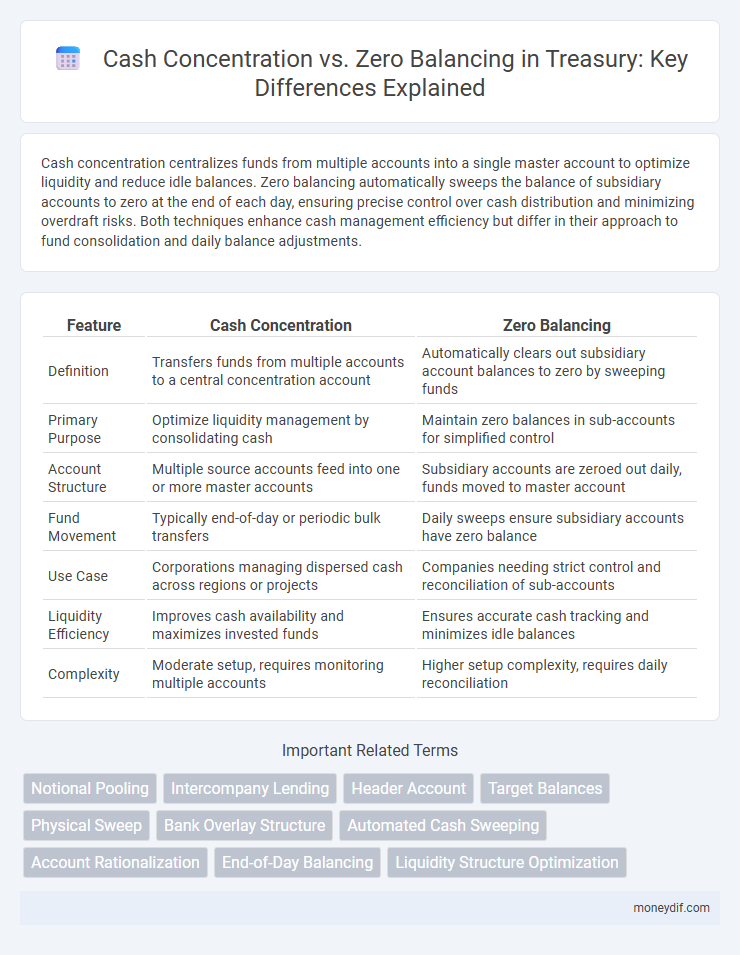

Cash concentration centralizes funds from multiple accounts into a single master account to optimize liquidity and reduce idle balances. Zero balancing automatically sweeps the balance of subsidiary accounts to zero at the end of each day, ensuring precise control over cash distribution and minimizing overdraft risks. Both techniques enhance cash management efficiency but differ in their approach to fund consolidation and daily balance adjustments.

Table of Comparison

| Feature | Cash Concentration | Zero Balancing |

|---|---|---|

| Definition | Transfers funds from multiple accounts to a central concentration account | Automatically clears out subsidiary account balances to zero by sweeping funds |

| Primary Purpose | Optimize liquidity management by consolidating cash | Maintain zero balances in sub-accounts for simplified control |

| Account Structure | Multiple source accounts feed into one or more master accounts | Subsidiary accounts are zeroed out daily, funds moved to master account |

| Fund Movement | Typically end-of-day or periodic bulk transfers | Daily sweeps ensure subsidiary accounts have zero balance |

| Use Case | Corporations managing dispersed cash across regions or projects | Companies needing strict control and reconciliation of sub-accounts |

| Liquidity Efficiency | Improves cash availability and maximizes invested funds | Ensures accurate cash tracking and minimizes idle balances |

| Complexity | Moderate setup, requires monitoring multiple accounts | Higher setup complexity, requires daily reconciliation |

Understanding Cash Concentration and Zero Balancing

Cash concentration centralizes funds from multiple accounts into a master account to optimize liquidity management and improve fund utilization. Zero balancing automatically transfers the exact amounts needed to bring subsidiary accounts to a zero balance, streamlining cash flow control and reducing idle balances. Both techniques enhance treasury efficiency by providing real-time fund visibility and minimizing external borrowing costs.

Key Differences Between Cash Concentration and Zero Balancing

Cash concentration consolidates funds from multiple accounts into a central master account to optimize liquidity management and reduce idle balances, while zero balancing transfers just enough funds at the end of each business day to bring subsidiary accounts to a zero balance. Cash concentration enables more flexible fund allocation and investment opportunities, whereas zero balancing ensures strict control over sub-account balances for precise cash flow tracking. The choice between these techniques depends on factors like organizational structure, cash flow predictability, and operational complexity.

Core Principles of Cash Concentration

Cash Concentration centralizes funds from multiple accounts into a single master account, optimizing liquidity management and improving cash visibility across the organization. It involves periodic transfers that aggregate balances, enabling efficient allocation of resources and reduced borrowing costs. This core principle contrasts with Zero Balancing, which maintains zero balances in subsidiary accounts by sweeping daily net inflows or outflows to the master account.

How Zero Balancing Works in Treasury Management

Zero Balancing in treasury management involves automatically transferring funds from multiple subsidiary accounts to a master account at the end of each business day, ensuring all sub-accounts maintain a zero balance. This process optimizes cash utilization by consolidating idle balances, minimizing borrowing costs, and enhancing liquidity visibility. It supports centralized control over corporate cash flows, enabling accurate forecasting and efficient fund allocation.

Benefits of Implementing Cash Concentration

Implementing cash concentration centralizes liquidity by pooling funds from multiple accounts into a single master account, enhancing cash visibility and control. This consolidation reduces idle balances, optimizes cash utilization, and improves interest income or reduces borrowing costs. Efficient cash concentration supports better forecasting, streamlined operations, and greater flexibility in managing company-wide cash resources.

Advantages of Zero Balancing for Corporate Treasury

Zero Balancing enhances liquidity management by consolidating funds into a central account daily, reducing idle balances and optimizing cash flow forecasting for corporate treasury. This method minimizes overdraft risks and eliminates the need for manual fund transfers, improving operational efficiency and lowering banking fees. Corporate treasuries benefit from increased control and visibility over cash positions, facilitating strategic decision-making and maximizing interest income.

Operational Process: Cash Concentration vs Zero Balancing

Cash Concentration centralizes funds by transferring surplus cash from multiple subsidiary accounts into a master account, optimizing liquidity and simplifying cash management. Zero Balancing operates by sweeping funds out of subsidiary accounts daily to zero, ensuring precise control over daily cash positions and reducing idle balances. Both methods streamline cash flows but differ in timing and account balance maintenance, impacting operational efficiency and treasury reporting.

Choosing Between Cash Concentration and Zero Balancing

Choosing between Cash Concentration and Zero Balancing depends on the company's liquidity needs and operational complexity. Cash Concentration centralizes funds from multiple accounts into a master account to optimize cash management and enhance forecasting accuracy. Zero Balancing sweeps daily balances to zero, reducing idle cash and allowing precise control over subsidiary accounts while maintaining efficient internal fund allocation.

Best Practices for Effective Treasury Cash Management

Cash Concentration consolidates funds from multiple accounts into a central account, improving liquidity visibility and control, while Zero Balancing transfers funds to maintain zero balances in subsidiary accounts, enhancing cash flow predictability. Best practices include implementing automated sweeping schedules, maintaining real-time account reconciliation, and aligning concentration strategies with business cycles to optimize working capital. Leveraging technology-driven solutions like treasury management systems (TMS) ensures accurate forecasting and reduces idle cash, driving efficient treasury cash management.

Common Challenges and Solutions in Cash Pooling Strategies

Cash concentration and zero balancing techniques in cash pooling often face challenges such as liquidity imbalances, complex intercompany reconciliation, and regulatory compliance across multiple jurisdictions. Effective solutions include implementing real-time cash position monitoring, automating intragroup transaction settlements, and adopting standardized reporting frameworks to ensure transparency and control. Leveraging advanced treasury management systems enhances accuracy and operational efficiency, mitigating common risks in centralized cash management strategies.

Important Terms

Notional Pooling

Notional pooling optimizes liquidity management by allowing multiple accounts' balances to be offset without physical fund transfers, whereas cash concentration physically transfers funds to a master account and zero balancing consolidates account balances daily to a target zero balance.

Intercompany Lending

Intercompany lending optimizes liquidity management by integrating cash concentration techniques for centralized fund pooling and zero balancing methods to maintain subsidiary account balances at zero, enhancing cash flow efficiency and reducing borrowing costs.

Header Account

Header Account centralizes transaction processing by consolidating funds from multiple sub-accounts in Cash Concentration, enhancing liquidity management efficiency. Zero Balancing ensures daily net-zero balances by transferring excess funds to or from the Header Account, optimizing cash flow control and minimizing idle balances.

Target Balances

Target balances in cash concentration systems optimize liquidity management by setting predefined account thresholds, while zero balancing transfers excess funds daily to maintain near-zero subaccount balances.

Physical Sweep

Physical Sweep automates fund transfers by consolidating cash from multiple accounts into a master account, optimizing liquidity management compared to Zero Balancing which resets all sub-accounts to zero daily to maintain target balances.

Bank Overlay Structure

Bank overlay structures optimize treasury management by integrating cash concentration and zero balancing techniques to centralize funds and control account balances. Cash concentration consolidates daily surpluses into a master account, while zero balancing automatically transfers funds to maintain zero balances in subsidiary accounts, enhancing liquidity efficiency and reducing borrowing costs.

Automated Cash Sweeping

Automated Cash Sweeping optimizes liquidity management by transferring surplus funds from multiple accounts to a master concentration account, enhancing cash concentration efficiency compared to zero balancing which maintains zero balances by distributing funds daily.

Account Rationalization

Account rationalization enhances treasury efficiency by consolidating multiple accounts into cash concentration or zero balancing structures to optimize liquidity management and reduce banking costs.

End-of-Day Balancing

End-of-Day Balancing optimizes corporate cash management by comparing Cash Concentration, which aggregates funds from multiple accounts into a central account for efficient liquidity, and Zero Balancing, which transfers funds at day's end to maintain zero balances in subsidiary accounts. Both strategies enhance cash visibility and control, with Cash Concentration emphasizing fund consolidation and Zero Balancing ensuring precise funding alignment across accounts.

Liquidity Structure Optimization

Liquidity structure optimization enhances cash flow management by implementing cash concentration to centralize funds from multiple accounts, reducing idle balances and improving investment opportunities. Zero balancing further refines this process by automatically transferring end-of-day account balances to a master account, ensuring optimal liquidity control and minimizing overdraft risks.

Cash Concentration vs Zero Balancing Infographic

moneydif.com

moneydif.com