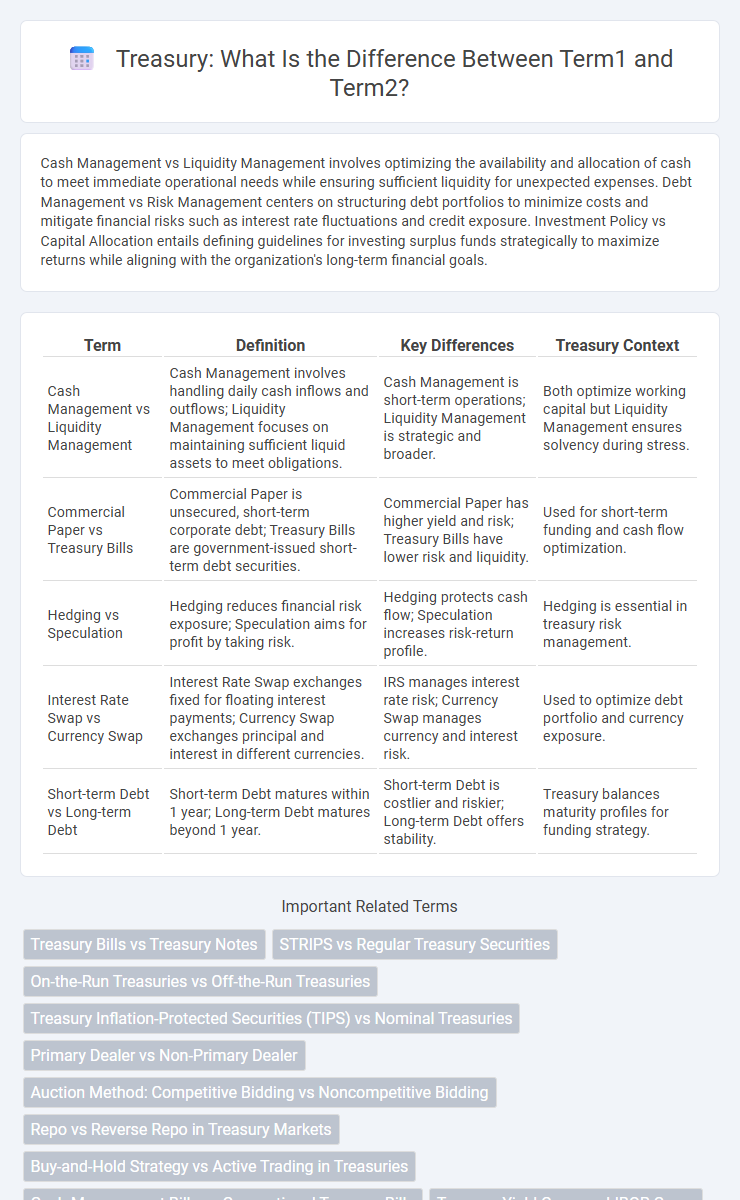

Cash Management vs Liquidity Management involves optimizing the availability and allocation of cash to meet immediate operational needs while ensuring sufficient liquidity for unexpected expenses. Debt Management vs Risk Management centers on structuring debt portfolios to minimize costs and mitigate financial risks such as interest rate fluctuations and credit exposure. Investment Policy vs Capital Allocation entails defining guidelines for investing surplus funds strategically to maximize returns while aligning with the organization's long-term financial goals.

Table of Comparison

| Term | Definition | Key Differences | Treasury Context |

|---|---|---|---|

| Cash Management vs Liquidity Management | Cash Management involves handling daily cash inflows and outflows; Liquidity Management focuses on maintaining sufficient liquid assets to meet obligations. | Cash Management is short-term operations; Liquidity Management is strategic and broader. | Both optimize working capital but Liquidity Management ensures solvency during stress. |

| Commercial Paper vs Treasury Bills | Commercial Paper is unsecured, short-term corporate debt; Treasury Bills are government-issued short-term debt securities. | Commercial Paper has higher yield and risk; Treasury Bills have lower risk and liquidity. | Used for short-term funding and cash flow optimization. |

| Hedging vs Speculation | Hedging reduces financial risk exposure; Speculation aims for profit by taking risk. | Hedging protects cash flow; Speculation increases risk-return profile. | Hedging is essential in treasury risk management. |

| Interest Rate Swap vs Currency Swap | Interest Rate Swap exchanges fixed for floating interest payments; Currency Swap exchanges principal and interest in different currencies. | IRS manages interest rate risk; Currency Swap manages currency and interest risk. | Used to optimize debt portfolio and currency exposure. |

| Short-term Debt vs Long-term Debt | Short-term Debt matures within 1 year; Long-term Debt matures beyond 1 year. | Short-term Debt is costlier and riskier; Long-term Debt offers stability. | Treasury balances maturity profiles for funding strategy. |

Treasury Bills vs Treasury Bonds

Treasury Bills are short-term government securities with maturities of one year or less, sold at a discount and redeemed at face value, making them ideal for liquidity management and short-term financing. Treasury Bonds, in contrast, are long-term debt instruments with maturities typically ranging from 10 to 30 years, paying periodic interest and suited for long-term investment and funding government obligations. The choice between Treasury Bills and Treasury Bonds depends on an entity's investment horizon, risk tolerance, and cash flow requirements in Treasury management.

Centralized Treasury vs Decentralized Treasury

Centralized Treasury consolidates cash management, risk oversight, and funding decisions within a single headquarters, enhancing control and efficiency for multinational corporations. Decentralized Treasury distributes these functions across regional or business unit levels, allowing for greater flexibility and responsiveness to local market conditions. Choosing between centralized and decentralized treasury structures impacts liquidity optimization, compliance management, and financial risk mitigation strategies.

Treasury Management System vs Manual Processes

A Treasury Management System (TMS) automates cash flow tracking, risk management, and financial reporting, significantly reducing errors common in manual processes. Manual treasury management relies heavily on spreadsheets and paper records, increasing the risk of data inconsistencies and delayed decision-making. Implementing a TMS enhances real-time visibility and accuracy, driving efficient liquidity management and compliance in corporate finance operations.

In-House Banking vs External Bank Accounts

In-House Banking centralizes treasury operations within a corporation, enabling optimized cash management, internal fund transfers, and reduced reliance on external banks, which increases control and lowers transaction costs. External Bank Accounts provide access to a broad range of banking services and diversified financial institutions, essential for liquidity management, currency hedging, and regulatory compliance across multiple jurisdictions. Choosing between In-House Banking and External Bank Accounts depends on factors like transaction volume, currency exposure, risk management strategies, and the need for real-time liquidity visibility.

Cash Flow Forecasting vs Liquidity Planning

Cash Flow Forecasting estimates future cash inflows and outflows to ensure short-term operational solvency, relying on historical data and payment schedules. Liquidity Planning encompasses a broader strategy to maintain adequate cash reserves and access to funding sources, managing risks associated with unexpected cash shortages. Both are essential for treasury management, but forecasting centers on timing accuracy while liquidity planning prioritizes resource availability and contingency readiness.

Treasury Outsourcing vs In-House Treasury

Treasury outsourcing involves delegating cash management, risk assessment, and liquidity monitoring to third-party specialists, enhancing operational efficiency and access to advanced technology. In-house treasury maintains direct control over financial strategies, fostering real-time decision-making and internal expertise but demands higher staffing and infrastructure costs. Companies must balance cost savings and flexibility from outsourcing against the customization and security offered by in-house treasury functions.

Domestic Treasury Operations vs International Treasury Operations

Domestic Treasury Operations concentrate on managing a company's liquidity, cash flow, and financial risks within its home country, ensuring regulatory compliance with local laws and tax regulations. International Treasury Operations deal with cross-border cash management, foreign exchange risk, and global funding strategies, requiring expertise in multiple currencies, international banking relationships, and compliance with diverse regulatory environments. Effective coordination between domestic and international treasury functions maximizes overall financial efficiency and mitigates global financial risks.

Physical Cash Pooling vs Notional Cash Pooling

Physical Cash Pooling involves the actual transfer of funds between accounts to consolidate cash, enhancing liquidity management and reducing interest expenses across subsidiaries. Notional Cash Pooling allows companies to offset balances electronically without moving funds, optimizing interest calculations while maintaining individual account autonomy. Both methods improve group-wide cash visibility but differ in legal complexity and operational execution.

Treasury Risk Management vs Treasury Compliance

Treasury Risk Management focuses on identifying, assessing, and mitigating financial risks such as interest rate fluctuations, liquidity shortages, and credit exposures to safeguard organizational assets. Treasury Compliance ensures adherence to regulatory requirements, internal policies, and reporting standards to prevent legal penalties and maintain transparency. Effective Treasury strategy integrates Risk Management with Compliance controls to optimize cash flow, minimize financial risks, and uphold regulatory integrity.

Traditional Treasury Methods vs Fintech Treasury Solutions

Traditional treasury methods rely heavily on manual processes, paper-based documentation, and legacy banking systems that often result in slower transaction times and increased risk of errors. Fintech treasury solutions leverage real-time data analytics, automated workflows, and cloud-based platforms to enhance liquidity management, cash flow forecasting, and risk mitigation. Integration with APIs and advanced cybersecurity measures enables fintech tools to provide greater transparency, efficiency, and scalability compared to conventional treasury operations.

Important Terms

Treasury Bills vs Treasury Notes

Treasury Bills are short-term government securities with maturities of one year or less, issued at a discount and redeemed at face value, while Treasury Notes have maturities ranging from two to ten years and pay semiannual interest along with principal at maturity. Investors seeking liquidity and minimal interest rate risk often prefer Treasury Bills, whereas those targeting steady, predictable income over a medium horizon typically choose Treasury Notes.

STRIPS vs Regular Treasury Securities

STRIPS (Separate Trading of Registered Interest and Principal Securities) are zero-coupon Treasury securities created by separating the interest and principal payments of Regular Treasury Securities, resulting in individual components sold at a discount and matured at face value. Regular Treasury Securities, such as Treasury notes and bonds, provide periodic interest payments and return principal at maturity, offering steady income and lower price volatility compared to STRIPS.

On-the-Run Treasuries vs Off-the-Run Treasuries

On-the-Run Treasuries are the most recently issued government bonds with higher liquidity and tighter spreads, while Off-the-Run Treasuries are older issues offering lower liquidity but potentially higher yields.

Treasury Inflation-Protected Securities (TIPS) vs Nominal Treasuries

Treasury Inflation-Protected Securities (TIPS) provide principal and interest payments adjusted for inflation, ensuring real return preservation, while Nominal Treasuries offer fixed interest rates that may lose purchasing power during inflationary periods. Investors favor TIPS for inflation hedging but Nominal Treasuries for stable, predictable income.

Primary Dealer vs Non-Primary Dealer

Primary dealers are authorized financial institutions that trade directly with the Federal Reserve in U.S. Treasury securities auctions, while non-primary dealers participate in secondary markets without direct auction access.

Auction Method: Competitive Bidding vs Noncompetitive Bidding

Competitive bidding in Treasury auctions allows bidders to specify the yield they are willing to accept, often resulting in better pricing efficiency, whereas noncompetitive bidding guarantees purchase at the average accepted yield without yield specification.

Repo vs Reverse Repo in Treasury Markets

In Treasury markets, a repo involves selling securities with an agreement to repurchase them later at a higher price, effectively a short-term collateralized loan, whereas a reverse repo is the purchase of securities with a commitment to resell, serving as a tool for managing liquidity and interest rates.

Buy-and-Hold Strategy vs Active Trading in Treasuries

Buy-and-hold strategy in Treasuries focuses on long-term stability and interest income, while active trading aims for short-term capital gains through frequent buying and selling.

Cash Management Bills vs Conventional Treasury Bills

Cash Management Bills offer shorter maturities and irregular issuance schedules compared to Conventional Treasury Bills, which have fixed maturities and regular auction cycles, impacting liquidity and investment strategies.

Treasury Yield Curve vs LIBOR Curve

The Treasury Yield Curve reflects the interest rates on U.S. government bonds across various maturities, serving as a benchmark for risk-free rates, while the LIBOR Curve represents the average interbank lending rates for different maturities and incorporates credit risk premiums. Differences between these curves influence pricing and risk assessment in fixed income markets, with the Treasury curve often used for sovereign risk-free valuation and the LIBOR curve impacting floating-rate instruments and derivatives pricing.

Sure! Here’s a list of niche "term1 vs term2" comparisons in the context of Treasury: Infographic

moneydif.com

moneydif.com