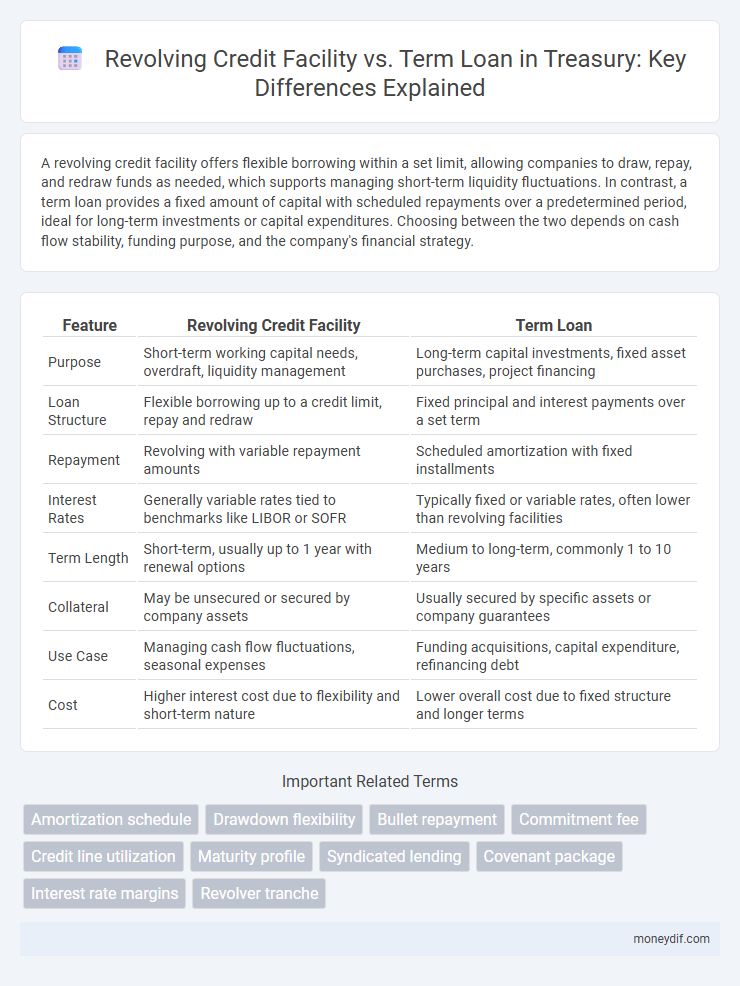

A revolving credit facility offers flexible borrowing within a set limit, allowing companies to draw, repay, and redraw funds as needed, which supports managing short-term liquidity fluctuations. In contrast, a term loan provides a fixed amount of capital with scheduled repayments over a predetermined period, ideal for long-term investments or capital expenditures. Choosing between the two depends on cash flow stability, funding purpose, and the company's financial strategy.

Table of Comparison

| Feature | Revolving Credit Facility | Term Loan |

|---|---|---|

| Purpose | Short-term working capital needs, overdraft, liquidity management | Long-term capital investments, fixed asset purchases, project financing |

| Loan Structure | Flexible borrowing up to a credit limit, repay and redraw | Fixed principal and interest payments over a set term |

| Repayment | Revolving with variable repayment amounts | Scheduled amortization with fixed installments |

| Interest Rates | Generally variable rates tied to benchmarks like LIBOR or SOFR | Typically fixed or variable rates, often lower than revolving facilities |

| Term Length | Short-term, usually up to 1 year with renewal options | Medium to long-term, commonly 1 to 10 years |

| Collateral | May be unsecured or secured by company assets | Usually secured by specific assets or company guarantees |

| Use Case | Managing cash flow fluctuations, seasonal expenses | Funding acquisitions, capital expenditure, refinancing debt |

| Cost | Higher interest cost due to flexibility and short-term nature | Lower overall cost due to fixed structure and longer terms |

Understanding Revolving Credit Facilities

Revolving credit facilities offer flexible borrowing options for managing short-term liquidity needs, allowing companies to draw, repay, and redraw funds up to a set credit limit during the facility term. Unlike term loans, which provide a lump sum with fixed repayment schedules, revolving credits adapt to fluctuating cash flow demands, making them ideal for working capital management. The interest on revolving credit is typically charged only on the drawn amount, enhancing cost efficiency for businesses with variable financing requirements.

Key Features of Term Loans

Term loans are structured debt financing with fixed repayment schedules and specified interest rates, offering predictability in cash flow management for corporates. These loans typically have longer maturities than revolving credit facilities, ranging from one to ten years, and are often secured by collateral to reduce lender risk. Borrowers benefit from lump-sum disbursement upfront, enabling funding for capital expenditures or expansion projects with clearly defined amortization terms.

Flexibility: Revolving Credit Facility vs Term Loan

A revolving credit facility offers greater flexibility by allowing borrowers to draw, repay, and redraw funds up to a predetermined limit during the term, making it ideal for managing short-term cash flow fluctuations. In contrast, a term loan provides a fixed amount of capital with a structured repayment schedule, suitable for long-term financing needs but less adaptable to variable funding requirements. Corporations often leverage revolving credit facilities for operational liquidity, while term loans fund fixed assets or major projects due to their predictable repayment structure.

Interest Rate Structures Compared

Revolving credit facilities typically feature variable interest rates that fluctuate based on benchmark rates like LIBOR or SOFR, offering flexibility for short-term borrowing needs. Term loans usually have fixed or amortizing interest rates, providing predictable payment schedules suitable for long-term financing. The choice between these instruments directly impacts a company's cost of capital and interest expense management, with revolving credit favoring rate variability and term loans emphasizing stability.

Typical Use Cases in Treasury Management

Revolving credit facilities provide flexible short-term funding ideal for managing daily liquidity fluctuations and working capital needs within treasury operations. Term loans offer fixed, long-term financing suited for capital expenditures or strategic investments requiring predictable repayment schedules. Treasury teams select revolving credits to optimize cash flow cycles, while term loans support asset acquisitions and long-term financial planning.

Collateral and Security Requirements

Revolving credit facilities typically require flexible collateral arrangements, often using a pool of current assets such as accounts receivable and inventory as security, allowing borrowers to draw and repay funds repeatedly within the credit limit. Term loans generally demand fixed collateral, including specific tangible assets like real estate, equipment, or long-term investments, providing lenders with more stable security throughout the loan tenure. Security requirements for revolving credit are more dynamic and may involve regular collateral valuation, whereas term loans focus on fixed security with less frequent revaluation.

Repayment Schedules and Drawdown Terms

Revolving credit facilities offer flexible drawdown terms, allowing borrowers to draw, repay, and redraw funds up to a set limit within the agreement period, making cash flow management more adaptable. Term loans have fixed drawdown amounts disbursed upfront or in installments, with structured repayment schedules usually involving periodic principal and interest payments over a defined tenure. The revolving credit's revolving nature contrasts with term loans' fixed repayment timeline, impacting liquidity planning and interest cost management in corporate treasury operations.

Cost Implications for Corporates

Revolving credit facilities typically incur higher interest rates and fees compared to term loans due to their flexibility and recurring availability, leading to increased short-term borrowing costs for corporates. Term loans offer fixed repayment schedules and lower interest rates, making them more cost-effective for long-term financing needs and capital expenditures. Corporates must consider the trade-off between liquidity provided by revolving credit and the reduced overall cost associated with term loans when structuring their debt portfolios.

Documentation and Approval Processes

Revolving credit facilities typically require flexible documentation that allows multiple draws and repayments over the credit term, enabling quicker approvals for subsequent advances without renegotiating terms. Term loans involve detailed, fixed documentation reflecting a single disbursement with a specific repayment schedule, often necessitating a more rigorous and time-consuming approval process upfront. Lenders prefer detailed covenants and thorough due diligence for term loans due to their long-term nature, while revolving facilities emphasize streamlined procedures to accommodate ongoing liquidity needs.

Choosing the Right Option for Treasury Strategy

Revolving credit facilities provide treasury departments with flexible access to capital, allowing for repeated borrowing and repayment up to a set credit limit, which supports fluctuating working capital needs. Term loans offer fixed amounts with scheduled repayments, ideal for financing long-term investments or capital expenditures requiring predictable cash flow management. Selecting the right financing option hinges on matching the company's liquidity requirements and cash flow stability to optimize treasury strategy and cost of capital.

Important Terms

Amortization schedule

An amortization schedule for a term loan details fixed principal and interest payments over a set period, leading to full repayment by maturity, whereas a revolving credit facility does not follow a fixed amortization schedule, allowing flexible borrowing and repayment within a credit limit. Term loans typically have scheduled amortization reducing the principal balance over time, while revolving credit facilities reflect fluctuating balances based on withdrawals and repayments without a predetermined payoff schedule.

Drawdown flexibility

Drawdown flexibility is a key advantage of revolving credit facilities, allowing borrowers to access funds repeatedly up to a pre-approved credit limit without the need for reapplication, unlike term loans that provide a lump sum with fixed repayment schedules and limited drawdown options. Revolving credit facilities offer enhanced liquidity management and cash flow optimization, making them ideal for short-term financing needs, whereas term loans are structured for long-term capital investments with fixed drawdown and amortization terms.

Bullet repayment

Bullet repayment requires the full principal of a term loan to be paid at maturity, unlike a revolving credit facility which allows flexible borrowing and repayment without fixed end-date principal repayment.

Commitment fee

Commitment fees for revolving credit facilities are typically calculated on the unused portion of the credit line, whereas term loans generally do not incur commitment fees since funds are disbursed upfront.

Credit line utilization

Credit line utilization rates are typically higher in revolving credit facilities due to flexible borrowing and repayment options, whereas term loans have fixed amounts and schedules, resulting in stable but less variable utilization.

Maturity profile

A maturity profile for revolving credit facilities typically features flexible, short-term drawdowns with periodic renewals, allowing borrowers to access funds as needed up to a credit limit within the term. In contrast, term loans have fixed maturities with scheduled principal repayments, requiring borrowers to repay the full amount over a predetermined schedule, impacting cash flow predictability and long-term financial planning.

Syndicated lending

Syndicated lending involves multiple lenders providing funds to a single borrower, often structured as revolving credit facilities or term loans to meet diverse financing needs. Revolving credit facilities offer flexible, reusable borrowing limits ideal for working capital, while term loans provide fixed amounts with scheduled repayments suited for long-term investments.

Covenant package

The Covenant package for a Revolving Credit Facility typically includes liquidity and borrowing base requirements, while the Term Loan covenant package focuses on leverage ratios and fixed charge coverage ratios.

Interest rate margins

Interest rate margins on revolving credit facilities are typically higher due to their flexibility and shorter commitment, while term loans often have lower margins reflecting their fixed repayment schedule and reduced lender risk. The cost differential is influenced by factors such as loan duration, credit risk, and market conditions impacting benchmark rates like LIBOR or SOFR.

Revolver tranche

A revolver tranche in a revolving credit facility allows borrowers to draw, repay, and redraw funds up to a specified credit limit, offering flexibility for working capital needs, whereas a term loan provides a fixed amount with a predetermined repayment schedule over a set maturity. Revolving credit facilities typically have variable interest rates tied to benchmarks like LIBOR or SOFR, while term loans may have fixed or variable rates and are often used for long-term investments or asset purchases.

Revolving credit facility vs Term loan Infographic

moneydif.com

moneydif.com