Primary dealers are financial institutions authorized to trade directly with a country's treasury and actively participate in government securities auctions, providing liquidity and market stability. Non-primary dealers engage in secondary market activities but lack direct access to treasury auctions, limiting their role in influencing primary market dynamics. The distinction impacts market operations, with primary dealers contributing crucially to the issuance and distribution of government debt.

Table of Comparison

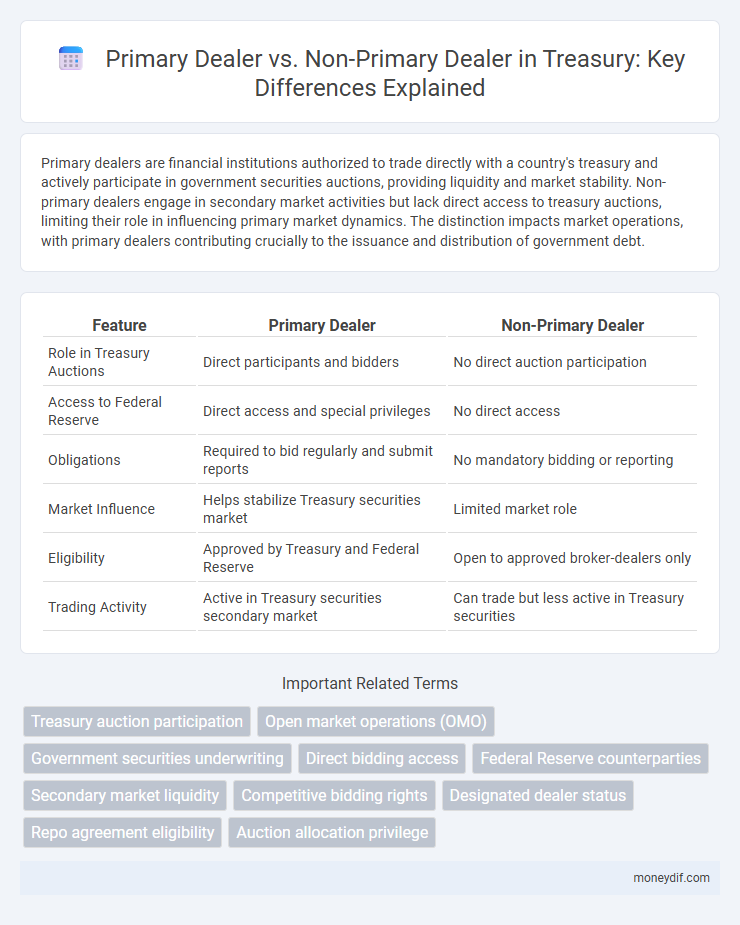

| Feature | Primary Dealer | Non-Primary Dealer |

|---|---|---|

| Role in Treasury Auctions | Direct participants and bidders | No direct auction participation |

| Access to Federal Reserve | Direct access and special privileges | No direct access |

| Obligations | Required to bid regularly and submit reports | No mandatory bidding or reporting |

| Market Influence | Helps stabilize Treasury securities market | Limited market role |

| Eligibility | Approved by Treasury and Federal Reserve | Open to approved broker-dealers only |

| Trading Activity | Active in Treasury securities secondary market | Can trade but less active in Treasury securities |

Introduction to Treasury Dealers

Treasury dealers play a crucial role in the government securities market, facilitating the buying and selling of U.S. Treasury bonds and notes. Primary dealers are authorized by the Federal Reserve Bank of New York to directly participate in Treasury auctions and provide market liquidity, while non-primary dealers operate in secondary markets without direct auction privileges. Understanding the distinction between these two types of dealers helps clarify their respective functions in maintaining efficient Treasury market operations.

Defining Primary Dealers

Primary dealers are financial institutions authorized by the Treasury Department to transact directly with the Federal Reserve in the buying and selling of government securities. These entities play a critical role in underwriting new issues of U.S. Treasury bonds and bills, ensuring liquidity and market stability. In contrast, non-primary dealers participate in the treasury market but lack direct access to auctions and Federal Reserve operations, limiting their influence on monetary policy implementation.

Understanding Non-Primary Dealers

Non-primary dealers are financial institutions that are not authorized to trade directly with the U.S. Treasury but participate in the secondary government securities market. These dealers play a crucial role by buying Treasury securities from primary dealers and providing liquidity to a broader range of investors. Understanding non-primary dealers is essential for grasping the full ecosystem of Treasury securities distribution and market depth.

Eligibility Criteria for Primary Dealers

Primary dealers must meet strict eligibility criteria including substantial capital requirements, a proven track record in government securities trading, and robust operational infrastructure to support market-making activities. These entities are required to participate actively in Treasury auctions and provide continuous two-way price quotations to ensure market liquidity. Non-primary dealers lack these formal qualifications and do not have direct access to Treasury auctions, limiting their role in the government securities market.

Key Roles and Responsibilities

Primary dealers serve as mandated trading counterparties to the U.S. Treasury, responsible for underwriting new government debt issuances and actively participating in Treasury auctions to support market liquidity. They provide real-time market information, facilitate price discovery, and act as key intermediaries between the Treasury and the broader financial markets. Non-primary dealers engage in secondary market trading of Treasury securities but lack direct obligations to buy new issues or report market conditions to the Treasury, limiting their influence on debt distribution and market operations.

Participation in Treasury Auctions

Primary dealers have exclusive authorization to participate directly in U.S. Treasury auctions, playing a critical role in underwriting and distributing government securities. Non-primary dealers must acquire Treasuries through secondary market transactions or from primary dealers, limiting their direct access to Treasury issuances. This distinction influences market liquidity and the transmission of monetary policy through Treasury securities.

Access to Central Bank Operations

Primary dealers have direct access to central bank operations, including participation in open market operations and repo transactions, enabling them to influence liquidity and monetary policy implementation. Non-primary dealers lack this privileged access, limiting their ability to conduct transactions directly with the central bank and forcing reliance on primary dealers for market activities. This differentiation affects market liquidity, price discovery, and the distribution of government securities.

Market Impact and Liquidity Provision

Primary dealers play a critical role in market impact by actively participating in U.S. Treasury auctions and ensuring price stability through continuous bidding, which enhances overall market liquidity. Non-primary dealers, while not directly involved in Treasury auctions, provide supplementary liquidity by trading Treasury securities in secondary markets, contributing to market depth but with less influence on price discovery. The distinction in market impact and liquidity provision results in primary dealers being essential liquidity providers, promoting smoother Treasury market functioning and efficient price formation.

Benefits and Challenges for Dealers

Primary dealers benefit from direct access to Treasury auctions, providing them with exclusive opportunities to acquire securities and enhance market liquidity, but face stringent regulatory requirements and capital commitments. Non-primary dealers have greater operational flexibility and lower compliance burdens but often encounter limited access to auction allotments and reduced influence in secondary market pricing. Both types of dealers must balance risk management and capital efficiency while navigating the complexities of Treasury market participation.

Choosing Between Primary and Non-Primary Dealer Status

Choosing between primary dealer and non-primary dealer status depends on a firm's strategic goals and operational capacities. Primary dealers have direct access to U.S. Treasury auctions, enabling them to buy government securities at issue and participate in market-making activities, which enhances liquidity and prestige. Non-primary dealers, lacking this privileged access, rely on secondary markets and often have lower regulatory requirements, making them suitable for firms seeking flexibility without the obligations of primary dealers.

Important Terms

Treasury auction participation

Primary dealers actively participate in Treasury auctions by submitting competitive bids and supporting market liquidity, while non-primary dealers typically engage less frequently or through secondary market transactions.

Open market operations (OMO)

Open market operations (OMO) primarily involve primary dealers as authorized participants who directly transact government securities with the central bank, whereas non-primary dealers engage indirectly in these operations through secondary market activities.

Government securities underwriting

Government securities underwriting is primarily conducted by primary dealers, who have exclusive rights and obligations to participate directly in Treasury auctions, whereas non-primary dealers can only trade these securities in the secondary market without underwriting privileges.

Direct bidding access

Direct bidding access allows primary dealers, who are authorized financial institutions, to submit bids directly in government securities auctions, whereas non-primary dealers must participate through intermediaries. This access enhances market liquidity and price transparency, benefiting primary dealers with preferential auction participation and fostering competitive pricing for government debt.

Federal Reserve counterparties

Federal Reserve counterparties primarily consist of Primary Dealers authorized to trade U.S. government securities, while Non-primary dealers lack this official designation and have limited direct access to Federal Reserve open market operations.

Secondary market liquidity

Secondary market liquidity is significantly higher among primary dealers due to their exclusive trading privileges and market-making roles compared to non-primary dealers.

Competitive bidding rights

Primary dealers hold exclusive competitive bidding rights in government securities auctions, unlike non-primary dealers who participate less directly.

Designated dealer status

Designated dealer status grants select financial institutions exclusive rights to underwrite and distribute government securities, distinguishing them from primary dealers who participate directly in primary market auctions, while non-primary dealers operate only in secondary markets.

Repo agreement eligibility

Primary dealers are eligible to enter repo agreements with the central bank under specified terms, while non-primary dealers typically face restrictions or additional criteria for eligibility.

Auction allocation privilege

Auction allocation privilege grants primary dealers prioritized access to Treasury securities, whereas non-primary dealers receive allocations only after primary dealers' demands are met.

Primary dealer vs Non-primary dealer Infographic

moneydif.com

moneydif.com