Cash Management Bills (CMBs) are short-term debt instruments issued by the U.S. Treasury to address temporary cash flow shortfalls and have variable maturities usually under 90 days. Treasury Bills (T-Bills) are also short-term securities but have standard maturities of 4, 8, 13, 26, or 52 weeks and are issued on a regular schedule to finance government needs. Both instruments are sold at a discount and do not pay interest before maturity, but CMBs provide greater flexibility for immediate funding needs.

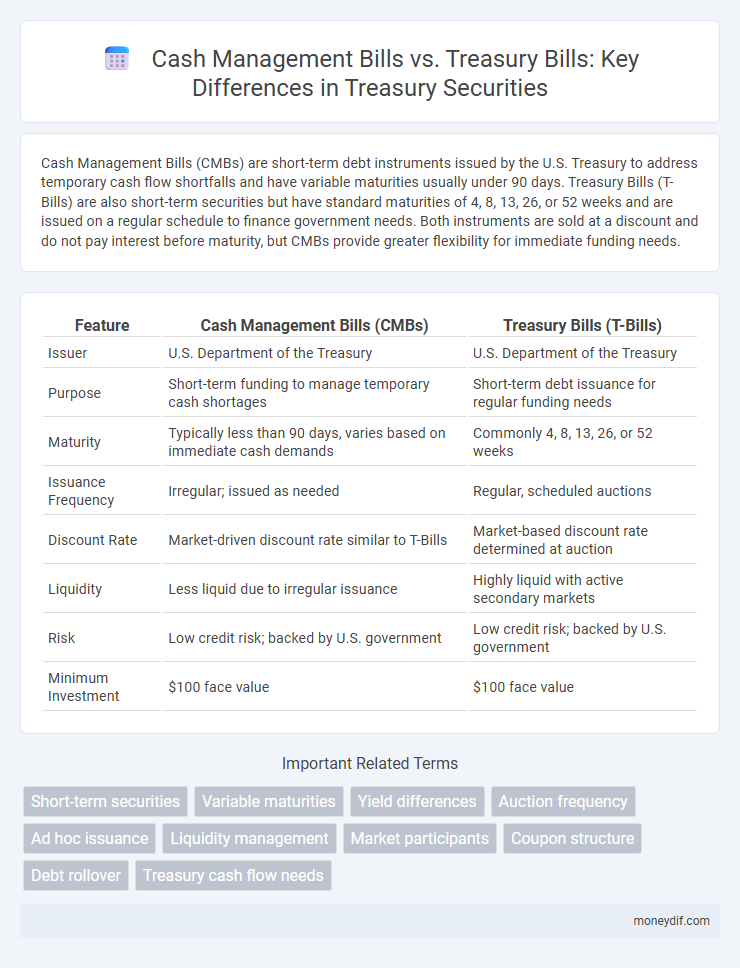

Table of Comparison

| Feature | Cash Management Bills (CMBs) | Treasury Bills (T-Bills) |

|---|---|---|

| Issuer | U.S. Department of the Treasury | U.S. Department of the Treasury |

| Purpose | Short-term funding to manage temporary cash shortages | Short-term debt issuance for regular funding needs |

| Maturity | Typically less than 90 days, varies based on immediate cash demands | Commonly 4, 8, 13, 26, or 52 weeks |

| Issuance Frequency | Irregular; issued as needed | Regular, scheduled auctions |

| Discount Rate | Market-driven discount rate similar to T-Bills | Market-based discount rate determined at auction |

| Liquidity | Less liquid due to irregular issuance | Highly liquid with active secondary markets |

| Risk | Low credit risk; backed by U.S. government | Low credit risk; backed by U.S. government |

| Minimum Investment | $100 face value | $100 face value |

Overview of Cash Management Bills and Treasury Bills

Cash Management Bills (CMBs) are short-term U.S. Treasury securities issued to cover temporary mismatches in government cash flow, typically with maturities ranging from a few days up to six months. Treasury Bills (T-Bills) serve as standard short-term investment instruments with fixed maturities of 4, 8, 13, 26, or 52 weeks and are regularly auctioned to manage federal debt. Both instruments are sold at a discount to face value, offering investors a secure, liquid means to park funds while supporting government financing needs.

Key Differences Between Cash Management Bills and Treasury Bills

Cash Management Bills (CMBs) are short-term securities issued irregularly to address temporary government funding needs, typically with maturities ranging from a few days to several weeks. Treasury Bills (T-Bills) are regularly issued short-term debt instruments with fixed maturities of 4, 13, 26, or 52 weeks, aimed at financing government operations and managing liquidity. While CMBs are issued on an as-needed basis and often at a premium yield due to their timing variability, T-Bills follow a predictable auction schedule and usually offer lower yields reflecting their standardized issuance.

Issuance Frequency and Purpose

Cash Management Bills (CMBs) are issued irregularly by the U.S. Treasury to manage short-term cash flow needs and address temporary funding gaps, whereas Treasury Bills (T-Bills) have a regular issuance schedule, typically weekly or monthly, to finance government operations. CMBs are primarily designed for fine-tuning the Treasury's daily cash position and are generally shorter in maturity compared to T-Bills, which serve as standard government securities for short-term borrowing. The issuance frequency and purpose distinguish CMBs as flexible cash flow tools, while T-Bills represent consistent, predictable short-term debt instruments.

Maturity Periods and Terms

Cash management bills (CMBs) have shorter maturity periods, typically ranging from 4 to 12 weeks, designed for immediate funding needs with flexible issuance dates. Treasury bills (T-bills) offer standard maturities of 4, 8, 13, 26, or 52 weeks, providing predictable investment horizons for cash management and liquidity purposes. The shorter, variable terms of CMBs contrast with the fixed, regular terms of T-bills, reflecting their specialized roles in Treasury cash flow management.

Yield and Pricing Mechanisms

Cash Management Bills (CMBs) are short-term US Treasury securities issued to meet temporary cash shortfalls, typically with maturities ranging from a few days to weeks, and they usually offer yields slightly lower than regular Treasury Bills (T-Bills) due to their ad-hoc issuance and demand-driven pricing. Treasury Bills are regularly auctioned at a discount to face value, with yields determined by competitive bidding in the auction market, reflecting broader market interest rates and Treasury financing needs. The pricing mechanism for CMBs often results in less price transparency and liquidity, causing yield fluctuations that differ from the more stable, well-understood pricing and yield dynamics of standard T-Bills.

Investor Eligibility and Participation

Cash Management Bills (CMBs) and Treasury Bills (T-Bills) offer distinct investor eligibility criteria, with CMBs primarily targeting institutional investors such as commercial banks and government entities due to their short-term, urgent funding nature. Treasury Bills, available to both individual and institutional investors, provide broader participation through regular auctions, promoting market liquidity and wider access. Both instruments serve as low-risk investment options backed by the U.S. government, but the difference in participation methods significantly impacts investor demographics and market engagement.

Risk Profiles and Creditworthiness

Cash Management Bills (CMBs) and Treasury Bills (T-Bills) both represent short-term government debt instruments with high creditworthiness backed by the full faith and credit of the U.S. Treasury. CMBs typically have shorter maturities, ranging from a few days to a few weeks, leading to lower interest rate risk but potentially higher rollover risk due to their irregular issuance schedule. Treasury Bills, issued regularly in 4, 8, 13, 26, and 52-week maturities, benefit from greater liquidity and a more predictable market, which generally translates to lower overall risk profiles compared to the less frequently issued Cash Management Bills.

Liquidity and Secondary Market Trading

Cash Management Bills (CMBs) offer high liquidity due to their short maturities and are typically issued to manage temporary funding needs, making them less frequently traded in the secondary market. Treasury Bills (T-Bills) also provide strong liquidity but benefit from a more active secondary market, enhancing price discovery and investor flexibility. Investors seeking quick access to funds may prefer CMBs for immediate liquidity, while those valuing tradability often opt for T-Bills.

Use Cases for Cash Management Bills vs Treasury Bills

Cash management bills (CMBs) serve as short-term funding tools used primarily to address temporary cash flow mismatches in government financing, often issued with maturities ranging from a few days to a few months. Treasury bills (T-bills) are standard short-term securities with regular issuance schedules, designed for broader market participation and stable government financing needs, typically maturing in 4, 13, 26, or 52 weeks. CMBs are ideal for managing urgent liquidity requirements without disrupting standard T-bill issuance, whereas T-bills provide predictable investment opportunities and support long-term debt structure.

Regulatory and Tax Considerations

Cash management bills (CMBs) are short-term securities issued for temporary funding needs, exempt from state and local taxes but subject to federal taxation, while Treasury bills (T-bills) also enjoy similar tax advantages with broader issuance terms. Regulatory oversight for CMBs is strict due to their ad hoc issuance, ensuring alignment with federal borrowing limits, whereas T-bills are regularly auctioned and governed by established market regulations under the U.S. Department of the Treasury. Both instruments benefit from high liquidity and creditworthiness, but their different regulatory frameworks affect investor eligibility and reporting requirements.

Important Terms

Short-term securities

Cash management bills (CMBs) and Treasury bills (T-bills) are both short-term government securities used for raising funds, with CMBs issued on an as-needed basis to cover temporary cash flow shortfalls, typically maturing in a few days to weeks, while T-bills are regularly issued with standardized maturities of 4, 13, 26, or 52 weeks. Both are sold at a discount and redeemed at face value, offering low-risk liquidity instruments essential for effective cash management and short-term investment strategies.

Variable maturities

Variable maturities in cash management bills typically range from a few days to several weeks, offering greater flexibility compared to standard Treasury bills which usually have fixed maturities of 4, 8, 13, 26, or 52 weeks.

Yield differences

Cash Management Bills offer shorter maturities and typically lower yields compared to Treasury Bills due to their demand-driven issuance and liquidity preferences.

Auction frequency

Auction frequency for Cash Management Bills (CMBs) is typically irregular and scheduled based on short-term government funding needs, whereas Treasury Bills (T-Bills) have a fixed, regular auction schedule, such as weekly or monthly intervals. This difference allows CMBs to offer greater flexibility in cash management, providing liquidity tailored to immediate fiscal requirements, while T-Bills serve as a consistent instrument for short-term government borrowing.

Ad hoc issuance

Ad hoc issuance refers to the unscheduled release of cash management bills (CMBs) to meet short-term government funding needs, distinguished from Treasury bills which follow a regular auction schedule and longer maturity terms. Cash management bills typically have maturities of a few days to a few months, providing immediate liquidity flexibility, while Treasury bills offer standardized maturities of 4, 13, 26, or 52 weeks aimed at broader investor participation and cash flow planning.

Liquidity management

Liquidity management involves optimizing cash flow by balancing short-term obligations and investment opportunities, where Cash Management Bills (CMBs) provide highly liquid, short-dated instruments issued to cover temporary government funding needs. Treasury Bills (T-Bills) are also short-term securities but serve as a more general government debt instrument with slightly longer maturities, making CMBs preferable for managing immediate liquidity gaps efficiently.

Market participants

Market participants such as institutional investors, commercial banks, and money market funds actively trade Cash Management Bills and Treasury Bills, leveraging their short-term maturities and government backing for liquidity, yield optimization, and risk management.

Coupon structure

Cash Management Bills are short-term, zero-coupon securities issued at a discount with no periodic interest payments, whereas Treasury Bills also have short maturities but may differ slightly in auction timing and discount rates, both lacking traditional coupon structures.

Debt rollover

Debt rollover involves replacing maturing obligations with new debt, often utilizing short-term instruments like Cash Management Bills (CMBs) and Treasury Bills (T-Bills) to manage liquidity efficiently. Cash Management Bills, issued on an as-needed basis for immediate cash requirements, offer more flexibility compared to regularly auctioned Treasury Bills, making them a preferred choice in short-term debt rollover strategies.

Treasury cash flow needs

Treasury cash flow needs are managed by strategically issuing Cash Management Bills (CMBs) for short-term, flexible financing to cover immediate funding gaps, whereas Treasury Bills (T-Bills) provide more predictable, regular funding with maturities ranging from 4 to 52 weeks. CMBs offer the Treasury the ability to adjust borrowing dynamically based on cash flow forecasts, while T-Bills support consistent debt management and liquidity in the market.

Cash management bills vs Treasury bills Infographic

moneydif.com

moneydif.com