Window dressing involves short-term financial maneuvers to improve the appearance of a company's balance sheet at period-end, while liquidity management focuses on maintaining optimal cash flow for ongoing operational needs. Effective liquidity management ensures sufficient cash reserves to meet obligations without compromising investment opportunities, whereas window dressing may temporarily distort financial health indicators. Prioritizing liquidity management over window dressing supports sustainable treasury operations and accurate financial reporting.

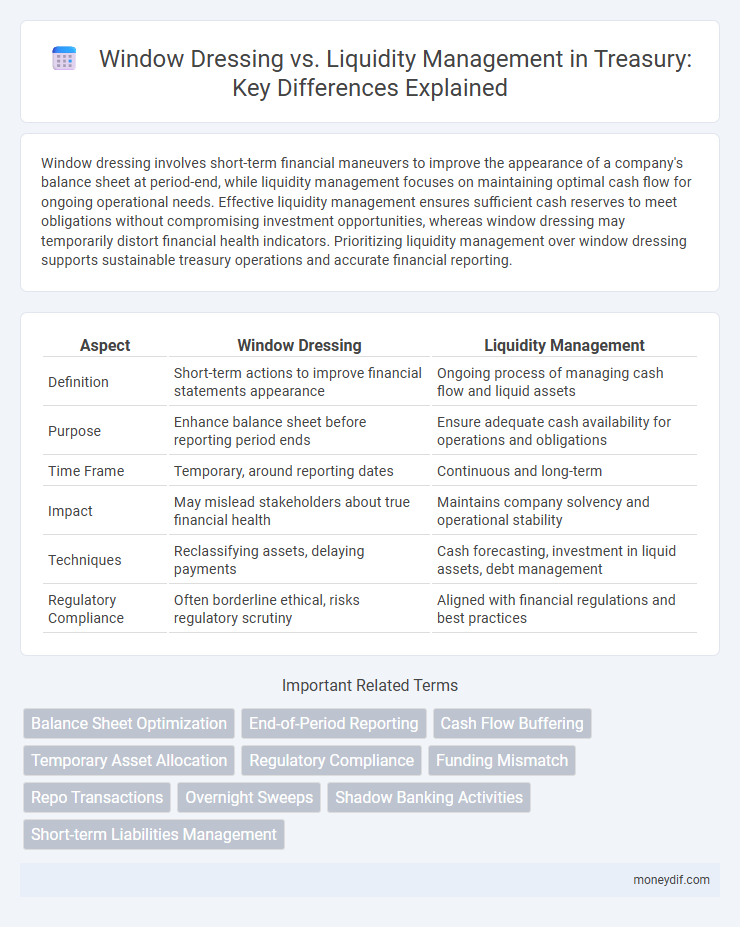

Table of Comparison

| Aspect | Window Dressing | Liquidity Management |

|---|---|---|

| Definition | Short-term actions to improve financial statements appearance | Ongoing process of managing cash flow and liquid assets |

| Purpose | Enhance balance sheet before reporting period ends | Ensure adequate cash availability for operations and obligations |

| Time Frame | Temporary, around reporting dates | Continuous and long-term |

| Impact | May mislead stakeholders about true financial health | Maintains company solvency and operational stability |

| Techniques | Reclassifying assets, delaying payments | Cash forecasting, investment in liquid assets, debt management |

| Regulatory Compliance | Often borderline ethical, risks regulatory scrutiny | Aligned with financial regulations and best practices |

Understanding Window Dressing in Treasury

Window dressing in treasury involves short-term financial tactics used by companies to enhance the appearance of their financial statements, often at the end of a reporting period. This practice typically includes manipulating cash balances, adjusting receivables and payables, or temporarily altering asset positions to present stronger liquidity or financial health. Unlike liquidity management, which focuses on optimizing cash flow and funding operations sustainably, window dressing prioritizes cosmetic improvements that may not reflect the company's ongoing financial stability.

Defining Liquidity Management for Treasurers

Liquidity management for treasurers involves maintaining optimal cash flow to meet short-term obligations while maximizing the use of available funds. It requires accurate forecasting of cash inflows and outflows, effective allocation of liquid assets, and ensuring access to credit facilities to avoid solvency risks. Unlike window dressing, which temporarily improves financial statements, liquidity management focuses on sustainable cash optimization and risk mitigation strategies.

Key Differences Between Window Dressing and Liquidity Management

Window dressing in treasury primarily aims to enhance the appearance of financial statements at period-end by temporarily altering asset or liability balances, often without sustainable impact on cash flow. Liquidity management focuses on maintaining sufficient cash or liquid assets to meet ongoing operational needs and obligations, ensuring financial stability and solvency. Key differences lie in their objectives: window dressing targets short-term presentation improvement, while liquidity management emphasizes long-term financial health and operational efficiency.

Objectives Behind Window Dressing Practices

Window dressing practices in treasury aim to enhance the appearance of financial statements by temporarily adjusting liquidity positions before reporting periods, creating an illusion of stronger cash reserves or improved working capital. These actions differ from liquidity management, which focuses on maintaining sufficient cash flow and ensuring operational continuity through real-time optimization of assets and liabilities. The primary objective behind window dressing is to influence stakeholder perceptions and meet external benchmarks, rather than achieving sustainable financial health.

Strategic Importance of Liquidity Management

Liquidity management plays a pivotal role in treasury by ensuring sufficient cash flow to meet short-term obligations and support operational stability, unlike window dressing which temporarily inflates financial statements to present a healthier balance sheet. Effective liquidity management enables businesses to optimize cash reserves, reduce financing costs, and enhance creditworthiness through precise cash forecasting and real-time monitoring of cash positions. Strategic liquidity management is essential for mitigating risks associated with market volatility and economic uncertainty, thereby sustaining long-term financial resilience and stakeholder confidence.

Regulatory Implications of Window Dressing

Window dressing in treasury involves manipulating financial statements or asset compositions near reporting dates to present a healthier liquidity position, which can mislead regulators and investors about the true financial health of the institution. Regulatory bodies such as the Basel Committee on Banking Supervision impose strict disclosure and liquidity coverage ratio requirements to prevent misleading practices and ensure transparent liquidity management. Non-compliance or detection of window dressing can result in significant regulatory sanctions, increased capital requirements, and damage to the institution's credibility.

Tools and Techniques for Effective Liquidity Management

Window dressing in treasury focuses on short-term balance sheet adjustments to improve financial appearance at period-end, often using temporary borrowing or delaying payments. Effective liquidity management employs tools such as cash flow forecasting, automated payment systems, and revolving credit facilities to ensure optimal cash availability. Techniques like scenario analysis and real-time liquidity monitoring enhance decision-making by providing actionable insights into cash positions and funding needs.

Risks Associated with Window Dressing

Window dressing in treasury involves manipulating financial statements near reporting dates to present a stronger liquidity position, which can obscure the true financial health and mislead stakeholders. This practice increases risks such as regulatory scrutiny, damaged reputations, and potential legal consequences due to misrepresentation. Unlike genuine liquidity management aimed at maintaining sustainable cash flow, window dressing prioritizes short-term appearance at the cost of long-term financial stability.

Enhancing Transparency in Treasury Operations

Window dressing in treasury involves short-term manipulation of financial statements to present a stronger liquidity position at period-end, which can obscure the true financial health. Liquidity management focuses on maintaining optimal cash flow and reserves to meet obligations, ensuring operational stability and accurate financial reporting. Enhancing transparency in treasury operations requires distinguishing these practices clearly, promoting consistent disclosure and real-time monitoring for better stakeholder confidence and regulatory compliance.

Best Practices for Sustainable Liquidity Management

Effective liquidity management requires consistent monitoring of cash flow forecasts, maintaining adequate buffer reserves, and establishing robust internal controls to prevent misleading financial appearances caused by window dressing. Best practices emphasize transparency, real-time data analytics, and alignment of liquidity policies with organizational risk tolerance to ensure sustainable liquidity beyond short-term reporting periods. Integrating scenario analysis and stress testing enhances resilience by preparing treasury functions for unexpected market fluctuations and liquidity shocks.

Important Terms

Balance Sheet Optimization

Balance sheet optimization strategically enhances financial health by balancing liquidity management and window dressing practices, ensuring accurate representation of assets and liabilities. Effective liquidity management focuses on sustaining cash flow and meeting short-term obligations, while avoiding unethical window dressing tactics that distort financial statements.

End-of-Period Reporting

End-of-period reporting often sees companies employing window dressing techniques to enhance financial statement appearances, temporarily inflating key liquidity metrics such as cash balances and current ratios. Effective liquidity management, by contrast, involves sustainably optimizing cash flows and working capital to ensure genuine financial health beyond misleading fluctuations at reporting dates.

Cash Flow Buffering

Cash flow buffering enhances liquidity management by maintaining adequate reserves to prevent misleading financial statements created through window dressing tactics.

Temporary Asset Allocation

Temporary asset allocation strategies balance window dressing tactics manipulating portfolio appearance near reporting dates and liquidity management ensuring sufficient cash flow for operational needs.

Regulatory Compliance

Regulatory compliance in financial reporting requires transparent disclosure of liquidity management practices, preventing window dressing tactics that obscure true fiscal health. Ensuring accurate representation of cash flow and liquid assets is crucial for meeting regulatory standards and maintaining investor trust.

Funding Mismatch

Funding mismatch occurs when short-term liabilities exceed the available liquid assets, creating pressure to meet immediate obligations and increasing financial risk. Window dressing manipulates balance sheets to appear solvent by temporarily boosting liquidity, whereas effective liquidity management ensures sustainable cash flow without relying on such artificial enhancements.

Repo Transactions

Repo transactions are strategically used in window dressing to temporarily enhance balance sheet appearance at quarter-end, whereas in liquidity management they serve to optimize short-term funding and cash flow stability.

Overnight Sweeps

Overnight sweeps strategically optimize window dressing by transferring idle funds into liquid accounts to enhance liquidity management and improve end-of-day balance sheet presentation.

Shadow Banking Activities

Shadow banking activities often involve window dressing techniques to temporarily enhance financial statements without improving actual liquidity, creating misleading perceptions of stability. Effective liquidity management in shadow banking requires transparent asset-liability matching to prevent sudden funding shortfalls and systemic risks.

Short-term Liabilities Management

Short-term liabilities management focuses on optimizing current obligations to improve financial ratios, often leading to window dressing practices that temporarily enhance balance sheets without real liquidity improvement. Effective liquidity management ensures sufficient cash flow to meet short-term liabilities sustainably, avoiding the risks associated with relying solely on cosmetic adjustments.

Window Dressing vs Liquidity Management Infographic

moneydif.com

moneydif.com