Treasury Inflation-Protected Securities (TIPS) offer investors protection against inflation by adjusting the principal based on changes in the Consumer Price Index, providing guaranteed real returns. Floating Rate Notes (FRNs) feature variable interest rates tied to short-term treasury bill yields, making them less sensitive to interest rate fluctuations and more adaptive to changing market conditions. Choosing between TIPS and FRNs depends on an investor's inflation outlook and interest rate risk tolerance.

Table of Comparison

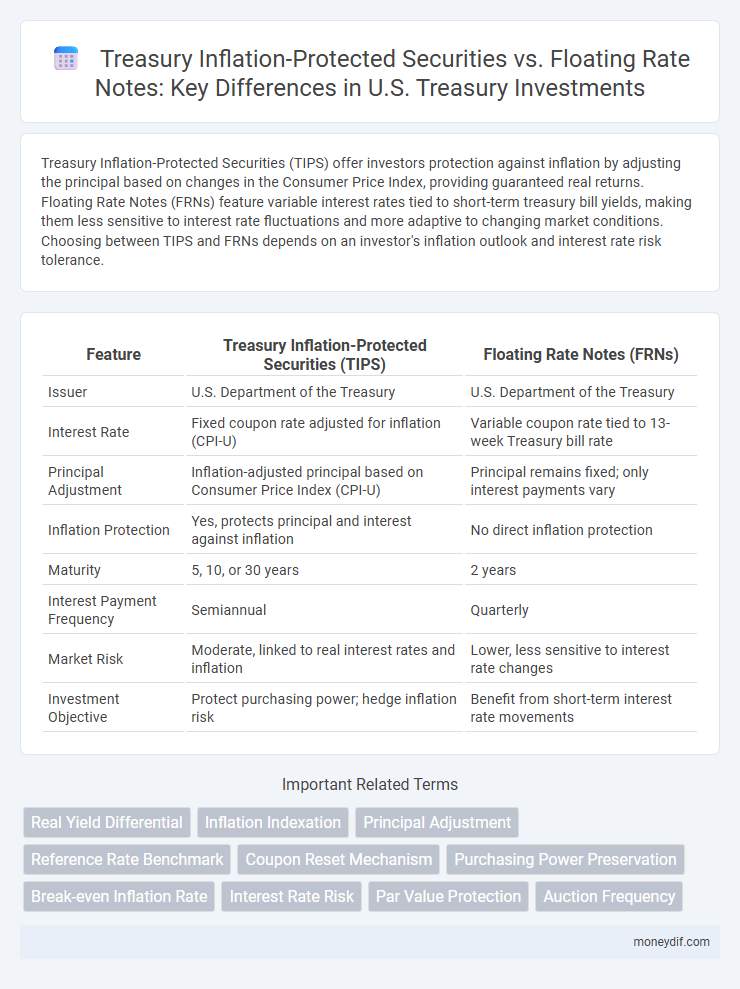

| Feature | Treasury Inflation-Protected Securities (TIPS) | Floating Rate Notes (FRNs) |

|---|---|---|

| Issuer | U.S. Department of the Treasury | U.S. Department of the Treasury |

| Interest Rate | Fixed coupon rate adjusted for inflation (CPI-U) | Variable coupon rate tied to 13-week Treasury bill rate |

| Principal Adjustment | Inflation-adjusted principal based on Consumer Price Index (CPI-U) | Principal remains fixed; only interest payments vary |

| Inflation Protection | Yes, protects principal and interest against inflation | No direct inflation protection |

| Maturity | 5, 10, or 30 years | 2 years |

| Interest Payment Frequency | Semiannual | Quarterly |

| Market Risk | Moderate, linked to real interest rates and inflation | Lower, less sensitive to interest rate changes |

| Investment Objective | Protect purchasing power; hedge inflation risk | Benefit from short-term interest rate movements |

Introduction to Treasury Inflation-Protected Securities (TIPS)

Treasury Inflation-Protected Securities (TIPS) are U.S. government bonds designed to protect investors from inflation by adjusting the principal value based on changes in the Consumer Price Index (CPI). Unlike Floating Rate Notes (FRNs), which have variable interest rates tied to short-term Treasury bill yields, TIPS offer a fixed interest rate applied to the inflation-adjusted principal, ensuring real return preservation. TIPS issuances provide a reliable hedge against inflation risk, making them a preferred tool for conservative investors seeking inflation-protected income streams.

Understanding Floating Rate Notes (FRNs)

Floating Rate Notes (FRNs) issued by the U.S. Treasury feature interest payments that adjust based on changes in short-term interest rates, specifically the 13-week Treasury bill auction rate. Unlike Treasury Inflation-Protected Securities (TIPS), which adjust principal based on inflation, FRNs offer protection against rising interest rates by varying coupon rates, making them attractive in volatile rate environments. FRNs typically have a maturity of two years, providing investors with a lower interest rate risk compared to fixed-rate securities.

Key Features: TIPS vs Floating Rate Notes

Treasury Inflation-Protected Securities (TIPS) offer principal adjustments based on changes in the Consumer Price Index, providing investors protection against inflation by increasing both principal and interest payments. Floating Rate Notes (FRNs) have variable interest rates linked to the discount rate of 13-week Treasury bills, resulting in coupon payments that adjust quarterly to reflect current market rates. TIPS ensure inflation-adjusted returns over their 5, 10, or 30-year maturities, while FRNs provide interest rate risk mitigation through their floating coupons with a typical 2-year maturity.

How TIPS Protect Against Inflation

Treasury Inflation-Protected Securities (TIPS) safeguard investors by adjusting their principal value based on changes in the Consumer Price Index, ensuring returns keep pace with inflation. In contrast, Floating Rate Notes (FRNs) offer interest payments tied to short-term Treasury bill yields, providing some interest rate risk mitigation but lacking direct inflation protection. TIPS effectively preserve purchasing power during inflationary periods by increasing both principal and interest payments, making them a preferred choice for inflation hedging within Treasury debt instruments.

Interest Payment Mechanisms: Fixed vs. Floating

Treasury Inflation-Protected Securities (TIPS) offer fixed interest rates applied to principal adjusted for inflation, ensuring real returns by increasing principal value with the Consumer Price Index. Floating Rate Notes (FRNs) feature variable interest rates tied to changes in the discount rate of 13-week Treasury bills, providing payments that fluctuate with short-term interest rate movements. This fundamental difference in interest payment mechanisms addresses distinct investor needs for inflation protection with TIPS versus interest rate sensitivity with FRNs.

Yield Performance Comparison

Treasury Inflation-Protected Securities (TIPS) provide investors with principal adjustments tied to the Consumer Price Index (CPI), offering real yield protection against inflation, whereas Floating Rate Notes (FRNs) feature variable coupon rates indexed to short-term Treasury bill rates, adjusting periodically to reflect current market conditions. Over periods of rising inflation, TIPS typically outperform FRNs due to their inflation adjustment mechanism increasing principal and interest payments, while FRNs yield varies with short-term rates that may lag inflation spikes. Ultimately, TIPS deliver superior real returns in inflationary environments, whereas FRNs offer more stable nominal yields during periods of low or declining inflation and interest rates.

Risk Factors: TIPS and FRNs

Treasury Inflation-Protected Securities (TIPS) carry inflation risk protection by adjusting principal based on Consumer Price Index changes, yet they face interest rate risk if inflation expectations shift unexpectedly. Floating Rate Notes (FRNs) mitigate interest rate risk due to variable coupon payments linked to the 13-week Treasury bill rate, but they remain exposed to credit risk and potential liquidity constraints. Both TIPS and FRNs are subject to market risk, with TIPS offering a hedge against inflation and FRNs providing flexibility in rising rate environments.

Suitability for Different Investors

Treasury Inflation-Protected Securities (TIPS) suit investors seeking protection against inflation and a guaranteed real rate of return, ideal for conservative portfolios focused on long-term purchasing power preservation. Floating Rate Notes (FRNs) attract investors aiming to benefit from variable interest rates tied to short-term Treasury yields, fitting those who prefer income that adjusts with changing market conditions. Both instruments offer low credit risk but cater to distinct investment goals based on interest rate sensitivity and inflation exposure.

Tax Implications of TIPS and FRNs

Treasury Inflation-Protected Securities (TIPS) generate taxable interest income that adjusts with inflation, causing investors to owe taxes annually on inflationary gains even if principal is not received until maturity. Floating Rate Notes (FRNs) pay variable interest rates tied to short-term Treasury bills, with interest income taxed as ordinary income at the federal level but exempt from state and local taxes. The distinct tax treatment of TIPS' inflation adjustments versus FRNs' fluctuating coupon payments critically affects after-tax returns for investors holding these Treasury securities.

TIPS vs Floating Rate Notes: Which to Choose?

Treasury Inflation-Protected Securities (TIPS) offer principal adjustments based on the Consumer Price Index, providing a hedge against inflation and preserving purchasing power. Floating Rate Notes (FRNs) feature interest rates that reset periodically based on short-term Treasury bill yields, offering protection against rising interest rates but lacking direct inflation protection. Investors should choose TIPS for inflation protection during rising inflation periods, while FRNs are better suited for environments with uncertain interest rates and lower inflation risk.

Important Terms

Real Yield Differential

Real yield differential between Treasury Inflation-Protected Securities (TIPS) and Floating Rate Notes (FRNs) indicates market expectations of inflation and interest rate risk premium.

Inflation Indexation

Treasury Inflation-Protected Securities (TIPS) offer inflation indexation by adjusting principal value based on the Consumer Price Index (CPI), preserving purchasing power during inflationary periods. Floating Rate Notes (FRNs) provide variable interest payments tied to short-term interest rates, lacking direct inflation adjustment but offering protection against rising nominal rates.

Principal Adjustment

Principal adjustment in Treasury Inflation-Protected Securities (TIPS) increases the principal value based on the Consumer Price Index, whereas Floating Rate Notes (FRNs) adjust interest payments according to fluctuating reference rates without altering principal.

Reference Rate Benchmark

The Reference Rate Benchmark influences Treasury Inflation-Protected Securities (TIPS) by adjusting their principal value based on Consumer Price Index (CPI) changes, ensuring protection against inflation, while Floating Rate Notes (FRNs) offer variable interest payments tied directly to short-term benchmark rates like the Secured Overnight Financing Rate (SOFR). TIPS provide real return linked to inflation adjustments, whereas FRNs deliver interest payments that fluctuate with shifts in reference interest rates, impacting yield and risk profiles differently.

Coupon Reset Mechanism

The Coupon Reset Mechanism in Treasury Inflation-Protected Securities (TIPS) adjusts principal based on inflation, unlike Floating Rate Notes (FRNs) whose coupon rates reset periodically based on reference interest rates, impacting their inflation protection and interest rate risk profiles.

Purchasing Power Preservation

Purchasing power preservation is effectively achieved through Treasury Inflation-Protected Securities (TIPS), which adjust principal based on the Consumer Price Index, thereby safeguarding investors against inflation. In contrast, Floating Rate Notes (FRNs) offer interest payments tied to short-term rates, providing protection against rising interest rates but less direct inflation protection compared to TIPS.

Break-even Inflation Rate

The break-even inflation rate, calculated as the yield difference between Treasury Inflation-Protected Securities (TIPS) and nominal Treasury Floating Rate Notes (FRNs), represents market expectations of average inflation over the securities' maturities.

Interest Rate Risk

Interest rate risk for Treasury Inflation-Protected Securities (TIPS) is mitigated by their principal adjustment based on inflation, preserving real value despite nominal rate fluctuations, while Floating Rate Notes (FRNs) reduce exposure by resetting coupon rates periodically to reflect current market interest rates, aligning income with prevailing conditions. Both securities offer distinct mechanisms to manage interest rate volatility: TIPS focusing on inflation protection, and FRNs emphasizing short-term rate responsiveness.

Par Value Protection

Par Value Protection ensures that Treasury Inflation-Protected Securities (TIPS) return at least the original principal amount at maturity, adjusting for inflation to preserve purchasing power, unlike Floating Rate Notes (FRNs) which offer variable interest rates tied to reference rates without inflation adjustment, posing potential principal risk in inflationary environments. TIPS provide built-in inflation adjustments through principal indexing based on the Consumer Price Index (CPI), whereas FRNs adjust coupon payments periodically but lack guaranteed inflation compensation, affecting real return stability.

Auction Frequency

Treasury Inflation-Protected Securities (TIPS) auctions occur monthly, providing regular updates to inflation expectations and real yields. Floating Rate Notes (FRNs) are auctioned quarterly, offering investors variable interest rates tied to the 13-week Treasury bill, reflecting short-term market conditions more frequently than fixed TIPS.

Treasury inflation-protected securities vs Floating rate notes Infographic

moneydif.com

moneydif.com