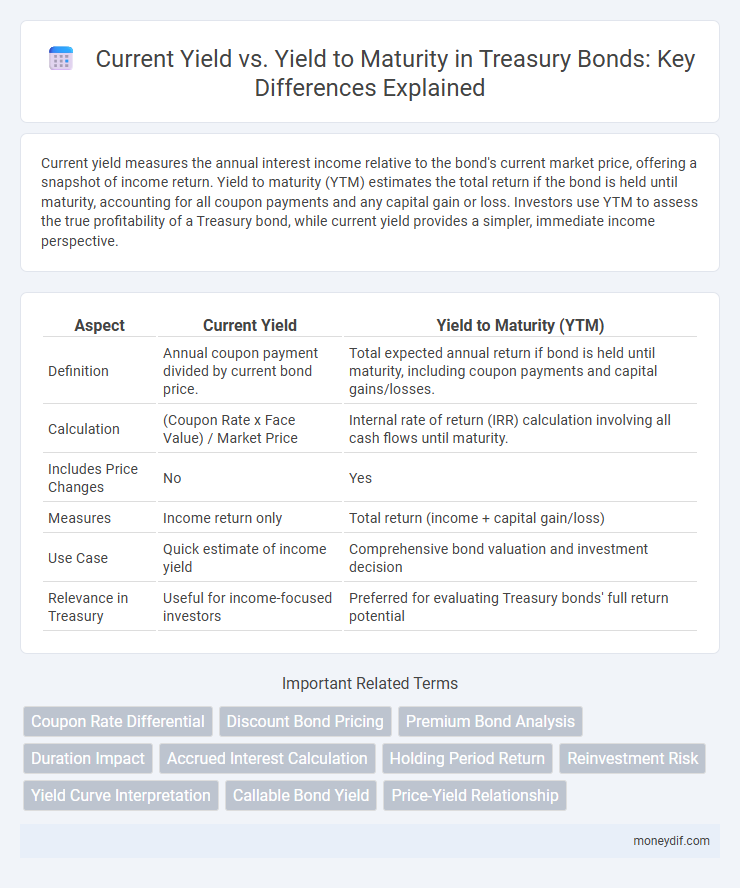

Current yield measures the annual interest income relative to the bond's current market price, offering a snapshot of income return. Yield to maturity (YTM) estimates the total return if the bond is held until maturity, accounting for all coupon payments and any capital gain or loss. Investors use YTM to assess the true profitability of a Treasury bond, while current yield provides a simpler, immediate income perspective.

Table of Comparison

| Aspect | Current Yield | Yield to Maturity (YTM) |

|---|---|---|

| Definition | Annual coupon payment divided by current bond price. | Total expected annual return if bond is held until maturity, including coupon payments and capital gains/losses. |

| Calculation | (Coupon Rate x Face Value) / Market Price | Internal rate of return (IRR) calculation involving all cash flows until maturity. |

| Includes Price Changes | No | Yes |

| Measures | Income return only | Total return (income + capital gain/loss) |

| Use Case | Quick estimate of income yield | Comprehensive bond valuation and investment decision |

| Relevance in Treasury | Useful for income-focused investors | Preferred for evaluating Treasury bonds' full return potential |

Understanding Current Yield and Yield to Maturity

Current yield measures the annual income (interest or dividends) earned from a bond relative to its current market price, providing a snapshot of return based on the bond's coupon payments. Yield to maturity (YTM) represents the total expected return if the bond is held until maturity, accounting for all coupon payments and any capital gain or loss. Understanding both metrics is essential for treasury professionals to assess bond investment profitability and make informed decisions in portfolio management.

Key Differences Between Current Yield and Yield to Maturity

Current yield calculates the annual income of a Treasury bond as a percentage of its current market price, focusing solely on interest payments. Yield to maturity (YTM) represents the total return an investor expects if the bond is held until maturity, integrating coupon payments and any capital gain or loss. YTM accounts for the time value of money and provides a more comprehensive measure of a Treasury bond's profitability compared to current yield.

Calculating Current Yield: Formula and Example

Current Yield is calculated by dividing the annual coupon payment by the bond's current market price, reflecting the return an investor expects if holding the bond for a year. For example, a Treasury bond with a $50 annual coupon and a market price of $1,000 has a Current Yield of 5% ($50 / $1,000). This measure helps investors assess income relative to the investment cost, distinct from Yield to Maturity, which considers total returns including capital gains or losses over the bond's life.

Yield to Maturity: Definition and Calculation

Yield to Maturity (YTM) represents the total return an investor can expect if a bond is held until it matures, accounting for all coupon payments and the difference between the purchase price and the face value. The YTM calculation involves solving for the discount rate that equates the present value of all future cash flows--coupon payments and principal repayment--to the bond's current market price. This metric provides a comprehensive measure of a bond's profitability, making it critical for comparing bonds with different maturities and coupon rates in Treasury portfolio management.

Factors Influencing Current Yield and Yield to Maturity

Current Yield is influenced primarily by the bond's annual coupon payment relative to its current market price, making it sensitive to price fluctuations and interest rate changes. Yield to Maturity (YTM) incorporates not only the coupon payments but also the capital gains or losses incurred if the bond is held to maturity, reflecting the total return including reinvestment of coupons. Factors such as bond price, coupon rate, time to maturity, and prevailing interest rates collectively impact both Current Yield and YTM, with YTM providing a more comprehensive measure of potential investment return.

Importance of Yield Metrics in Treasury Investing

Current Yield measures the annual income of a Treasury security relative to its current market price, providing a snapshot of income potential. Yield to Maturity (YTM) accounts for total return, incorporating interest payments and capital gain or loss if held to maturity, essential for assessing true profitability. Understanding both metrics enables investors to evaluate income consistency and long-term investment value, optimizing portfolio allocation in Treasury securities.

Current Yield vs Yield to Maturity: Pros and Cons

Current yield highlights the annual income relative to the bond's market price, offering a straightforward measure for investors seeking immediate income comparison. Yield to maturity (YTM) provides a comprehensive return estimate by accounting for all coupon payments and the difference between the purchase price and par value if held to maturity. While current yield excels in simplicity and immediate income assessment, YTM delivers a more accurate total return projection but requires more complex calculations and assumptions about reinvestment rates.

Impact of Market Interest Rates on Treasury Yields

Current yield reflects the annual coupon income relative to the Treasury bond's current market price, providing a snapshot of income return without accounting for bond maturity. Yield to maturity (YTM) considers total returns including coupon payments and capital gains or losses, fully capturing the impact of fluctuating market interest rates on Treasury prices and returns. When market interest rates rise, Treasury prices fall, causing current yield to increase while YTM adjusts to reflect the overall expected return if held to maturity.

Practical Applications: When to Use Each Yield Measure

Current yield is practical for investors seeking a quick snapshot of the income return relative to a bond's current price, especially in evaluating short-term income potential from Treasury securities. Yield to maturity (YTM) provides a comprehensive measure accounting for total returns if the bond is held until maturity, making it essential for long-term investment decisions and comparing bonds with varying maturities and coupons. Treasury portfolio managers use current yield to assess immediate cash flow while relying on YTM to project total earnings and make informed buy-and-hold strategies.

Choosing the Right Yield Metric for Treasury Analysis

Current yield measures the annual coupon payment divided by the bond's current market price, providing a snapshot of income relative to investment cost. Yield to maturity (YTM) incorporates total returns, including coupon payments and capital gains or losses if held to maturity, offering a comprehensive profitability estimate. Investors analyzing Treasury securities should prioritize YTM for long-term investment decisions, while current yield suits quick income-focused assessments.

Important Terms

Coupon Rate Differential

Coupon rate differential significantly impacts the relationship between current yield and yield to maturity, as a higher coupon rate increases current yield relative to yield to maturity on a bond trading at par or premium.

Discount Bond Pricing

Discount bond pricing reflects a bond trading below its face value due to its coupon rate being lower than prevailing interest rates, causing the current yield to be higher than the coupon rate but typically lower than the yield to maturity (YTM). Yield to maturity accounts for total returns, including capital gains realized when the bond matures at par value, making it a more comprehensive measure compared to current yield, which only considers annual coupon income relative to the bond's current market price.

Premium Bond Analysis

Premium bonds typically exhibit a current yield higher than their yield to maturity due to the premium price paid above face value and the amortization of that premium over the bond's remaining life.

Duration Impact

Duration Impact measures bond price sensitivity to interest rate changes, where Current Yield reflects annual income relative to price, while Yield to Maturity accounts for total expected return including coupon payments and capital gains or losses.

Accrued Interest Calculation

Accrued interest calculation impacts bond pricing by representing the interest accumulated between coupon payments, affecting transactions in the secondary market. Current yield measures annual coupon income relative to price, while yield to maturity accounts for total returns including accrued interest, reflecting a bond's complete profitability if held to maturity.

Holding Period Return

Holding Period Return measures total investment gains over a specific period, directly comparing current yield's income focus with yield to maturity's comprehensive total return forecast.

Reinvestment Risk

Reinvestment risk arises when the current yield on a bond exceeds its yield to maturity, indicating that future coupon payments may have to be reinvested at lower interest rates, potentially reducing overall returns. This risk is particularly significant for bonds with high current yields but declining yield to maturity, affecting income-focused investors seeking stable cash flows.

Yield Curve Interpretation

Yield to Maturity reflects total bond returns assuming holding to maturity, while Current Yield measures annual income relative to price, making YTM a more comprehensive indicator for yield curve interpretation.

Callable Bond Yield

Callable bond yield often exceeds current yield and yield to maturity due to the issuer's option to redeem the bond before maturity, impacting investor returns and risk assessments.

Price-Yield Relationship

The Price-Yield relationship shows that as bond prices increase, current yield decreases while yield to maturity reflects the total return considering price, coupon, and time to maturity.

Current Yield vs Yield to Maturity Infographic

moneydif.com

moneydif.com