Lockbox services accelerate the collection and processing of incoming payments by directing customer remittances to a central post office box, improving cash flow management. Sweep accounts automatically transfer excess funds from a business checking account to a higher-interest investment or savings account, optimizing interest earnings while maintaining liquidity. Both tools enhance treasury operations but serve distinct purposes: lockboxes expedite receivables processing, while sweep accounts maximize returns on idle cash.

Table of Comparison

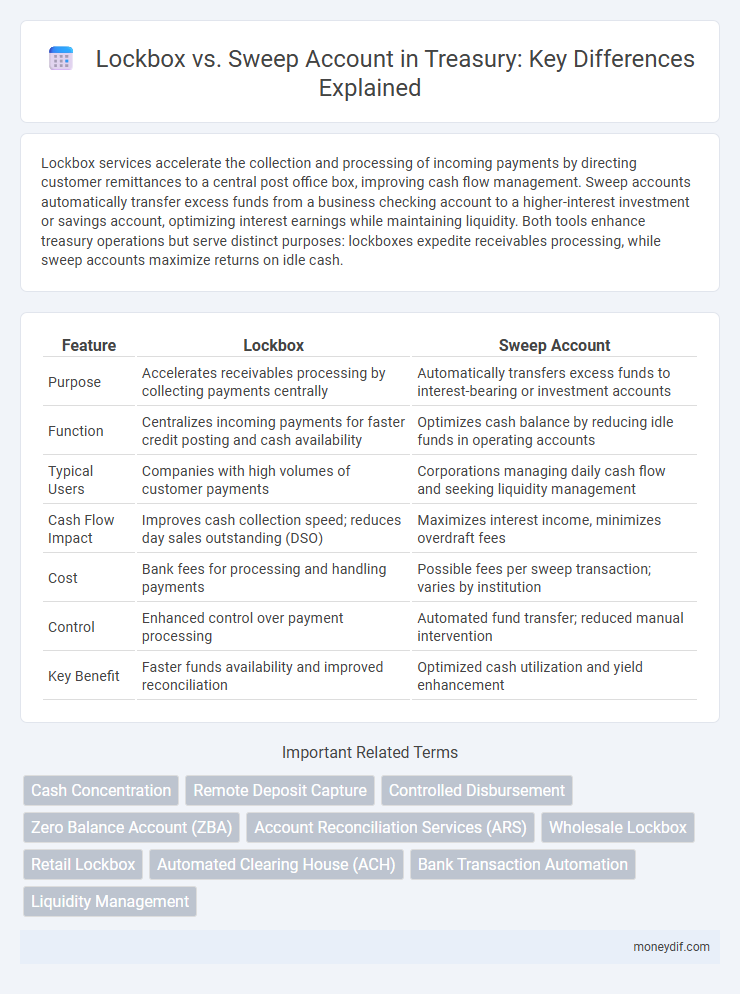

| Feature | Lockbox | Sweep Account |

|---|---|---|

| Purpose | Accelerates receivables processing by collecting payments centrally | Automatically transfers excess funds to interest-bearing or investment accounts |

| Function | Centralizes incoming payments for faster credit posting and cash availability | Optimizes cash balance by reducing idle funds in operating accounts |

| Typical Users | Companies with high volumes of customer payments | Corporations managing daily cash flow and seeking liquidity management |

| Cash Flow Impact | Improves cash collection speed; reduces day sales outstanding (DSO) | Maximizes interest income, minimizes overdraft fees |

| Cost | Bank fees for processing and handling payments | Possible fees per sweep transaction; varies by institution |

| Control | Enhanced control over payment processing | Automated fund transfer; reduced manual intervention |

| Key Benefit | Faster funds availability and improved reconciliation | Optimized cash utilization and yield enhancement |

Introduction to Treasury Management Solutions

Lockbox and sweep accounts are essential tools in treasury management solutions designed to enhance cash flow efficiency and optimize working capital. A lockbox system accelerates receivables collection by directing payments to a secure post office box managed by a bank, enabling faster deposit and processing. Sweep accounts automatically transfer excess funds between checking and investment or loan accounts to maximize interest earnings or minimize borrowing costs.

What is a Lockbox Account?

A lockbox account is a specialized bank service used in treasury management to expedite the collection and processing of receivables by directing customer payments to a secure post office box managed by a financial institution. This system accelerates cash flow and reduces processing time by eliminating internal mail handling and manual deposit. Lockbox accounts enhance payment accuracy and improve funds availability, supporting efficient working capital management.

Understanding Sweep Accounts

Sweep accounts automatically transfer excess funds from a primary account into a higher-interest investment or savings vehicle, optimizing cash management and maximizing returns. These accounts help corporations maintain liquidity while ensuring idle cash generates additional income without manual intervention. By reducing idle balances in operating accounts, sweep accounts enhance treasury efficiency and improve overall cash flow optimization.

Key Differences Between Lockbox and Sweep Accounts

Lockbox accounts centralize receivables processing by directing customer payments to a secure location for expedited deposit and reduced float time. Sweep accounts automate the transfer of excess funds between checking and investment or loan accounts to optimize interest income and minimize overdraft risk. The primary difference lies in lockbox accounts enhancing cash inflows through streamlined collections, while sweep accounts focus on dynamic fund management and liquidity optimization.

Benefits of Implementing a Lockbox System

Implementing a lockbox system accelerates cash flow by reducing mail float and processing time, enabling faster deposit of customer payments directly into the bank. It improves payment accuracy and reduces fraud risk through centralized and secure handling of receivables. Enhanced efficiency in cash application also leads to better liquidity management and optimized working capital for the treasury team.

Advantages of Using Sweep Accounts

Sweep accounts enhance cash management by automatically transferring idle funds into higher-interest investment options, maximizing returns without manual intervention. They improve liquidity control by ensuring optimal fund allocation between operational and investment accounts, reducing overdraft risks. This automation streamlines treasury operations, increases efficiency, and supports better forecasting and cash flow optimization.

Lockbox vs Sweep Account: Cost Comparison

Lockbox services typically involve fixed fees based on the volume of transactions and payments processed, leading to predictable costs for businesses managing receivables. Sweep accounts often incur variable fees tied to the amount of funds transferred between accounts daily, which can fluctuate based on cash flow patterns. Evaluating a cost comparison requires analyzing transaction volume, average balances, and frequency to determine which service offers better cost-efficiency for a company's treasury management needs.

Security Considerations in Treasury Operations

Lockbox services enhance security by reducing the risk of theft and fraud through direct payment processing by banks, minimizing the handling of physical checks by company employees. Sweep accounts improve security by automating fund transfers between operating and investment accounts, reducing idle cash exposure and limiting unauthorized access to surplus funds. Both solutions leverage electronic reconciliation and controlled access protocols to strengthen overall treasury operations security.

Choosing the Right Solution for Your Business Needs

Lockbox services streamline receivables by accelerating payment processing through centralized mail handling, ideal for businesses seeking efficient cash flow management with minimal operational involvement. Sweep accounts automatically move excess funds between checking and investment accounts, optimizing liquidity and maximizing interest earnings for companies with fluctuating daily balances. Selecting between lockbox and sweep accounts depends on your business's transaction volume, cash flow predictability, and the need for immediate liquidity versus investment growth.

Future Trends in Treasury Cash Management

Lockbox and sweep accounts are evolving with advances in automation and real-time data analytics, enhancing cash visibility and accelerating receivables processing. Treasury departments are increasingly integrating AI-driven forecasting tools to optimize liquidity through dynamic allocation between lockbox collections and sweep mechanisms. Future trends indicate a shift towards seamless, cloud-based platforms that unify cash management functions, driving efficiency and reducing manual reconciliation efforts.

Important Terms

Cash Concentration

Cash concentration strategies optimize liquidity by centralizing funds from multiple accounts; lockbox services accelerate receivables processing by collecting payments directly at a post office box, while sweep accounts automatically transfer excess balances into higher-interest investment or paydown accounts at the end of each business day, enhancing cash management efficiency. Compared to lockboxes, sweep accounts offer real-time cash optimization by dynamically reallocating funds, whereas lockboxes primarily improve cash flow timing and reduce mail processing delays.

Remote Deposit Capture

Remote Deposit Capture (RDC) enables businesses to scan and deposit checks electronically, streamlining cash flow compared to traditional Lockbox services where banks handle physical check processing. Unlike Sweep Accounts that automatically transfer excess funds between accounts to optimize interest, RDC focuses solely on digitizing deposits for faster availability and improved liquidity management.

Controlled Disbursement

Controlled disbursement is a cash management service that enhances liquidity by providing early notification of checks clearing, allowing precise daily funding. Compared to lockbox systems that expedite receivables processing and sweep accounts that automatically transfer excess funds, controlled disbursement specifically optimizes outflows for improved cash flow forecasting and reduced idle balances.

Zero Balance Account (ZBA)

A Zero Balance Account (ZBA) streamlines cash management by maintaining a zero balance and automatically transferring funds from a master account to cover disbursements, contrasting with Lockbox services which expedite receivables processing by collecting payments directly from customers. Sweep accounts continuously transfer excess funds between checking and investment accounts to optimize liquidity, whereas ZBA focuses on consolidating disbursements and reducing idle balances within a centralized system.

Account Reconciliation Services (ARS)

Account Reconciliation Services (ARS) streamline financial accuracy by automating the matching of payments received via Lockbox processing with Sweep Account transactions to ensure precise cash management and reduced reconciliation errors.

Wholesale Lockbox

Wholesale Lockbox services efficiently process high-volume payment collections, offering faster remittance compared to sweep accounts, which automatically transfer funds between accounts to optimize cash flow.

Retail Lockbox

Retail Lockbox streamlines payment processing by collecting customer payments directly from mail, whereas sweep accounts optimize cash flow by automatically transferring surplus funds between accounts.

Automated Clearing House (ACH)

Automated Clearing House (ACH) transactions facilitate efficient fund transfers in banking operations, where Lockbox services streamline receivables processing by collecting payments for immediate deposit, while Sweep Accounts automatically transfer excess funds between checking and investment accounts to optimize liquidity management.

Bank Transaction Automation

Bank transaction automation enhances cash flow management through digital processing of Lockbox and Sweep Account services; Lockbox automates receivable collections by directly depositing customer payments into a bank account, reducing manual handling and accelerating fund availability. Sweep Accounts optimize liquidity by automatically transferring excess funds from operating accounts into higher-interest investment accounts overnight, maximizing interest earnings while maintaining sufficient operational balance.

Liquidity Management

Lockbox services accelerate receivables processing by directly depositing customer payments into a bank account, while sweep accounts optimize liquidity by automatically transferring excess funds between checking and investment accounts to maximize interest earnings.

Lockbox vs Sweep Account Infographic

moneydif.com

moneydif.com