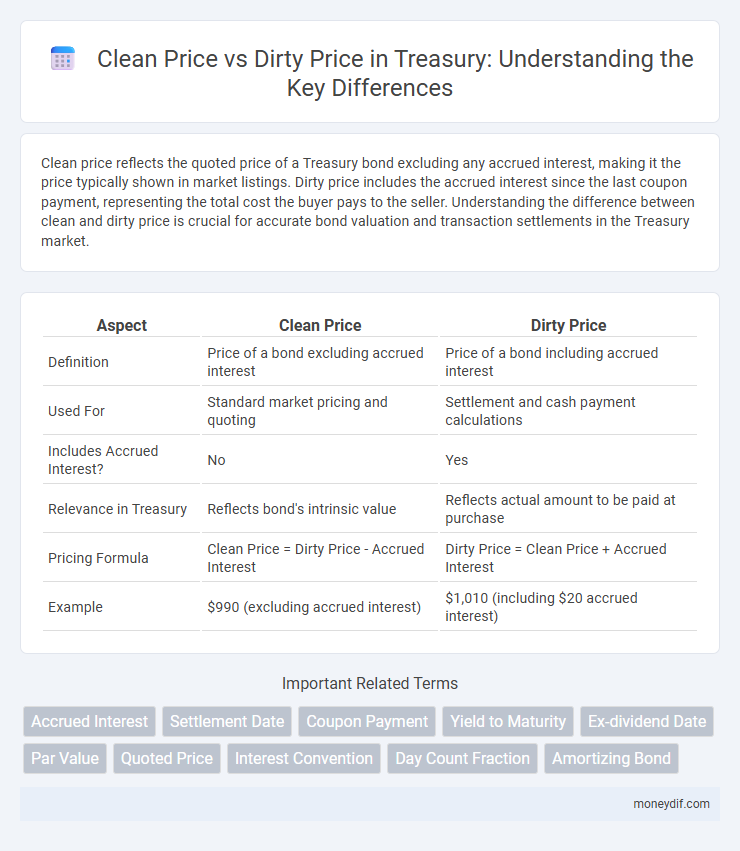

Clean price reflects the quoted price of a Treasury bond excluding any accrued interest, making it the price typically shown in market listings. Dirty price includes the accrued interest since the last coupon payment, representing the total cost the buyer pays to the seller. Understanding the difference between clean and dirty price is crucial for accurate bond valuation and transaction settlements in the Treasury market.

Table of Comparison

| Aspect | Clean Price | Dirty Price |

|---|---|---|

| Definition | Price of a bond excluding accrued interest | Price of a bond including accrued interest |

| Used For | Standard market pricing and quoting | Settlement and cash payment calculations |

| Includes Accrued Interest? | No | Yes |

| Relevance in Treasury | Reflects bond's intrinsic value | Reflects actual amount to be paid at purchase |

| Pricing Formula | Clean Price = Dirty Price - Accrued Interest | Dirty Price = Clean Price + Accrued Interest |

| Example | $990 (excluding accrued interest) | $1,010 (including $20 accrued interest) |

Introduction to Treasury Pricing: Clean vs Dirty

The clean price of a Treasury bond reflects its value without accrued interest, serving as the quoted market price for trading purposes. In contrast, the dirty price includes the accrued interest since the last coupon payment, representing the total amount a buyer pays. Understanding the distinction between clean and dirty prices is essential for accurate bond valuation and settlement in Treasury markets.

Defining Clean Price in Treasury Securities

Clean price in Treasury securities represents the quoted price excluding accrued interest, reflecting the pure value of the bond itself. It is used primarily for quoting and trading purposes, providing a standardized price unaffected by the time elapsed since the last coupon payment. Investors use clean price to assess the market value of Treasury bonds without the distortion of accrued interest calculations.

Understanding Dirty Price: Components and Calculation

Dirty price represents the total value of a Treasury bond, including its clean price plus accrued interest since the last coupon payment. Accrued interest is calculated by multiplying the bond's coupon rate by the fraction of the coupon period that has elapsed, ensuring investors are compensated for interest earned but not yet paid. This comprehensive pricing method provides a more accurate reflection of the bond's current worth in secondary market trading.

Accrued Interest: The Key Difference Explained

Accrued interest represents the interest accumulated on a bond since the last coupon payment and is the key factor distinguishing clean price from dirty price. The clean price of a bond excludes accrued interest, reflecting only the bond's intrinsic value, while the dirty price includes accrued interest, representing the total amount a buyer pays. Understanding accrued interest is crucial for accurate bond valuation and transaction pricing in treasury management.

How Clean and Dirty Prices Affect Trading

Clean price excludes accrued interest, providing a clear view of a bond's base value, which simplifies comparison and analysis during trading. Dirty price includes accrued interest, reflecting the actual amount a buyer pays, impacting transaction costs and settlement amounts. Traders must consider both prices to accurately assess yield, make informed trading decisions, and manage cash flow effectively.

Pricing Conventions in the Treasury Market

Clean price reflects the quoted price of a Treasury security excluding accrued interest, serving as the standard convention for pricing and quoting in the Treasury market. Dirty price incorporates accrued interest since the last coupon payment, representing the actual amount the buyer pays at settlement. Understanding these pricing conventions is crucial for accurate valuation and comparison of Treasury bonds and notes in trading and portfolio management.

Clean Price vs Dirty Price: Impact on Investors

Clean price represents the bond's price excluding accrued interest, while dirty price includes accrued interest, reflecting the total cost to the investor. Investors focused on transaction transparency prefer the clean price for its clarity, whereas the dirty price provides a more accurate indication of cash flow at settlement. Understanding the distinction between clean and dirty prices is crucial for investors to evaluate bond returns and compare investment opportunities effectively.

Calculating Accrued Interest in Treasury Bonds

Calculating accrued interest in Treasury bonds involves determining the interest earned from the last coupon payment date up to the settlement date, which is added to the clean price to obtain the dirty price. The clean price reflects the bond's value excluding accrued interest, while the dirty price includes accrued interest, representing the total amount paid by the buyer. Accurate accrued interest calculation uses the day count convention specified in the bond terms, typically 30/360 or actual/actual, ensuring precise valuation during transactions.

Real-World Examples: Clean and Dirty Price Comparisons

In Treasury bond trading, the clean price excludes accrued interest, reflecting the bond's base value, while the dirty price includes accrued interest, representing the total cost paid by the buyer. For example, a 10-year U.S. Treasury note priced at a clean price of 99.50 with accrued interest of 0.75 results in a dirty price of 100.25, indicating the actual transaction amount. Investors must understand both prices to accurately assess purchase costs and yields in the primary and secondary markets.

Regulatory and Reporting Standards for Treasury Pricing

Regulatory frameworks such as IFRS and US GAAP mandate the use of clean price for transparent valuation of Treasury securities, excluding accrued interest to enhance comparability. Reporting standards require disclosing dirty price to reflect total payment at settlement, ensuring accuracy in financial statements and risk assessments. Compliance with these standards ensures consistent Treasury pricing that aligns with market conventions and investor protections.

Important Terms

Accrued Interest

Accrued interest is the interest accumulated on a bond since the last coupon payment, affecting the price calculation where the clean price excludes accrued interest while the dirty price includes it. Investors use the dirty price to determine the total cost of purchasing a bond between coupon dates, ensuring accurate compensation for interest earned.

Settlement Date

The settlement date is the specific day when the transfer of securities ownership and payment occurs, critically affecting the calculation of clean price versus dirty price. The clean price excludes accrued interest up to the settlement date, while the dirty price includes this accrued interest, reflecting the total amount the buyer pays on the settlement date.

Coupon Payment

Coupon payment represents the interest income received by bondholders, which affects the dirty price by including accrued interest since the last coupon date, while the clean price reflects the bond's price excluding this accrued interest. Understanding the distinction between clean and dirty prices is essential for accurately valuing bonds and calculating yields based on the timing of coupon payments.

Yield to Maturity

Yield to Maturity is calculated using the dirty price, which includes accrued interest, whereas the clean price excludes accrued interest and is used primarily for quoting bonds.

Ex-dividend Date

The ex-dividend date marks the cutoff when buyers no longer receive the upcoming dividend, causing the dirty price of a bond to reflect accrued interest while the clean price remains dividend-excluded.

Par Value

Par value is the nominal value of a bond used to calculate its clean price, while the dirty price includes the clean price plus accrued interest since the last coupon payment.

Quoted Price

Quoted price, or clean price, excludes accrued interest while dirty price includes accrued interest, reflecting the total amount payable for a bond.

Interest Convention

The interest convention determines whether bond pricing uses clean price, excluding accrued interest, or dirty price, which includes accrued interest, to accurately reflect transaction value.

Day Count Fraction

Day count fraction determines interest accrual periods crucial for calculating the difference between clean price, which excludes accrued interest, and dirty price, which includes it.

Amortizing Bond

Amortizing bonds involve periodic principal repayments, causing the outstanding balance and accrued interest to decrease over time, which directly impacts the bond's clean price--the quoted price excluding accrued interest--and dirty price--the total price including accrued interest. The dirty price reflects the actual amount paid by the buyer, combining the clean price and the interest earned since the last coupon payment, critical for accurate cash flow and yield calculations in amortizing bond investments.

Clean price vs Dirty price Infographic

moneydif.com

moneydif.com