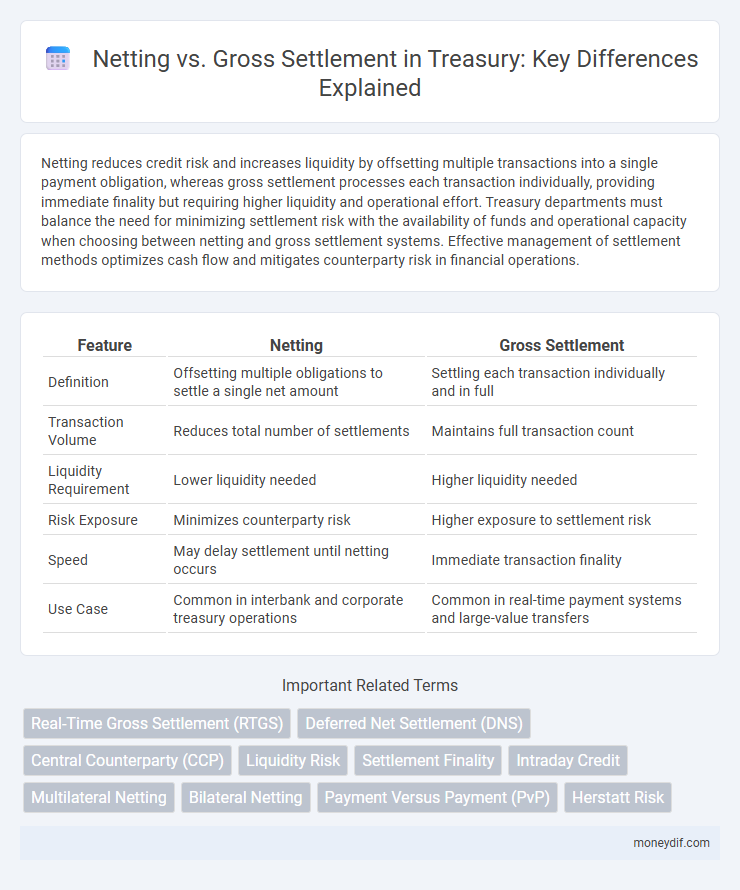

Netting reduces credit risk and increases liquidity by offsetting multiple transactions into a single payment obligation, whereas gross settlement processes each transaction individually, providing immediate finality but requiring higher liquidity and operational effort. Treasury departments must balance the need for minimizing settlement risk with the availability of funds and operational capacity when choosing between netting and gross settlement systems. Effective management of settlement methods optimizes cash flow and mitigates counterparty risk in financial operations.

Table of Comparison

| Feature | Netting | Gross Settlement |

|---|---|---|

| Definition | Offsetting multiple obligations to settle a single net amount | Settling each transaction individually and in full |

| Transaction Volume | Reduces total number of settlements | Maintains full transaction count |

| Liquidity Requirement | Lower liquidity needed | Higher liquidity needed |

| Risk Exposure | Minimizes counterparty risk | Higher exposure to settlement risk |

| Speed | May delay settlement until netting occurs | Immediate transaction finality |

| Use Case | Common in interbank and corporate treasury operations | Common in real-time payment systems and large-value transfers |

Introduction to Netting and Gross Settlement in Treasury

Netting in treasury consolidates multiple financial obligations into a single payment obligation, reducing settlement risk and enhancing liquidity efficiency. Gross settlement processes each transaction individually, ensuring immediate finality and eliminating counterparty credit risk at the expense of higher liquidity requirements. Understanding the trade-offs between netting's risk mitigation and gross settlement's finality is crucial for effective liquidity management and operational risk control.

Key Definitions: Netting vs Gross Settlement

Netting in treasury management consolidates multiple financial obligations into a single payment to minimize transaction volumes and reduce counterparty risk. Gross settlement processes each transaction individually, ensuring immediate and final transfer of funds on a transaction-by-transaction basis. Understanding the distinction between netting and gross settlement is crucial for optimizing liquidity management and mitigating systemic risk in payment systems.

Operational Mechanisms: How Netting Works

Netting operates by consolidating multiple financial transactions between counterparties into a single net payment obligation, reducing the total number and value of payments exchanged. This process involves aggregating debit and credit positions, enabling the settlement of only the net difference, which streamlines liquidity management and minimizes counterparty risk. The operational mechanism relies on centralized clearing systems or bilateral agreements to calculate net exposures and facilitate efficient, risk-reducing settlements.

Operational Mechanisms: How Gross Settlement Works

Gross settlement operates by processing each transaction individually and immediately, ensuring that payments are settled in real-time without netting against other transactions. This mechanism requires participants to have sufficient liquidity at the time of payment to cover the entire transaction amount. It reduces settlement risk by finalizing payments irrevocably upon processing but demands higher liquidity management and intraday funding from treasury operations.

Advantages of Netting in Treasury Operations

Netting in treasury operations reduces settlement risk by consolidating multiple transactions into a single net payment, optimizing cash flow and enhancing liquidity management. This process decreases operational costs and minimizes the volume of funds transferred between counterparties, improving overall efficiency. By simplifying reconciliation and lowering counterparty risk exposure, netting contributes to stronger financial control and streamlined treasury workflows.

Benefits and Limitations of Gross Settlement

Gross settlement ensures immediate and final transfer of funds for each individual transaction, reducing credit risk and enhancing liquidity transparency for treasury operations. The primary benefit lies in eliminating exposure between parties by settling transactions individually, which is crucial for high-value or time-sensitive payments. However, limitations include higher liquidity requirements and increased operational costs compared to netting systems, making it less efficient for large volumes of low-value transactions.

Risk Management Implications: Netting vs Gross Settlement

Netting reduces counterparty credit risk by offsetting mutual obligations, minimizing exposure and improving liquidity management in Treasury operations. Gross settlement requires full payment of each transaction individually, increasing settlement risk but providing finality and reducing credit exposure to single transactions. Effective risk management balances the operational efficiencies of netting against the certainty of gross settlement to optimize capital usage and mitigate systemic risk.

Impact on Liquidity and Capital Requirements

Netting settlement reduces liquidity needs and capital requirements by offsetting multiple transactions into a single net payment, minimizing cash outflows and counterparty risk. Gross settlement demands full payment for each transaction individually, increasing liquidity usage and capital reserves to mitigate default risk. Implementing netting arrangements enhances treasury efficiency by optimizing liquidity management and lowering capital charges under regulatory frameworks such as Basel III.

Regulatory Considerations for Settlement Methods

Regulatory considerations for settlement methods emphasize minimizing systemic risk and ensuring financial stability, with netting recognized for reducing counterparty exposure by offsetting mutual obligations before final settlement. Gross settlement requires immediate payment of full transaction amounts, aligning with regulatory frameworks like RTGS systems that emphasize real-time liquidity provision and mitigate settlement fails. Authorities such as the Basel Committee advocate netting arrangements under strict collateral and capital requirements to enhance efficiency while maintaining prudential safeguards in treasury operations.

Choosing the Right Settlement Method for Treasury Functions

Netting streamlines treasury operations by consolidating multiple transactions into a single net payment, reducing settlement risk and improving liquidity management. Gross settlement processes each payment individually, offering real-time finality and minimizing credit exposure among counterparties. Selecting the appropriate method depends on the treasury's risk tolerance, transaction volume, and the need for immediate settlement finality versus operational efficiency.

Important Terms

Real-Time Gross Settlement (RTGS)

Real-Time Gross Settlement (RTGS) systems process high-value interbank payments individually and immediately without netting, ensuring finality and reducing settlement risk compared to netting systems that aggregate transactions before settlement.

Deferred Net Settlement (DNS)

Deferred Net Settlement (DNS) consolidates multiple payment obligations into a single net payment to optimize liquidity management, reducing transaction volume compared to Gross Settlement systems that settle each transaction individually. By minimizing the total value exchanged at settlement, DNS enhances efficiency and lowers settlement risk relative to Gross Settlement, which processes each payment separately and in real-time.

Central Counterparty (CCP)

Central Counterparty (CCP) enhances financial stability by facilitating netting, which reduces settlement risk and capital requirements compared to gross settlement systems where each transaction is settled individually.

Liquidity Risk

Liquidity risk intensifies in gross settlement systems due to the requirement for full payment of obligations individually, often leading to substantial intraday liquidity demands. Netting mechanisms reduce liquidity risk by consolidating multiple payment obligations into a single net amount, minimizing the funds needed to settle transactions efficiently.

Settlement Finality

Settlement finality ensures that netting reduces counterparty risk by consolidating multiple obligations into a single payment, whereas gross settlement processes each transaction individually, increasing liquidity demands but providing real-time finality.

Intraday Credit

Intraday credit facilitates liquidity by allowing banks to manage payment obligations efficiently, with netting reducing the total settlement amount compared to gross settlement, which requires full transaction-by-transaction funding.

Multilateral Netting

Multilateral netting consolidates multiple obligations into a single net payment among multiple parties, reducing settlement risk and liquidity needs compared to gross settlement systems, which require each transaction to be settled individually.

Bilateral Netting

Bilateral netting consolidates multiple payment obligations between two parties into a single net payment, reducing credit risk and settlement costs compared to gross settlement, where each transaction is settled individually. This process enhances liquidity management and operational efficiency by minimizing the number and value of settlements required in financial markets.

Payment Versus Payment (PvP)

Payment Versus Payment (PvP) ensures simultaneous exchange of currencies to mitigate settlement risk, contrasting with netting which aggregates transactions to offset obligations, while gross settlement processes each payment individually without netting benefits.

Herstatt Risk

Herstatt Risk, also known as settlement risk, arises when one party in a foreign exchange transaction fails to deliver the currency after the counterparty has already paid, exposing parties to potential financial loss. Netting reduces Herstatt Risk by consolidating multiple transactions into a single payment obligation, whereas Gross Settlement processes each transaction individually, increasing exposure to settlement failures.

Netting vs Gross Settlement Infographic

moneydif.com

moneydif.com