Discount notes are short-term debt instruments issued at a price lower than their face value, paying no periodic interest but maturing at par, which makes them ideal for investors seeking liquidity and minimal risk. Coupon bonds provide periodic interest payments, known as coupons, throughout the life of the bond, offering a steady income stream and typically longer maturities. Choosing between a discount note and a coupon bond depends on an investor's preference for immediate yield realization versus ongoing interest income.

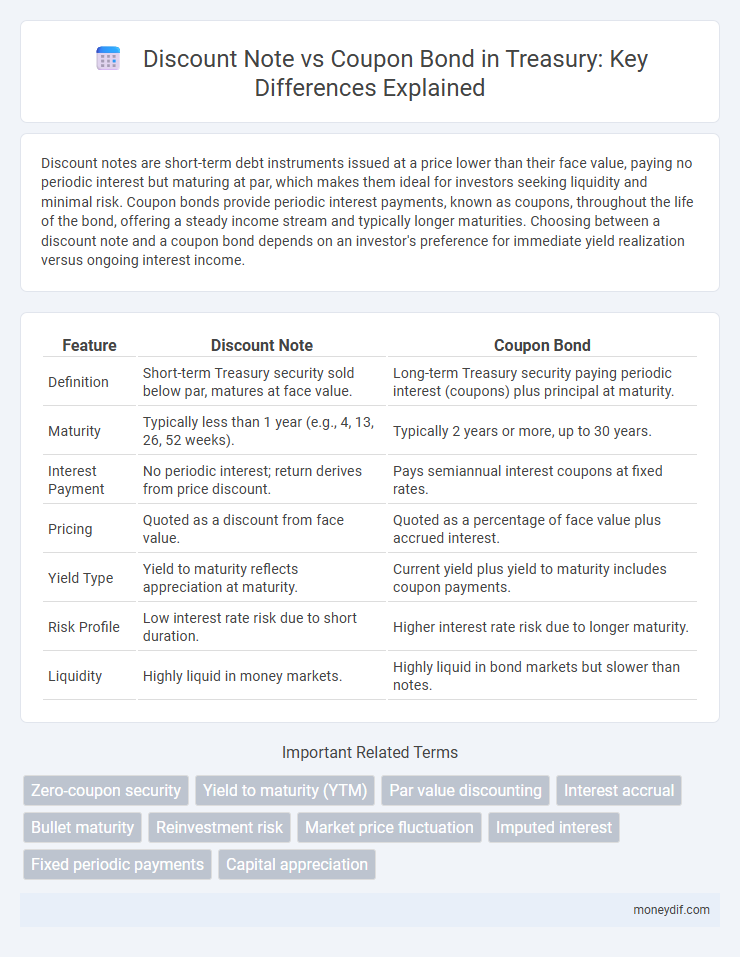

Table of Comparison

| Feature | Discount Note | Coupon Bond |

|---|---|---|

| Definition | Short-term Treasury security sold below par, matures at face value. | Long-term Treasury security paying periodic interest (coupons) plus principal at maturity. |

| Maturity | Typically less than 1 year (e.g., 4, 13, 26, 52 weeks). | Typically 2 years or more, up to 30 years. |

| Interest Payment | No periodic interest; return derives from price discount. | Pays semiannual interest coupons at fixed rates. |

| Pricing | Quoted as a discount from face value. | Quoted as a percentage of face value plus accrued interest. |

| Yield Type | Yield to maturity reflects appreciation at maturity. | Current yield plus yield to maturity includes coupon payments. |

| Risk Profile | Low interest rate risk due to short duration. | Higher interest rate risk due to longer maturity. |

| Liquidity | Highly liquid in money markets. | Highly liquid in bond markets but slower than notes. |

Overview of Treasury Discount Notes and Coupon Bonds

Treasury Discount Notes are short-term securities issued at a price lower than their face value and mature at par, offering no periodic interest payments but a return via capital appreciation. Coupon Bonds represent longer-term debt instruments that pay semi-annual interest, known as coupons, and repay the principal amount at maturity. The primary difference lies in their interest structure: discount notes provide a lump-sum yield upon maturity, while coupon bonds generate periodic income streams.

Key Features of Discount Notes

Discount notes are short-term Treasury securities issued at a price lower than their face value, maturing within one year without periodic interest payments. They generate returns by the difference between the purchase price and the face value paid at maturity, making them zero-coupon instruments. These notes offer high liquidity and minimal risk, attracting investors seeking secure, short-duration investments backed by the U.S. government.

Key Characteristics of Coupon Bonds

Coupon bonds feature periodic interest payments, known as coupons, typically paid semiannually to bondholders. These bonds have a fixed face value repaid at maturity, providing predictable income streams and principal return. Investors value coupon bonds for their steady cash flows and potential price appreciation in secondary markets.

Issuance and Maturity Structures

Discount notes are short-term Treasury securities issued at a discount to face value, maturing in one year or less without periodic interest payments, while coupon bonds are long-term instruments paying semiannual interest over maturities up to 30 years. Issuance of discount notes typically targets immediate liquidity needs with a single payment at maturity, contrasting with coupon bonds that provide steady income streams through periodic coupons. Treasury discount notes have simpler maturity structures, whereas coupon bonds offer complex schedules aligned with investor income preferences and long-term funding strategies.

Interest Payment Mechanisms: Zero-Coupon vs Periodic Coupons

Discount notes are zero-coupon securities sold at a discount and redeemed at face value, with no periodic interest payments, making them ideal for short-term liquidity. Coupon bonds pay periodic interest, known as coupons, typically semiannually, providing investors with regular income streams alongside principal repayment at maturity. The choice between discount notes and coupon bonds hinges on investor preference for immediate yield realization versus steady income flow over time.

Risk Profiles and Investment Considerations

Discount notes, issued at a price below face value and mature at par, present lower interest rate risk due to their short maturities but lack periodic income streams, making them suitable for conservative investors seeking capital preservation. Coupon bonds pay periodic interest, introducing reinvestment risk and greater price volatility, appealing to investors desiring steady income despite higher exposure to interest rate fluctuations. Risk profiles diverge as discount notes minimize duration risk, while coupon bonds require careful analysis of interest rate trends and yield curves to optimize total returns.

Yield Calculation Methods for Discount Notes and Coupon Bonds

Yield calculation for discount notes involves computing the difference between the purchase price and the face value, annualized based on the maturity period, reflecting a zero-coupon yield structure. Coupon bond yields incorporate periodic coupon payments and the difference between purchase price and par value, often calculated using yield to maturity (YTM) methods that solve for the internal rate of return over the bond's full life. The choice of yield calculation impacts investment decisions, with discount notes emphasizing discount yield formulas and coupon bonds requiring more complex cash flow discounting techniques.

Tax Implications and Reporting Differences

Discount notes, such as Treasury bills, are sold below face value and the imputed interest is subject to federal income tax annually, requiring investors to report the accrued interest each year despite no periodic payments. Coupon bonds pay semi-annual interest which is taxable as ordinary income in the year received, with investors reporting interest income separately from the principal repayment. The reporting differences impact tax planning strategies, as discount notes require accrual accounting for interest while coupon bonds rely on actual cash interest receipts.

Common Use Cases in Treasury Financing

Discount notes are short-term Treasury securities issued at a discount and redeemed at face value, commonly used for managing short-term liquidity needs and cash flow smoothing. Coupon bonds pay periodic interest and are favored for long-term financing requirements, providing predictable income streams to investors. Treasury utilizes discount notes for quick capital access, while coupon bonds support sustained funding and budget planning.

Comparing Liquidity and Market Demand

Discount notes exhibit higher liquidity due to their shorter maturities and zero-coupon structure, attracting investors seeking quick turnover and minimal interest rate risk. Coupon bonds, offering periodic interest payments, generally face lower liquidity but appeal to income-focused investors demanding steady cash flows. Market demand for discount notes spikes in volatile markets, while coupon bonds maintain consistent appeal during stable economic periods.

Important Terms

Zero-coupon security

Zero-coupon securities are discount notes sold below face value without periodic coupon payments, unlike coupon bonds that pay regular interest until maturity.

Yield to maturity (YTM)

Yield to maturity (YTM) on discount notes reflects the total return as the price appreciates to face value at maturity, whereas YTM on coupon bonds incorporates periodic interest payments alongside price appreciation, affecting overall yield calculations.

Par value discounting

Par value discounting in discount notes reflects their issuance below face value with no periodic interest, unlike coupon bonds that pay regular coupon interest and are priced based on discounted future cash flows including coupons and principal.

Interest accrual

Interest accrual on discount notes occurs through the gradual increase in the bond's value from its discounted purchase price to its face value at maturity, reflecting implicit interest income without periodic payments. In contrast, coupon bonds accrue interest via explicit periodic coupon payments based on the bond's stated coupon rate, providing regular income streams to investors before maturity.

Bullet maturity

Bullet maturity structures involve a lump-sum principal repayment at maturity, making discount notes--issued below face value and repaid in one payment--similar to coupon bonds that pay periodic interest but differ fundamentally in cash flow timing and valuation.

Reinvestment risk

Reinvestment risk is higher for coupon bonds than discount notes because coupon payments require reinvestment at uncertain future rates, whereas discount notes provide a single lump-sum payment at maturity.

Market price fluctuation

Market price fluctuation in discount notes is primarily influenced by changes in interest rates since these instruments are sold below face value and mature at par, causing inverse price-yield relationships. Coupon bonds exhibit price volatility due to periodic interest payments, with longer maturities and lower coupon rates amplifying sensitivity to interest rate movements.

Imputed interest

Imputed interest represents the implied return on a discount note, calculated as the difference between the purchase price and the maturity value, reflecting income earned without periodic coupon payments. In contrast, a coupon bond pays explicit interest through periodic coupons, while its market price may include accrued interest, but the imputed interest concept primarily applies to zero-coupon or discount instruments.

Fixed periodic payments

Fixed periodic payments in coupon bonds provide regular interest income, while discount notes are issued below face value and pay no periodic interest, offering returns solely at maturity.

Capital appreciation

Capital appreciation is primarily associated with discount notes, which are issued below par value and mature at face value, unlike coupon bonds that pay periodic interest without significant price gains.

Discount note vs Coupon bond Infographic

moneydif.com

moneydif.com