Book-entry bonds are recorded electronically in an account, enhancing security and ease of transfer by eliminating physical certificates, while bearer bonds are unregistered and owned by whoever physically holds the certificate, posing higher risks of loss or theft. Treasury securities predominantly use the book-entry system to improve transparency, reduce fraud, and streamline management. Investors benefit from faster settlement and reduced administrative costs with book-entry bonds compared to bearer bonds.

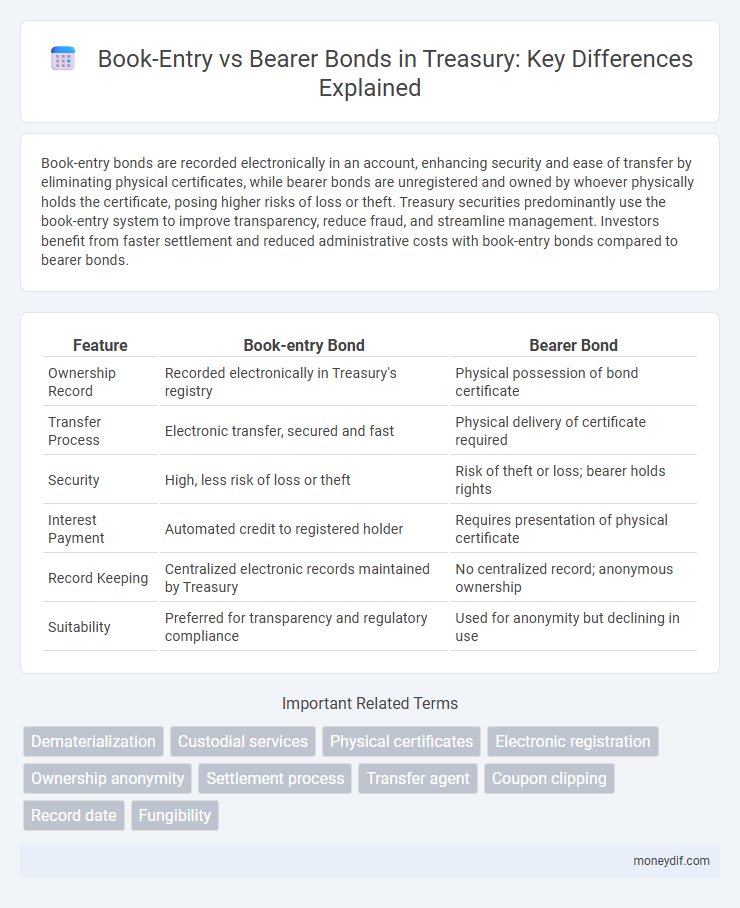

Table of Comparison

| Feature | Book-entry Bond | Bearer Bond |

|---|---|---|

| Ownership Record | Recorded electronically in Treasury's registry | Physical possession of bond certificate |

| Transfer Process | Electronic transfer, secured and fast | Physical delivery of certificate required |

| Security | High, less risk of loss or theft | Risk of theft or loss; bearer holds rights |

| Interest Payment | Automated credit to registered holder | Requires presentation of physical certificate |

| Record Keeping | Centralized electronic records maintained by Treasury | No centralized record; anonymous ownership |

| Suitability | Preferred for transparency and regulatory compliance | Used for anonymity but declining in use |

Introduction to Treasury Securities

Treasury securities include book-entry and bearer bonds, representing different ownership registration methods. Book-entry Treasury securities are electronically recorded in the owner's name, enhancing security and ease of transfer without physical certificates. Bearer bonds, now largely phased out, were payable to whoever physically held the certificate, posing higher risks of loss or theft.

Understanding Book-entry Bonds

Book-entry bonds are securities recorded electronically, eliminating the need for physical certificates and enhancing transaction security and efficiency within the Treasury market. These bonds enable seamless ownership tracking and reduce risks associated with loss or theft compared to bearer bonds, which require physical possession for ownership proof. Treasury departments often prefer book-entry bonds due to their streamlined record-keeping and compliance advantages in managing public debt.

Exploring Bearer Bonds

Bearer bonds are unregistered debt securities that grant ownership to the holder, making them highly transferable and anonymous compared to book-entry bonds, which are recorded electronically in the owner's name. These bonds facilitate easy trading without the need for formal ownership records, attracting investors seeking privacy and ease of transfer. However, bearer bonds pose higher risks of loss or theft and face regulatory scrutiny due to potential misuse for money laundering.

Key Differences: Book-entry vs Bearer Bonds

Book-entry bonds are electronically recorded and maintained in an account by a financial institution, ensuring secure ownership tracking and easy transferability, whereas bearer bonds exist as physical certificates, transferring ownership through physical possession. Book-entry bonds offer enhanced safety and reduced risk of loss or theft compared to bearer bonds, which are susceptible to being lost or stolen without recourse. The regulatory framework favors book-entry systems, which facilitate transparency and compliance, unlike bearer bonds that often lack detailed ownership records and are less favored in modern Treasury operations.

Security and Fraud Risks

Book-entry bonds provide enhanced security by electronically recording ownership, reducing the risk of loss, theft, or forgery compared to bearer bonds, which rely on physical possession and are more vulnerable to fraud and unauthorized transfers. Bearer bonds, without registered ownership records, pose higher risks of theft and fraudulent claims, making recovery difficult if lost or stolen. Treasury departments prefer book-entry systems to ensure transparency, traceability, and reduced fraud in bond management.

Ownership and Transferability

Book-entry bonds record ownership electronically, ensuring secure and easily transferable holdings through registered accounts, which greatly reduces the risk of loss or theft. In contrast, bearer bonds represent ownership by physical possession, allowing anonymous transfer simply by handing over the certificate, but exposing holders to higher risks of loss and fraud. The electronic system of book-entry bonds facilitates faster settlement and traceability compared to the less secure, paper-based bearer bonds.

Regulatory and Legal Framework

Book-entry bonds are governed by stringent regulatory frameworks such as the Securities Exchange Act and are registered electronically, ensuring transparent ownership and compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. Bearer bonds lack registration, posing challenges under modern legal standards due to anonymity, increasing risks of fraud, tax evasion, and difficulties in tracking ownership in regulatory audits. Governments have largely phased out bearer bonds to align with international standards set by entities like the Financial Action Task Force (FATF), promoting greater security and regulatory oversight in Treasury securities.

Tax Implications

Book-entry bonds offer enhanced tax reporting benefits due to centralized record-keeping, enabling straightforward interest income tracking and automatic withholding for tax compliance. Bearer bonds complicate tax obligations as interest payments are made anonymously to holders, increasing the risk of non-compliance and potential tax evasion. The U.S. Treasury favors book-entry systems to improve tax transparency and reduce administrative burdens associated with bondholder identification.

Market Trends and Investor Preferences

Market trends indicate a growing preference for book-entry bonds due to enhanced security, ease of transfer, and reduced administrative costs compared to bearer bonds. Institutional investors favor book-entry systems for their transparency and compliance with regulatory requirements, while bearer bonds face declining demand amid heightened concerns over anonymity and fraud risks. The shift toward digital record-keeping and electronic settlement platforms further solidifies book-entry bonds as the dominant choice in treasury securities trading.

Future Outlook for Treasury Bonds

Book-entry Treasury bonds offer enhanced security and efficiency through electronic record-keeping, reducing risks associated with physical certificates that bearer bonds carry. The future outlook favors book-entry systems as digitization and regulatory frameworks evolve to improve transparency and investor protection. Demand for bearer bonds is expected to decline due to increased concerns over anonymity facilitating illicit activities and the growing adoption of blockchain technologies in securities settlement.

Important Terms

Dematerialization

Dematerialization eliminates physical bearer bonds by converting them into secure electronic book-entry records, enhancing efficiency and reducing risks of loss or theft.

Custodial services

Custodial services for book-entry securities ensure secure electronic record-keeping and transfer, whereas bearer bonds require physical custody and carry higher risk of loss or theft due to their transferable nature.

Physical certificates

Physical certificates represent ownership but lack the electronic record-keeping and transfer efficiency found in book-entry systems, unlike bearer bonds which are negotiable physical instruments that confer ownership to the holder.

Electronic registration

Electronic registration enhances security and efficiency by maintaining book-entry securities, eliminating the risks and anonymity associated with bearer bonds.

Ownership anonymity

Ownership anonymity in bearer bonds is maintained by physical possession, allowing holders to transfer ownership without registration, whereas book-entry securities record ownership electronically, reducing anonymity by linking assets directly to registered owners. Bearer bonds offer higher privacy but pose greater risks of loss or theft, while book-entry systems enhance security and regulatory compliance through transparent ownership records.

Settlement process

The settlement process for book-entry securities involves electronic transfer and recording of ownership through centralized depositories, ensuring faster and more secure transactions compared to bearer bonds, which require physical delivery and transfer of certificates for ownership rights. Book-entry settlement minimizes the risk of loss, theft, or forgery inherent in bearer bond transactions by maintaining accurate, centralized records of securities ownership.

Transfer agent

Transfer agents maintain accurate ownership records for book-entry securities, enhancing security and efficiency compared to the anonymous ownership of bearer bonds.

Coupon clipping

Coupon clipping involves physically removing coupons from bearer bonds to claim interest payments, whereas book-entry bonds electronically record ownership and interest payments without the need for physical coupons. The transition to book-entry systems enhances security and efficiency by eliminating risks associated with lost or stolen bearer bond coupons.

Record date

The record date determines investor eligibility for dividends or interest payments, distinguishing book-entry bonds, which register ownership electronically, from bearer bonds that grant benefits to the physical holder.

Fungibility

Book-entry securities enhance fungibility by enabling electronic ownership transfers without physical certificates, unlike bearer bonds that require physical possession for transfer and are less easily divided or exchanged.

Book-entry vs Bearer bond Infographic

moneydif.com

moneydif.com