Yield curve risk arises from fluctuations in interest rates across different maturities, impacting the value of fixed-income investments and potentially leading to losses when rates shift unfavorably. Reinvestment risk involves the uncertainty of having to reinvest cash flows, such as coupon payments or principal repayments, at lower interest rates than the original investment. Managing both risks is crucial for maintaining portfolio stability and achieving desired return objectives in varying interest rate environments.

Table of Comparison

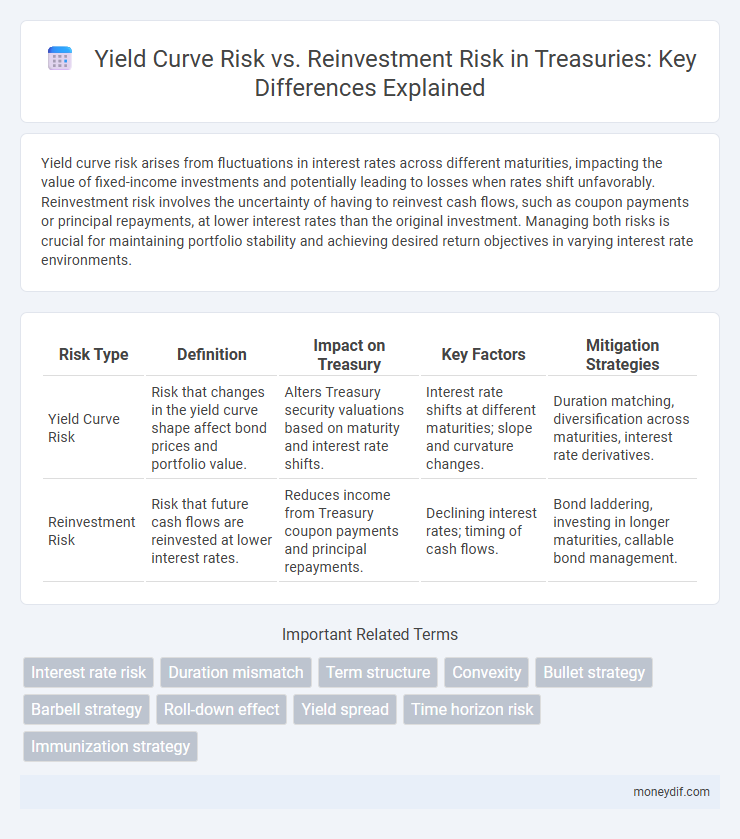

| Risk Type | Definition | Impact on Treasury | Key Factors | Mitigation Strategies |

|---|---|---|---|---|

| Yield Curve Risk | Risk that changes in the yield curve shape affect bond prices and portfolio value. | Alters Treasury security valuations based on maturity and interest rate shifts. | Interest rate shifts at different maturities; slope and curvature changes. | Duration matching, diversification across maturities, interest rate derivatives. |

| Reinvestment Risk | Risk that future cash flows are reinvested at lower interest rates. | Reduces income from Treasury coupon payments and principal repayments. | Declining interest rates; timing of cash flows. | Bond laddering, investing in longer maturities, callable bond management. |

Understanding Yield Curve Risk in Treasury Management

Yield curve risk in treasury management refers to the potential impact on a portfolio's value due to fluctuations in the shape or slope of the yield curve, affecting interest rate sensitive instruments. This risk arises when changes in long-term and short-term interest rates diverge, influencing the valuation of bonds and fixed-income securities differently across maturities. Effective management requires analyzing yield curve shifts to optimize investment strategies and mitigate adverse financial outcomes in treasury operations.

Defining Reinvestment Risk for Fixed Income Portfolios

Reinvestment risk in fixed income portfolios refers to the possibility that future coupon payments or principal repayments will be reinvested at lower interest rates than the original investment, reducing overall portfolio returns. This risk is especially significant in a declining interest rate environment where investors face diminished income from reinvested funds. Managing reinvestment risk involves strategies like laddering maturities or investing in bonds with varying durations to minimize cash flow timing mismatches and preserve yield.

Key Differences: Yield Curve Risk vs Reinvestment Risk

Yield curve risk involves potential losses from changes in the shape or slope of the yield curve affecting bond prices and portfolio values, particularly for longer maturity securities. Reinvestment risk arises when declining interest rates force reinvestment of coupon or principal payments at lower yields, reducing overall returns. While yield curve risk impacts market value fluctuations, reinvestment risk primarily affects income streams and cash flow reinvestment opportunities.

How Yield Curve Shifts Impact Treasury Securities

Yield curve shifts significantly impact Treasury securities by altering their price sensitivity and reinvestment opportunities. When the yield curve steepens, long-term Treasury yields rise, causing prices of existing long-term bonds to drop, increasing yield curve risk. Conversely, a flattening or inverted yield curve reduces reinvestment risk by limiting the opportunity to reinvest at higher rates, thus affecting the overall portfolio returns of Treasury securities.

Factors Influencing Reinvestment Risk in Treasuries

Factors influencing reinvestment risk in Treasuries include prevailing interest rates, the timing of coupon payments, and the maturity profile of the bond portfolio. Rising interest rates reduce reinvestment risk by allowing coupons to be reinvested at higher yields, while falling rates increase the risk of lower returns on reinvested coupons. The frequency of coupon payments and the investor's ability to reinvest cash flows at comparable rates significantly impact overall reinvestment risk exposure.

Managing Yield Curve Exposure in Treasury Strategies

Managing yield curve exposure in treasury strategies involves balancing yield curve risk--the potential loss due to changes in the shape or slope of the yield curve--with reinvestment risk, which arises when future cash flows must be reinvested at lower yields. Effective treasury management employs techniques such as duration matching, laddering bond maturities, and using interest rate swaps to mitigate distortions caused by volatile interest rate environments. Understanding and quantifying both curvature risk and reinvestment risk is essential to optimize portfolio returns while maintaining liquidity and reducing the cost of capital.

Reinvestment Risk and Its Effect on Cash Flow Predictability

Reinvestment risk refers to the uncertainty associated with the rates at which future cash flows from an investment can be reinvested. This risk impacts cash flow predictability by potentially reducing the expected returns if reinvested at lower interest rates, causing fluctuations in income streams from coupon payments or maturing securities. Treasury managers must carefully consider reinvestment risk when managing portfolios to maintain stable and predictable cash inflows.

Yield Curve Risk Mitigation Techniques for Treasury Investors

Yield curve risk arises from fluctuations in interest rates across different maturities, affecting the market value of fixed-income securities. Treasury investors mitigate this risk through strategies such as bond laddering, which staggers maturities to reduce sensitivity to rate shifts, and duration matching to align asset duration with investment horizon. Utilizing interest rate derivatives like swaps and futures further hedges exposure, ensuring portfolio resilience against unpredictable yield curve movements.

Balancing Yield Curve Risk and Reinvestment Risk in Portfolios

Balancing yield curve risk and reinvestment risk in portfolios involves strategically managing the maturity structure of bond investments to optimize returns while minimizing exposure to interest rate fluctuations. Yield curve risk arises from changes in the shape and slope of the yield curve affecting bond prices, whereas reinvestment risk concerns the uncertainty of returns from reinvesting coupon payments at potentially lower interest rates. Effective portfolio management requires diversifying maturities and using strategies like laddering or barbell approaches to mitigate the impact of interest rate volatility on overall portfolio performance.

Best Practices for Treasury Risk Assessment and Control

Effective Treasury risk assessment and control require distinguishing between yield curve risk, which involves potential losses from changes in interest rates across different maturities, and reinvestment risk, the uncertainty of future returns when cash flows are reinvested at lower rates. Best practices include conducting scenario analysis and stress testing on various yield curve shifts to measure exposure and implementing diversification strategies to mitigate reinvestment risk. Continuous monitoring using advanced analytics and aligning risk limits with strategic objectives enhances the robustness of Treasury risk management frameworks.

Important Terms

Interest rate risk

Interest rate risk encompasses yield curve risk, which affects bond prices due to shifts in different maturities, and reinvestment risk, which impacts returns when coupon payments are reinvested at fluctuating interest rates.

Duration mismatch

Duration mismatch occurs when the timing of asset and liability cash flows differ, exposing investors to yield curve risk and reinvestment risk simultaneously. Yield curve risk impacts bond prices due to interest rate changes across maturities, while reinvestment risk affects the returns from coupons or principal repayments being reinvested at uncertain future rates.

Term structure

Term structure of interest rates illustrates yield curve risk as fluctuations in bond prices due to changing rates over time, while reinvestment risk arises from uncertain future rates affecting coupon reinvestment returns.

Convexity

Convexity measures the curvature of the price-yield relationship of bonds, influencing sensitivity to yield curve risk, where changes in interest rates affect bond prices differently across maturities. It also impacts reinvestment risk by affecting the timing and amount of coupon payments that must be reinvested at varying interest rates, altering overall bond returns.

Bullet strategy

The bullet strategy mitigates reinvestment risk by concentrating bond maturities around a single date but increases exposure to yield curve risk due to lack of diversification across different maturities.

Barbell strategy

The Barbell strategy balances Yield curve risk by allocating investments at both short and long maturities, reducing exposure to intermediate-term interest rate fluctuations. This approach simultaneously manages Reinvestment risk by relying on short-term bonds for liquidity and long-term bonds for higher yields, optimizing overall portfolio performance amid changing interest rates.

Roll-down effect

The roll-down effect describes how a bond's price changes as it approaches maturity, impacting yield curve risk by potentially enhancing returns when the yield curve is upward sloping. Reinvestment risk arises because coupon payments received may have to be reinvested at lower rates if interest rates decline, contrasting with yield curve risk's sensitivity to shifts in the overall shape of the yield curve.

Yield spread

Yield spread reflects the difference in yields between two bonds, often highlighting the risk premium required for credit or maturity differences, which directly impacts Yield curve risk--the risk that changes in the shape or slope of the yield curve affect bond prices. Reinvestment risk arises when declining interest rates force investors to reinvest coupon payments at lower yields, contrasting with yield curve risk that focuses on price volatility due to shifts along the curve.

Time horizon risk

Time horizon risk arises when the investment period does not align with the maturity of fixed-income securities, intensifying exposure to yield curve risk, which involves fluctuations in interest rates at different maturities affecting bond prices. Reinvestment risk, on the other hand, concerns the uncertainty of reinvesting coupon payments or principal at lower rates, which becomes more pronounced when short-term rates decline relative to long-term yields on the yield curve.

Immunization strategy

Immunization strategy in fixed income portfolio management targets balancing yield curve risk and reinvestment risk by matching the duration of assets and liabilities to minimize sensitivity to interest rate changes. This approach ensures that fluctuations in bond prices due to interest rate movements are offset by changes in reinvestment rates, stabilizing the portfolio's overall return.

Yield curve risk vs Reinvestment risk Infographic

moneydif.com

moneydif.com