Treasury STRIPS are separate trading of registered interest and principal securities created by separating the coupon and principal payments of Treasury bonds, allowing investors to trade the individual components as zero-coupon securities. Each STRIP is identified by a unique CUSIP number, which serves as a standardized identifier for securities, facilitating efficient tracking and trading in the financial markets. Understanding the differences between STRIPS and their corresponding CUSIPs is essential for investors seeking precise management of interest rate risk and investment strategies in fixed-income portfolios.

Table of Comparison

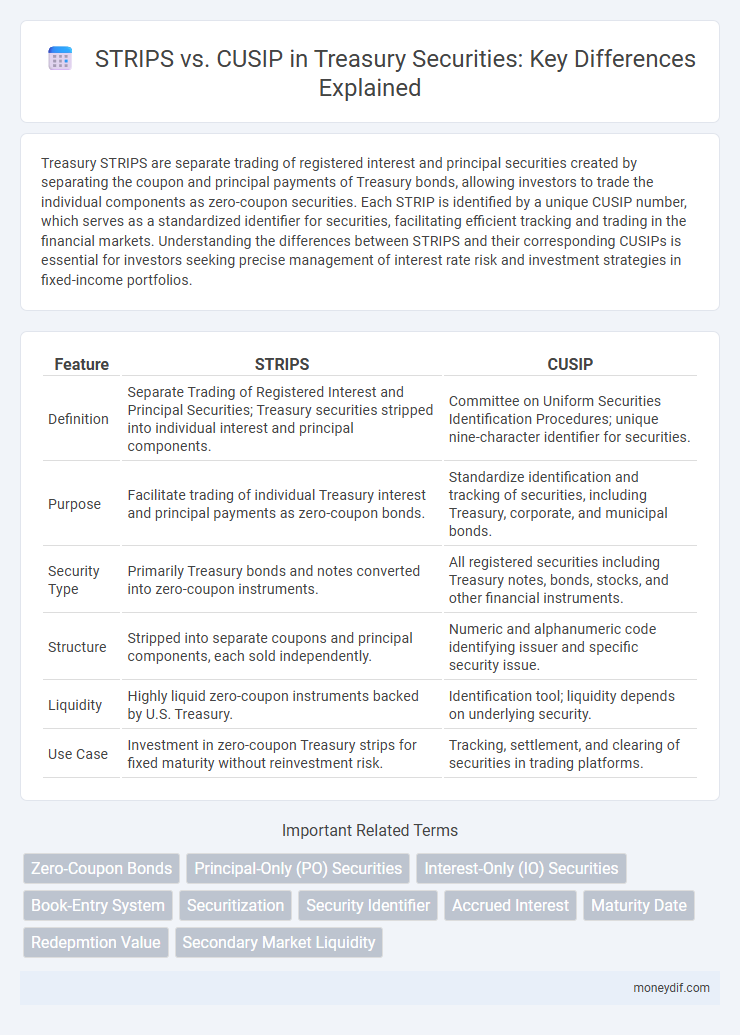

| Feature | STRIPS | CUSIP |

|---|---|---|

| Definition | Separate Trading of Registered Interest and Principal Securities; Treasury securities stripped into individual interest and principal components. | Committee on Uniform Securities Identification Procedures; unique nine-character identifier for securities. |

| Purpose | Facilitate trading of individual Treasury interest and principal payments as zero-coupon bonds. | Standardize identification and tracking of securities, including Treasury, corporate, and municipal bonds. |

| Security Type | Primarily Treasury bonds and notes converted into zero-coupon instruments. | All registered securities including Treasury notes, bonds, stocks, and other financial instruments. |

| Structure | Stripped into separate coupons and principal components, each sold independently. | Numeric and alphanumeric code identifying issuer and specific security issue. |

| Liquidity | Highly liquid zero-coupon instruments backed by U.S. Treasury. | Identification tool; liquidity depends on underlying security. |

| Use Case | Investment in zero-coupon Treasury strips for fixed maturity without reinvestment risk. | Tracking, settlement, and clearing of securities in trading platforms. |

Introduction to STRIPS and CUSIP

STRIPS (Separate Trading of Registered Interest and Principal Securities) are Treasury securities that allow investors to hold and trade individual interest and principal components separately, enhancing flexibility and targeting specific cash flow needs. Each STRIP is assigned a unique CUSIP (Committee on Uniform Securities Identification Procedures) number, a standardized identifier that facilitates precise tracking and trading of Treasury securities in financial markets. The combination of STRIPS and their CUSIP identifiers streamlines portfolio management and improves liquidity by enabling detailed differentiation and trade of Treasury bond components.

Defining STRIPS: Structure and Purpose

STRIPS (Separate Trading of Registered Interest and Principal Securities) are Treasury securities that have been separated into individual interest and principal components, allowing investors to trade these components independently. Each STRIP corresponds to an original Treasury bond or note, but is assigned its own unique CUSIP (Committee on Uniform Securities Identification Procedures) identifier to facilitate precise tracking and trading. The primary purpose of STRIPS is to provide zero-coupon investment options, enabling investors to lock in a fixed return by purchasing a bond stripped of periodic interest payments.

Understanding CUSIP: Identification and Usage

CUSIP, or Committee on Uniform Securities Identification Procedures, is a unique identifier assigned to financial instruments, including Treasury securities, facilitating efficient tracking and settlement. Unlike STRIPS, which represent separated principal and interest components of Treasury securities used for zero-coupon investments, CUSIPs serve as standardized codes ensuring precise identification of each security. Understanding CUSIP is essential for investors, brokers, and regulators to accurately manage transactions, portfolio allocations, and compliance in the Treasury market.

Key Differences Between STRIPS and CUSIP

STRIPS (Separate Trading of Registered Interest and Principal Securities) represent zero-coupon Treasury securities created by separating the interest and principal components of Treasury bonds or notes. CUSIP (Committee on Uniform Securities Identification Procedures) numbers are unique identifiers assigned to all registered securities, including Treasury STRIPS, to facilitate tracking and trading. The key difference is that STRIPS refers to a type of Treasury security product, whereas a CUSIP is an identification system used across all securities for accurate classification and settlement.

The Role of STRIPS in Treasury Securities

STRIPS (Separate Trading of Registered Interest and Principal Securities) transform Treasury bonds or notes into zero-coupon securities, allowing investors to purchase individual interest or principal components separately. Each STRIP has a unique CUSIP (Committee on Uniform Securities Identification Procedures) number, enabling precise tracking and trading in secondary markets. STRIPS enhance portfolio management by providing predictable, interest-free cash flows distinct from traditional coupon-paying Treasuries.

How CUSIP Codes Facilitate Treasury Transactions

CUSIP codes uniquely identify Treasury securities, streamlining the buying, selling, and tracking processes in financial markets. While STRIPS represent separate principal and interest components of Treasury bonds, CUSIP codes provide precise identification for each security, including STRIP components. This standardized system reduces transaction errors and enhances efficiency in Treasury operations and settlement processes.

Benefits of Investing in STRIPS

STRIPS, or Separate Trading of Registered Interest and Principal Securities, offer investors the advantage of zero-coupon bonds derived from U.S. Treasury securities, allowing for precise investment planning with fixed maturity payments. Unlike CUSIPs, which are identifiers for various securities, STRIPS provide predictable cash flows and eliminate reinvestment risk by paying a lump sum at maturity. This makes STRIPS particularly beneficial for long-term investors seeking guaranteed returns and portfolio diversification through Treasury-backed securities.

Importance of CUSIP in Treasury Market Transparency

CUSIP numbers provide a standardized identification system essential for seamless trading and settlement of Treasury securities, enabling precise tracking and reducing operational risks in the market. Unlike STRIPS, which represent separate principal and interest components of Treasury bonds, CUSIPs ensure transparency by offering unique identifiers for all Treasury instruments, facilitating price discovery and investor confidence. The uniform visibility granted by CUSIPs enhances liquidity and regulatory oversight, supporting a more efficient and transparent Treasury market environment.

STRIPS vs CUSIP: Risk and Return Considerations

STRIPS, or Separate Trading of Registered Interest and Principal Securities, represent zero-coupon Treasury securities sold at a deep discount, exposing investors to interest rate risk but offering predictable returns at maturity. CUSIP numbers uniquely identify Treasury securities, including STRIPS, facilitating trading and risk assessment without influencing the intrinsic risk or return profile. Investors seeking exposure to Treasury securities should evaluate STRIPS for their sensitivity to interest rate fluctuations and duration risk, while using CUSIP identifiers to manage portfolio holdings and verify security details efficiently.

Choosing Between STRIPS and CUSIP for Treasury Investments

STRIPS (Separate Trading of Registered Interest and Principal Securities) represent Treasury bonds or notes separated into individual interest and principal components, allowing investors to purchase zero-coupon securities with distinct maturities. CUSIP (Committee on Uniform Securities Identification Procedures) numbers uniquely identify securities, including Treasury issues, facilitating tracking and trading but not affecting the security's cash flow structure. Investors focused on precise cash flow timing and long-term, predictable returns often prefer STRIPS, while those prioritizing ease of trade and portfolio identification may favor CUSIP-labeled aggregated Treasury securities.

Important Terms

Zero-Coupon Bonds

Zero-coupon bonds are financial instruments that do not pay periodic interest but are instead issued at a discount and mature at face value, commonly represented by STRIPS (Separate Trading of Registered Interest and Principal of Securities) which allow the separation of principal and interest components of Treasury securities. CUSIP (Committee on Uniform Securities Identification Procedures) numbers uniquely identify these securities for trading and settlement, ensuring precise tracking and differentiation between various zero-coupon bonds including STRIPS.

Principal-Only (PO) Securities

Principal-Only (PO) Securities are a type of Treasury STRIPS identified by unique CUSIP numbers that distinguish them from other Treasury securities by representing only the principal repayments without interest payments.

Interest-Only (IO) Securities

Interest-Only (IO) securities are a type of mortgage-backed security derived from the interest portion of mortgage payments, often structured through STRIPS to isolate and trade interest cash flows separately from principal. Unlike CUSIP numbers that serve as unique identifiers for securities including IO securities, STRIPS represent the actual underlying components split into interest-only and principal-only parts, facilitating targeted investment strategies in interest cash flows.

Book-Entry System

The Book-Entry System uses unique identifiers like CUSIP for securities, whereas STRIPS represent separate principal and interest components of Treasury securities without traditional CUSIP numbers.

Securitization

Securitization transforms financial assets into tradable securities, with STRIPS representing separated principal and interest components of Treasury bonds identified by unique CUSIP numbers for precise tracking and trading.

Security Identifier

Security Identifiers like CUSIP and STRIPS uniquely identify financial instruments, with CUSIP codes used primarily for corporate and municipal bonds, stocks, and other registered securities in the U.S. while STRIPS represent separate interest and principal components of U.S. Treasury bonds, identified by specific CUSIP numbers assigned to each zero-coupon security.

Accrued Interest

Accrued interest on STRIPS is zero because they are zero-coupon securities separated from CUSIP-identified underlying bonds that accumulate interest until maturity.

Maturity Date

STRIPS are zero-coupon Treasury securities with maturity dates linked to their underlying CUSIP numbers, enabling precise tracking and valuation until maturity.

Redepmtion Value

Redemption value for STRIPS represents the fixed amount paid at maturity based on the stripped Treasury security's face value, while CUSIP identifies specific securities including redeemed bonds but does not directly indicate redemption value. STRIPS provide a clear, predetermined redemption value tied to zero-coupon Treasury securities, whereas CUSIP serves primarily as an alphanumeric identifier for tracking and settlement purposes.

Secondary Market Liquidity

Secondary market liquidity for STRIPS often differs from that of CUSIPs, as STRIPS are zero-coupon securities derived from Treasury bonds with separate principal and interest components, leading to varied trading volumes and price transparency. CUSIPs, being standard identifiers for a broader range of securities, typically exhibit higher liquidity due to widespread recognition and ease of tracking in secondary markets.

STRIPS vs CUSIP Infographic

moneydif.com

moneydif.com