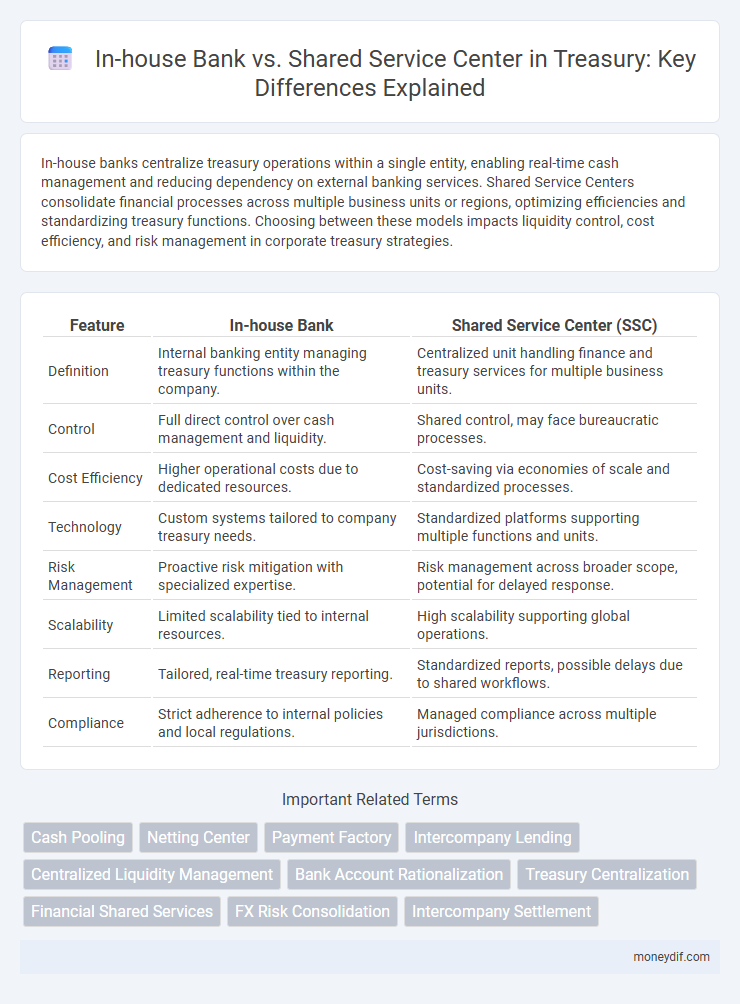

In-house banks centralize treasury operations within a single entity, enabling real-time cash management and reducing dependency on external banking services. Shared Service Centers consolidate financial processes across multiple business units or regions, optimizing efficiencies and standardizing treasury functions. Choosing between these models impacts liquidity control, cost efficiency, and risk management in corporate treasury strategies.

Table of Comparison

| Feature | In-house Bank | Shared Service Center (SSC) |

|---|---|---|

| Definition | Internal banking entity managing treasury functions within the company. | Centralized unit handling finance and treasury services for multiple business units. |

| Control | Full direct control over cash management and liquidity. | Shared control, may face bureaucratic processes. |

| Cost Efficiency | Higher operational costs due to dedicated resources. | Cost-saving via economies of scale and standardized processes. |

| Technology | Custom systems tailored to company treasury needs. | Standardized platforms supporting multiple functions and units. |

| Risk Management | Proactive risk mitigation with specialized expertise. | Risk management across broader scope, potential for delayed response. |

| Scalability | Limited scalability tied to internal resources. | High scalability supporting global operations. |

| Reporting | Tailored, real-time treasury reporting. | Standardized reports, possible delays due to shared workflows. |

| Compliance | Strict adherence to internal policies and local regulations. | Managed compliance across multiple jurisdictions. |

Understanding In-House Banks in Treasury Management

In-house banks centralize treasury operations within a corporation to streamline cash management, enhance liquidity control, and reduce external banking costs. They facilitate intercompany netting, internal funding, and centralized payment processing, optimizing working capital efficiency. Integrating in-house banks with treasury management systems improves real-time cash visibility and risk management across multiple subsidiaries and currencies.

Defining the Role of Shared Service Centers in Treasury

Shared Service Centers in Treasury centralize financial processes such as cash management, payment processing, and reconciliation to enhance operational efficiency and cost control. Unlike in-house banks that manage liquidity and banking relationships internally, Shared Service Centers standardize and automate transactional activities across business units. This strategic role supports treasury's focus on risk management and financial strategy by streamlining routine tasks and improving data accuracy.

Core Functions: In-House Bank vs Shared Service Center

Core functions of an In-House Bank include cash management, intercompany netting, and centralized funding, enabling real-time liquidity optimization and risk mitigation. Shared Service Centers focus on transaction processing, accounts payable/receivable, and standardized financial reporting to improve operational efficiency and reduce costs. Both models support treasury operations but differ in scope, with In-House Banks emphasizing strategic cash control and Shared Service Centers prioritizing transactional efficiency.

Centralization Benefits in Treasury Operations

Centralizing treasury operations through an in-house bank enables real-time cash visibility, improved liquidity management, and reduced external banking fees. Shared Service Centers consolidate financial processes across business units, enhancing efficiency by standardizing payments, collections, and reporting functions. Both models optimize working capital and risk management but differ in control level, with in-house banks offering more direct oversight of internal funding and intercompany transactions.

Technology and Automation: Comparing Solutions

In-house banks leverage customized treasury management systems that integrate directly with enterprise resource planning (ERP) platforms, enabling real-time liquidity monitoring and automated internal funding processes. Shared Service Centers (SSCs) often utilize standardized, scalable automation tools such as robotic process automation (RPA) and advanced treasury workstations to consolidate and streamline multiple regional operations. The choice between in-house banks and SSCs hinges on the balance between tailored technological control and the efficiency gains from centralized, automated shared services.

Risk Management Approaches in Both Models

In-house bank models centralize treasury functions within the organization, enabling direct oversight and tailored risk management strategies that improve liquidity control and reduce counterparty risk. Shared Service Centers aggregate treasury services for multiple business units or subsidiaries, leveraging standardized processes and technology to enhance operational efficiency while managing compliance and fraud risks through centralized monitoring. Both models require robust risk frameworks, but in-house banks emphasize customized risk mitigation, whereas shared service centers prioritize scalability and consistency across diverse entities.

Cost Efficiency: In-House Bank Versus Shared Service Center

In-house banks centralize cash management and reduce external banking fees, enhancing cost efficiency through optimized liquidity and netting strategies. Shared Service Centers consolidate treasury functions for multiple business units, lowering personnel expenses and standardizing processes to achieve economies of scale. Comparing both, in-house banks deliver superior control over internal funds flow while shared service centers offer broader operational cost savings across decentralized entities.

Compliance and Regulatory Considerations

In-house banks provide centralized control over treasury operations, ensuring direct compliance with local and international regulatory requirements such as AML, KYC, and GDPR. Shared service centers consolidate financial processes across multiple entities, requiring robust regulatory frameworks to manage cross-jurisdictional compliance and mitigate operational risks. Effective compliance management in both models involves detailed audit trails, real-time reporting, and adherence to evolving regulations in treasury functions.

Choosing the Right Model for Your Treasury Strategy

Selecting the appropriate treasury model involves evaluating the unique operational needs and scalability requirements of your organization. An in-house bank offers centralized control, real-time liquidity management, and enhanced risk mitigation, ideal for companies with complex global cash flows. In contrast, a shared service center provides cost efficiency and standardized processes through centralized transaction handling, best suited for businesses prioritizing operational efficiency over direct control.

Future Trends: In-House Banks and Shared Service Centers

In-house banks and shared service centers are evolving towards greater integration with advanced technologies such as artificial intelligence and blockchain to enhance real-time cash management and risk mitigation. The future trend emphasizes centralized liquidity control through AI-driven analytics, enabling more accurate forecasting and automated intercompany transactions. Increased regulatory compliance and cybersecurity measures will drive treasury functions to adopt hybrid models that combine the agility of in-house banks with the efficiency of shared service centers.

Important Terms

Cash Pooling

Cash pooling enhances liquidity management by centralizing funds within an in-house bank, enabling real-time cash concentration and interest optimization across subsidiaries. Compared to shared service centers that focus on transactional processing, in-house banks provide strategic cash management, risk control, and internal financing benefits critical for multinational corporations.

Netting Center

Netting centers enhance cash flow efficiency by centralizing intercompany payment settlements, bridging operational benefits between in-house banks and shared service centers.

Payment Factory

A Payment Factory centralizes payment processing by integrating In-house Bank functions and Shared Service Center operations to enhance efficiency, reduce costs, and improve cash flow management.

Intercompany Lending

Intercompany lending through an in-house bank centralizes financial management and reduces funding costs, while a shared service center enhances operational efficiency by consolidating transaction processing and compliance functions.

Centralized Liquidity Management

Centralized Liquidity Management optimizes cash flow by consolidating funds either through an In-house Bank, which operates as a dedicated internal financial institution within a corporation, or via a Shared Service Center that handles treasury functions for multiple business units to streamline liquidity processes and reduce transaction costs. Comparing both, an In-house Bank provides greater control and regulatory compliance benefits, while Shared Service Centers offer cost efficiencies and standardized operations across diverse subsidiaries.

Bank Account Rationalization

Bank account rationalization streamlines corporate cash management by reducing redundant accounts and consolidating balances within an in-house bank framework, enhancing liquidity control and minimizing bank fees. Integrating a shared service center centralizes transaction processing and standardizes reconciliation, supporting efficient intercompany settlements and improving overall treasury operations.

Treasury Centralization

Treasury centralization enhances financial control and liquidity management by consolidating cash flow operations within an in-house bank compared to decentralized processing in a shared service center.

Financial Shared Services

In-house Bank optimizes cash management and liquidity internally, while a Shared Service Center centralizes financial transactions and operational processes to improve efficiency and reduce costs.

FX Risk Consolidation

FX Risk Consolidation enhances currency exposure management by centralizing foreign exchange risks either within an In-house Bank or a Shared Service Center, enabling streamlined hedging strategies and improved liquidity control. The In-house Bank typically offers greater autonomy and direct market access, while Shared Service Centers provide cost efficiencies and standardized processes across multiple business units.

Intercompany Settlement

Intercompany Settlement streamlines financial transactions by enabling seamless clearing of intercompany payables and receivables, with In-house Banks optimizing liquidity management through centralized cash pooling and funding strategies. Shared Service Centers enhance operational efficiency by consolidating transactional processes and maintaining consistent compliance across multiple entities within the corporate group.

In-house Bank vs Shared Service Center Infographic

moneydif.com

moneydif.com