Duration gap measures the sensitivity of a portfolio's value to interest rate changes by comparing the durations of assets and liabilities. Convexity accounts for the curvature in the price-yield relationship, providing a more accurate estimate of interest rate risk beyond the linear approximation given by duration. Managing both duration gap and convexity is crucial for effective interest rate risk management in treasury portfolios.

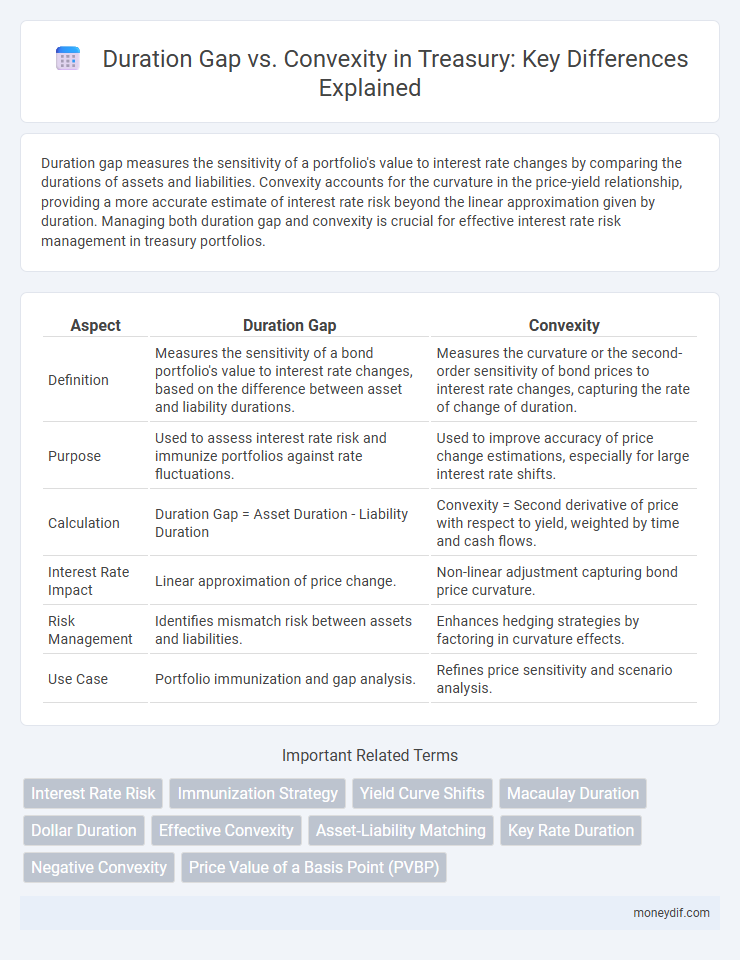

Table of Comparison

| Aspect | Duration Gap | Convexity |

|---|---|---|

| Definition | Measures the sensitivity of a bond portfolio's value to interest rate changes, based on the difference between asset and liability durations. | Measures the curvature or the second-order sensitivity of bond prices to interest rate changes, capturing the rate of change of duration. |

| Purpose | Used to assess interest rate risk and immunize portfolios against rate fluctuations. | Used to improve accuracy of price change estimations, especially for large interest rate shifts. |

| Calculation | Duration Gap = Asset Duration - Liability Duration | Convexity = Second derivative of price with respect to yield, weighted by time and cash flows. |

| Interest Rate Impact | Linear approximation of price change. | Non-linear adjustment capturing bond price curvature. |

| Risk Management | Identifies mismatch risk between assets and liabilities. | Enhances hedging strategies by factoring in curvature effects. |

| Use Case | Portfolio immunization and gap analysis. | Refines price sensitivity and scenario analysis. |

Understanding Duration Gap in Treasury Management

Duration gap in treasury management measures the sensitivity difference between assets and liabilities to interest rate changes, quantifying interest rate risk exposure. A positive duration gap indicates assets have longer durations than liabilities, leading to potential losses if rates rise, while negative gaps suggest liabilities are more sensitive. Monitoring and managing duration gap enables treasurers to stabilize net interest income and safeguard the institution's economic value amid fluctuating interest rates.

The Concept of Convexity in Fixed Income Securities

Convexity in fixed income securities measures the curvature of the price-yield relationship, capturing how bond prices accelerate as interest rates change. It complements duration by providing a more accurate estimate of price sensitivity to large interest rate movements, especially for instruments with embedded options. Higher convexity indicates greater price stability and lower interest rate risk, which is crucial for effective treasury risk management and portfolio optimization.

Key Differences Between Duration Gap and Convexity

Duration gap measures the sensitivity of a portfolio's value to interest rate changes by comparing the duration of assets and liabilities, reflecting the timing mismatch of cash flows. Convexity quantifies the curvature of the price-yield relationship, capturing the degree of sensitivity change with varying interest rates and indicating the acceleration of bond price changes. Key differences lie in duration gap addressing interest rate risk from maturity mismatches, while convexity offers a more precise estimate of price volatility under large interest rate fluctuations.

Impact of Interest Rate Changes on Duration Gap and Convexity

Duration gap measures the sensitivity of a portfolio's value to small parallel shifts in interest rates, capturing linear interest rate risk, while convexity accounts for the curvature in the price-yield relationship, reflecting the acceleration of price changes for larger rate movements. Interest rate increases reduce bond prices, with portfolios exhibiting high convexity experiencing less price decline compared to those measured solely by duration gap. Managing both duration gap and convexity is crucial for Treasury risk management to minimize losses from volatile interest rate environments and optimize hedge effectiveness.

Measuring Interest Rate Risk: Duration Gap vs Convexity

Duration gap measures the sensitivity of a portfolio's value to small parallel shifts in interest rates, quantifying the timing mismatch between assets and liabilities. Convexity further refines this assessment by capturing the curvature in the price-yield relationship, improving accuracy for larger rate changes and non-parallel shifts. Together, duration gap provides a linear approximation of interest rate risk, while convexity accounts for nonlinear effects, enhancing risk management in treasury portfolios.

Strategies for Managing Duration Gap in Treasury Portfolios

Managing duration gap in treasury portfolios involves adjusting the portfolio's average duration to align asset and liability sensitivities to interest rate changes, reducing interest rate risk. Strategies include employing interest rate swaps, adjusting bond maturities, and using convexity measures to fine-tune exposure, ensuring portfolio value is less sensitive to rate fluctuations. Incorporating convexity analysis enhances the precision of immunization techniques, enabling more effective hedging against nonlinear interest rate movements.

The Role of Convexity in Enhancing Risk Assessment

Convexity plays a critical role in enhancing risk assessment by capturing the curvature in the price-yield relationship of fixed-income securities, thereby providing a more accurate approximation of bond price changes than duration alone. While duration measures the sensitivity of a bond's price to small interest rate changes, convexity accounts for the rate at which duration itself changes, reducing the risk of underestimating potential losses in volatile interest rate environments. Incorporating convexity into duration gap analysis improves the precision of interest rate risk management and optimizes hedging strategies within treasury portfolios.

Limitations of Relying Solely on Duration Gap

Relying solely on duration gap to measure interest rate risk overlooks the nonlinear relationship between bond prices and yields, making it insufficient for capturing the impact of large interest rate changes. Convexity complements duration by accounting for the curvature in price-yield movements, providing a more accurate assessment of potential portfolio value fluctuations. Ignoring convexity can lead to underestimating risks in volatile interest rate environments, resulting in suboptimal hedging strategies.

Integrating Duration Gap and Convexity in Asset-Liability Management

Integrating duration gap and convexity in asset-liability management enhances interest rate risk assessment by capturing both linear and nonlinear price sensitivities of portfolio components. Accurate measurement of duration gap facilitates matching the interest rate sensitivity of assets and liabilities, while incorporating convexity adjustments prevents underestimation of risk during large interest rate shifts. This combined approach optimizes hedging strategies and ensures more precise balance sheet immunization against changing market conditions.

Best Practices for Treasury Risk Mitigation Using Duration and Convexity

Effective treasury risk mitigation leverages both duration and convexity to measure and manage interest rate sensitivity in fixed income portfolios. Duration provides a linear approximation of price changes, while convexity accounts for the curvature in price-yield relationships, enhancing the accuracy of risk assessment under varying interest rate scenarios. Best practices involve balancing duration gaps to minimize exposure while using convexity adjustments to anticipate nonlinear price movements, ensuring robust hedging strategies and optimal asset-liability management.

Important Terms

Interest Rate Risk

Interest rate risk is mitigated by managing duration gap to balance asset and liability sensitivity while convexity measures bond price sensitivity to interest rate changes affecting risk exposure.

Immunization Strategy

Immunization strategy minimizes interest rate risk by matching the duration gap between assets and liabilities while leveraging convexity to protect against bond price volatility.

Yield Curve Shifts

Yield curve shifts impact bond portfolio risk by affecting duration gap sensitivity and convexity measures, where convexity mitigates losses from large interest rate changes beyond what duration predicts.

Macaulay Duration

Macaulay Duration measures the weighted average time to receive a bond's cash flows, quantifying interest rate risk, while Duration Gap assesses the mismatch between assets and liabilities, and Convexity refines interest rate sensitivity by accounting for nonlinear price changes.

Dollar Duration

Dollar Duration quantifies the monetary impact of interest rate changes on bond prices, serving as a practical measure to manage interest rate risk. Compared to Duration Gap and Convexity, Dollar Duration directly expresses price sensitivity in currency units, while Duration Gap evaluates the mismatch between asset and liability durations, and Convexity accounts for the curvature in the price-yield relationship, enhancing accuracy for larger rate changes.

Effective Convexity

Effective convexity measures bond price sensitivity to interest rate changes by accounting for embedded options, providing a more accurate risk assessment compared to the duration gap method which estimates exposure based solely on linear interest rate shifts.

Asset-Liability Matching

Asset-liability matching optimizes portfolio risk by minimizing duration gap and managing convexity to align asset and liability cash flow sensitivities to interest rate changes.

Key Rate Duration

Key Rate Duration measures the sensitivity of a bond's price to interest rate changes at specific maturities, helping identify Duration Gap exposure and assess Convexity effects for more precise interest rate risk management.

Negative Convexity

Negative convexity occurs when bond prices decrease at an accelerating rate as yields rise, causing the duration gap to understate interest rate risk compared to convexity measures.

Price Value of a Basis Point (PVBP)

Price Value of a Basis Point (PVBP) quantifies the change in a bond's price for a one basis point change in yield, linking directly to duration gap as it measures interest rate risk sensitivity while convexity accounts for the curvature of price-yield relationship enhancing accuracy in PVBP estimation. Understanding PVBP in the context of duration gap versus convexity is critical for bond portfolio risk management, as duration gap estimates linear price changes whereas convexity adjusts for non-linear price movements, improving hedging strategies.

Duration Gap vs Convexity Infographic

moneydif.com

moneydif.com