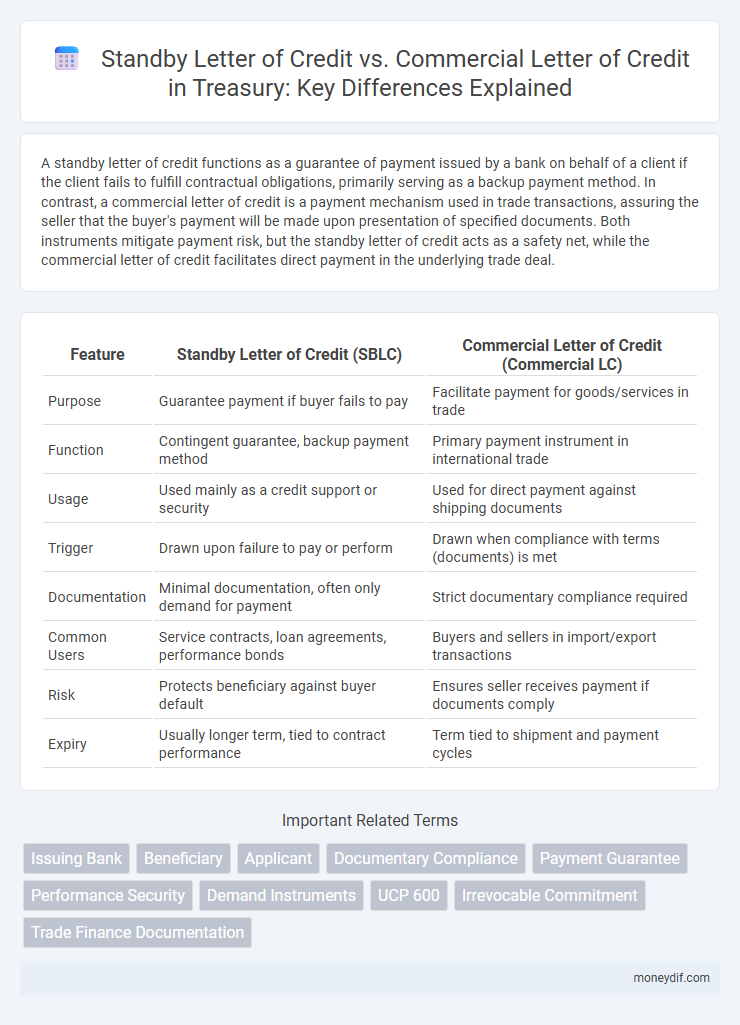

A standby letter of credit functions as a guarantee of payment issued by a bank on behalf of a client if the client fails to fulfill contractual obligations, primarily serving as a backup payment method. In contrast, a commercial letter of credit is a payment mechanism used in trade transactions, assuring the seller that the buyer's payment will be made upon presentation of specified documents. Both instruments mitigate payment risk, but the standby letter of credit acts as a safety net, while the commercial letter of credit facilitates direct payment in the underlying trade deal.

Table of Comparison

| Feature | Standby Letter of Credit (SBLC) | Commercial Letter of Credit (Commercial LC) |

|---|---|---|

| Purpose | Guarantee payment if buyer fails to pay | Facilitate payment for goods/services in trade |

| Function | Contingent guarantee, backup payment method | Primary payment instrument in international trade |

| Usage | Used mainly as a credit support or security | Used for direct payment against shipping documents |

| Trigger | Drawn upon failure to pay or perform | Drawn when compliance with terms (documents) is met |

| Documentation | Minimal documentation, often only demand for payment | Strict documentary compliance required |

| Common Users | Service contracts, loan agreements, performance bonds | Buyers and sellers in import/export transactions |

| Risk | Protects beneficiary against buyer default | Ensures seller receives payment if documents comply |

| Expiry | Usually longer term, tied to contract performance | Term tied to shipment and payment cycles |

Overview of Standby and Commercial Letters of Credit

Standby letters of credit (SBLC) function as a payment guarantee ensuring the beneficiary receives funds only if the applicant defaults, primarily supporting non-performance or financial risk mitigation. Commercial letters of credit (LC) facilitate trade transactions by guaranteeing payment against the presentation of specified shipping documents, directly supporting the exchange of goods and services. Both instruments serve as critical tools in treasury management to mitigate counterparty risk and ensure payment security in domestic and international trade.

Key Differences Between Standby and Commercial Letters of Credit

A Standby Letter of Credit (SBLC) serves as a financial safety net, ensuring payment only if the buyer fails to fulfill contractual obligations, primarily used for guarantees or contingencies. In contrast, a Commercial Letter of Credit (CLC) functions as a direct payment mechanism for goods or services, facilitating international trade by assuring the seller receives payment upon presenting specified documents. The key differences lie in their purpose: SBLC acts as a backup guarantee, while CLC acts as a primary payment instrument in trade transactions.

How Standby Letters of Credit Work in Treasury

Standby Letters of Credit (SBLCs) function as a financial safety net in treasury operations, providing assurance of payment if the applicant defaults on contractual obligations. Unlike Commercial Letters of Credit, which facilitate direct payment for goods or services, SBLCs serve as a contingency instrument, activated only upon non-performance or failure to pay. Treasury departments utilize SBLCs to mitigate credit risk and enhance liquidity management by ensuring third-party obligations are backed by irrevocable guarantees from financial institutions.

Role of Commercial Letters of Credit in International Trade

Commercial Letters of Credit serve as a critical payment guarantee mechanism in international trade, providing exporters with assurance of timely payment upon fulfilling agreed shipment conditions. These instruments mitigate risks associated with cross-border transactions by involving reputable banks that verify compliance with contract terms before releasing funds. Their role enhances trust between trading partners, facilitates smoother transaction flows, and supports global supply chain reliability.

Risks Associated with Each Type of Letter of Credit

Standby letters of credit (SBLC) carry risks primarily related to fraud and payment disputes, as they function as a guarantee for payment if the buyer defaults, leaving the issuer exposed to claims without proper documentation. Commercial letters of credit (LC) involve risks tied to discrepancies in shipment documents and compliance issues, which can delay or prevent payment if terms are not strictly met. Both instruments require vigilant risk assessment, but SBLCs often demand stricter monitoring of underlying contracts, while commercial LCs depend heavily on precise document conformity to mitigate financial exposure.

Documentation Requirements for Standby vs Commercial Letters of Credit

Standby letters of credit (SBLC) typically require minimal documentation, often limited to a demand for payment accompanied by specified supporting documents, such as a statement of default or non-performance. Commercial letters of credit (LC) demand extensive documentation, including invoices, bills of lading, insurance certificates, and inspection reports, to prove shipment and compliance with contract terms. The stringent documentary compliance in commercial LCs contrasts with the more straightforward and demand-driven nature of SBLC documentation requirements.

Cost Comparison: Standby vs Commercial Letters of Credit

Standby letters of credit (SBLC) generally carry higher issuance fees, ranging from 0.5% to 3% annually, reflecting their role as a payment guarantee rather than a payment mechanism. Commercial letters of credit typically have lower cost structures, with fees around 0.25% to 1% per transaction, as they facilitate direct payment for goods or services. The overall cost comparison depends on usage frequency, credit risk, and transaction value, with standby letters often incurring additional administrative expenses due to their contingency nature.

Typical Use Cases in Corporate Treasury

Standby letters of credit (SBLCs) serve as secondary payment guarantees, commonly used in corporate treasury for risk mitigation in transactions such as securing performance bonds or ensuring payment in lease agreements. Commercial letters of credit (LCs) primarily facilitate international trade by guaranteeing payment to exporters upon presentation of prescribed shipping documents, streamlining cash flow and reducing counterparty risk. Treasury teams leverage SBLCs for credit support in financial arrangements, while commercial LCs are vital for managing trade finance operations and optimizing working capital in cross-border deals.

Choosing the Right Letter of Credit for Treasury Objectives

Selecting the appropriate letter of credit in treasury management hinges on understanding the distinct functions of Standby Letters of Credit (SBLC) and Commercial Letters of Credit (LC). SBLCs serve as a financial safety net, guaranteeing payment if the applicant defaults, making them ideal for risk mitigation in contingent liabilities. Commercial LCs facilitate direct payment for goods and services upon compliance with specified terms, supporting cash flow optimization and transaction security in trade finance.

Best Practices for Managing Letters of Credit in Treasury

Effective management of letters of credit (LCs) in treasury requires understanding the distinctions between standby letters of credit (SBLC) and commercial letters of credit (Commercial LC). SBLCs serve as a payment guarantee, activated only upon default, while Commercial LCs facilitate immediate payment against shipment documents. Best practices include rigorous documentation verification, maintaining clear expiration dates, and ensuring proper coordination with banks to mitigate financial risk and optimize liquidity management.

Important Terms

Issuing Bank

The issuing bank guarantees payment in a standby letter of credit as a backup security, whereas in a commercial letter of credit it directly facilitates payment upon presentation of compliant trade documents.

Beneficiary

The beneficiary in a Standby Letter of Credit receives payment only upon default or non-performance of contractual obligations, whereas in a Commercial Letter of Credit, the beneficiary is paid upon presenting compliant shipping and transaction documents.

Applicant

An applicant in a standby letter of credit (SBLC) guarantees payment if the beneficiary fails to fulfill contractual obligations, serving as a financial safety net in transactions. In a commercial letter of credit (LC), the applicant requests the issuing bank to pay the beneficiary upon presentation of specified documents, facilitating trade by assuring payment upon shipment or delivery.

Documentary Compliance

Documentary compliance in standby letters of credit ensures the beneficiary meets strict proof of non-performance or default, unlike commercial letters of credit which prioritize delivery documents confirming shipment and payment obligations. The specific document requirements in standby letters of credit focus on presenting demand guarantees, affidavits, or certificates, whereas commercial letters of credit demand bills of lading, invoices, and inspection certificates to facilitate trade finance transactions.

Payment Guarantee

A Payment Guarantee through a Standby Letter of Credit ensures secondary payment security if the buyer defaults, while a Commercial Letter of Credit serves as a primary payment method for international trade transactions.

Performance Security

Performance Security through a Standby Letter of Credit guarantees contractual obligations by providing payment upon default, while a Commercial Letter of Credit primarily facilitates payment for goods or services upon compliance with shipment terms.

Demand Instruments

Demand Instruments specialize in facilitating faster, more secure Standby Letters of Credit that provide payment guarantees compared to Commercial Letters of Credit, which primarily support transaction-based payments.

UCP 600

UCP 600 governs Commercial Letters of Credit, providing standardized rules for their issuance and negotiation, whereas Standby Letters of Credit are typically governed by the ICC's ISP98 or local laws and serve as a payment guarantee rather than a primary payment method. Commercial Letters of Credit ensure payment upon presentation of compliant documents for trade transactions, while Standby Letters of Credit act as a backup payment if the applicant fails to fulfill contractual obligations.

Irrevocable Commitment

An irrevocable commitment in a standby letter of credit (SBLC) guarantees payment upon presentation of specified documents or default, ensuring security beyond commercial transactions, while a commercial letter of credit (LC) facilitates payment specifically for the purchase and shipment of goods or services. The SBLC serves as a backup payment mechanism with strict conditions, whereas the commercial LC acts as the primary payment instrument within trade finance.

Trade Finance Documentation

Trade finance documentation for a Standby Letter of Credit (SBLC) primarily serves as a guarantee of payment in case of default, with documents focusing on compliance with terms like non-performance or breach of contract. In contrast, Commercial Letters of Credit require comprehensive shipping and trade documents such as bills of lading, commercial invoices, and insurance policies to facilitate direct payment upon presentation of conforming documents.

Standby letter of credit vs Commercial letter of credit Infographic

moneydif.com

moneydif.com