero-coupon instruments, making their value more sensitive to interest rate fluctuations. TIPS (Treasury Inflation-Protected Securities) offer protection against inflation risk by adjusting the principal based on the Consumer Price Index, resulting in more stable real returns. Investors seeking to hedge inflation will prefer TIPS, while those focused on maximizing duration exposure might opt for STRIPS despite higher volatility.

Market Performance and Historical Returns

STRIPS (Separate Trading of Registered Interest and Principal Securities) have historically exhibited lower price volatility compared to TIPS (Treasury Inflation-Protected Securities) due to their fixed principal and coupon payments, making STRIPS attractive for precise duration targeting in portfolio management. TIPS offer inflation-adjusted returns, which have outperformed nominal Treasury bonds during periods of rising consumer price indexes, but their market performance can be affected by real interest rate fluctuations and liquidity premiums. Over the past two decades, STRIPS have delivered stable returns aligned with nominal yields, while TIPS have provided real return protection, leading to outperformance during inflationary cycles but variable total returns in low-inflation environments.

Choosing Between STRIPS and TIPS: Which is Right for You?

STRIPS (Separate Trading of Registered Interest and Principal Securities) are zero-coupon bonds best suited for investors seeking long-term, predictable returns without periodic interest payments, while TIPS (Treasury Inflation-Protected Securities) provide inflation-adjusted principal and interest, ideal for preserving purchasing power. STRIPS are favorable for those aiming for a fixed lump-sum at maturity, whereas TIPS cater to investors needing protection against inflation fluctuations. Assessing your financial goals and inflation outlook helps determine whether the zero-coupon nature of STRIPS or the inflation hedge of TIPS aligns better with your investment strategy.

Important Terms

Zero-Coupon Bonds

Zero-coupon bonds like STRIPS offer fixed returns with no periodic interest, while TIPS provide inflation-adjusted principal payments protecting investors against inflation.

Inflation-Protected Securities

Inflation-Protected Securities include TIPS, which provide both principal adjustment for inflation and interest payments, whereas STRIPS are zero-coupon bonds derived from Treasury securities that do not adjust for inflation but can be used to create inflation-hedged portfolios.

Principal Accretion

Principal Accretion in STRIPS involves adjusting bond principal by reinvesting coupon payments, whereas TIPS principal accretion reflects inflation-linked adjustments to preserve purchasing power.

Real Yield

Real yield on TIPS reflects inflation-adjusted returns, whereas STRIPS offer nominal yields stripped of coupon payments, highlighting differences in inflation protection and interest rate risk.

Discount Bond

Discount bonds, often issued at a price below their face value, differ from STRIPS, which are zero-coupon securities created by separating the interest and principal payments of Treasury bonds and sold at deep discounts. TIPS (Treasury Inflation-Protected Securities) contrast with discount bonds and STRIPS by providing principal adjustments based on inflation rates, offering protection against inflation rather than purely time-discounted returns.

Nominal Yield

Nominal yield measures the return on STRIPS without inflation protection, while TIPS offer adjusted yields reflecting real returns after inflation.

CPI-Linked Adjustment

CPI-linked adjustment in TIPS offers inflation-protected principal and interest through direct Treasury securities, whereas STRIPS, as zero-coupon Treasury securities, do not provide periodic inflation adjustments but can be used to replicate CPI-linked cash flows through customized portfolios.

Liquidity Premium

Liquidity premium in STRIPS often exceeds that in TIPS due to lower marketability and higher transaction costs, which investors demand as compensation for reduced liquidity.

Taxation of Accrued Interest

Taxation of accrued interest on STRIPS is deferred until maturity resulting in phantom income, whereas TIPS provide taxable inflation-adjusted interest annually, impacting investor tax liabilities differently.

Deflation Risk

STRIPS expose investors to higher deflation risk due to lack of inflation protection, whereas TIPS mitigate deflation risk by adjusting principal based on the Consumer Price Index.

STRIPS vs TIPS Infographic

moneydif.com

moneydif.com