Predictive analytics in treasury forecasts future financial trends and cash flows using historical data, enabling proactive decision-making. Prescriptive analytics goes a step further by recommending specific actions based on predictive insights to optimize liquidity and risk management. Integrating both approaches enhances strategic planning and improves overall treasury performance.

Table of Comparison

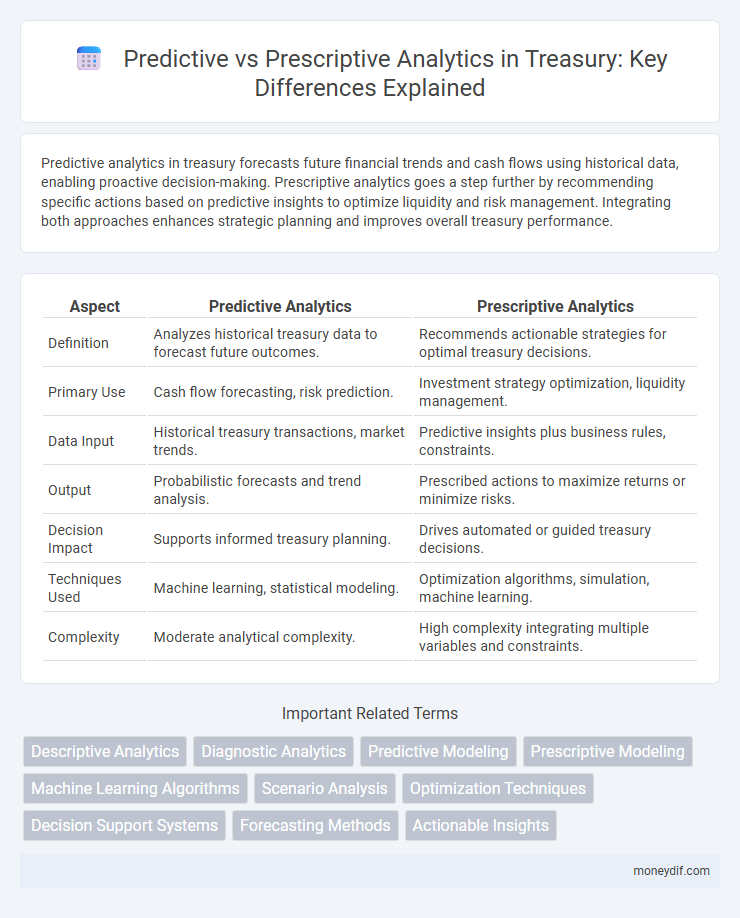

| Aspect | Predictive Analytics | Prescriptive Analytics |

|---|---|---|

| Definition | Analyzes historical treasury data to forecast future outcomes. | Recommends actionable strategies for optimal treasury decisions. |

| Primary Use | Cash flow forecasting, risk prediction. | Investment strategy optimization, liquidity management. |

| Data Input | Historical treasury transactions, market trends. | Predictive insights plus business rules, constraints. |

| Output | Probabilistic forecasts and trend analysis. | Prescribed actions to maximize returns or minimize risks. |

| Decision Impact | Supports informed treasury planning. | Drives automated or guided treasury decisions. |

| Techniques Used | Machine learning, statistical modeling. | Optimization algorithms, simulation, machine learning. |

| Complexity | Moderate analytical complexity. | High complexity integrating multiple variables and constraints. |

Understanding Predictive Analytics in Treasury

Predictive analytics in treasury leverages historical financial data and statistical algorithms to forecast future cash flows, liquidity needs, and market risks with high accuracy. By analyzing patterns and trends in treasury operations, it enables treasurers to anticipate potential cash shortages or investment opportunities, enhancing decision-making efficiency. This data-driven approach reduces uncertainties, allowing financial managers to optimize working capital and improve risk management strategies.

Prescriptive Analytics: A Step Beyond Prediction

Prescriptive analytics in treasury extends beyond predictive analytics by not only forecasting cash flow trends and risk scenarios but also recommending optimal financial actions such as investment strategies and liquidity management. This advanced approach integrates machine learning algorithms with real-time data to optimize decision-making processes, minimizing financial risks and enhancing capital efficiency. By incorporating scenario analysis and optimization models, prescriptive analytics enables treasury teams to proactively navigate complex market conditions and regulatory compliance.

Key Differences Between Predictive and Prescriptive Analytics

Predictive analytics in treasury focuses on forecasting future financial trends using historical data and statistical models, helping identify potential risks and opportunities. Prescriptive analytics goes beyond prediction by recommending specific actions to optimize cash flow, manage liquidity, and enhance investment strategies. The key difference lies in predictive analytics providing insights into what might happen, while prescriptive analytics delivers actionable guidance for decision-making based on those predictions.

Applications of Predictive Analytics in Treasury Operations

Predictive analytics in treasury operations leverages historical financial data and machine learning algorithms to forecast cash flow trends, optimize liquidity management, and assess credit risk more accurately. These applications enable treasury teams to anticipate market fluctuations and make data-driven decisions that enhance risk mitigation and capital allocation. By predicting potential cash shortfalls and identifying investment opportunities, predictive analytics improves overall financial stability and operational efficiency.

How Prescriptive Analytics Enhances Treasury Decision-Making

Prescriptive analytics enhances treasury decision-making by providing actionable recommendations that optimize cash management, risk mitigation, and investment strategies based on predictive insights and real-time data. It leverages advanced algorithms and machine learning to simulate various financial scenarios, enabling treasury teams to make informed decisions that maximize liquidity and minimize risk exposure. Integrating prescriptive analytics into treasury operations drives efficiency, improves forecasting accuracy, and supports strategic planning under dynamic market conditions.

Data Requirements for Predictive vs Prescriptive Analytics

Predictive analytics requires historical and real-time data sets to identify patterns and forecast future outcomes using statistical models and machine learning algorithms. Prescriptive analytics demands more complex data inputs, including predictive results, optimization models, and business rules, to recommend actionable decisions that maximize financial performance and manage risk. Effective treasury management leverages both analytics types but depends heavily on the quality, volume, and timeliness of financial, market, and operational data.

Benefits and Limitations of Predictive Analytics in Treasury

Predictive analytics in treasury leverages historical financial data and machine learning algorithms to forecast cash flow, liquidity needs, and market risks, enhancing decision-making accuracy. Benefits include improved risk management, efficient working capital allocation, and proactive identification of potential financial disruptions. Limitations arise from dependency on data quality, inability to prescribe specific actions, and challenges in adapting to sudden market volatility or unprecedented events.

Leveraging Prescriptive Analytics to Optimize Treasury Performance

Prescriptive analytics drives treasury optimization by recommending specific actions based on predictive insights and real-time financial data, improving liquidity management and risk mitigation. It integrates machine learning algorithms and scenario analysis to enhance decision-making accuracy in cash forecasting and investment strategies. Deploying prescriptive analytics tools enables treasury teams to increase operational efficiency, reduce costs, and maximize returns on corporate assets.

Integrating Predictive and Prescriptive Analytics in Treasury Strategies

Integrating predictive and prescriptive analytics in treasury strategies enhances cash flow forecasting accuracy and optimizes liquidity management decisions. Predictive analytics leverages historical data to anticipate future financial trends, while prescriptive analytics recommends actionable strategies based on those predictions. Combining these approaches enables treasury teams to proactively manage risks, optimize investment portfolios, and improve overall financial performance.

Future Trends: The Role of Advanced Analytics in Treasury Management

Predictive analytics in treasury management leverages historical financial data and machine learning algorithms to forecast cash flow, liquidity needs, and market risks, enabling proactive decision-making. Prescriptive analytics goes beyond prediction by recommending actionable strategies to optimize treasury operations, such as automated hedging and dynamic investment allocation. Future trends emphasize integrating AI-driven prescriptive analytics with real-time data streams, enhancing accuracy and agility in managing treasury risks and capital efficiency.

Important Terms

Descriptive Analytics

Descriptive Analytics summarizes historical data to reveal patterns, Predictive Analytics uses statistical models to forecast future outcomes, and Prescriptive Analytics recommends actions based on predicted scenarios to optimize decision-making.

Diagnostic Analytics

Diagnostic Analytics focuses on identifying the root causes of past outcomes by analyzing historical data patterns, serving as a critical foundation for Predictive Analytics, which forecasts future trends based on these insights. Prescriptive Analytics builds on this by recommending specific actions to optimize future results, integrating both diagnostic insights and predictive models to drive decision-making.

Predictive Modeling

Predictive modeling leverages historical data to forecast future outcomes, distinguishing predictive analytics, which anticipates trends, from prescriptive analytics, which recommends actionable decisions based on those predictions.

Prescriptive Modeling

Prescriptive modeling uses predictive analytics outputs to recommend actionable decisions by analyzing possible outcomes and optimizing strategies based on data-driven insights.

Machine Learning Algorithms

Machine learning algorithms in predictive analytics analyze historical data to forecast future outcomes, employing techniques like regression, decision trees, and neural networks for accurate predictions. In contrast, prescriptive analytics leverages these algorithms to recommend optimal actions by simulating various scenarios and optimizing decision-making processes through reinforcement learning and optimization models.

Scenario Analysis

Scenario analysis enhances predictive analytics by evaluating various future outcomes based on historical data patterns and probabilities. In contrast, prescriptive analytics uses scenario analysis to recommend optimal decisions by simulating the effects of different actions and constraints in complex environments.

Optimization Techniques

Optimization techniques in predictive analytics focus on enhancing model accuracy and forecasting by tuning algorithms such as regression, decision trees, and neural networks, enabling precise future outcome predictions based on historical data. In prescriptive analytics, optimization techniques leverage mathematical programming and simulation methods to determine the best decisions and actions by analyzing predicted scenarios, maximizing objectives like cost reduction, resource allocation, and operational efficiency.

Decision Support Systems

Decision Support Systems leverage Predictive Analytics to forecast future outcomes and Prescriptive Analytics to recommend optimal actions based on those predictions for enhanced decision-making.

Forecasting Methods

Forecasting methods in predictive analytics employ historical data and statistical models such as time series analysis, regression, and machine learning algorithms to estimate future outcomes. Prescriptive analytics builds on these forecasts by integrating optimization techniques and simulation models to recommend actionable decisions that maximize desired objectives.

Actionable Insights

Actionable insights generated from predictive analytics focus on forecasting future trends and behaviors by analyzing historical data patterns, enabling timely and informed decision-making. Prescriptive analytics goes further by recommending specific actions based on those predictions, optimizing outcomes through simulation, optimization algorithms, and scenario analysis.

Predictive Analytics vs Prescriptive Analytics Infographic

moneydif.com

moneydif.com