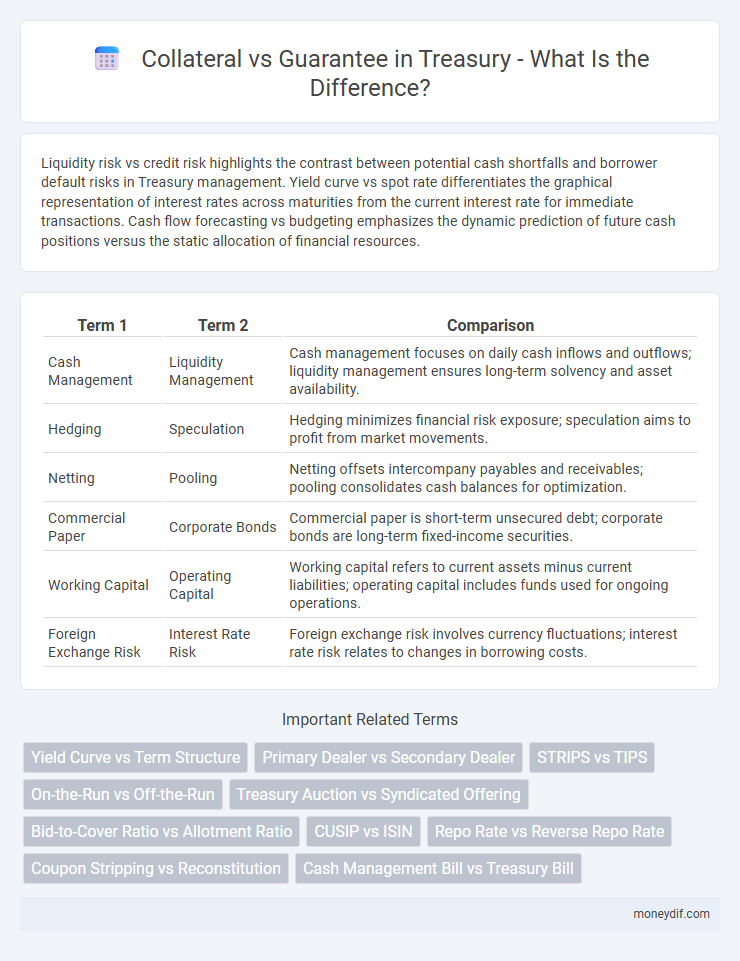

Liquidity risk vs credit risk highlights the contrast between potential cash shortfalls and borrower default risks in Treasury management. Yield curve vs spot rate differentiates the graphical representation of interest rates across maturities from the current interest rate for immediate transactions. Cash flow forecasting vs budgeting emphasizes the dynamic prediction of future cash positions versus the static allocation of financial resources.

Table of Comparison

| Term 1 | Term 2 | Comparison |

|---|---|---|

| Cash Management | Liquidity Management | Cash management focuses on daily cash inflows and outflows; liquidity management ensures long-term solvency and asset availability. |

| Hedging | Speculation | Hedging minimizes financial risk exposure; speculation aims to profit from market movements. |

| Netting | Pooling | Netting offsets intercompany payables and receivables; pooling consolidates cash balances for optimization. |

| Commercial Paper | Corporate Bonds | Commercial paper is short-term unsecured debt; corporate bonds are long-term fixed-income securities. |

| Working Capital | Operating Capital | Working capital refers to current assets minus current liabilities; operating capital includes funds used for ongoing operations. |

| Foreign Exchange Risk | Interest Rate Risk | Foreign exchange risk involves currency fluctuations; interest rate risk relates to changes in borrowing costs. |

Centralized Treasury vs Decentralized Treasury

Centralized Treasury consolidates cash management and financial decision-making within a single corporate entity, optimizing liquidity control and risk management. Decentralized Treasury distributes these functions across multiple business units or geographic locations, allowing greater autonomy but potentially increasing operational complexity. Companies choose between centralized and decentralized models based on size, regulatory environment, and strategic priorities.

Cash Pooling vs Notional Pooling

Cash Pooling consolidates actual cash balances from multiple accounts into a single master account to optimize liquidity management, while Notional Pooling aggregates balances notionally without physical fund transfers, maintaining separate accounts but netting interest across them. Cash Pooling requires physical movement of funds, impacting transactional flows and accounting, whereas Notional Pooling allows interest optimization without altering individual account positions. Both strategies enhance working capital efficiency, with Cash Pooling favored for straightforward cash visibility and Notional Pooling preferred for regulatory or operational constraints on fund transfers.

Forecasted Cash Flows vs Actual Cash Flows

Forecasted cash flows represent the projected inflows and outflows of cash based on budgets and financial models, essential for liquidity planning and risk management. Actual cash flows reflect the real-time transactions recorded in the treasury system, providing accurate data for cash position analysis and variance assessment. Comparing forecasted versus actual cash flows reveals discrepancies that help optimize working capital and improve financial forecasting accuracy.

Internal Funding vs External Funding

Internal funding refers to financing sources generated within the organization, such as retained earnings or working capital, whereas external funding involves obtaining capital from outside entities like banks, bondholders, or equity investors. Internal funding typically offers lower cost and greater control but may limit growth potential, while external funding can provide substantial resources at the expense of increased obligations and potential dilution of ownership. Treasury teams evaluate these options to optimize capital structure, manage liquidity, and align funding strategies with corporate financial goals.

Liquidity Risk vs Credit Risk

Liquidity risk refers to the potential inability to meet short-term financial obligations due to insufficient cash flow or liquid assets, while credit risk involves the possibility of loss arising from a borrower's failure to repay a loan or meet contractual debt obligations. Treasury management prioritizes mitigating liquidity risk by maintaining adequate cash reserves and access to credit lines, whereas credit risk is managed through rigorous credit assessments and counterparty evaluations. Effective differentiation and management of these risks are essential for maintaining corporate financial stability and operational continuity.

Fixed Income Securities vs Money Market Instruments

Fixed Income Securities typically offer longer maturities and higher yields compared to Money Market Instruments, which are short-term, highly liquid, and low-risk debt tools. Treasury Bonds and Notes fall under Fixed Income, providing fixed interest payments over several years, whereas Treasury Bills and commercial paper represent Money Market Instruments with maturities under one year. Investors seeking stable income prioritize Fixed Income Securities, while those requiring capital preservation and liquidity often prefer Money Market Instruments.

Hard Currency vs Soft Currency

Hard currency refers to a globally accepted, stable, and reliable currency such as the US dollar or Euro, commonly used in international trade and finance. Soft currency, often associated with developing or unstable economies, faces limited convertibility and higher volatility, impacting Treasury risk management and liquidity strategies. Understanding the distinctions between hard currency and soft currency is crucial for Treasury operations involving foreign exchange exposure and cross-border investments.

Treasury Management Systems vs Manual Processes

Treasury Management Systems (TMS) automate cash flow forecasting, enhancing accuracy compared to error-prone manual processes that rely heavily on spreadsheets and manual input. TMS provide real-time visibility into liquidity positions and risk exposures, whereas manual processes often suffer from delayed data consolidation and limited transparency. Implementing TMS reduces operational risk and improves compliance adherence, contrasting with manual methods that increase susceptibility to human error and regulatory gaps.

Back Office vs Front Office

Back Office in Treasury handles settlement, reconciliation, and compliance functions, ensuring accuracy and risk mitigation behind the scenes. Front Office focuses on trading, risk management, and client interactions, driving revenue and market activities. Clear delineation between Back Office and Front Office supports efficient treasury operations and regulatory adherence.

Static Hedging vs Dynamic Hedging

Static hedging involves establishing a fixed hedge position that remains unchanged throughout the investment horizon, minimizing management efforts and providing cost certainty. Dynamic hedging requires continuous adjustment of hedge positions based on market movements and risk exposure, allowing for greater flexibility and responsiveness to changing conditions. Effective treasury risk management integrates both approaches to balance stability and adaptability in currency, interest rate, or commodity exposures.

Important Terms

Yield Curve vs Term Structure

The yield curve represents the graphical depiction of interest rates across different maturities for Treasury securities, while the term structure specifically refers to the relationship between bond yields and their time to maturity. Analyzing the yield curve reveals market expectations of future interest rates and economic activity, whereas the term structure provides a theoretical framework for pricing bonds and understanding interest rate risk.

Primary Dealer vs Secondary Dealer

Primary dealers directly transact with the Federal Reserve to distribute Treasury securities, while secondary dealers trade these securities in the open market without direct Fed involvement.

STRIPS vs TIPS

STRIPS (Separate Trading of Registered Interest and Principal Securities) allow investors to hold and trade the interest and principal components of Treasury bonds separately, enhancing flexibility in managing fixed-income portfolios. TIPS (Treasury Inflation-Protected Securities) provide principal adjustments tied to the Consumer Price Index, offering inflation protection and preserving purchasing power over time.

On-the-Run vs Off-the-Run

On-the-Run Treasury securities represent the most recently issued bonds with highest liquidity, while Off-the-Run securities are older issues that typically offer higher yields due to lower demand.

Treasury Auction vs Syndicated Offering

Treasury Auction involves the government directly selling securities to investors through competitive bidding, while Syndicated Offering relies on a group of investment banks to underwrite and distribute securities to the market.

Bid-to-Cover Ratio vs Allotment Ratio

Bid-to-Cover Ratio measures demand by comparing total bids to available Treasury securities, indicating market interest and pricing pressure. Allotment Ratio reflects the portion of bids accepted and allocated to investors, revealing the Treasury's distribution strategy and issuance control.

CUSIP vs ISIN

CUSIP identifies U.S. and Canadian securities with a 9-character alphanumeric code, whereas ISIN provides a global 12-character alphanumeric identifier for securities across all countries.

Repo Rate vs Reverse Repo Rate

Repo Rate vs Reverse Repo Rate: The Repo Rate is the interest rate at which the central bank lends money to commercial banks for short-term funding, influencing liquidity and credit flow in the economy. The Reverse Repo Rate is the rate at which the central bank borrows money from commercial banks, helping absorb excess liquidity and control inflation.

Coupon Stripping vs Reconstitution

Coupon stripping involves separating Treasury bond coupons from the principal for individual trading, while reconstitution combines these stripped components back into original Treasury securities to restore their full value.

Cash Management Bill vs Treasury Bill

Cash Management Bills (CMBs) are short-term government securities issued to manage temporary cash flow mismatches, typically maturing in 91 days or less, whereas Treasury Bills (T-Bills) are standard short-term debt instruments issued for funding government operations, usually available in 4, 13, 26, or 52-week maturities. CMBs offer flexibility for urgent fiscal requirements without a fixed issuance schedule, contrasting with T-Bills' regular auction calendar and larger market liquidity.

Sure! Here’s a list of niche Treasury terms using the "term1 vs term2" format: Infographic

moneydif.com

moneydif.com