Direct bidders submit bids for Treasury securities without intermediaries, often representing their own accounts, while competitive bidders specify the yield or price they are willing to accept. Competitive bidders, typically large financial institutions, compete directly against other bidders, with awards made to those offering the lowest yield. This distinction affects access, bid strategy, and the likelihood of obtaining desired Treasury issues.

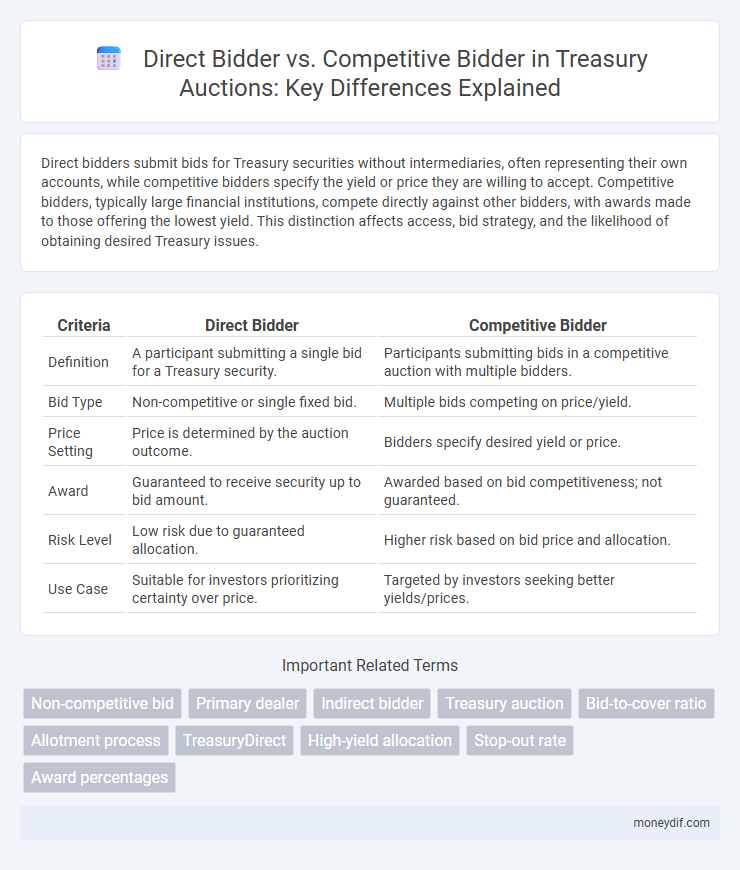

Table of Comparison

| Criteria | Direct Bidder | Competitive Bidder |

|---|---|---|

| Definition | A participant submitting a single bid for a Treasury security. | Participants submitting bids in a competitive auction with multiple bidders. |

| Bid Type | Non-competitive or single fixed bid. | Multiple bids competing on price/yield. |

| Price Setting | Price is determined by the auction outcome. | Bidders specify desired yield or price. |

| Award | Guaranteed to receive security up to bid amount. | Awarded based on bid competitiveness; not guaranteed. |

| Risk Level | Low risk due to guaranteed allocation. | Higher risk based on bid price and allocation. |

| Use Case | Suitable for investors prioritizing certainty over price. | Targeted by investors seeking better yields/prices. |

Understanding Direct Bidders in Treasury Auctions

Direct bidders in Treasury auctions submit bids on their own behalf without intermediaries, allowing for greater control over investment decisions and pricing. Unlike competitive bidders who must specify yield or discount rate, direct bidders often participate non-competitively by agreeing to accept the yield determined at auction, ensuring full allotment of the securities. This method benefits individual investors and smaller institutions seeking guaranteed Treasury allocations without the risk of bid rejection.

The Role of Competitive Bidders in Treasury Markets

Competitive bidders play a crucial role in Treasury markets by submitting sealed bids that specify both the price and quantity of securities desired, ensuring an efficient price discovery process. Their participation enhances market liquidity and promotes transparency, leading to accurate pricing of government debt instruments. Unlike direct bidders who accept the yield determined by the auction, competitive bidders influence the final auction yield through their bid submissions, directly impacting Treasury funding costs.

Key Differences Between Direct and Competitive Bidders

Direct bidders purchase treasury securities straight from the government during auctions, ensuring guaranteed allocation without intermediaries, while competitive bidders submit specific yield bids and may receive partial or no allocation depending on auction demand. Direct bidding offers predictable pricing at the established yield, whereas competitive bidding involves price uncertainty and potential for higher or lower yields based on market competition. Understanding these differences is crucial for investors aiming to optimize returns and risk exposure in treasury auctions.

How Treasury Securities Are Auctioned: An Overview

Treasury securities are auctioned through two primary methods: competitive bidding and non-competitive bidding. Competitive bidders specify the yield or discount rate they are willing to accept, and securities are awarded to the lowest yield bids until the offering amount is met, while non-competitive bidders agree to accept the yield determined at auction. Direct bidders participate by submitting competitive bids directly to the Treasury, bypassing intermediaries, which can lead to greater control over pricing and allocation during the auction process.

Advantages of Direct Bidding in Treasury Auctions

Direct bidding in Treasury auctions offers advantages such as eliminating intermediaries, which reduces transaction costs and enhances control over the bidding process. This approach allows bidders to submit offers directly to the Treasury, improving transparency and immediate access to auction results. Furthermore, direct bidders can optimize their strategies based on real-time market information, potentially securing better yields on government securities.

Benefits and Risks of Competitive Bidding

Competitive bidding in Treasury auctions enables multiple bidders to submit price and quantity proposals, fostering market-driven yields and enhancing price discovery efficiency. This process benefits the government by potentially lowering borrowing costs through increased competition but introduces risks such as bid shading and winner's curse, where aggressive bids may lead to suboptimal returns or market volatility. Although competitive bidding promotes transparency, it requires bidders to accurately assess market conditions to avoid adverse financial outcomes.

Eligibility Requirements for Direct and Competitive Bidders

Direct bidders must meet strict eligibility requirements including strong creditworthiness, sufficient capital reserves, and regulatory approvals to participate directly in Treasury auctions. Competitive bidders are usually institutional investors or authorized intermediaries who meet criteria such as federal registration, compliance with market conduct rules, and demonstrated financial capacity to submit matched bids. Both bidder categories require adherence to Treasury's anti-fraud policies and timely submission of bid guarantees to ensure eligibility and auction integrity.

Impact on Treasury Yield and Market Liquidity

Direct bidders, typically large institutional investors, submit bids directly to the Treasury, leading to stronger demand and potentially lower yields due to reduced intermediary costs. Competitive bidders, including brokers and dealers, drive price discovery and enhance market liquidity by facilitating broader participation and secondary market trading. The presence of both bidding types helps maintain balanced Treasury yields and robust market liquidity, ensuring efficient government debt issuance and investor confidence.

Historical Trends: Direct vs. Competitive Bidding

Historical trends in Treasury auctions reveal a significant increase in direct bidding participation, reflecting a shift towards greater involvement from individual investors and non-dealer entities. Competitive bidding remains dominant among primary dealers and institutional investors, but direct bidders account for a growing share of auction awards, especially in Treasury bills and notes. This trend highlights the evolving dynamics of market access and the diversification of bidder categories over recent decades.

Strategic Considerations for Treasury Auction Participants

Direct bidders submit bids for Treasury securities without intermediaries, allowing greater control over pricing and allocation, which supports tailored investment strategies and risk management. Competitive bidders, often institutions using brokers, rely on market mechanisms to set prices and quantities, facilitating liquidity and broad market participation. Treasury auction participants strategically choose between direct and competitive bidding based on factors like cost efficiency, market access, and portfolio diversification goals.

Important Terms

Non-competitive bid

A non-competitive bid guarantees allocation at the average winning price without price competition, while direct bidders submit competitive bids specifying quantities and prices to potentially acquire securities below market rates.

Primary dealer

Primary dealers act as intermediaries in government securities auctions, enabling both direct bidders who submit bids on their own behalf and competitive bidders who participate through these dealers to acquire debt instruments.

Indirect bidder

An indirect bidder participates in a bidding process by leveraging intermediaries or partners, distinguishing it from a direct bidder who submits proposals personally and a competitive bidder who actively contends in open auctions or tenders. Understanding the distinctions among indirect, direct, and competitive bidders is crucial for evaluating procurement strategies, pricing dynamics, and market competition in industries such as construction, government contracts, and supply chain management.

Treasury auction

In Treasury auctions, direct bidders submit competitive bids specifying quantities and prices, aiming to secure securities at their bid price, while competitive bidders may submit non-competitive bids accepting the auction's final yield without specifying price.

Bid-to-cover ratio

The bid-to-cover ratio measures demand in auctions, where a higher ratio indicates stronger competition; direct bidders often submit fewer but larger bids, while competitive bidders typically place numerous smaller bids to increase winning chances. Understanding the distinction between direct and competitive bidders helps analyze bidding strategies and auction outcomes in financial markets.

Allotment process

The allotment process differentiates between direct bidders, who receive shares at a fixed price without bidding, and competitive bidders, who submit bids at varying prices, with shares allocated based on bid price and demand.

TreasuryDirect

TreasuryDirect allows investors to participate as direct bidders purchasing U.S. Treasury securities at non-competitive bids, while competitive bidders submit sealed bids specifying the yield they are willing to accept, with allocations determined by auction results.

High-yield allocation

High-yield allocation favors direct bidders over competitive bidders by prioritizing bids with higher credit risk tolerance and yield expectations in fixed-income securities auctions.

Stop-out rate

The stop-out rate of direct bidders typically surpasses that of competitive bidders due to their stronger market insights and bidding strategies.

Award percentages

Direct bidders secure awards at a significantly higher percentage rate than competitive bidders, often exceeding 70% compared to competitive bidders' 45-55% success rates in public procurement processes.

Direct bidder vs Competitive bidder Infographic

moneydif.com

moneydif.com